FIRST: No. The Federal Reserve Did Not '‘Drink the Kool-Aid’ in 2021:

Let me enthusiastically endorse the second half of this from Olivier Blanchard.

It seems to me to be completely right: The way to bet for the medium- and long-run is that we are still in a régime of secular stagnation. The demand for safe assets continues to be extremely high, because so much wealth is being held and will continue to be held by actors that are not pursuing a portfolio strategy of maximizing their real risk-adjusted expected return. (And do remember that Steve Cohen and I noted this emerging trend and tried to grapple with understanding what it was going to mean back in… it was 2010: The End of Influence: What Happens When Other Countries Have the Money <https://www.amazon.com/End-Influence-Happens-Other-Countries/dp/0465018769/>.) As long as the demand for assets that are “safe” in the sense that their nominal values track one of the global reserve currencies is so high relative to supply as to be constantly pushing their values up to par, things are going to be really weird:

But that consideration seems to me to make the first half of what he says wrong. Indeed, I do not understand what argument could lead somebody to believe it:

Olivier Blanchard: Economists Exchange: ‘I didn’t anticipate the role of the goods market, which is that in many sectors the strong demand led to supply disruptions and very large increases in prices. In the end, inflation came first not from where I would have expected it to come, which was wages, but rather from prices…. I think that the increase in prices, the disruptions in supply chains, are very much the result of strong demand hitting supply walls. So, I would claim that I should get a few points for being right in February or March of 2021. Anybody could have come to the same conclusion. I’m happy I did…. What should the Fed have done or said when the fiscal package was passed? I hope that Jay Powell picked up his phone and told the administration that this was going to be an issue. His staff drank the Kool-Aid, and he, not being a professional economist, could not easily second-guess them. They thought inflation expectations would remain anchored and that the Phillips curve was flat….

The question is, indeed, how much of this is a blip. I use the word bump, which I think has a slightly longer length than a blip. But I believe we will then go back to low real interest rates. So, on this, I’m going to do the Larry Summers thing. I am going to say, with probability 0.9, we’ll return to something like that world. I think there’s a tendency for markets to focus on the current, on the present and extrapolate it forever. But if I look at the factors behind the decline in real interest rates since the mid–1980s, none of them seems about to turn around, except perhaps one, which is investment…

LINK: <https://www.ft.com/content/e63dab63-bf41-4c43-b827-1b1736fc518d>

The point that in a régime of secular stagnation the loss function is asymmetric is decisive.

The Federal Reserve can deal with an overheated economy by raising interest rates, sharply—sharply!—decreasing demand for construction investment, for exports, and for domestic production of import-competing goods, and so freeing-up productive capacity to satisfy the other components of domestic demand, thus removing inflationary pressures. The Federal Reserve cannot—cannot!—deal with a frozen economy at its zero nominal lower bound on interest rates. Forward guidance is simply not effective at the required scale: modern central banks have inordinate difficulty in credibly committing to be “irresponsible” and inflationary in the future. Quantitative easing is the closest thing to powerless that a monetary-management tool can be. Therefore monetary policy needs to focus, unless doing so has the most dire consequences, at avoiding situations in which nominal interest rates hit the zero nominal lower bound. And there was a definite, palpable risk in early 2021 that the economy without the early 2021 fiscal package was going to stay at the zero nominal lower bound.

Indeed. Blanchard says that he expected “inflation [to] c[o]me first… from… wages”—an overheated labor market giving workers the power to bargain for substantial real wage increases, which would then force businesses to raise their prices to try to recoup some of the costs. But that is not what happened: instead, under the pressure of plague waves, supply chains broke and bottlenecks emerged. Prices of bottlenecked goods spiked, and so the world economy turned its attention to the now-crowdsourced problem of figuring out how to get rid of those bottlenecks and expand productive capacity.

