FIRST:

Over at what Jeffrey Sachs once told us students was “the only real newspaper”, the Financial Times, Martin Wolf interviews Larry Summers, who instructs all and sundry on what they should do with the batons they hold:

Larry Summers: ‘The destabilisation wrought by British errors will not be confined to Britain’: ‘The only silver lining in this moment is, as Paul Krugman and others suggest, that long-term inflation expectations have not yet become entrenched. It is crucial that we take advantage of that by acting firmly to restrain inflation.

The global situation is no less problematic…. China…. The pressure for capital flight, the dependence on real estate, the magnitude of the demographic challenge, the complexity of running an economy in a way that both enforces political loyalty and spurs innovation, all of this suggests to me that there are likely to be very challenging years ahead in China.

With a tendency to turn substantially inwards and the real prospect of economic weakness in both the US and China, and with a European economy that will be held back at best and hobbled at worst by high energy prices, it is difficult to be optimistic about the global prospect. My hope, but not my expectation, would be that there would be serious dialogue, led by the international financial institutions, on:

the need for a global stability strategy…

appropriate… policies in each of the major regions…

the development of capacities to provide substantial additional resources to the developing countries…

more satisfactory approaches than now exist for…r debt relief…

providing large-scale financing of a green transition

fortifying the world against the next pandemic...

Larry is, I think, completely correct here on nearly everything—all except two points.

The first point I would question is his belief that we are more likely than not to see another global plague sometime in the next fifteen years. Yes, increasing interconnection carries increasing risks of plague—we find no Mediterranean-wide plagues before the Roman Empire, but under the empire we see such plagues starting in 165, 249, and 541. But we are a much more biomedically aware and capable civilization.. What made COVID–19 so difficult to deal with for us was its asymptomatic respiratory spread. Unless we get another such, I think we will have a much easier time dealing with future plagues.

That said, plague prevention and control is a place we are a good dose of utilitarianism is smart: it is worth spending a lot to avoid even a small risk of a big catastrophe, and there is no way the private market sector will be willing to make the necessary upfront investments. Plague prevention and preparation thus ought to be done by the world government. Since we lack such a world government, that means: it needs to be done by the United States, with whatever assistance we can cajole from other governments.

Larry’s focus on the need to immediately build institutions to finance the rapid large-scale green transition is exactly on point. Green transition is now not a cost and a drag on the rest of the economy but a benefit. Technologies have advanced remarkably fast, and have progressed sufficiently far that measured real output in the future will be higher the faster we make this transition. It will be another Schumpeterian creative-destruction episode promising enormous net benefits. As with all Schumpeterian creative-destruction episodes, the disruption it will cause will be immense—but less disruption than would letting global warming rip unchecked.

The disruption, however, will fall on different people and and politically powerful people than those who will suffer the most under global warming. Larry was in there pitching 30 years ago as Al Gore led the Clinton administration in its attempt to start this serious green transition 30 years ago. We got within one Senate vote of making it happen. Now we are 30 years late. The sorrow those 30 wasted years will bring will be immense. We should not add more years to the generation that the locust hath eaten.

Larry is also right on the need for more and better debt relief, and for more and better financing of productive investment in the global south. That is a World Bank standby, almost universally acknowledged by anyone who has spent any time at the World Bank, or, indeed, simply being aware of the state of the world and of the hideous tragedy that the extraordinarily unequal geographical distribution of economic growth. Building such institutions is, however, a wicked problem: genuinely hard to deal with even with the best will and with proper attention from those who guide the world’s allocation of resources. The attention has almost never been present. And good will has often been absent.

Larry is also right on what he uphemistically callsna “global stability strategy”. That should, I think, be unpacked.

I think he means is that we are no longer in the pre-World War I world where Britain was the semi-benevolent hegemon or the pre-George W. Bush world in which the United States understood that it was Atlas, bearing the weight of the world on its shoulders. What would happen in a good world is that the governments and central banks of the United States, the European Union, and China would all recognize that there is too much potential blowback for all of them from an inward an inward focus. They would instead recognize that they are global stewards, and that their successors will harshly condemn them if they focus on the impact of their policies on their own countries rather than on the globe as a whole.

