The Bond Market Thinks a Possible Return to Secular Stagnation Has Just Entered the Chat

A surprising recent move in inflation-breakevens: hard to understand without both (a) a return of inflation becoming a very minor possibility, and (b) a feared Fed loss of control in terms of its...

A surprising recent move in inflation-breakevens: hard to understand without both (a) a return of inflation becoming a very minor possibility, and (b) a feared Fed loss of control in terms of its ability to boost the economy…

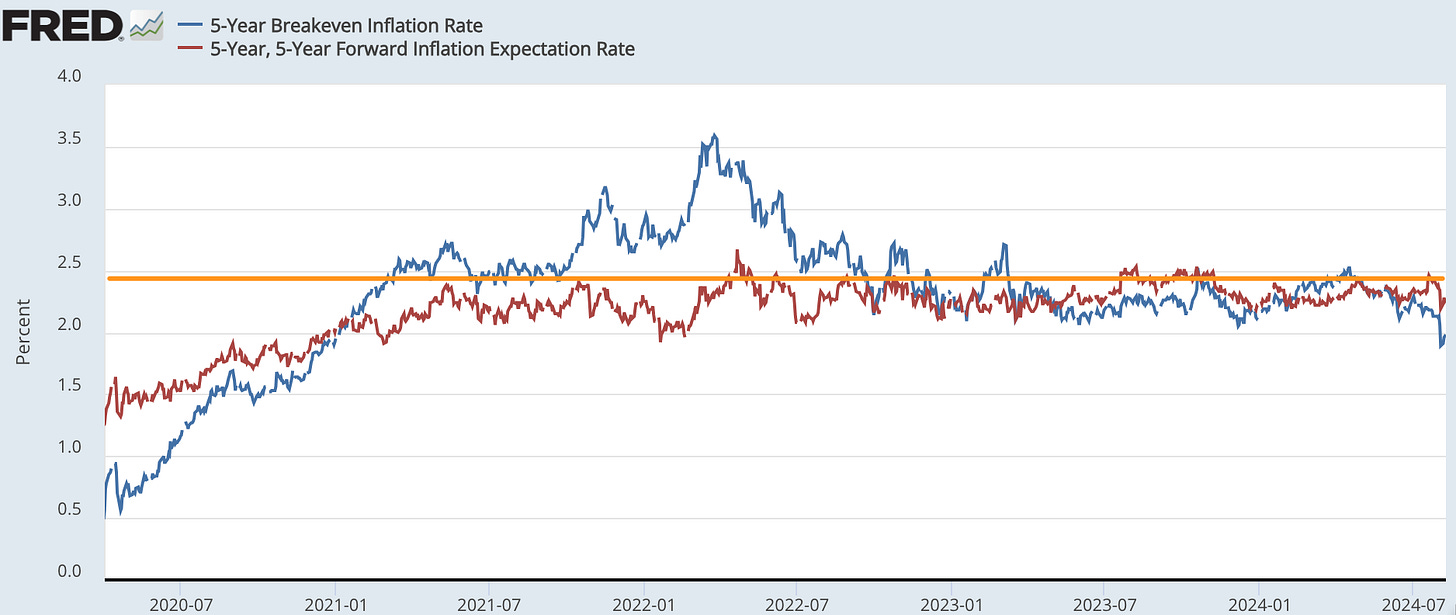

Market-based expectations of CPI inflation. The inflation-breakevens for between now and five years from now (dark red) and between five and ten years from now (dark blue): what inflation would have to be for you to make the same money in a nominal Treasury or an inflation-indexed Treasury security. Orange is the Federal Reserve’s target: 2% on a PCE chain-index basis, 2.5% on a CPI basis:

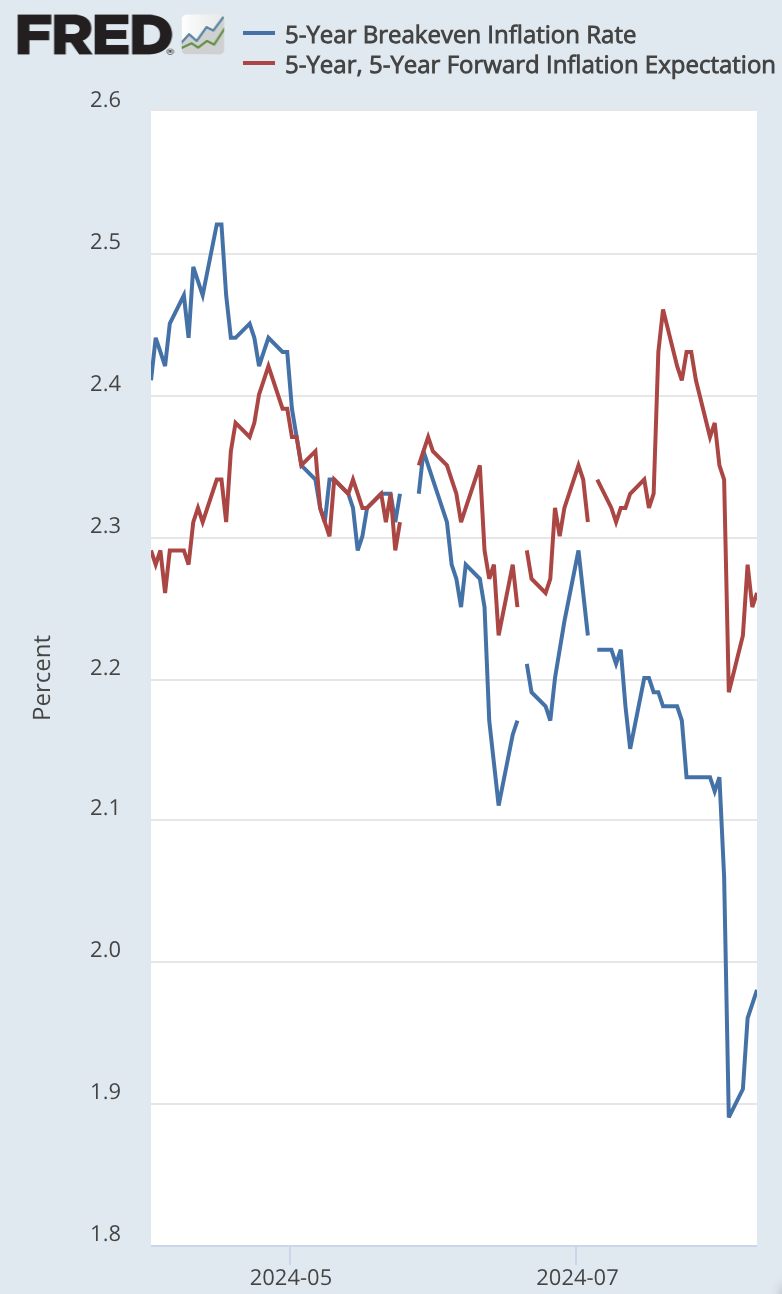

Zooming in:

That is a fully 2%-point reduction in the price level expected for August 2029.

It was Tom Hutcheson who pointed this out to me this AM:

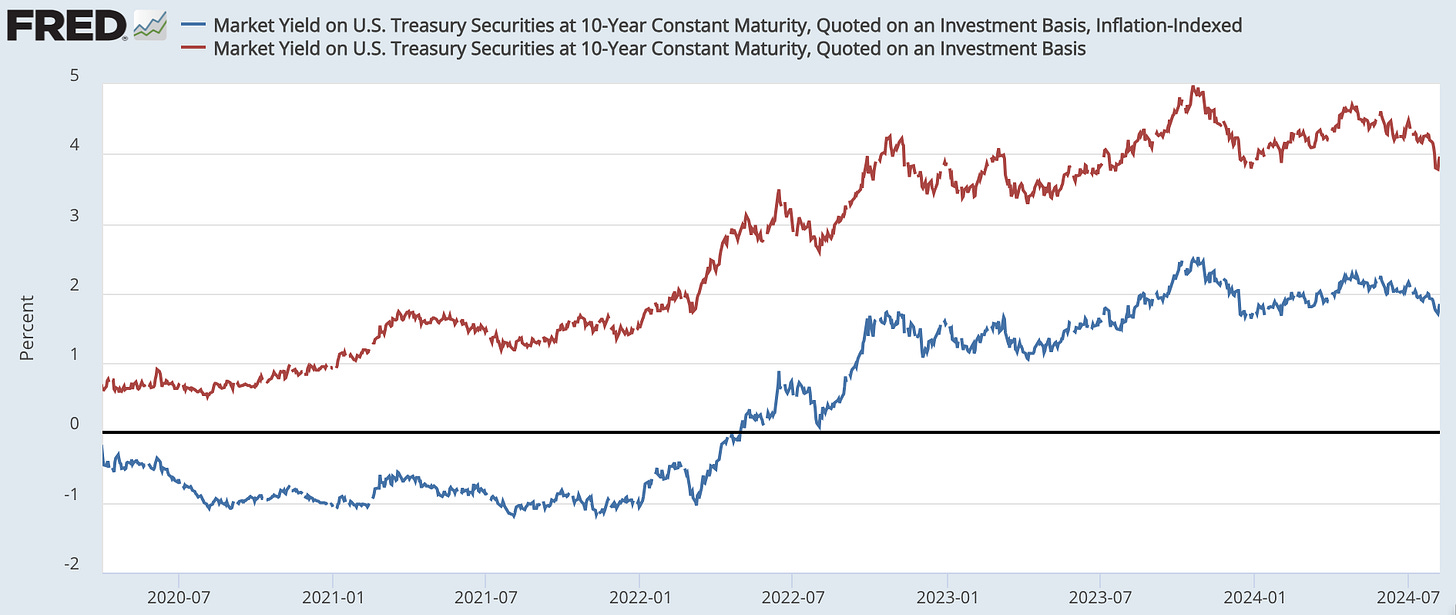

I am finding it hard to grok the scenarios here. Over the past 20 days the nominal Ten-Year Treasury’s yield has fallen by 0.29%-points, while the real Ten-Year TIPS’s yield has fallen by only 0.08%-points.

Note that these are not true expectations of the marginal players in the market, but are rather what are very confusingly called zero-risk probability expectations: the gain or loss in each possible future scenario is multiplied not just by the probability of that state occurring but by the relative marginal value of money to you if that state occurs. That correction may not be minor here.

What might be going on—or might not—is that, at least in the mind of the marginal speculator whose opinions set the market, the value of protection against a renewal of inflation has dropped drastically with very little change in the anticipated real slope of the intertemporal price system. The marginal TIPS-nominal Treasury arbitrageur looks to be taking the “economy runs too hot over the next five years” scenarios off the table.

But even so: five years in which the Fed undershoots its inflation targets by a cumulative 2%-points in aggregate suggests that the central scenario is perilously close to a return to a world in which the Federal Reserve loses traction in its ability to stimulate the economy, while stimulative fiscal policy is blocked by political gridlock and economic debt-level fears.

References:

FRED. 2024. “Fred Graph: 5-Year Brekeven Inflation Rate, & 5-Year, 5-Year Forward Inflation Breakeven”. Federal Reserve Economic Data. St. Louis: Federal Reserve Bank of St. Louis. August 9. <https://fred.stlouisfed.org/series/T5YIE>.

FRED. 2024. “Fred Graph: Market Yield on U.S. Treasuries at 10-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed, & Market Yield on U.S. Treasuries at 10-Year Constant Maturity, Quoted on an Investment Basis”. Federal Reserve Economic Data. St. Louis: Federal Reserve Bank of St. Louis. August 9. <https://fred.stlouisfed.org/series/DFII10#0>.

Hutcheson, Thomas L. 2024. “TIPs market traders back off…” SubStack Notes. August 9. <https://substack.com/@thomaslhutcheson/note/c-64943533>.

Sorry, this is my fault. I sold my TLT two weeks ago. It is amazing to see the lengths that markets will move just to provoke my regret on every trade I make.

I'd have expected a much bigger drop in the real rate, given increasing evidence that generative AI is unlikely to generate the profit bonanza that's been assumed until now. But it still seems as if the Fed, rather than anything in the real economy is what drives bond rates