The "Wall Street Journal" Tells Us: Trump Takes Command of Inflation, Which Was Massively Unsatisfactory under Biden

Journamalism in a Neofascist Chaos-Monkey Age...

Journamalism in a Neofascist Chaos-Monkey Age...

my advice to you who are not deeply steeped in Fed watching is this: from now on, as long as Rupert Murdoch, Lachlan Murdoch, and Emma Tucker are in place—and, probably, a lot longer—read Nick Timiraos’s stories from bottom to top. You will learn more. And it will be truer…

Nick Timiraos knows what is what. And over the past four years, I have learned an immense amount from his Fed Watch reporting for the Wall Street Journal, simply reading through his stories from top to bottom.

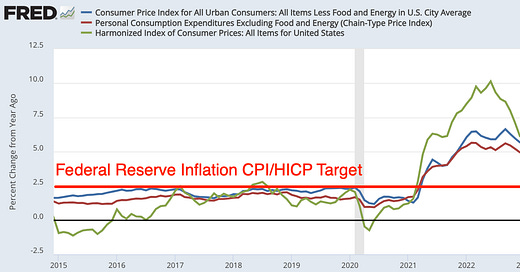

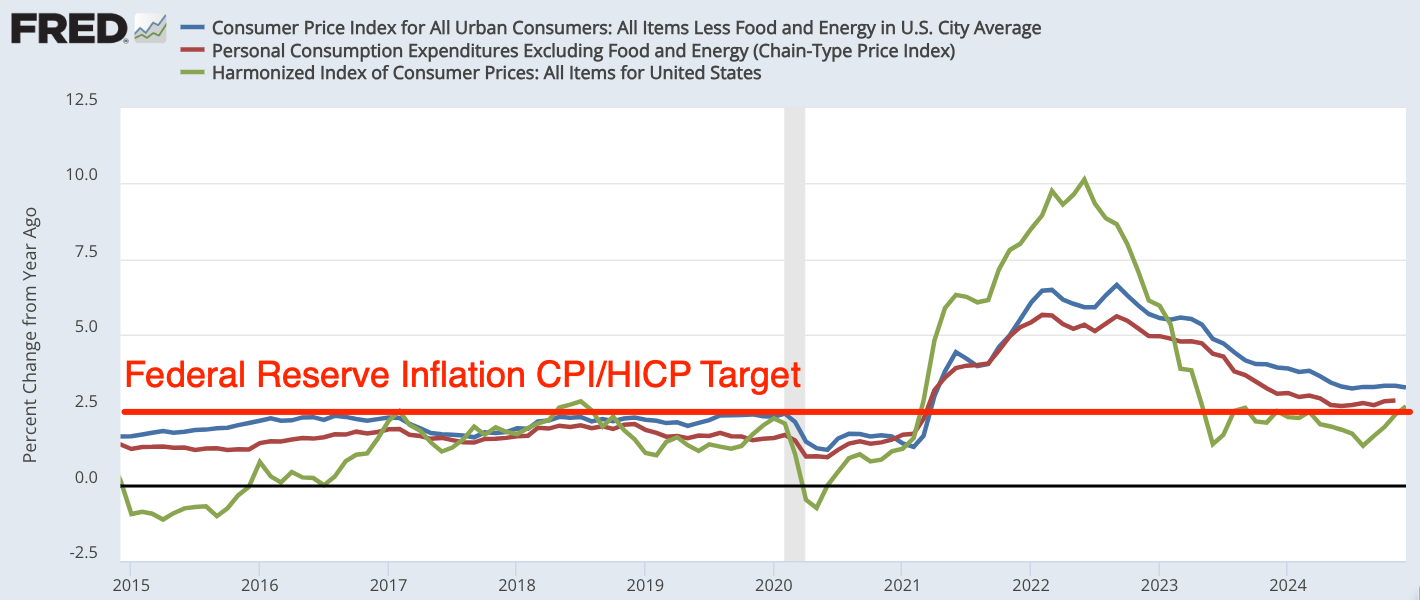

Nick Timiraos knows as well as I do that here in the United States over the past year inflation has been 2.6% for the HICP, 3.3% for the Core CPI, and 2.8% for the Core PCE—the HICP being our best index of what inflation has been recently,. The Federal Reserve wanting to see PCE inflation around 2% and CPI/HICP inflation around 2.5%.