Getting this message across has been, and will continue to be, very difficult.

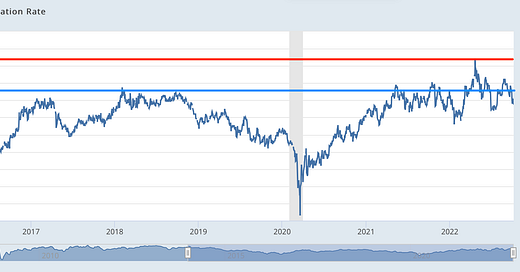

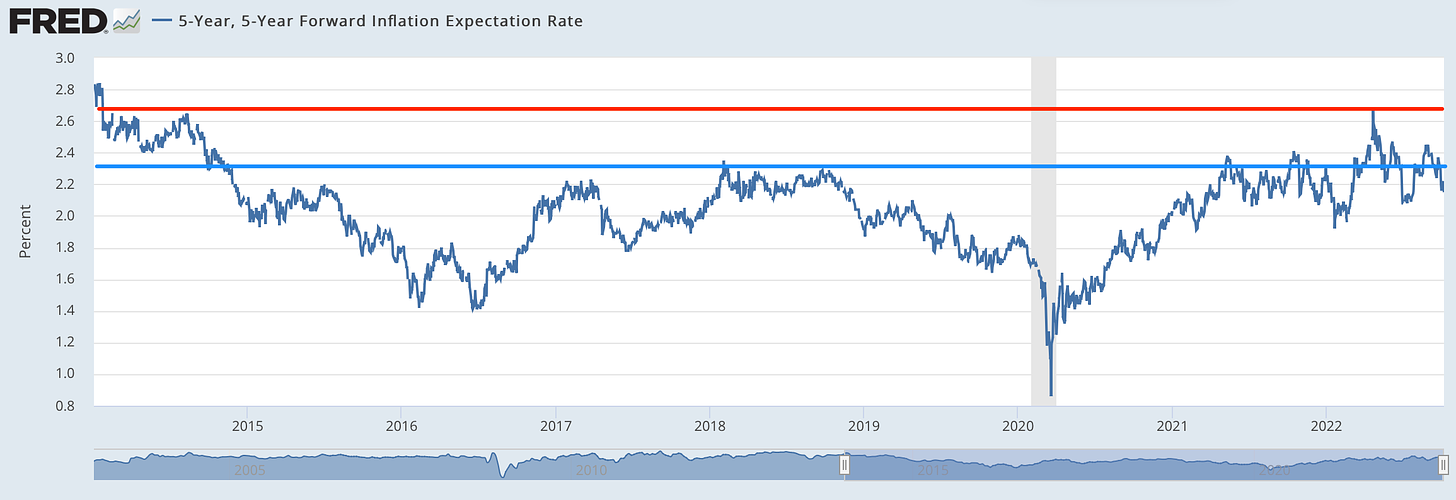

The only other disagreement I have with Larry—and it is a relatively minor one in the grand scheme of things—is with respect to his position on inflation. He says that the “only silver lining” is that long-term inflation expectations have not yet become entrenched. I would prefer to put that differently: long-term inflation expectations are still anchored at a very low level. In fact, the bond-market five-year five-year forward expected inflation rate breakeven is in the range in which I would normally start worrying that markets believe that long run monetary policy is going to be inappropriately tight—that the Federal Reserve will fail to keep inflation up at its 2% PCE chain-index target.

Yes, we have short-run inflation. But at least some of this short-run inflation is something the market needs to deal in order to deal appropriately on the resource allocation with the tasks of rapid post-plague reopening and supply disruptions. Having an inflation target does not mean one should automatically get upset when there is a substantial deviation from that target for one year, or even two.

We need to balance the long-run risks: the risk of not tightening monetary policy enough, and of the deanchoring of inflation expectations followed by stagflation; the risk of tightening too far, and landing back in the long-run trap of secular stagnation at the zero lower bound; plus there is the additional risk of not tightening enough in the short run, and then over tightening in the medium run, which would bring us stagflation followed by a return to secular stagnation. To imply, or to state, that there is a big risk only on one side is, I think, to get it wrong.

