Discover more from Brad DeLong's Grasping Reality

First: The Thin Gruel of Monetary-Policy Discussion These Days

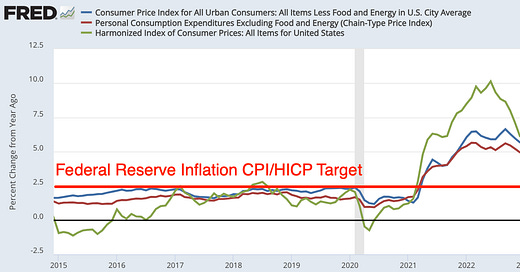

I think Paul Krugman makes a leap of logic here, without filling in the intermediate steps. Suppose that you do have not general “overheating” but rather concentrated and specific “overheating” in particular sectors causing your inflation: Why should that lead you to moderate your contractionary monetary policy response. What argument would be that concentrated-and-specific is less likely to get baked into expectations of future wage inandprice increases. But why? The 1970s inflation was very concentrated-and-specific, and got very baked into future wage in price increases. The argument Paul does not seem to make—but that I think he believes—is that skewness-inflation is an essential part of desirable structural adjustment.

Don’t get me wrong—Paul is very smart. But the range of arguments deployed here is much thinner than I think it should be:

Paul Krugman: Overheaters, Skewers & the Nonlinear Economy: ‘If demand is skewed… people are buying much more of some things than usual, but less of others, so some parts of the economy are running hot while others run cold… price increases in the booming sectors… outweigh price cuts in the slumping sectors, raising the average rate of inflation above what you’d expect given the overall level of demand…. We agree that both overheating and skewed demand are driving inflation, [but] their relative importance matters. If you think it’s mainly overheating, you want the Federal Reserve to slam the brake… maybe even pushing us into recession. If you think it’s mainly skew… you want a much milder response, easing off the gas pedal but mostly counting on supply and demand adjustments to bring inflation down. But an argument about relative magnitudes isn’t the same as a fight over fundamentals…. There’s far more consensus about inflation among serious thinkers than many people, including some of the participants in this debate, may realize…

LINK: <https://messaging-custom-newsletters.nytimes.com/template/oakv2>

As I read through the flow of news about monetary policy, the state of the business cycle, and the recovery from the plague recession, I find myself frustrated by what seems to me to be a great deal of fuzzy thinking on the part of even the smartest analysts. It seems to me that the first question should be: "How can the Federal Reserve best accomplish its task of making Say’s Law true in practice even though it is false in theory?" If you start from that question, you get a different and I think better slant on things.

Back up: Say’s Law was the claim made by economist John Baptist say in 1803—later abandoned by him—that excess supplies of commodities in particular markets and of labor in particular sectors were necessary and good components of beneficial economic adjustment, and that we did not need to fear that excess supply would ever become pervasive and economy-wide and so destructive. Say was, as he realized eventually, wrong. Just as a competent government arranges the system of property and contract and compensates for Pigovian externalities (and performs a Beveridgean pre- or re-distributional adjustment of the distribution of wealth so that the societal well-being function the market maximizes aligns with society’s preferences), so it must also manage aggregate demand. A central bank’s place in aggregate demand is to manage the supply of money—in its triple role as liquidity, as safe-asset store savings vehicle for moving social power to command commodities into the future, and as a source of safety and security—to demand, so that there does not emerge the excess demand for money that is the flip side of general glut and of deep depression. We know that the central bank has successfully accomplished this money-management task when the real rate of interest in markets is in accord with the Wicksellian “neutral” real rate.

It was Paul Krugman’s genius back in 1999 <https://www.brookings.edu/wp-content/uploads/1998/06/1998b_bpea_krugman_dominquez_rogoff.pdf> to figure out that when interest rates attain their zero lower bound, that is a powerful signal that, if more expansionary fiscal policy is off the table, the optimal macroeconomic outcome requires inflation: since liquid money and short-term government bonds have then become perfect substitutes as far as portfolio returns are concerned, standard open-market operations are neutral, and so aggregate demand can be affected only through the inflation-expectations channel. (What’s that? Quantitative easing? Very weak indeed.)

Yes, you can argue that monetary policy should aim not just at avoiding both a deflationary excess demand or an excess supply of money, but should also produce a stable yardstick for economic calculation. And you would be right to so argue. But then you are down to a matter of tradeoffs: how elastic a yardstick do you tolerate in return for doing your principal job of balancing the money market and so avoiding what used to be called a “general glut”?

