State of þe Macroeconomy; & BRIEFLY NOTED: For 2023-03-04 Sa

My visualization of the Cosmic All with respect to inflation goes awry; Ethan Mollick on talking to ChatBots; MAGABert; Robert Bates on Doug North's legacy; Reid Robinson on talking to ChatBots; Jo...

FOCUS: State of þe Macroeconomy:

What is the current state of the macroeconomy?

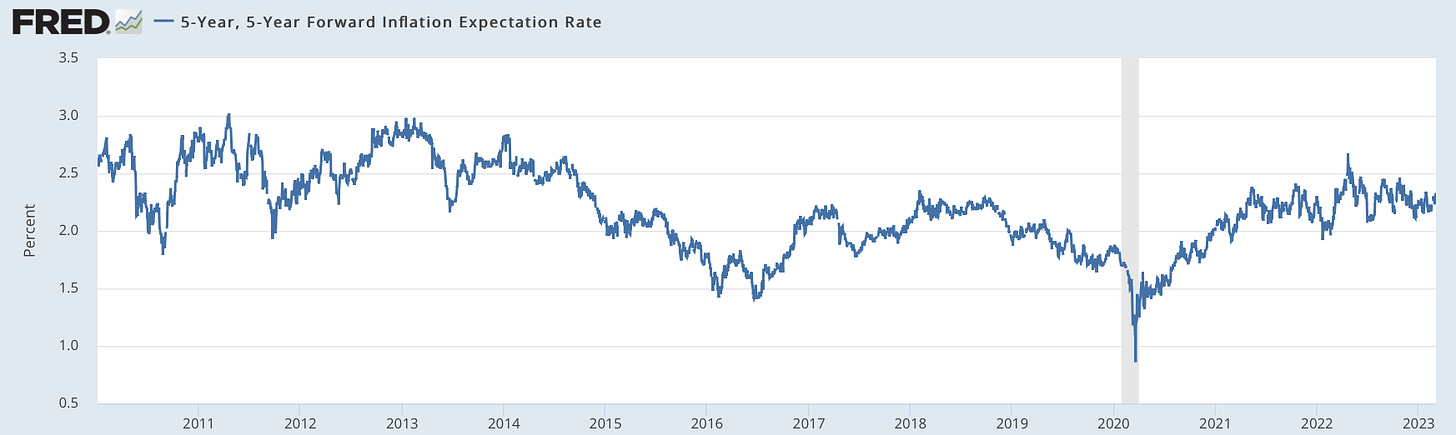

First, and most important, and hold to this: the inflation expectations implicit in bond prices tell us that the marginal active trader betting on such things in the bond market expects Consumer Price Index (CPI) inflation between five and ten years from now to be 2.3% per year. That is smack in the middle of the 2.0% to 2.5% range on the CPI that indicates that the Federal Reserve is nailing its 2.0% per year Personal Consumption Expenditures (PCE) inflation target. Thus the bond market expects that the Federal Reserve has done or will do whatever it takes to get inflation to its target in the five- to ten-year medium run:

This is most important because bond traders are the most easily scared and flighty of people as far as expectations of inflation are concerned. First, their loss function is highly asymmetrical: inflation damages their portfolios mightily. Second, they talk to each other too much, and thus give each other much more confidence in the results of their groupthink. If bond traders do not expect the Fed to miss its inflation target in the medium run, it is highly unlikely that there is any group—workers, managers, equity investors, commodity suppliers, and so forth—that thinks that the Fed is going to miss its inflation target on the upside, and is hence making plans that rest on that outcome.

That has powerful implications for the standard Phillips Curve, using π for inflation:

actual inflation equals expected inflation, plus the sensitivity of current inflation to demand times the difference between the natural and the actual rate of unemployment, plus all the shocks to the economy. Stagflation occurs when a high level of inflation in the recent past feeds back and raises expectations of inflation in the present. That might happen someday. It is not happening now. The inflation that is happening now is a consequence of (1) there still being post-plague reopening bottleneck shocks and Attack on Ukraine- and other-related supply shocks, plus (2) an economy that is running hot, in the sense that both workers and managers think they have unusual pricing power to raise what they charge, and are using it. What is the division between (1) and (2). We have no idea. All we have are ill-founded guesses.

