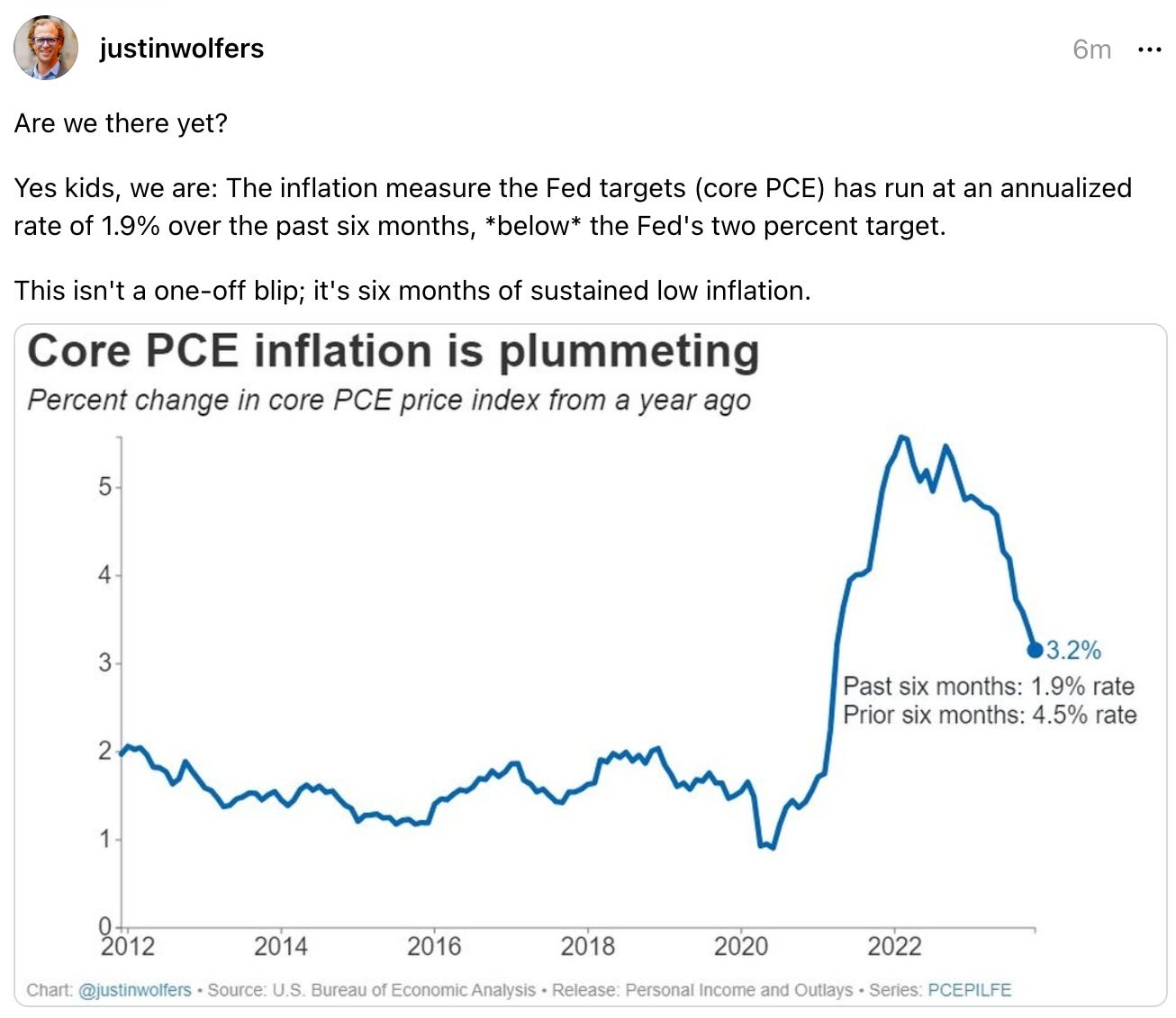

The Fed Is Now Behind the Curve in Beginning the Easing Phase of Its Cycle: Six-Month PCE Inflation at Target: 1.9% per Year

I confess I do not see a valid argument against an 0.5%-point interest-rate cut at the next Fed meeting...

I confess I do not see a valid argument against an 0.5%-point interest-rate cut at the next Fed meeting...

The Federal Reserve’s target inflation index—the PCE—came in negative for the month of November:

As Justin Wolfers says: we are there—soft landing achieved:

Which raises the question: why is monetary policy still in a range we think of as substantially restrictive, rather than neutral? The bond market agrees that monetary policy is substantially restrictive: the yield curve inversion is still quite large, as the gap between the top Federal Funds and the red nominal 10-Yr Treasury Bond rate tells us:

Meanwhile, the green bond-market 10-year forward inflation expectations line shows us that bond market expectations of inflation are still rock-solid where we would want them to be. And long real interest rates—the blue line—remain high in recent historical perspective.

In fact, real long rates have not been this high since March of 2010:

With expectations rock-solid where they should be, I do not see an argument against an 0.5%-point interest rate cut at the next Fed meeting: What eventuality is maintaining substantially restrictive policy supposed to be buying insurance against?

The best reason not to cut rates 50 basis points next month is that the bond market doesn't think it's warranted. Yes, policy looks restrictive, but the economy is doing OK and markets judge a gradual pace of rate cuts in 2024 poses little risk of recession. Front-loading the rate cuts would be more about sending a message than achieving an economic outcome. Brad, what message do you see a January rate cut sending?

Question. How literally SHOULD we take TIPS expectations of below target inflation? Is this just some calibration error or (as I'm afraid) expectation by one tail of the Fed pushing inflation down below target and causing a recession or two over the next 10 years?

Wow do we ever need the Treasury to give us those shorter tenor TIPS! Now!