Soft Landing Touchdown: The Macro Sitch as of the Start of December 2023

Yes, I know: I find it hard to believe that nothing has gone wrong...

Should I postpone my more-or-less monthly look at the state of the macroeconomy until next week, given that the Employment report did not come out on the first Friday of the month of December but is instead coming out on the second Friday? On balance, no. There is unlikely to be any significant news come Friday in the Employment Report. And if there is, interpretation will be fraught given the seasonal michegas…

So here goes:

There is, in total, little to report. Things stay as they were—on track for a soft landing, with near-full employment retained as what turns out to have been a transitory inflation episode ends.

The things to keep in the forefront of your head are:

First, the 2.5%-year rate of Core PCE inflation in the United States over the past six months. According to the framework of flexible inflation targeting, that is just slightly above target. If that were our sufficient statistic for the state of the macroeconomy and the inflation process, we would conclude that monetary policy should be slightly restrictive, but only slightly: it would be nice, given the 2%/year Core PCE target, to reduce inflation by a hair, but only by a hair, and certainly not worth running substantial risks of pushing inflation below target in the near time in a way that would risk triggering inflation.

Second, the current CPI ten-year inflation-breakeven rock-solid at 2.3%/year, and thus a current PCE expectation presumably at 1.8%/year—below target. The bond market believes that the balance of the probabilities is that the Fed is more likely to slightly overdo it on the inflation-control front over the next decade than to underdo it. Presumably that tells us that the Fed should do a little bit less than the market current expects it to do in the future. But translating that into an actionable policy recommendation is extremely murky

Third, the current 4.3%/year Treasury Ten-Year nominal interest rate, which combined with PCE inflation expectations means a 2.5%/year Ten-Year Treasury real rate, up from -0.9%/year at the start of 2021. That is a huge swing. Is such a huge swing upward consistent with the observation that optimal monetary policy right now is only slightly restrictive? It is hard to see how it could be. Policy at the start of 2021 was stimulative, yes; but such a huge upward swing take us to “slightly restrictive” only if there has also been, contemporaneously, a huge upward swing in the long-term neutral real interest rate r* as well.

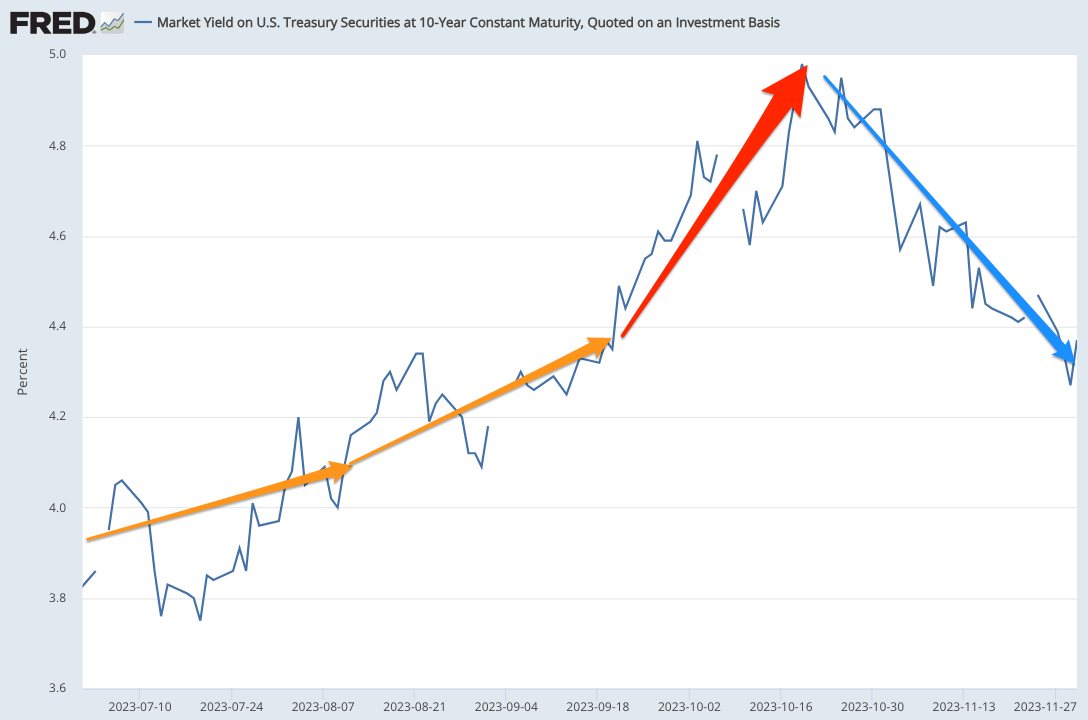

Fourth, the long-bond’s fall round trip. After creeping-up from a Ten-Year Treasury Bond nominal rate of 3.9%/year at the start to 4.4%/year at the end of the summer, the early fall saw an upward explosion to 5%/year in a month, followed by a slower return to its current 4.3%/year. And this without noticeable fundamental news about either potential deviations from the soft-landing scenario, the level of the long-run neutral interest-rate r*, inflation expectations, or Fed attitudes. Go figure:

This remains, so far, exactly what a soft-landing scenario would look like. And now the bond market appears to be expecting the Federal Reserve to start cutting interest rates in March, and thereafter to cut them slowly;

Chris Anstey: Powell Sets Up Space for Cutting, Not Easing <https://www.bloomberg.com/news/newsletters/2023-12-04/world-economy-latest-powell-sets-up-space-for-cutting-not-easing>: ‘A torrid bond-market rally shows traders are convinced the US tightening cycle is over…. Inflation Undershoots: In both economic data and policy signaling, last week marked a turning point in the Federal Reserve’s battle to end the worst bout of inflation in the US since the early 1980s…. Chair Jerome Powell… highlighted another data point: over the six months through October, core PCE ran at an annual rate of 2.5%… said that the Fed’s benchmark interest rate “well into restrictive territory.”… Investors doubled down on expectations for rate cuts in 2024, sending two-year Treasury yields tumbling…. Even by March, “inflation should be low enough to allow for a rate cut,” Anna Wong, the chief US economist at Bloomberg Economics, said last week…

Keep reading with a 7-day free trial

Subscribe to DeLong's Grasping Reality: Economy in the 2000s & Before to keep reading this post and get 7 days of free access to the full post archives.