CONDITION: Return to in-Person Instruction:

It is not at all clear that one would actually want to attend the Blackstock College of Pamela Dean’s Tam Lin or the Somerville College of Dorothy L Sayers’s Gaudy Night. But are there better approximations to the Platonic Idea of College, or a better setting for Story?

Pamela Dean: Tam Lin <https://archive.org/details/tamlin0000dean>

Dorothy L Sayers: Gaudy Night <https://archive.org/details/gaudynight00doro>

First: The 1970s Are a Very Bad Analogy for Today:

Philipp Hildebrand is talking his book. And it is a very good book to talk.

Philipp Hildebrand: The Old Inflation Playbook No Longer Applies: ‘The debate about how “transitory” inflation would end up being missed the point. The root cause of this rise is more important…. Post-pandemic inflation surge is not principally being driven by excessive demand but by limits on supply capacity…. First, there are economy-wide constraints. In the restart of activity after lockdowns it proved harder to bring supply capacity on stream than for demand to restart. Even more important has been a second sort of misfiring: supply capacity was in the wrong place…. We therefore find ourselves in a fundamentally different situation from the one Paul Volcker faced when he became chair of the US Federal Reserve in 1979. Then, the economy was running hot and the aim was to drive inflation that had become embedded out of the system. But this is not a Volcker moment…. When inflation is driven by demand, judicious policy can in principle stabilise both inflation and growth. This is not possible in a world where inflation is the result of supply constraints. Heightened macro volatility becomes inevitable. Central banks have either to accept higher inflation or be prepared literally to destroy demand across the whole economy to ease supply constraints in one part of it…

LINK: <https://www.ft.com/content/1e59e952-c5cf-4c8e-983a-560170c87cda>

Back in the 1970s we knew what the structural-adjustment problem was. The two triplings of oil prices, in 1973 and 1979, meant that everything energy intensive had the relative price structure strongly tilted against it. There was not a great deal of price discovery to be done: simply take the energy intensity of an activity and multiply it by nine, and you get with the new equilibrium real price of it was going to be.

The problem in that 1970s was that an expectation that wage inflation next year would be about what wage inflation had been this year, perhaps a percentage point per year or so more, also got embedded in the economy. But that embedding came with no countervailing information flow in terms of price discovery about the true real costs of energy intensive activities. We already knew what OPEC had done, and what its consequences were going to be.

Our problem today is considerably different. We are wheeling the structure of our economy in a number of different directions with remarkable speed. And there is no sufficient statistic for what the new real equilibrium prices are going to be in the same way that black gold delivered in Cushing, Oklahoma was a sufficient statistic back in The Day. Thus we need to see where the bottlenecks are, and those bottlenecks need to move prices in order to incentivize people to correct them. What we do not want to do is squeeze down on economic production in general so that the bottlenecks go away. That would produce low inflation, true. That would also produce low production. And that would keep us from undertaking the von Hayekian price discovery that the economy needs to learn as fast as possible.

And, with good luck, and with a Federal Reserve able to manage expectations of its own future actions, we can do this with just a one time step-up of the price level, and not get expectations of continual year-after-year wage inflation in bedded in the expectational and contracting structures of the economy.

One Audio:

PODCAST The Media Show: The Editor Planning to Shake Up News: ‘Ben Smith aims to take on CNN, the New York Times and the BBC… LINK: <https://www.bbc.co.uk/sounds/play/m00139kr>

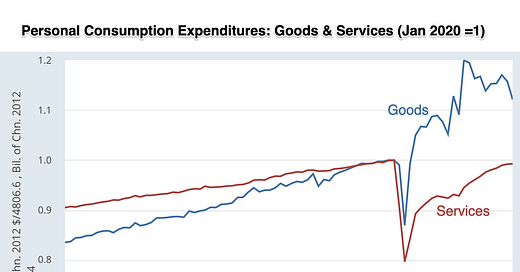

One Picture:

Very Briefly Noted:

J. G. Manning: Land Tenure, Rural Space, & the Political Economy of Ptolemaic Egypt (332 BC–30 BC)<https://www.researchgate.net/publication/256001785_Land_Tenure_Rural_Space_and_the_Political_Economy_of_Ptolemaic_Egypt_332_BC-30_BC>

Wikipedia: Li Bai <https://en.wikipedia.org/wiki/Li_Bai>

The Pall Mall Gazette (1903): On the Kaiping Mines: ‘Chinese Engineering and Mining Company: An Interesting Story from Tientsin: Some Facts that Await Explanation… <https://delong.typepad.com/sdj/2007/07/the-pall-mall-g.html>

Jeff Dean: Themes from 2021 and Beyond: ‘1: More Capable, General-Purpose ML Models…. 2: Continued Efficiency Improvements for ML…. 3: ML Is Becoming More Personally and Communally Beneficial…. 4: Growing Benefits of ML in Science, Health and Sustainability…. 5: Deeper and Broader Understanding of ML… <https://ai.googleblog.com/2022/01/google-research-themes-from-2021-and.html>