Price increases that focus crowdsourced attention on places in the economy where there are constraining bottlenecks is usually seen as a good thing for a market economy to have: it is how we become richer. Would it be a better world if we had not had that focus of attention on relieving bottlenecks, and so expanding productive capacity? I really do not think so.

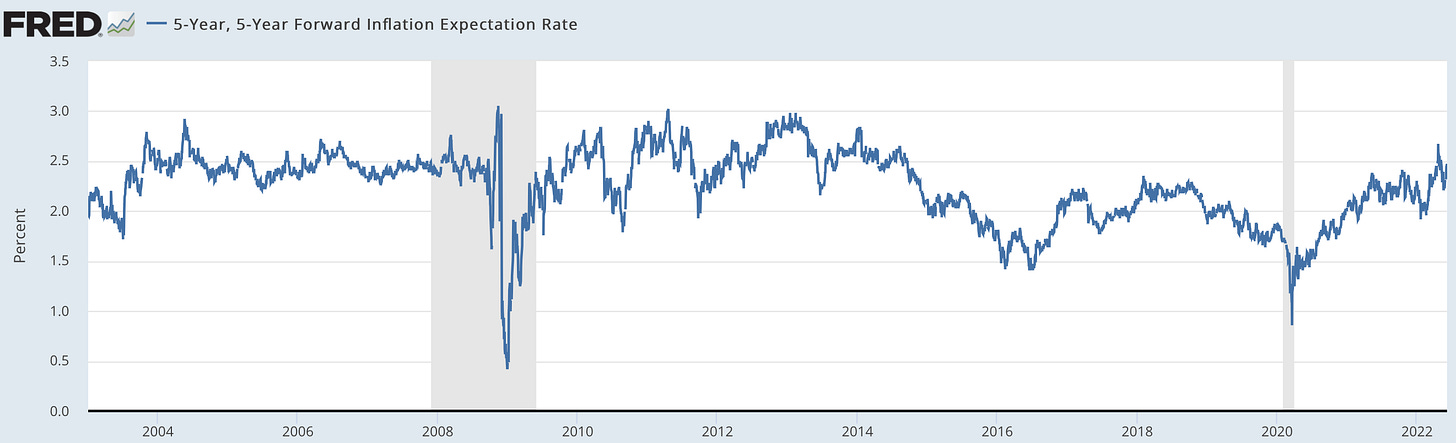

After all, in any reasonable societal well-being function, short-run inflation has significant costs only if it destroys the long-run inflation anchor. And it has not done so. So when Blanchard says that Powell’s “staff drank the Kool-Aid… thought inflation expectations would remain anchored…” and so a failure to raise interest rates substantially was a policy mistake, I say: “Huh?!”

Not passing the early 2021 fiscal package, or having the Federal Reserve immediately respond by raising interest rates a year ago, would have slowed down the recovery: a serious loss. And it would have produced nothing more than an infinitesimal gain—as long as the long-run inflation anchor remains. Which it does. Long-term inflation expectations have remained anchored:. Should they breakout above 2.5%, I will be calling on the Federal Reserve to do more, and do it faster. But they are still on track, still where they should be:

Very Briefly Noted:

Matthew Belloni & al.: Dimon’s “Hurricane”: ‘Jamie Dimon… is normally pretty measured in his economic pronouncements… <https://puck.news/dimons-hurricane-sheryls-wall-street/?_cio_id=f6c60600ef33f033>

Kristie L. Ebi: Surviving a Future of Extreme Heat <https://www.project-syndicate.org/commentary/preparing-for-extreme-heat-climate-change-by-kristie-l-ebi-2022-06>

Ben Thompson: Apple WWDC, M2, Additional Notes: ‘What was striking about yesterday’s keynote, though, was… the unveiling of cross-platform features… <https://stratechery.com/2022/apple-wwdc-m2-additional-notes/>

Christopher Johnson: Rumours Xi Jinping Is Losing His Grip Are Greatly Exaggerated: ‘Evidence is thin that past episodes of factional strife in China’s communist party are repeating themselves… <https://www.ft.com/content/5e14bfb2-f0a9-4259-9d4c-a1b0ff607560>