Stable-yardstick considerations are counterbalanced by greasing-the-adjustment-process considerations: in an economy in which cutting your nominal wage is often viewed as a grave status insult, labor adjustment into expanding sectors requires that some wages rise while others remain constant. That imparts of an inflationary bias to optimal monetary policy. And the more is the amount of desirable structural change to be accomplished faster, the greater is that inflationary bias.

All of these seem to me to be essential pieces of any discussion of optimal monetary policy right now. Yet how rare is the take that manages to consider more than one of them!

One Video:

Mariana Mazzucato: What Is Economic Value, & Who Creates It? <https://www.youtube.com/watch?v=uXrCeiQxWyc>

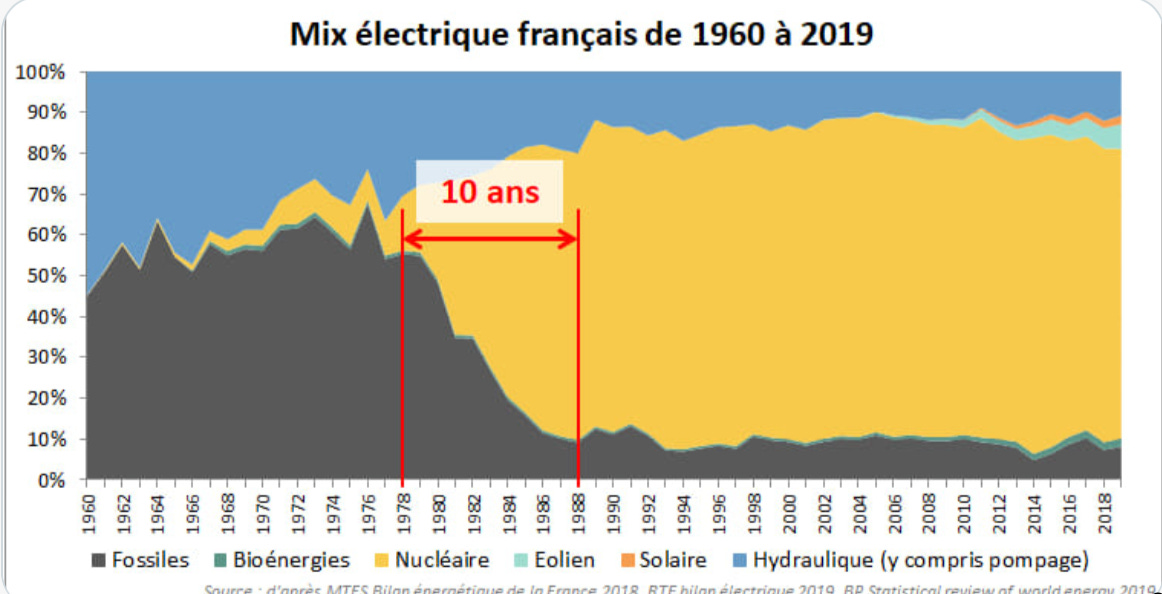

One Picture: French Nuclearization:

Very Briefly Noted:

Alan Cole: Five Reasons the Sanctions Are Working: ‘In lieu of a military response, Biden and his allies are waging economic war on Putin’s Russia. It’s not a close fight… <https://fullstackeconomics.com/five-reasons-the-sanctions-are-working/>

Roger Cohen: How Ukrainians Are Using Social Media to Speak Out About the War: ‘Technology, blamed of late for every ill from the death of truth to the spread of loneliness, restores feeling and revives human connection as the war unfolds. Brave civilians brandishing newly acquired rifles against armored divisions cannot leave the onlooker cold… <https://www.nytimes.com/2022/03/01/world/europe/zelensky-ukraine-war-outrage.html>

Sahil Kapur: _’“I’ll be the majority leader.” Mitch McConnell knifes Rick Scott’s agenda for a GOP Senate. “We would not have as part of our agenda a bill that raises taxes on half the American people and sunsets Social Security and Medicare within five years”…

Lev Menand: ’You might be wondering: Why hasn’t the ruble fallen further following US EU UK sanctions against the Russian Central Bank? After all, don’t these sanctions prevent currency stabilization by freezing Russia’s $630 bn+ of reserves? Yes but: Russia still has positive fx flows and the Russian Central Bank has enlisted exporters to act as currency stabilization agents by requiring them to sell 80 % of their fx for rubles, meaning when they receive dollars they sell most of them from rubles…

Paragraphs:

Cory Doctorow: Amazon’s $31b “Ad Business” Isn’t: ‘Looking at Amazon’s quarterly financials… $31b ad division…. As Marketplace Pulse succinctly put it, “Everything on Amazon is an Ad”… the first 3–7 thumbnails are “sponsored results.” On a product page the top bar, the bottom third, and large swathes of the right bar and main body are for sale…. Amazon retail business today is… a chokepoint capitalist marketplace with customers corralled on one side and merchants on the other, with a gate in between where it collects rent to let one side talk to other… the opposite of a “customer-centric” business. As Trung Phan reminds us, Amazon launched with a much-vaunted “collaborative filter” whose recommendations were driven by users, not sellers…

LINK: <https://pluralistic.net/2022/02/27/not-an-ad/#shakedowns>

Marco del Negro & al.: Drivers of Inflation: The New York Fed DSGE Model’s Perspective: ‘After a sharp decline in the first few months of the COVID–19 pandemic, inflation rebounded in the second half of 2020 and surged through 2021…. The New York Fed DSGE model[‘s]… main finding is that the recent rise in inflation is mostly accounted for by a large cost-push shock that occurred in the second quarter of 2021…. Based on the model’s reading of historical data, this shock is expected to fade gradually over the course of 2022, returning quarterly inflation to close to 2 percent only in mid–2023…

Joe Weisenthal: Five Things You Need to Know to Start Your Day: ‘In the last few days, Russia has seen itself lose access to hundreds of billions in foreign currency reserves. While people usually think of money as something that you have, the reality in the modern fiat system is that money is usually something you are owed. Your money is someone else’s liability. This is something Russia is seeing right now dramatic fashion…

Chad Orzel: State of the State of the Union: ‘Sometime in the early 2000s, though, W. Bush broke me. The combination of policies that I found appalling and his speaking style just became intolerable…. Way back in the 80’s, the State of the Union seemed like an important and borderline solemn civic ritual, and watching it felt like part of my duty as an engaged and educated adult. These days, it’s just tawdry political theater, and I want nothing to do with it. And I’m probably in the top quartile of political engagement, relative to the population as a whole. I don’t know how we find a way back from that…

LINK:

Nicholas Gruen: The Wages off Another Low Dishonest Decade & Some Other Reading/Listening: ‘In 1937… Walter Lippmann had published The Good Society. He began… by lamenting the naïvete of [his] first… published… just before the outbreak of WWI. His words speak to our own time…. "The general scheme of the human future seemed fairly clear to me then.… I had no premonition that the long peace which had lasted since Waterloo was soon to… end. I did not understand the prophetic warning of my teacher… that there might be a war which would unsettle the foundations of society–indeed I was unable to imagine such a war and I did not know what were the foundations which might be unsettled. For in that generation most men had forgotten the labors that had made them prosperous, the struggles that had made them free, the victories that had given them peace. They took for granted, like the oxygen they breathed and the solid ground beneath their feet, the first and last things of western civilisation…”

LINK:

John Spencer: The Eight Rules of Urban Warfare & Why We Must Work to Change Them: ‘1. The urban defender has the advantage…. 2. The urban terrain reduces the attacker’s advantages in intelligence, surveillance, and reconnaissance, the utility of aerial assets, and the attacker’s ability to engage at distance…. 3. The defender can see and engage the attacker coming, because the attacker has limited cover and concealment…. 4. Buildings serve as fortified bunkers that must be negotiated…. 5. Attackers must use explosive force to penetrate buildings…. 6. The defender maintains relative freedom of maneuver within the urban terrain…. 7. The underground serves as the defender’s refugee…. 8. Neither the attacker nor the defender can concentrate their forces against the other…

LINK: <https://mwi.usma.edu/the-eight-rules-of-urban-warfare-and-why-we-must-work-to-change-them/>

Steve Saideman: ‘This war is still quite young and Russia can still reach its objectives (at greater cost than expected). What we have learned once again is that: -modern war is complex, -it really is about logistics and about morale -bad news rarely goes up the chain well -cognition is key (the late Robert Jervis is right again) -nationalism matters but in ways that folks keep forgetting. -having a comedian as President means much in a war of narratives -having equipment is one thing, knowing what to do with it is something else -easy to learn the wrong lessons from past wars. Did Putin think that his tanks would have same kind of fast run through Kiev that US had through Baghdad? -easy to make early reckless assessments!…

LINK:

one of the "dives," I should have written

N. Gruen must be sitting in one of the bars on 52nd Street