FIRST: Tesla’s Valuation(s)

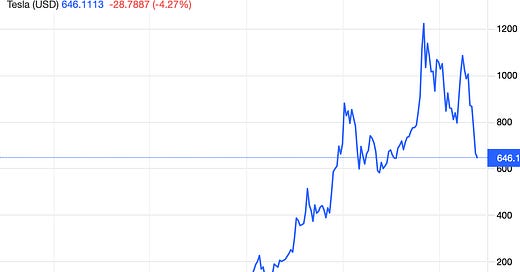

There I was, noodling around, sitting outside in the morning California sunshine (66F, going up to 80F at 5 PM), picking up scraps of information for tonight’s “Hexapodia Podcast” taping with Noah Smith on “crypto”. I found myself looking at Tesla’s stock price: after all, “crypto” today appears highly correlated in its stock market valuation with “tech”, and Tesla is now looking like a tech-factor stock rather than a manufacturing-factor stock. That is, Tesla is trading as if it is constructing a walled garden within which it will then leverage a piece of software written once that runs everywhere and harvests the activity of its users for some chain of actions vague in the middle that ends with “PROFITS LARGE FOREVER!”. It is not trading like a company whose profits depend on large-scale efficient execution of manufacturing processes—a company that makes large things out of metal using technologies for which the knowledge is widely distributed.

And I ran across a tweet thread by the highly estimable Brianna Wu:

Brianna Wu: ’What gets me about Tesla fanatics. It’s not just the death threats and personal attacks for asking eminently reasonable questions about a stock valued more than every other car company combined. It’s the men who assume questioning it means you’re too stupid to understand.

Well, I do question why a company with a P/E of 90 is worth so much more that Ford, which has a P/E of less than 4 AND sells more than 4x as many cars, AND has a killer electric truck in market. I DO question why Tesla is worth so much when it currently has 85 percent of the EV market and can barely squeeze a profit without resorting to bitcoin speculation, which by the way has plummeted in value.

I DO question how many people are going to continue to have faith in a founder that announces some wild new idea every four seconds, and can’t seem to bring any of it to market. Battery swaps, solar charger SuperChargers, Cars moonlighting as autonomous Taxis.

All these questions are reasonable. Sexist horseshit assuming I don’t know what I’m talking about is not. You can send armies of anonymous accounts to scream at me till the cows come home. I don’t care. But you can’t delay the market from asking these questions forever…

LINK: <https://twitter.com/BriannaWu>

Consider: At its current stock price of $675/share, and with more than a billion shares outstanding, Tesla is “worth” $675,000 for each of the million cars it manufactured in the past year—it is selling, even now, at not just 90 times earnings, but 11 times trailing annual revenue. Think that, as equities, Tesla shares to have a long-run permanent earnings yield of 5%/year in order to support stock valuations. Thus the company’s realistic projected permanent earnings have to be $35 billion/year. Selling all the cars sold in America, and selling each for a profit of $20,000 per car, and getting there very quickly (for money in fifteen years is worth half of money today at standard equity discount rates)—that is what the marginal Tesla shareholder right now is “thinking” about Tesla and its prospects. (If you think it is going to take ten years for Tesla to reach market dominance, you need $30,000 profit per car.)

Or they could do it with a quarter of the American car market, with profits of $80,000 per car.

Or they could do it with a quarter of the American car market, with profits of $160,000 per car if it took them 15 years to get there.

It could happen. But do note that these numbers have your profits calculated after taxes and debt interest: this is not EBIT, let alone EBITDA.

Or some one of Tesla’s other future businesses could catch fire, at 1/4 of the iPhone scale of profitability—but what incentive does Elon have not to tunnel the valuable intellectual property out of Tesla and into another one of his vehicles as that happens?

Complicating matters is that Elon Musk is not a prudent fiduciary seeking to maximize the fundamental value of the payouts to shareholders from companies he is involved in. Elon wants to have fun and change the world: payment systems, electric cars, batteries, subways, travel to Mars, satellites! High stock market valuations are useful tools for that: they gave Elon social power in the form of wealth, and he then leverages that into social power in the form of celebrity influence. But if you own stock in an Elon company, he does not work for you. You are, if anything, his prey—or, at best, a spear-carrier in the background on the stage, not even part of the chorus.

Tesla is… unlikely to be near its fundamental value today. Five years ago it was valued at 1/10 as much—that would be, if it obtained maturity fifteen years (now ten years out, in 2032), a quarter of the American car market with a profit of $8,000 per car: the equivalent of the old Ford Motor Company in its glory days, in a boom year.

Let me hasten to add that just because it is unlikely that Tesla shares are valued near their fundamental values, when Tesla is assessed as a profit-making enterprise, does not say much about the true value of Tesla.

In particular, it does not mean that Tesla is in any sense unworthy as a productive enterprise—on the contrary: it is an extraordinarily valuable enterprise, considered from the appropriate point of view.

But shareholders are unlikely to receive a great deal of that value.

We all have learned enormous amounts from Tesla’s attempts to profitably make electric cars at scale. In particular, all of Tesla’s present and future competitors have learned. The world in the future would be a poorer place if Tesla had not taken the plunge.

But the ultimate valuable product of Tesla is not likely to be cars sold in the future for more than the cost of materials and labor.

The ultimate valuable product of Tesla is likely to be the public good of all the engineering and social-organizational learning that Tesla-as-an-experiment is generating right now.

One Video:

Asianometry: (759) MEMS: The Second Silicon Revolution?: ‘MEMS or Microelectromechanical Systems are microsystems with both electric and mechanical functions…. The tech is miraculous but… [there are] big problems with making small mechanical systems… <https://www.youtube.com/watch?v=RiRyap-EVg0>:

Very Briefly Noted:

Thomas Stackpole: Cautionary Tales from Cryptoland: ‘Web3 is off to a rocky start…. Ask the tough questions, seek out experts wherever they can, and try not to fall for the boosterism… <https://hbr.org/2022/05/cautionary-tales-from-cryptoland>

Bryan Walsh: ’The quantum computing space… stands to drive the next great leap in computing…. But none of that will be possible unless researchers can do the hard engineering work…. IBM… a 4,000-plus qubit computer by 2025…. Plenty of experts are skeptical that IBM or any of its competitors will ever get there… <https://www.vox.com/23132776/quantum-computers-ibm-google-cybersecurity-artificial-intelligence-white-house>

Martin Wolf: Johnson Must Embrace the Brexit He Made: ‘Once again [Alexander Boris de Pfeffel Johnson] is planning… to repudiate parts of the UK’s Brexit deal… on which he campaigned. This would destroy the UK’s reputation…. The UK has to keep its promises. This depressing version of Groundhog Day must now end… <https://www.ft.com/content/1390c053-2740-40c6-9e4e-525f7c4cad71>

Twitter & ‘Stack:

Timothy Burke: The News: A Yet-Unbroken Chain: ‘“Replacement theory” is just a new name for a very old and historically powerful idea in American history…

LINK:

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.