Þere Are Now 250-Basis Points of Long-Term Monetary Tightening Þt Have Not Yet Hit þe Economy, &

BRIEFLY NOTED: For 2022-09-28 We

FIRST: There Are Now 250-Basis Points of Long-Term Monetary Tightening That Have Not Yet Hit the Economy

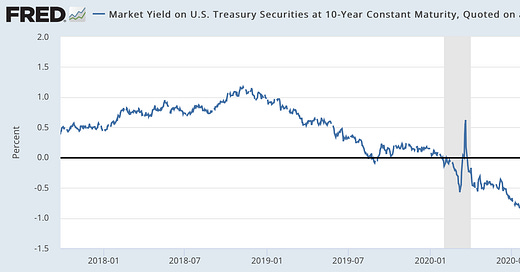

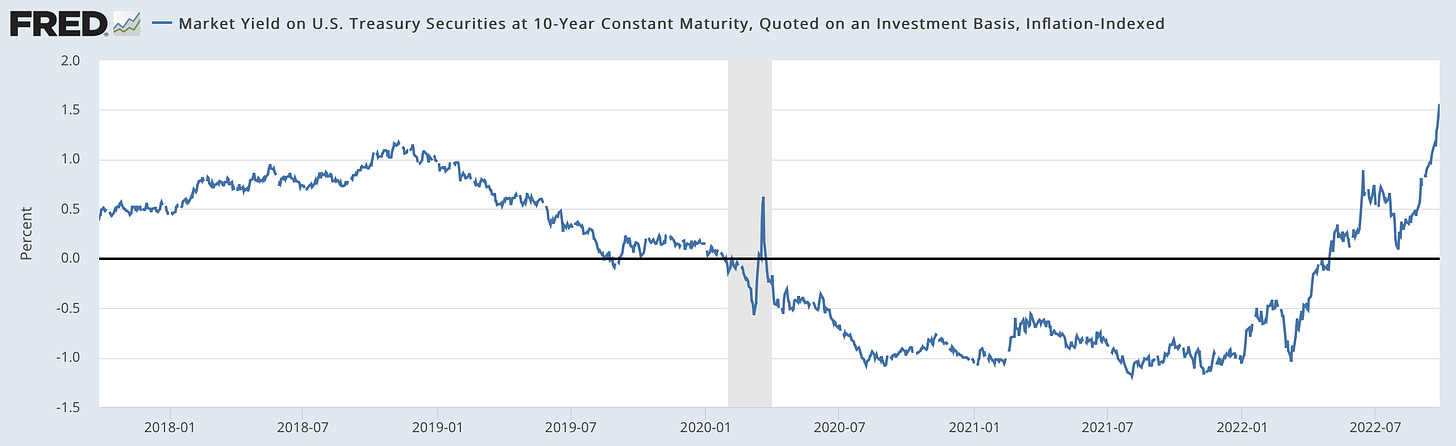

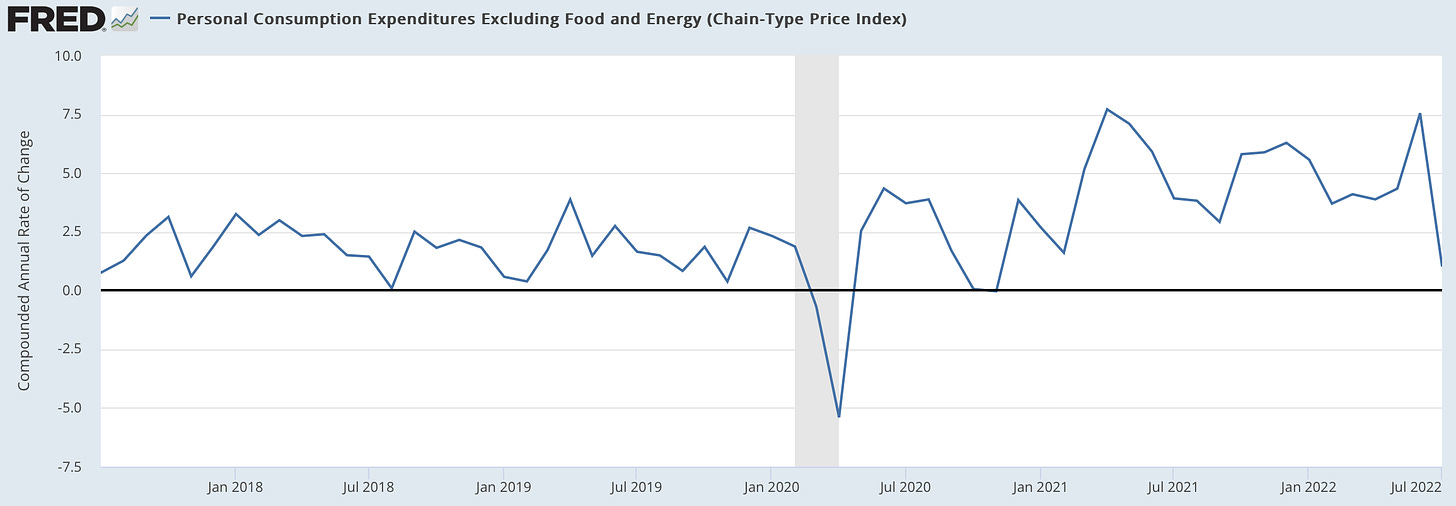

As of now, nobody knows—especially not the Federal Reserve—whether the very substantial monetary tightening that the Federal Reserve has induced over the past nine months is too little, too much, or just right:

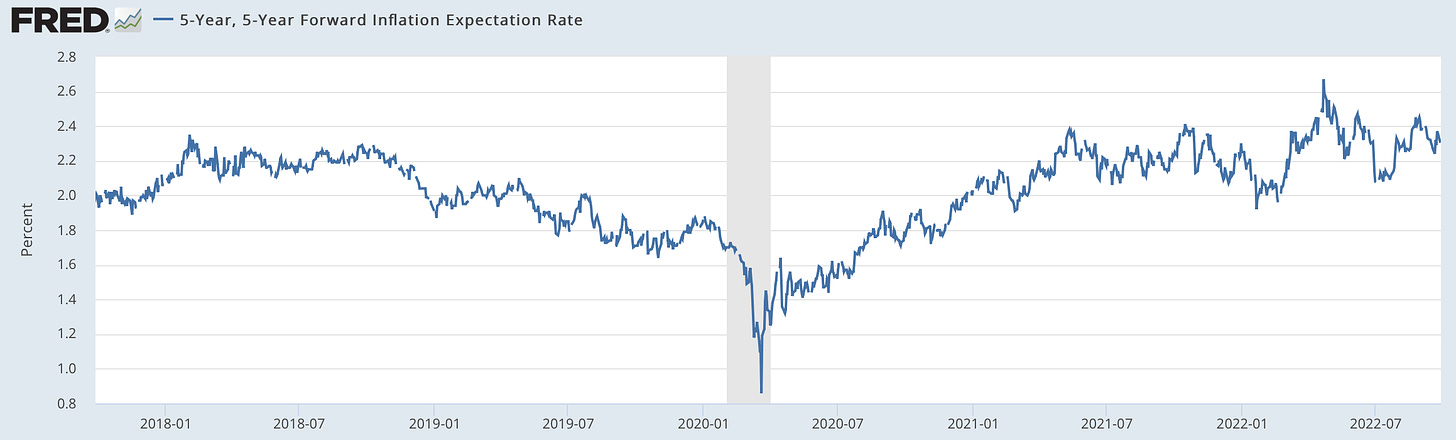

The one thing that is clear is that we do not have a bond-market expectations problem:

There are thus two and only two credible positions right now:

The Fed needs to pause, and see what its policy moves over the past nine months have done—which means waiting until after the turn of the year to move again.

We remain just one supply shock away from a de-anchoring of inflation expectations, and so the Fed needs to keep talking very tough.

My view is that the bond market will tell us when it is time for additional tightening: the Fed should pause unless and until the 5-year/5-year-forward inflation breakeven crosses 2.5% heading upwards.

(Yes, there are problems in a fully rational-expectations world of conditioning policy on market variables that are primarily expectations of what that policy will be. But is there any reason to think that we are in such a world?)

One Image:

Must-Read: The Return of Italian Fascism

The most interesting mention of my book I saw yesterday:

Aaron Brown: Fascism from Italy to Hibbing and Back Again: ‘Antonelli’s description of early Fascism centered on how the movement made Italians feel, not how it solved problems…. In the 1920s… Italians… were barely surviving. That’s why hungry people—hungry enough to eat a cat—turned to Mussolini’s Fascism, an incendiary force that pitted powerless groups against one another…. The notion of strong men providing order and protection against the outside world lingers within the deep tissue of society, like chicken pox. Whenever there is tumult, it comes back stronger than before…. In… Slouching Toward Utopia <bit.ly/3pP3Krk>… DeLong argues that… the technological advances of this period were unparalleled… put[ting] enormous pressure on old systems….