Larry’s rhetorical tone is also, I think, a source of additional danger. Jay Powell as chair of the Federal Reserve has so far done a superb job. But he is not a Keynesian macroeconomist. Rather, he is a highly effective—indeed superb—manager and consensus-builder, and a Republican worthy. As such, he hearing from every single other Republican worthy that his policies have to date been inappropriately loose, and that he is well behind the curve. (Never mind that Alan Greenspan was also said to be “behind the curve” in the 1990s as he triggered the dot-com boom and what Janet Yellen called “the fabulous decade.”)

If Lael Brainard were Chair of the Fed, I would think Larry’s rhetorical tone largely appropriate. But she is not.

Hence I do not think it is wise to point to the danger of Charybdis, without also noting the threat of Scylla on the other side of the strait though which we are trying to row.

One Video: Me on Bloomberg Surveillance

Tom Keene & co.: Bloomberg Surveillance : BLOOMBERG : September 26, 2022 6:00am-9:00am EDT : Free Borrow & Streaming : Internet Archive

<https://archive.org/details/BLOOMBERG_20220926_100000_Bloomberg_Surveillance/start/10140/end/10620>

Other Things That Went Whizzing by…

Very Briefly Noted:

Matthew Yglesias: Europe should look at hard rationing and price controls for natural gas: ‘Europe has a problem this fall and winter... home heating... electricity generation... chemical manufacturing.... Lots of European governments are breaking out the subsidies.... In my view, Europe really needs a different approach... less... market mechanisms and subsidies... more... explicit rationing and price controls...

Helen Thomas: Liz Truss and business are at cross-purposes: ‘The UK prime minister is serving up an outdated version of what companies actually want.... In the absence of progress on supply-side reforms to immigration, infrastructure and planning, the temptation to reach for ideologically compliant but largely pointless wins will prove overwhelming...

Derek Thomson: A Simple Plan to Solve All of America’s Problems: “The U.S. doesn’t have enough COVID tests—or houses, immigrants, physicians, or solar panels. We need an abundance agenda…

Jeremy Shapiro: We Are On a Path to Nuclear War: ‘The war in Ukraine has a direction that observers can see and that we should name. What began as a criminal Russian aggression against Ukraine has become a proxy war between Washington and Moscow...

Micah Sifry: How "Democracy Centers" are Sprouting Across the South: ‘Place-based year-round organizing aimed at combating voter suppression by meeting people where they live and around their community's pain points...

Gregory Allen: Choking off China’s Access to the Future of AI…

Ben Thompson: Meta Meets Microsoft: ‘This Article was going to be easy: writing that Meta’s metaverse wasn’t very compelling.... Trying the Quest Pro... was the turning point: I was really impressed, and that makes this Article much harder to write...

Rohit: Divining Talent: ‘The biggest question that I was left with immediately having read the book was, if you’re not Tyler Cowen or Daniel Gross, can these techniques work?…

Zach Bleemer & al.: Metrics That Matter: ‘Counting What's Really Important to College Students…

¶s:

Heather Cox Richardson: October 11, 2022: ‘Last Thursday, October 6, the Republican members of the House Judiciary Committee tweeted: “Kanye. Elon. Trump.”... Antisemitism, Putin’s demands in Ukraine, and stolen documents seem like an odd collection of things for the Republican members of the House Judiciary Committee... to endorse before November’s midterm elections. But... the Republican Party is demonstrating that it has fallen under the sway of its extremist wing.... Marjorie Taylor Greene (R-GA)... that “Biden is Hitler.”... Tommy Tuberville... Democrats are in favor of “reparation” because they are “pro-crime.”... Senate Republicans have introduced a bill to get rid of the drug pricing reforms the Democrats passed in the Inflation Reduction Act... strong signaling for their intentions going forward...