Robert Harris: Munich <https://www.google.com/books/edition/Munich/1BAcDgAAQBAJ> <https://www.audible.com/pd/Munich-Audiobook/B075DH7P3Y> <https://www.youtube. com/watch?v=AQ7x8odi-OU>

Brad DeLong: The Business-Cycle History of the Past Thirty Years Through the Lens of Aggregate Demand: Four Components of Multiplier-Driving Spending <https://www.bradford-delong.com/2018/12/four-components-of-multiplier-driving-spending.html>

Tim de Chant: Fabs Stretched Thin as Chip Shortage Shrinks Inventories to Just 5 Days | Ars Technica: ‘Relief appears to be months, if not years, away… <https://arstechnica.com/tech-policy/2022/01/fabs-stretched-thin-as-chip-shortage-shrinks-inventories-to-just-5-days/>

Wikipedia: Reagan’s Neshoba County Fair “States’ Rights” Speech<https://en.wikipedia.org/wiki/Reagan%27s_Neshoba_County_Fair_%22states%27_rights%22_speech>

Mona Charen: A Proud Moment: Romney’s NAACP Speech <https://www.nationalreview.com/2012/07/proud-moment-romneys-naacp-speech-mona-charen/>

Patrick Olivelle, ed. & trans.: King, Governance, and Law in Ancient India: Kautilya’s Arthasastra <https://www.google.com/books/edition/King_Governance_and_Law_in_Ancient_India/6MlgU0oQb4sC>

John Bull: ’Let me tell you about the only time in WW2 that the German Wehrmacht and the US Army fought ON THE SAME SIDE in WW2. This is the Battle of Itter Castle…

John Ganz: Sorel: ‘Most importantly it’s the myth of the general strike that’s important…. "Not descriptions of things but expressions of a will to act…”

Twitter:

Brad DeLong: ‘“‘I’d say China’s failure to democratize, while sad, is hardly bizarre.” No: it is not bizarre. Cue “Mother of Parliaments” lecture. You need late-Roman legal codification, Gemanic assembly institutions, feudalism as limitations on superiors’ power, the rise of law as a durable system in the Papal-Imperial struggles that were the Investiture Controversy, that institutional configuration hopping the English Channel with the Plantagenets, the extremely shaky inheritance legal position of the Tudors causing them to supplant Parliamentary approval for Divine Right, and then the failure of the Tudor Dynasty leading to the imposition of alien Scottish monarchs whom the elite wanted to control, and then French support of the exiled Scottish ex-monarchs convincing the elite it had to pony up for a strong state rather than follow the Polish route—you needed all of that to get the largely-peaceful transition to representative government which then, with franchise extension, turns into stable democracy. Other countries couldn’t do it. France has its last coup in 1978, for godssake. The United States became a democracy in aspiration only in 1965…

LINK:

Paragraphs:

Walter Scheidel: Resetting History’s Dial? A Critique of David Graeber & David Wengrow, “The Dawn of Everything: A New History of Humanity”: ‘It also suffers from serious shortcomings: the authors’ commitment to an excessively idealist view of historical dynamics, their use of rhetorical strategies that misguide their audience, and their resultant inability to account for broad trajectories of human development…