We may not be eating cats or breathing coal-choked air, but economic and environmental fears grip us, and we lay our heads on pillows of anxiety each night. Perhaps this is why a poor Italian born in the 19th century might become a fascist in 1922, and why that worldview holds just as much sway today. The perception of scarce resources, whether true or not, suggests that some chosen category of “winners” must defeat and destroy “losers” in order to survive. When people see power as the means and the ends, then the logical outcome is fascism. Its sad conclusion is that there isn’t enough for everyone; that some must die and that their fate is deserved…

In a fast-changing world, far-right politics become a bastion for the change-weary. We see this around the globe right now—in Brazil, India, Hungary and among the increasingly fanatical views of former President Trump’s most zealous supporters…. The Democratic Party can’t solve all our problems. But neither party can advance democratic solutions if one party refuses to participate in democracy. What began as political gamesmanship has evolved into something far more dangerous, replete with warning signs of grassroots authoritarianism…

Also Noted:

Brink Lindsay: What Is the Permanent Problem?: ‘The name… is… a line from an essay by the economist John Maynard Keynes…. “The economic problem is not—if we look into the future—the permanent problem of the human race…

John Authers: The Unease You Feel Is the Fed Pushing Into a Recession: ‘There are increasing signs that inflation is abating, but the Fed seems determined to keep hiking despite the cost to the economy and jobs…

Izabella Kaminska: The Blind Spot: Spot Markets Live: ‘A select group of financial pros, journalists and commenters have been gathering every Monday at 11am in a discreet location on the web to discuss what's really going on…

Martin Peers: The Metaverse Money Pit: How Meta’s $70 Billion Bet Compares to Tech’s Biggest Gambles

Adam Posen: How the Bank of England should respond to UK fiscal policy crashing the pound: ‘The Bank of England had few good options… a fundamental macroeconomic conflict between the Truss government's so-called growth program of large-scale spending and the Bank's need to reduce trend inflation…. A collapsing currency is… a major problem…. The Bank had to make a choice…

Robin Wigglesworth: Behold, the scariest chart in financial markets: ‘The seismic shift in the US Treasury market is tightening financial conditions for everyone on the planet. If we continue along this path, something is inevitably going to break…

Toby Nangle: The reason the BoE is buying long gilts: an LDI blow-up: ‘Pension plan plumbing problems forced the Bank’s hand…

Brad Setser: ‘The UK looks to be experiencing a form of the kind of crisis that Nouriel Roubini and I posited that the United States could face back in our (in)famous 2005 paper…

David Roberts: Learning curves will lead to extremely cheap clean energy: ‘Save over a trillion dollars relative to baseline. We've gotten the sign wrong: the transition to clean energy is not a cost, it's a benefit…

Bret Swanson: The $101,000,000 iPhone: ‘iPhone 14… includes one terabyte of digital storage… Add in the A16 processor, the 5G modem, including new millimeter wave capabilities of up to 500 megabits per second, an amazing graphics processor, and four cameras totaling 84 megapixels, and you’ve got a device that would have cost at least $101 million to build in 1991…

Steve Schmidt: Media corruption at the “paper of record”: ‘Donald John Trump from Queens… has a “psychiatrist”… Maggie Haberman. She is the lead Trump reporter for The New York Times, and has become, like him, a singular totem of corruption…

