FIRST: The Crypto Grifts Continue…

“An illusion of proximity to success” is a very good line here. When real upward mobility is hard to find, people are easy prey to grifters:

Ed Zitron: If You’re Not A Skeptic, You’re A Sucker: ‘I recognize that a lot of cryptocurrency fans feel somewhat unworthy of your sympathy… [but] millions of people interact with these chaotic, manipulated, and kleptocratic systems because they feel they have no other choice…. We are throwing regular people into a financial meat grinder in one of the most desperate financial eras in history. Thanks to the years of media attention given to millennial millionaires that have hit it big on crypto, the average person has an illusion of proximity to success, driven by endless advertising and marketing that tells them that they’re part of the future, and it’s a future where they’re going to be rich…. This is why I find those who call people worried about cryptocurrency “skeptics” so annoying—because the alternative is only zealotry…. By humoring Bitcoin as a valid store of value or investment, you are tacitly approving of the fact that there is no valid reason why it is worth anything, let alone tens of thousands of dollars. By having superstars talk about how this is “the future,” you are tricking the average person into believing that there is hope, all while throwing them into markets that are almost purpose-built to exploit…

LINK:

In general, there are three ways to make money in finance;

Find some return associated with risks you understand better than anybody else.

Match someone who needs to shed understood risks with somebody who has risk-bearing capacity.

Sell somebody risks they do not understand.

It is remarkable. There are current uses of BitCoin for money-laundering payments, ransomware payments, and ransom payments. If you are holding BitCoin to sell it to some poor S.O.B. whose database has been hacked or encrypted, someone whose niece has been kidnapped, or someone trying to evade Russia-Ukraine War sanctions—well, I won’t say “more power to you”, but I will not say that you are crazy.

But as for other, “speculative” motives for holding BitCoin or other crypto assets today…

Your return depends on the long-term value of crypto assets. And that depends on the long-term use cases for crypto assets. But there is more: your return depends on the long-term use cases for those crypto assets you are holding today.

Yes, crypto assets may have value for some use cases 50 years in the future, when everything is ironed out.

But is there any reason to think that the particular asset you hold today will be the asset with a future use case? No. The asset with a future use case will have had a great deal of software and social-engineering development underpinning its creation. Is there any reason to think that, when such future assets are implented and stood up, that they will give a share of what they coin to holders of earlier-generation, now-obsolete crypto assets? None at all.

There is absolutely no reason to think that investments today in today's crypto assets will give you any property rights whatsoever to whatever future crypto assets have long-term use cases and thus carry long-run value.

One Video: My Very First Talk on: “Slouching Towards Utopia: An Economic History of the 20th Century”

Not perfect. But good enough to let out into the wild…

PLEASE PRE-ORDER MY SLOUCHING TOWARDS UTOPIA <https://bit.ly/3pP3Krk>…

.pptx slides: <https://www.icloud.com/iclouddrive/01cECe9P7_5p1RkRd3-QZkdNQ#2022-06-17-slouching-first-talk-(davis-script).pptx>