In order to control (2), the Federal Reserve has raised its policy-control rate, the three-month Treasury Bill rate, from zero at the start of 2022 to, currently, 4.5% per year, and promised to maintain it there until they are confident that inflation is rapidly moving back to the 2% per year PCE target. This increase has been effective: the ten-year Treasury Bond rate that is the best single number at summarizing how interest costs are boosting or retarding spending has risen from 1.5% per year to 4.0% per year—a gearing of 2/3, which is significantly larger than the standard gearing of 1/3 which we typically see (or used to see: things might have changed) when long bond rates react to Federal Reserve policy moves:

There are those who say that, actually, the Federal Reserve has not tightened at all: that, yes, nominal interest costs are higher, but because debt principal is being eaten away by inflation real interest costs have not been increased. They are wrong. The market does not expect inflation in the medium-run. Moreover, the increase in the interest rate on inflation-indexed bonds has been the same 2.5%-points per year—the same 250 basis points—as the increase in the interest rate on the nominal ten-year bond:

Nominal interest rates have increased. Relevant inflation expectations have not. Hence real borrowing costs have increased. Those increases will cool off demand for investment goods, consumer durables, housing and non-residential structures, and, through the exchange rate channel, for U.S. exports and for domestic production of import-competing manufactures. That cooling-off of demand will, the Federal Reserve hopes, remove the positive contribution to inflation made by the β(u* - u) term in the Phillips Curve, and as the reopening and supply shocks die off, leave inflation equal to expected inflation and hence, since the market expects the Federal Reserve to hit its inflation target, at 2% per year.

But the monthly core inflation—i.e., inflation removing volatile food and energy prices—numbers tell us that this is not happening yet. We no longer see the 7% to 10% annualized inflation months that we saw during the reopening, as we left the inevitable rubber on the road as we tried to rejoin the highway traffic at speed. It has been five months since we saw a 7& annualized core-CPI month as the Attack on Ukraine adverse supply shock worked its way through the world economy. But I would have expected annualized core inflation numbers now to start with a “4” rather than a “5”, and I would have been looking forward to months with annualized core inflation numbers starting with a “3”. That has not happened this winter. Thus my visualization of the Cosmic All has been awry:

My view: there is an 80% chance that over spring and summer we will see those “4” and “3” leading digits in the annualized monthly reported inflation rates. But we may not. The world is a surprising place.

How much of a contribution is a tight labor market (and product market) in which workers (and managers) think they have power to raise what they charge making to our inflation? We do not know. We have no reliable and solid measures of the state of the labor market (or of the product market) as it relates to inflation. We are at see.