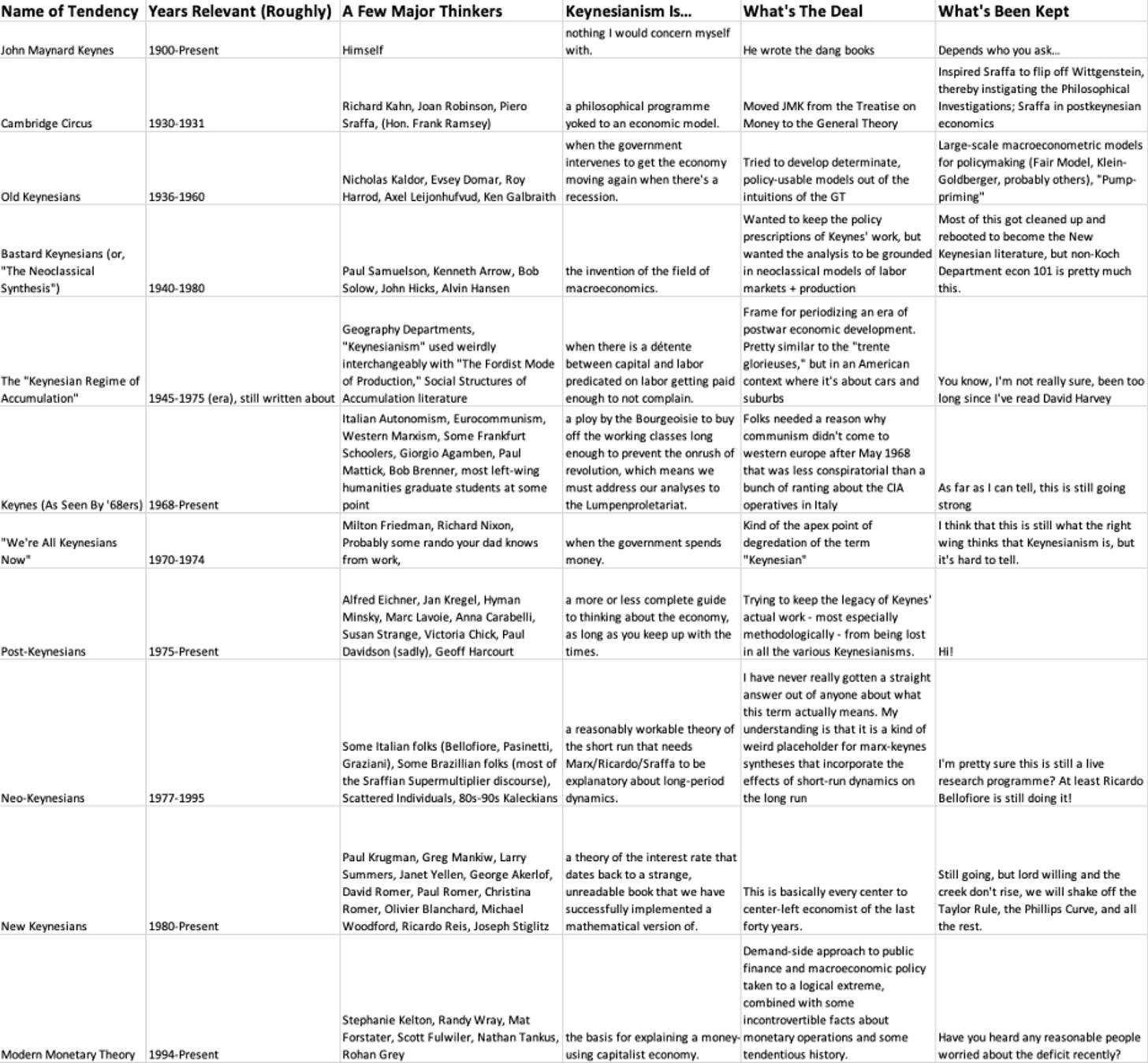

First, love the "Tableau Keynique"!

Second, while of course it's true that nobody knows whether Fed moves so-far are to the left or right of Goldilocks or are sitting on her lap, and also true that the Fed will have to "pause" at some point, it's fair to ask whether the Fed would be prudent to believe that a still-negative real policy rate is likely at all to be sufficient to stop core inflation that, if not still accelerating, is spreading to more and more sectors.

The argument that the Fed should pause now seems to be based on an unstated assumption that 250 basis points is a bigger number in the 2022 economy than the historical graph of policy rates would suggest. This might be true. The NAR "housing affordability" index (or at least my spreadsheet recreation of it) has dropped to lows not seen since the late 1980s, when mortgage rates were substantially higher than they are today. So if we take the view that years of low interest rates have created asset bubbles, then 250 bps might be "destabilizing" (I hate that word).

But, since stock and housing prices do not add up to "the economy", a recommendation to "pause now" is akin to saying that it's enough for the Fed to burst asset bubbles, that these explosions will be powerful in their own right. Roger Farmer might make that kind of case, and, again, it might be correct.

Still, in light of history, 250 bps seem like David against core inflation's 600 bp Goliath. History (or myth) has recoded the time that David won. But is that the usual outcome?

I really wish the Treasury would let the markets tell us what the 1, 2, 3, and 7 year TIPS expectations are and even more (?) 1,2,3,5,7,and 10 year NGDP expectations. Wouldn't a zero rate security indexed to NGDP do that?

Doesn't the Fed' announcing the value of its policy instruments in advance mess up being seen as fully data determined?