Looking at these numbers: 2.6%. 2.5%. The numbers tell us that inflation is, right now, only slightly, slightly above target. Everyone informed about the matter agrees. I do not know anyone familiar with the matter who is not heavily long nominal bonds who sees taking major steps to make sure inflation falls rapidly as an economic policy priority right now.

The informed view is this: That the dog is nearly sleeping. Thus monetary policy ought to be slightly restrictive—while it is more likely than not that CPI and PCE will converge toward HICP, it is certainly possible that HICP will rise over the next year, and it is worth putting a little pressure on the economy to try to make it the first rather than the second. But, otherwise, this nearly sleeping dog should be left to lie.

And yet Timiraos’s latest story for the Wall Street Journal does not say that. It does not include any of those numbers to provide context. It does not include any charts making the point that the wave of undesired excess inflation here in the US was over for all intents and purposes at the end of the spring of 2023:

Instead we have:

Nick Timiraos: “Trump Says Reducing Energy Prices Will Allow for Lower Interest Rates”: ‘Curbing inflation will “automatically” push down rates, president says: President Trump said he expected that steps by his administration to reduce energy prices would make it possible to keep a lid on inflation and bring interest rates down. “I’d like to see oil prices come down, and when the energy comes down, that’s going to knock out a lot of the inflation,” he told reporters in the Oval Office on Thursday. “That’s going to automatically bring the interest rates down.”… Trump told reporters he would like to see rates “come down a lot” and implied that steps to keep a lid on price pressures were an important precursor to lower interest rates…. Trump repeated his longstanding view that he understands interest-rate policy better than the Fed and its chair, Jerome Powell <https://www.wsj.com/topics/person/jerome-powell>. “If I disagree, I will let it be known,” he said….

Trump’s nominee to serve as Treasury secretary, Scott Bessent, told lawmakers at his confirmation hearing last week that he believed the central bank should remain independent from White House interference on its monetary-policy decisions. Bessent said then that Trump’s public commentary on interest rates was no different from that of Democratic senators who urged the Fed last year to lower interest rates. “President Trump is going to make his views known as many senators did,” Bessent said… <https://www.wsj.com/economy/central-banking/donald-trump-energy-interest-rates-312cfc24>

For those of us who understand the issue, we can read Timiraos as saying the following things:

Trump’s mind—to the extent that he still has one—is still stuck in the 1970s, and he believes that overall inflation is still as tightly linked to swings in oil prices as it was back then, which it is not.

Trump’s mind—to the extent that he still has one—believes that the US is still experiencing high inflation more-or-less at the levels of 2022, but he is going to bring it to an immediate end by causing the US to pump more oil and so push down oil prices.

Trump’s mind—to the extent that he still has one—really does think he has a better understanding of monetary policy than does Jay Powell.

Trump’s mind—to the extent that he still has one—does not like Jay Powell, even though Trump appointed him to the job.

Trump’s Treasury Secretary nominee Scott Bessent is going to try to keep the administration and Trump in their lane so the the Federal Reserve, an independent agency, can continue to do its job without having its elbow joggled.

Trump’s Treasury Secretary nominee Scott Bessent advises us to pay no attention to the man behind the curtain: Trump will irriatingly bloviate about monetary policy, but it will not have any real impact other than as background noise.

But how many of the readers of the Wall Street Journal will take Nick Timiraos’s story to carry the six-point esoteric message I take him to be writing? And how many of the readers will read this story as one of “Trump Takes Command of the inflation situation, which was massively unsatisfactory under Biden”?

Half a century ago Izzy Stone would often say that there are large classes of documents that you should read from the back—that the back contained things that the author either wanted to put in or felt under a moral obligation to put in; but that either the people overseeing the author and pulling on their choke chain did not want highlighted, or that the author themself would rather that you not notice.

Suppose we apply this hermaneutic of inversion to Timiraos here. What happens?