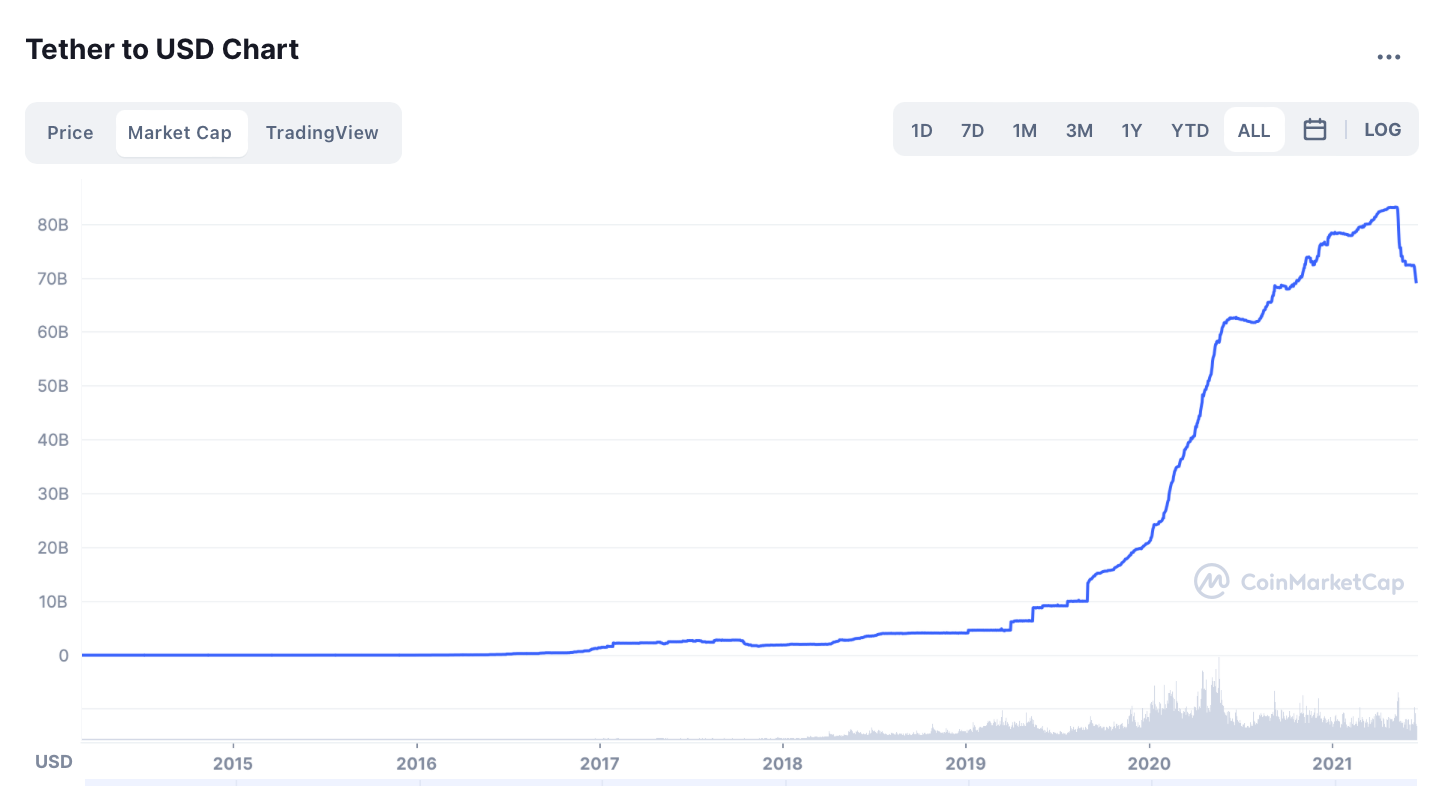

One Image: The Market Capitalization of the Tether Crypto “Stablecoin”:

Very Briefly Noted:

Whitney Baker: An Age of Real Wealth Destruction: ‘Investors will need to seek real returns from ‘alpha’ as nominal rate hikes and monetary contraction pierce asset bubbles…. Both inflation and interest rates will be much higher, for much longer, than the markets are willing to price… <https://www.ft.com/content/118ebb57-072e-455a-81bd-fb42a95b7a91>

David Hounshell: From the American System to Mass Production, 1800–1932: The Development of Manufacturing Technology in the United States <https://www.amazon.com/American-System-Mass-Production-1800-1932/dp/080183158X>

FT Alphaville: About Us: ‘Alphaville seeks to cover everything in financial markets through a wide-angle lens. From microstructure to M&A, corporate fraud and big-idea macroeconomics, if it interests you it should interest us. And if it doesn’t interest you, we’ll be trying our hardest to change that… <https://www.ft.com/content/35840fe7-e9fa-44d7-af67-1f2a7cd848d7>

Daron Acemoglu: Topics in Inequality, Lecture 8 Pareto Income and Wealth Distributions <https://economics.mit.edu/files/10517>

W. Stanley Jevons (1865): The Coal Question <https://archive.org/details/in.ernet.dli.2015.224624/page/n36/mode/1up?view=theater>

Alex Shephard: The January 6 Committee Is Telling a More Honest Story About Trump Than the Media Has:’The larger story it’s telling about Trump’s plot to steal the election is much more important than supplying a steady diet of fresh scoops… <https://newrepublic.com/article/166819/january-6-committee-media-scoops>

Stephen Holmes & Ivan Krastev: The Light That Failed: Why the West Is Losing the Fight for Democracy <https://www.amazon.com/Light-That-Failed-Losing-Democracy-ebook/dp/B07VWL1V3Z/>

Francis Fukuyama: Liberalism & Its Discontents <https://www.amazon.com/Liberalism-Its-Discontents-Francis-Fukuyama-ebook/dp/B09DBDMGMR/>

Tom Clark: How the Rich Ate Us <https://www.prospectmagazine.co.uk/arts-and-books/how-the-rich-ate-us>

Paul Krugman: How Low Must Inflation Go? <https://www.nytimes.com/2022/06/03/opinion/inflation-federal-reserve.html>

Twitter & ‘Stack:

Michael Pettis: The very smart Brad DeLong… thinks there is a very good chance that China will get caught in the middle-income trap. I am not sure what the middle-income trap is, but whatever it is, I agree with him…. As the Chinese economy slows sharply in the coming years, this will be interpreted by many to mean that Beijing didn’t read enough Milton Friedman, whereas in fact the problem, as I see it, is that we all didn’t read enough Albert Hirschman…

Timothy Burke: Academia: Disentanglement

Nassim Nicholas Taleb: _’Elon Musk… wild success… more likely to be the result of reckless betting, extreme luck, & the opposite of wisdom: folly…

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.