Paul Waugh: Johnson Is Now the Sick Man of No.10, Infecting Everyone Around Him: ‘A double-whammy defeat in Wakefield and in Tiverton and Honiton would only confirm the terminal state of the patient…. Faced with a Prime Minister who will never change his habits, or who can’t be trusted even if he promises to change, it’s no surprise that backbenchers think it’s time to change leader instead… <https://link.news.inews.co.uk/view/61fea10c5501fe7b723832e5gnfdt.7h4/6b9f7a22>

Chris Anstey: What’s Happening in the World Economy: Team Transitory Still Warn on Big Hikes: ‘A key reason not to get spooked about surging prices is the evidence that expectations among consumers and investors for inflation over the longer run remain well anchored. That means they’re not baking in high inflation forever—something that should in itself help to stabilize prices… <https://www.bloomberg.com/news/newsletters/2022-06-06/what-s-happening-in-the-world-economy-team-transitory-still-warn-on-big-hikes?cmpid=BBD060622_NEF>

Matthew Belloni & al.: Elon’s Foot-in-Mouth Disease: ’He has a “super bad feeling” about the U.S. economy… hard to square with the news, also on Friday, that payrolls surged by 390,000 in May… <https://puck.news/dimons-hurricane-sheryls-wall-street/?_cio_id=f6c60600ef33f033>

Twitter & ‘Stack:

James Ledbetter: A Brief History of Fintech’s Meltdown

Michael Pettis: The very smart Brad DeLong… thinks there is a very good chance that China will get caught in the middle-income trap. I am not sure what the middle-income trap is, but whatever it is, I agree with him…

Matthew Yglesias: Russia’s War on the World’s Food Supply: ‘While the Russian government would clearly like to exploit the havoc they are wreaking for gains in Ukraine, they have very little leverage…. [In] “cereals,” some European countries do take a hit, but plenty of others benefit from the grain shortage…

Noah Smith: The Japan that Abe Shinzo Made: ‘The expansion of the labor force, the rise of immigration and diversity, and the country’s willingness to assert itself in the international security sphere…

Paragraph:

Matthew Levine is always a must-read. In fact, he is always a must-read to a frightening extent. Here he is on the latest from Elon Musk:

Matthew Levine: Elon Has a New Bot Excuse: ‘This again. No, come on, stop it…. The merger agreement does not… allow Musk to walk away because he changed his mind. He needed some pretext…. He came up with what he thought was a good one: Twitter says, in its public filings, that no more than 5% of its “monetizable daily active users” are “false or spam”…. To a non-lawyer I suppose this looked like a good pretext, but it was not. It was not for at least three reasons: Musk had not a shred… of evidence…. Musk could not get out of the merger agreement unless the error was likely to have a “material adverse effect” on Twitter’s business, and it absolutely would not. Musk has been talking about Twitter’s bot problem forever, and in fact he originally said that he wanted to buy Twitter in order to fix the bot problem, so no one could possibly believe him when he said that he wanted to walk away from the deal because he just discovered that Twitter has a bot problem…. He set his lawyers… to work finding a pretext that they could stomach. And they found one, and today they filed it with the US Securities and Exchange Commission, in the form of a letter to Twitter threatening to call off the deal. Their pretext… is that, when Musk asks for information about the spam bots, Twitter doesn’t give him the information he wants…. To be clear, it isn’t a good pretext…. It is hard to imagine him winning if this ends up in court: If he refuses to close because Twitter won’t humor his bot-fishing expedition, it seems unlikely that a Delaware court will side with him. But it does raise the risk for Twitter, which gives him a bit more leverage to try to renegotiate the price. It is all going to get so much dumber…

LINK: <https://www.bloomberg.com/opinion/articles/2022-06-06/elon-has-a-new-bot-excuse#xj4y7vzkg>

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.