Edward Luce: The world is starting to hate the Fed: ‘It is Joe Biden, not America’s central bank, who has the tools to cushion the global blow caused by domestic policy.... Biden has so far found little bandwidth to confront these challenges. He had a chance to make US vaccine technology available to the developing world. Indeed, he initially vowed to suspend Covid vaccine patents. That now looks like an empty gesture since his administration did not follow up. As a result, a third of the world’s population has not yet had one vaccine while most westerners have had at least two — some as many as five. Had the US taken a stronger lead, the world’s inflation-inducing supply bottlenecks would not have been as chronic.... America’s big shortcoming is political not technocratic. The global face of the problem is the mighty dollar but its causes lie deeper. The US can be oblivious at big moments to the spillover effects of what it does at home, which often come back to bite it. Call it exorbitant indifference…

Tom Nichols: J. D. Vance and the Collapse of Dignity: ‘One moment... struck me.... Trump declared, “J. D. is kissing my ass, he wants my support so bad”—while Vance was standing right by the stage. Last night, Ryan slammed Vance for selling his dignity.... Vance’s reaction to Trump calling him out as a spineless loser at his own rally was to run up to Trump like a puppy that just got a treat, wagging his tail for another tasty biscuit.... The new American right, however, has blown past the relatively innocuous populism of the past 40 years and added a fetid cynicism about almost everything related to public life. Not only are the MAGA Republicans seemingly repelled by the idea of voting for someone better than they are; they support candidates who are often manifestly worse people than the average citizen, so that they may slather their fears about their own shortcomings and prejudices under a sludgy and undifferentiated hatred about almost everyone in public office…’ m an adult. I get it. Our elected officials aren’t saints, and only rarely are they heroes. But must they now be a cavalcade of clowns and charlatans, joyously parading their embrace of vice and their rejection of virtue? The Republican Party seems to think so…

Robert Tracinski: There Is a Name for Meloni's Blend of Socialism and Nationalism: ‘What is more striking about... Meloni’s speech is the weird combination of the conservative culture war and an anti-capitalist conspiracy theory about “financial speculators.”... There is no sane reason to believe that contemporary “wokeness” underpins big business or consumer culture or an international conspiracy of bankers. This Underpants Gnomes-style theory in which wokeness equals profits doesn’t add up. But don’t bother to examine this particular folly, ask only what it accomplishes. It allows for a kind of illiberal synthesis that combines the rhetoric and priorities of the illiberal right—nationalistic, religiously intolerant, and socially conservative—with the appeal to envy of the illiberal left.... Europe has a history of a more traditionalist style of conservatism, which rejects capitalism as a symptom of modernization...

Heebie-Geebie: Tracking and Entrenchment of Status: ‘There's robust ed literature about how kids seem to fall off a cliff when they enter middle school, and I know that all complex phenomenon have a million contributing factors. But at the moment it seems starkly like a result of the heavy tracking into honors/general that starts right then.... You vaccuum out all the kids who are most successful in the classroom and who get the most positive feedback for modeling good habits, and leave behind a critical threshold of students who are in a negative feedback loop for behavior and quickly becoming more and more disengaged. At the same time, I would not want to condemn my kid to a class that moves as slowly as you would need to move in order to ensure that everyone is understanding the new math. That is also soul-deadening. Bleagh...

Pity the friend-of-Larry blogger who is condemned top parse Summers' wide-ranging interviews for time immemorial! (But great job - this was very useful.)

Two things struck me & I think they would both be Hexapodia-worthy:

1) Wow, we have both Tooze and Summers calling for a "global stability strategy". Seems like time to expand both upon the possible attributes of such a beast and possible paths by which it might come into existence.

2) "Green transition is now not a cost and a drag on the rest of the economy but a benefit. Technologies have advanced remarkably fast, and have progressed sufficiently far that measured real output in the future will be higher the faster we make this transition." I think an episode justifying this claim is in order. I'm familiar with Ramez Naam's stuff on learning curves and with the Way, Ives, Mealy, Farmer "Empirically grounded" paper that projects these curves into a cost-saving ($13T!), logistic substitution model of an energy transition - but it would be good to hear if you (and Noah) take these predictions as reliable - and why. I think there are some flaws in the Way et al. model, but I should probably save those thoughts until you (or you and Noah) expand upon its virtues. (Apologies if you did this in some earlier post - I can't find it.)

Middle school tracking. How sure should be be about this? Might not the non-honors math student benefit from being taught math in a non-honors way? Or different material: Bayesian statistics instead of calculus,