CONDITION: Structural Sexism:

An actual statistical count of something we had all noticed:

Markus Eberhardt & al.: Stereotyping in the Economics Job Market : ‘Women are “hardworking”, men are “brilliant”… <https://voxeu.org/article/stereotyping-economics-job-market>

This leads to a dilemma. As one of my colleagues said at one of our internal meetings as to what the messaging should be as we tried to get our graduating Ph.D. students jobs, the message that “he is really brilliant, even though the core of his dissertation is somewhat of a mess” is an effective (and often true) message in getting potential employers to look at men, but ineffective (even though often true) message in getting potential employers to look at women.

So what should we do in this situation that we are in?

First: The Fed Has Done an Amazing Job!

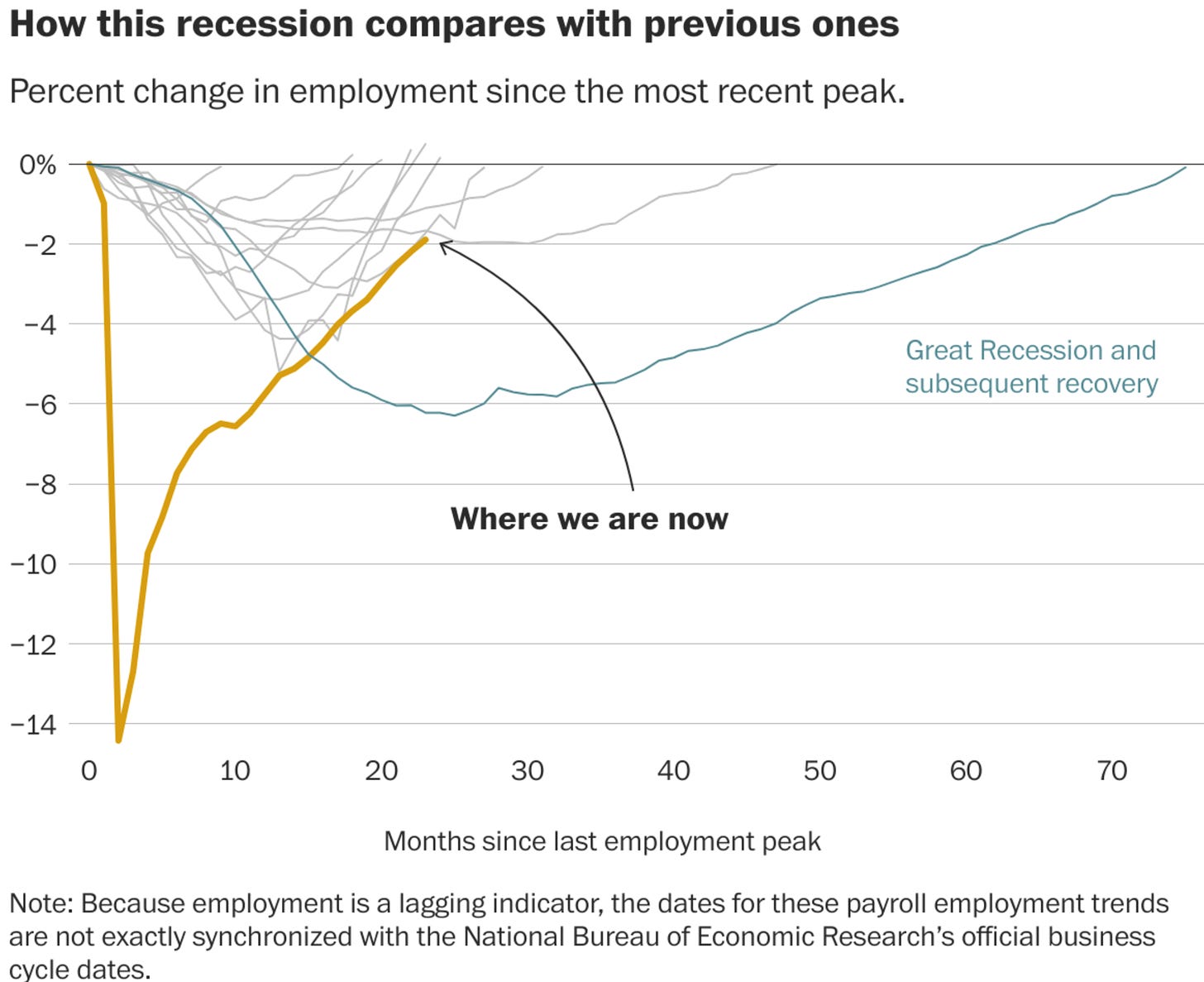

Pause for a second, and just look at what the Powell-Brainard Fed (with a major assist from the Biden administration, and earlier from the Pelosi caucus in the House driving income support) has accomplished:

Worlds, worlds, worlds better than the Bernanke Fed and the Obama Administration. Worlds better.

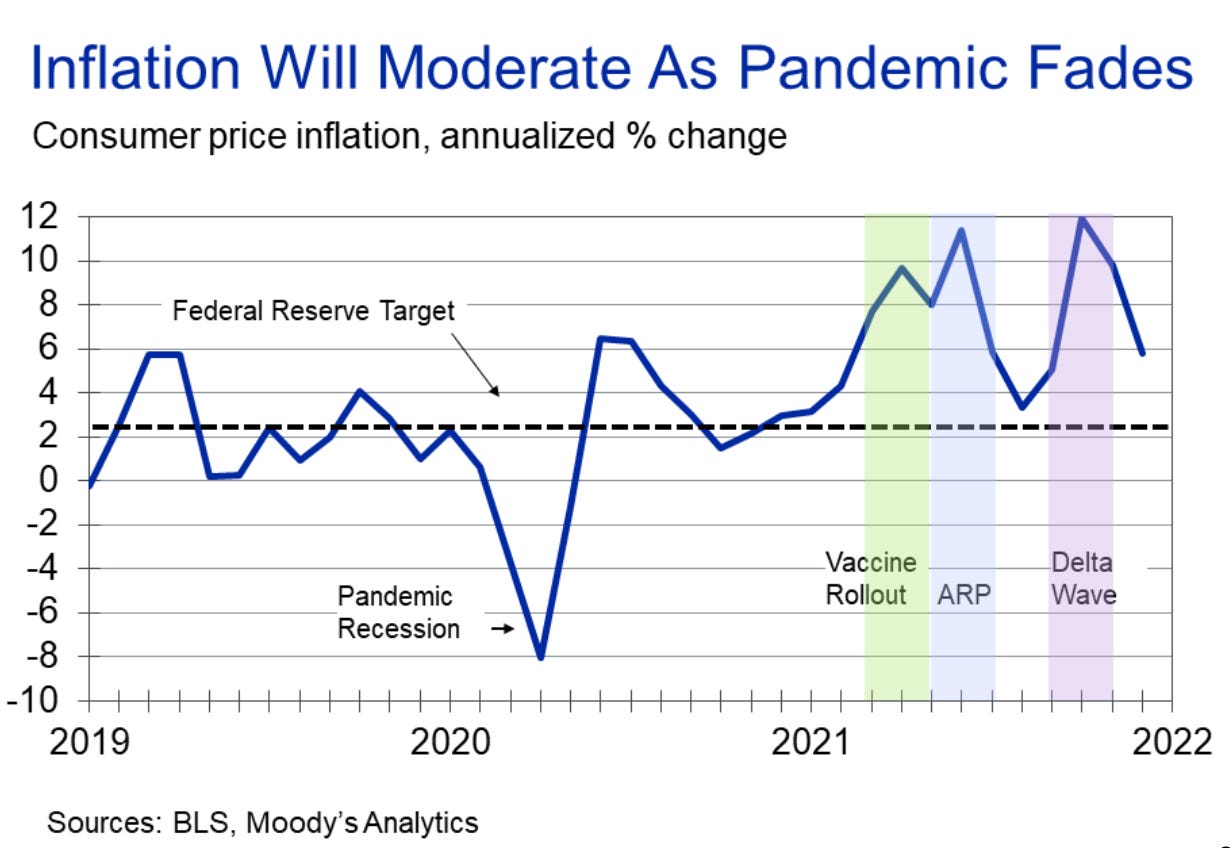

And has this come at a cost? Let’s see. What are forecasters thinking about the likely trajectory of inflation? Here is Mark Zandi:

Mark Zandi: ’Inflation has peaked… despite tomorrow’s blaring headlines…. Inflation peaked in October when the Delta wave of the pandemic was doing its maximum damage to global supply chains and keeping millions of sick workers off the job…

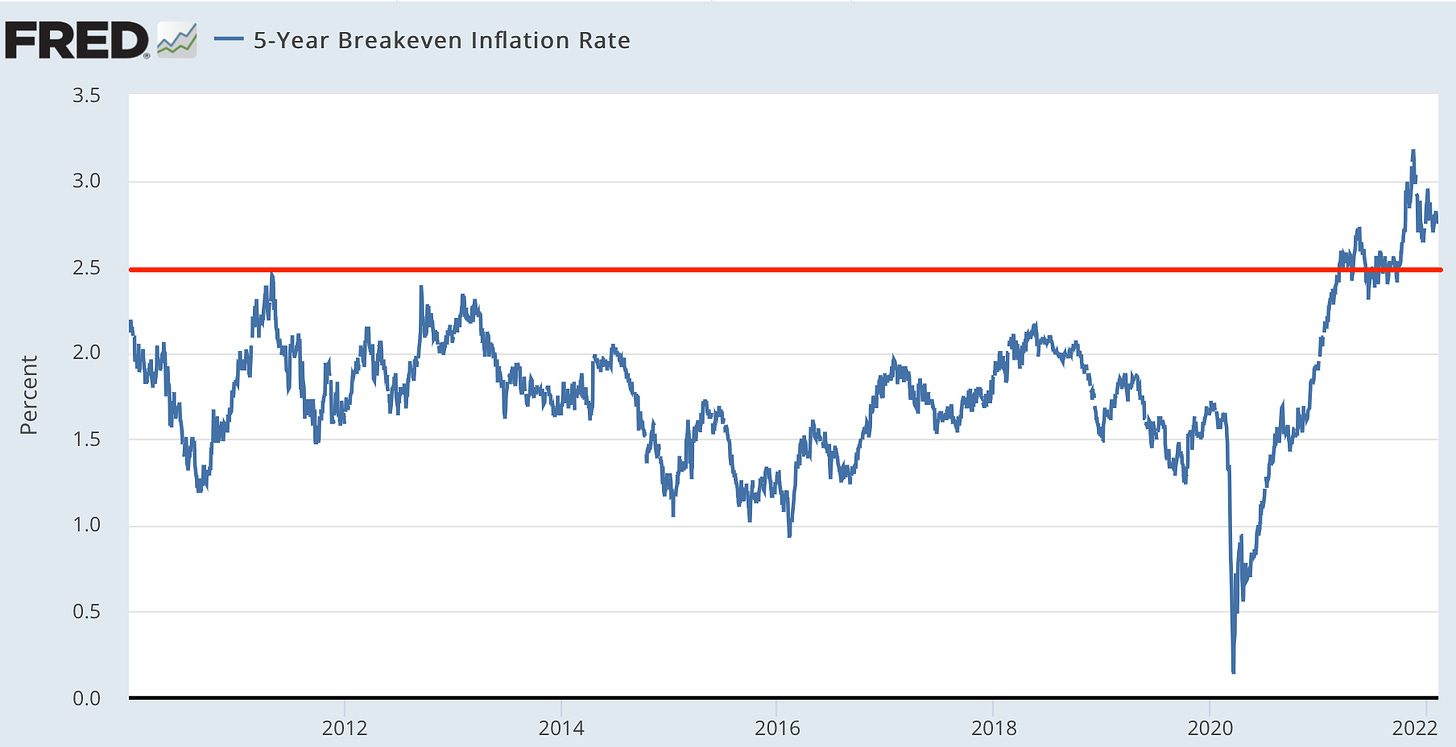

And what does the bond market think about the future outlook:

Since 2010 the bond market has, always, doubted that the Federal Reserve will achieve its inflation target over the next five years. Now, for the first time, it expects inflation over the next five years to be a cumulative 1.5%-points above the target. That implies a little above-target inflation in the next few months, and then over the following four years inflation at or below target.

The bond market is strrrrrooonnngggly on team “inflation is transitory'“ and team “the Fed has got this”.

This is a huge, tremendous policy victory on so many fronts.

So why does Paul Krugman avoid taking a victory lap here?

Paul Krugman: Can the Fed Let Us Down Easy?: ‘American workers are quitting at record rates, suggesting that they’re confident they can easily find new jobs. Wages are rising rapidly, suggesting that labor currently has a lot of bargaining power…. Inflation is running uncomfortably high…. It’s time for the Federal Reserve to cool things down…. Can the Fed pull this off without sending us into a recession? It will be tricky…. Hitting desired economic targets is hard, even when the fundamentals are on your side….There’s a pretty good chance that the Fed can let us down easy…

I confess I do not know. If I were writing his column, I would be much more extravagant in my praise of what the Powell-Brainard Fed hath wrought…

UPDATE: And:

Robert B. Hubbell: The Biden Economic Boom: ‘Here is the biggest story you didn’t hear about over the weekend: The January jobs report was good. Very good. It was so good that it exceeded everyone’s expectations—including those of the White House. Given the (apparent) weak jobs reports for November and December, pundits were expecting more of the same in January. Sean Spicer, the truth-challenged press secretary and Dancing with the Stars washout, was practicing the cha‑cha in anticipation of a bleak jobs report. CNN ran a commentary that led with, “The January jobs report is likely to be ugly.” Not only was the January jobs report good, but the Labor Department revised upward the employment statistics for November and December 2021, which had previously suggested a slowing economy…

LINK:

One Audio

Noah Smith: Interview: Ryan Petersen, Founder & CEO of Flexport: ‘The supply chain crunch, modern logistics, and that famous trip around the Port of Long Beach… <https://noahpinion.substack.com/p/interview-ryan-petersen-ceo-of-flexport>:

One Picture:

Very Briefly Noted:

Mitch McConnell: A GOP Crackup?: “We all were here. We saw what happened. It was a violent insurrection for the purpose of trying to prevent the peaceful transfer of power after a legitimately certified election, from one administration to the next. That’s what it was…

Alex Konrad: Flexport Is Silicon Valley’s Solution To The Supply Chain Mess—Why Do Insiders Hope It Sinks?<https://www.forbes.com/sites/alexkonrad/2022/02/07/flexport-is-silicon-valleys-solution-to-the-supply-chain-mess-why-do-insiders-hope-it-sinks/>

Simon Kuznets (1971): Nobel Prize Lecture <https://www.nobelprize.org/prizes/economic-sciences/1971/kuznets/lecture/>

John Quiggin & Flavio Menezes: Monopoly & Inflationary Effects of Demand Shocks<https://crookedtimber.org/2022/02/09/49503/>

Laura Krantz: 3 Graduate Students File Sexual Harassment Suit Against Prominent Harvard Anthropology Professor <https://www.bostonglobe.com/2022/02/08/metro/3-graduate-students-file-sexual-harassment-suit-against-prominent-harvard-anthropology-professor/?event=event25>

Nell Gluckman: They Signed a Letter in Support of a Colleague. Now They Want to Take it Back<https://s3.documentcloud.org/documents/21201049/comaroff-retraction-letter-new.pdf> <https://www.chronicle.com/article/they-signed-a-letter-in-support-of-a-colleague-now-they-want-to-take-it-back>