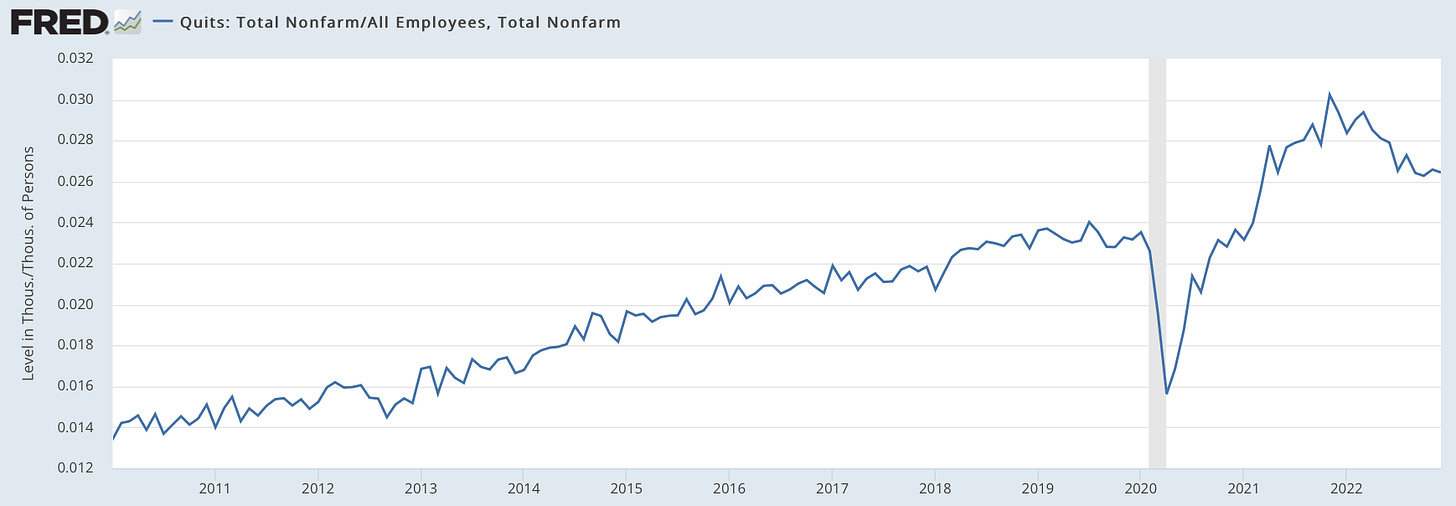

I have been, tentatively, trusting the quit rate:

The quit rate tells us about the fraction of people who think that their outside prospects in the labor market are good enough that they can give in to the temptation to tell the boss to take this job and shove it. In 2019 the U.S. economy ran with a quit rate of 2.4% per month (yes: per month) without anybody whining about inflation pressures in the labor market. The current quit rate is 2.6% per month, down from the post-plague reopening high of 3% per month.

There are, as Milton Friedman famously said, long and variable lags in all of these processes. My view is that the last 100 basis points—the last percentage point per year—of increase in the long bond rate from 3% per year to 4% per year has not yet impacted the economy at all, and hence there is downward pressure on demand and thus on the willingness of employers to expand and thus on the quit rate coming. Will what the Fed has already done in terms of this last increase in interest rates manage, when it hits and has its effects on spending, push the quit rate down into a region in which there will no longer be inflationary pressures coming from the economy “running hot”?

I say probably.

And Paul Krugman has a view:

Paul Krugman: Wonking out: Peering through the fog of inflation: ‘In early 2021, some economists warned that expansionary fiscal policy and loose monetary policy would be highly inflationary. As inflation began to rise, some of us argued that it was mainly “transitory,” a result of pandemic distortions that would fade away. But inflation went far higher for longer than we expected, and at least some of Team Transitory issued mea culpas, while some of those who had predicted inflation doubled down on their pessimism, with warnings of many years of stagflation to come. Then the inflation numbers began looking much better, and extreme pessimism began to look silly. But the story wasn’t over; in recent months the inflation picture has begun to look somewhat worse again, and there has been a palpable push by extreme inflation pessimists to insist that they were right all along…. Maybe the crucial point is just how murky the situation is. The truth is that we don’t have a very clear picture of what’s happening to inflation right now…. The Fed is creeping its way forward through a dense data fog, and this suggests to me that it should avoid drastic moves in either direction…. Economic observers may want to take a deep breath and cool some of the rhetoric. The truth on inflation has gotten harder to discern, and that fog isn’t something a clash of egos is going to clear away…

MUST-READ: Grappling wiþ Simulacra of Conversations:

“Power and weirdness” is a very good phrase…

To the extent that you can anchor them to reality, either by forcing them to look at and prioritize facts, or do a search that they then trust, you can use them for good:

Ethan Mollick: Power and Weirdness: How to Use Bing AI: ‘Bing will produce results pretty similar to ChatGPT until you convince it to look something up. When it does, something magical seems to happen. Here’s an example: write a paragraph about eating a meal produces pretty boring ChatGPT-like prose. It is in no way bad, but it is bland.... But now lets ask Bing to use the internet: look up the writing styles of Ruth Reichl and Anthony Bourdain. Use what you have learned to improve the paragraph. Several fascinating things happen as a result. First, you can see Bing performs a web search (the check-mark at the top). Next, you will see it uses this search to provide annotations and sources, which are clickable. They don’t always go to the exactly correct source, but they usually do. Finally, you will notice the writing has changed a lot. The answer is more sophisticated and the text is actually interesting to read…

Otherwise…

ONE IMAGE: Ruben Bolling Is a National Treasure:

ONE VIDEO: The “New Institutionalism”

Robert Bates discusses the legacy of Doug North:

Very Briefly Noted:

Francis Wilkinson: Fox News Is Trapped by Its Own Zealotry: ‘Fear of losing viewers to more fervent purveyors of the Trump gospel ultimately ensnared the network in a $1.6 billion defamation suit…

Kaushik Basu: How Singapore Impresses: ‘There are many reasons for Singapore’s rapid growth over the past six decades, but its authoritarian regime is not necessarily one of them. Instead, the city-state’s economic miracle has more to do with its unique brand of multiculturalism and enviable social cohesion…

Jamelle Bouie: ‘Just a hilarious amount of corruption swirling around the supreme court: Heidi Przybyla: “Dark money and special deals: How Leonard Leo and his friends benefited from his judicial activism: The Federalist Society co-chairman’s lifestyle took a lavish turn after he became Donald Trump’s adviser on judicial nominations…

David Rovella: China Leans Into Battle for Tech Supremacy: ‘Chinese internet moguls are being replaced by chip researchers and engineers on key lawmaking and advisory bodies, a potential sign of Beijing’s lingering distrust for private enterprise and sharpening focus on the tech race...

Ilari Mäkelä: On Humans Podcast ~ Science and Philosophy of Our Shared Humanity…

¶s:

Josh Marshall: Dispatch No. 55: Let’s Look at the Deep Archeology of Fox News: ‘The evidence emerging from the Dominion lawsuit against Fox News has the quality of liberal fever dreams. What’s the worst you can possibly imagine about Fox? What’s the most cartoonish caricature, the worst it could possibly be? Well, in these emails and texts you basically have that. Only it’s real. It’s not anyone believing the worst and giving no benefit of the doubt. This is what Fox is.... Over the course of the 1960s and 1970s they set about trying to build a series of counter-institutions…. Brookings was mainstream, stodgy, quasi-academic. Heritage was thoroughly ideological and partisan. In practice it was usually little more than a propaganda mill for the right. This pattern was duplicated countless times…. What we see today in Fox News is most of the story: a purported news organization that knowingly and repeatedly reports lies to its viewers…. What has always been the tell about Fox News is the tagline and motto: fair and balanced. The operation’s very branding is an aggressive bit of trolling. An unabashedly partisan and ideological operation selling itself under the heading of “fair and balanced.” It’s less a lie than a knowing taunt…. [Tucker] Carlson… launched The Daily Caller…. But what quickly became clear is that there was little audience, market or demand for that kind of conservative publication [that did not tell its audience the lies they wanted to hear]. To whatever extent Carlson had ever really been committed to creating that kind of publishing operation, he quickly lost patience with it and shifted gears to the publication we’ve been familiar with for the last dozen years: a slightly less transgressive and racist version of Breitbart. There simply wasn’t any future or money in that other kind of operation...

Reid Robinson: How to write an effective GPT-3 prompt: ‘1. Offer context; 2. Include helpful information upfront; 3. Give examples; 4. Tell it the length of the response you want; 5. Define the expected formats: 6. Use some of these handy expressions:"Let's think step by step", "Thinking backwards", "In the style of [famous person]", "As a [insert profession/role]"…