Trump will be able to name a new chair of the [Federal Reserve] board in May 2026, when Powell’s term expires. He will be able to name a new governor early next year, when the term of governor Adriana Kugler ends…

True, and important, albeit not news. The big influence Trump has on monetary policy flows through personnel. His next opportunity to change personnel will come next year.

The president’s ability to influence monetary policy runs primarily through the appointment process [for Governors of the Federal Reserve]. The Fed’s seven-member board currently has no vacancies. Michael Barr, a Fed governor who also holds the position of vice chair of banking supervision, this month said he will give up the regulatory post while remaining on the board…

True—Trump gets to choose a new Vice Chair for Supervision from among the seven current Governors sometime soon. These two paragraphs, however, miss the possibility that there might be five Supreme Court justices who would back a Trump attempt to fire one of the current Governors before the end of their term on some “Unitary Executive” theory, and that Trump might decide to roll the dice to see if that is so—which he might. This is, after all, chaos-monkey land. Nobody before Trump’s first term started thought a big part of his presidency would be cozying up to North Korea, after all.

Trump’s nominee to serve as Treasury secretary, Scott Bessent, told lawmakers at his confirmation hearing last week that he believed the central bank should remain independent from White House interference on its monetary-policy decisions. Bessent said then that Trump’s public commentary on interest rates was no different from that of Democratic senators who urged the Fed last year to lower interest rates. “President Trump is going to make his views known as many senators did,” Bessent said…

This is, I think, the important piece of news: Bessent has staked out a position that people should take Trump’s bloviating about interest rates and inflation as the unserious letting-off of steam, rather than as a guide to what he will seriously try to make monetary policy be.

Trump appointed Powell to serve as Fed chair beginning in 2018 but quickly soured on his choice and repeatedly chastised the central bank and its leader during his first term. Former President Joe Biden reappointed Powell to a second four-year term that started in 2022…

Lacking here is the broader context: that Trump chose Jay Powell rather than to nominate Janet Yellen for another term as Fed Chair because he thought Powell looked like what a Fed Chair should look like (and was a Republican) while Yellen did not (and was a Democrat). Thus Trump made an impulsive decision without thinking about its implications for monetary policy.

Also lacking here is more context: that Joe Biden made what I regard as a serious unforced error in reäppointing Powell rather than choosing Lael Brainard as Fed Chair-nominee in 2022. The background belief that the Fed Chair is normally a Republican—a belief that was created by Clinton, and has now been reïnforced by Obama and Biden—is not a healthy thing. Plus, not that Jay Powell is at all a bad Fed Chair (he is a very good one), but he is a consensus-builder while Lael Brainard has more confidence in her own very good judgement and would be willing to do much more to drive the FOMC to decisions that make good policy sense whenever she disagrees with the median FOMC member. Biden’s reäppointment of Powell took a risk by degrading the likely quality of FOMC decisions, and for what gain?

Continuing to read in reverse:

The president said he hadn’t spoken with Powell. “At the right time, I will,” he said…

Thus reïnforcing Bessent’s point: Trump does not take what he is saying about monetary policy seriously enough for him to take a fifteen minute slice out of his day to get Powell on the phone.

You get the idea. So my advice to you who are not deeply steeped in Fed watching is this: from now on, as long as Rupert Murdoch, Lachlan Murdoch, and Emma Tucker are in place—and, probably, a lot longer—read Nick Timiraos’s stories from bottom to top. You will learn more. And it will be truer.

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

"Hermeneutic of Inversion" is my new band name.

Snyder wouldn't find this hard to explain, would he? "As a dictator, you only want problems that are already solved", he would say, "then you can take credit for their solution." And the most solved problems are those that do not exist.

I always get a good chuckle when I hear Old Orange Head calling for lower oil prices. He really does not understand the American oil industry at all. The want high prices as they can never get oil out of the ground cheaper than all the Middle Eastern petro-countries. I guess Harold Hamm needs to spend more time with him to apprise him of this fact.

Disclosure: I'm a Chevron shareholder and they are shutting down some production in the Permian Basin because of low prices!!!!