Paragraphs:

Izabella Kaminska: Why Rogan Is the Media’s “Inverted Yield Curve” - The Blind Spot: ‘The TLDR: Rogan’s mass appeal—much larger than that of the legacy media —feels like a market breakdown. It simply shouldn’t be happening. It’s the inverted yield curve of the media industry. Or the snubbing of structured data in favour of the unstructured sort. Neither should make sense, so when they manifest it signals something significant: the market is favouring inefficiency over efficiency. The question is why?… Does that mean I disagree with long, largely unedited, formats? No. I think it’s fine to be long and rambling…. But Rogan’s mass popularity is upsetting…. With it, the long-held assumption that “mainstream media value” resides in filtering, refining and editorialising information for the sake of sensemaking is also being tested…. Inverted yield curves are distress signals precisely because they shouldn’t exist. They appear because there’s a wedge in the balancing mechanism…. My experiences with communist Poland inform my views a lot on this. It’s worth remembering that anyone suggesting the dockers’ strikes in Gdansk were a substantial force to be reckoned with in the 1980s, would also have been labelled disinformation agents by the state. Yet we know what happened next. That inverted information yield curve led to system revolution and system collapse. Let’s hope this time round we can work together to avoid total destabilisation…

LINK: <https://the-blindspot.com/why-rogan-is-the-medias-inverted-yield-curve/>

James Baldwin: : His Books & His Legacy: ‘James Baldwin (1924–1987) was versatile. Novels, plays, essays, short stories, poetry—he wrote in all these formats. Baldwin was also a pioneer, addressing Black civil rights and gay rights in his writing before these movements were visible in mainstream life. As if that wasn’t enough, the author was also a committed political activist, speaking at countless events across America in the 1950s and 1960s on the subject of racism…. He is remembered for two books in particular—_Go Tell it on the Mountain, his first novel which was published in 1953, and Notes of a Native Son_, a collection of essays published in 1955…

Brad DeLong: Economic Bridge Building: ’A new book by Glenn Hubbard, former chair of the US Council of Economic Advisers under Republican President George W. Bush, sounds as though it could have been written by a social democrat. There is common ground in the recognition that mass flourishing requires participation, not protectionism…

Steve M.: Despite Desperate Efforts To Prove Otherwise, It’s Still Trump’s Nomination To Lose: ‘Ruffini tries to massage the numbers in order to get a bad result for Trump…. Trump is still beating DeSantis by 16 when name recognition is equalized—except when you poll just Republicans who like both of them. There’s just one problem: Elections don’t work like that…. Republican voters won’t dump Trump, because if they do, we win—“we” being the hated Democrats and RINOs and mainstream media. Voting for DeSantis will never be the thumb in our eye that voting for Trump is…. Just being indicted won’t necessarily hurt Trump…. When has Trump ever gotten his comeuppance? He’s never been truly held accountable. There’s a good chance he never will be…

LINK: <https://nomoremister.blogspot.com/2022/01/despite-desperate-efforts-to-prove.html>

WSJ Editorial Board: Mike Pence’s Constitution: ‘Mike Pence’s Constitution The former Vice President stands up to Trump, despite the potential political cost…. We wrote often during his Presidency that Democrats couldn’t defeat Donald Trump, but Mr. Trump could defeat himself. He did, and his post-election behavior compounded the harm to his party. Republicans who want to repeat the experience may find the electoral result is the same—and this time without the fortunate presence of Mike Pence…

Inflation at 7% YOY!! Auntie Em! Auntie Em! And so today (2/10/22) the 30 year mortgage has SKYROCKETED!!! to ...wait for it...uh...I guess where it was in 2020 and the 10-yr yield is where it was in 2019...you know, the rates we all thought would never go lower and were happy refinancing. Inflation apparently is making interest rates great again.

Ok, let's suppose that against all odds Trump winds up in prison by 2024. Will he win despite that, or worse yet *because* of that? I wish I knew.