LINK: <https://zenodo.org/record/5907061#.YfIPMC-B1R->

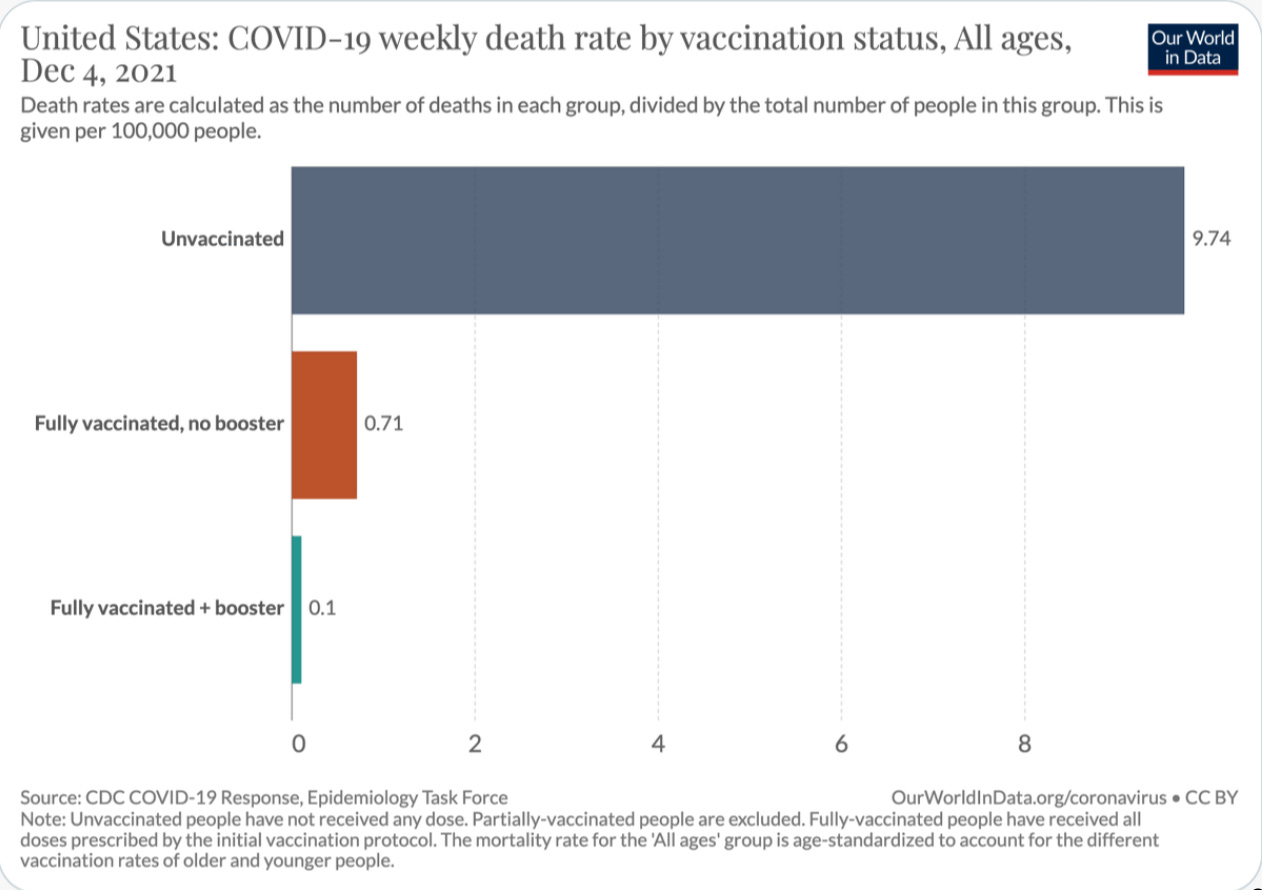

Jason Kottke: What Will Pandemic Life Be Like in a Month?: ‘[Bob] Wachter’s personal plan…. "The main questions center on indoor spaces crowded with unmasked people of uncertain vaccination status. Small indoor groups, visiting friends & family, indoor dining: all fine, without masks…. My practice will be to always carry a KN95, and to don it in very crowded, poorly ventilated spaces with lots of unmasked people, particularly in parts of the U.S. or world with low vax or high case rates…. At least at first, I’ll still mask on public transit (trains, planes) & shopping—crowded public spaces w/ lots of unmasked people. Once masks are no longer mandated, I don’t think I’ll mask at the hospital unless I’m seeing a patient with respiratory symptoms…

LINK: <https://kottke.org/22/01/what-will-pandemic-life-be-like-in-a-month>

Barry Eichengreen: Digital Currencies—More than a Passing Fad?: ‘Thu, February 10, 2022 :: Dinner Program :: The financial sector is currently in one of those periods of exceptionally rapid change that punctuate history. From the adoption of cloud computing to store and process financial data, artificial intelligence and machine learning algorithms to analyze it, and blockchain to secure it, the future will surely see additional movement in these directions. But it is uncertain whether digital currencies will be part of that future. Plain vanilla cryptocurrency like bitcoin lack the essential attributes of money and are likely to remain no more than niche investment products. Stablecoins have more of the attributes of money but are expensive to operate. Central bank digital currencies are more obviously viable, but they are a solution in search of a problem. It’s thus not clear, argues Barry Eichengreen, professor of economics at U.C. Berkeley, what economic and social problems they can solve that can’t also be solved by suitably regulated private sector entities…

LINK: <https://www.cmc.edu/athenaeum/digital-currencies-more-passing-fad>

Ben Norton: The Racist Founding Fathers of Libertarianism: ‘Hayek… "I don’t have many strong dislikes. I admit that as a teacher—I have no racial prejudices in general—but there were certain types, and conspicuous among them the Near Eastern populations, which I still dislike because they are fundamentally dishonest. And I must say dishonesty is a thing I intensely dislike. It was a type which, in my childhood in Austria, was described as Levantine, typical of the people of the eastern Mediterranean. But I encountered it later, and I have a profound dislike for the typical Indian students at the London School of Economics, which I admit are all one type–Bengali moneylender sons. They are to me a detestable type, I admit, but not with any racial feeling. I have found a little of the same amongst the Egyptians–basically a lack of honesty in them…

LINK: <https://bennorton.com/the-racist-founding-fathers-of-libertarianism/>

Robert Kuttner: The Stock Market Bubble and the Regulation Paradox - The American Prospect: ‘If we want the whole economy to benefit from the tonic of low interest rates, we need tight regulation against speculative abuses. We are belatedly getting some of that regulation, but in terms of maintaining the recovery the belated regulatory crackdown and the Fed’s interest rate policy may be out of sync. Better not to abandon regulation in the first place…

LINK: <https://prospect.org/economy/stock-market-bubble-and-regulation-paradox/>

Copy editing ... French coup ... 1958 rather than 1978 presumably. And I suppose, potentially, 1961, not to mention 1968. For the briefest moment the election of Mitterrand came to mind - fortunately for the reader, not that year. Anyway, 1958.

Our most recent try being 2021, be it noted. But I seem to have drifted far away from copy editing.

That WWII vignette is certainly striking.