FIRST: These People Have Jobs?: Law & Twitter Department

One of the great challenges in understanding just what Ms. Market has been thinking this year was the magnitude of the drop in the equity value of Twitter between May 6 and May 16, when its market price dropped from $50 to $37 a share—essentially giving back 80% of the premium that had been baked into it when Elon Musk decided to contract to buy Twitter at $54.20:

That Twitter dropped was no surprise: Elon had had second thoughts, and was trying to get out of the deal:

May 13: Musk declares his plan to buy Twitter “temporarily on hold.” Musk says he needs to pinpoint the number of spam and fake accounts on the social media platform. Shares of Twitter tumble, while those of Tesla rebound sharply… <https://apnews.com/article/twitter-elon-musk-timeline-c6b09620ee0905e59df9325ed042a609>

Do note that the slide started a week before the May 13 “hold”.

I was puzzled. My view at the time: Twitter had negotiated with Musk a contract that gave him very little way out, and that gave Twitter the right to demand that a court enforce "specific performance”. Twitter was highly likely to get something within shouting distance of $54.20—say, a 20% discount—if Musk did back away. Moreover, there were the 230 million monetizable Daily Active Users of Twitter, who were not ‘bots, Even if Musk backed out, Twitter was now in play. And somebody was likely to think they had a plan to unlock value and get $160 per mDAU, or more, out of the property.

So what scenario was Ms. Market pricing in? That the contract did not say what it said? That a Delaware Court—and the Delaware Court of Chancery prides itself on making contracts real, in Delaware jurisdiction at least—would not make the contract real? It wasn’t until October 4, 2022, when Musk sent a letter proposing to complete the acquisition, that the Twitter stock price recovered to where I thought it had belonged.

One reason that Ms. Market did not believe that the Delaware court would do what the Delaware court seemed to me to be on a direct path to doing was that the zone was flooded with bullshit.

Back on July 13 someone sent me a clipping from the Wall Street Journal, and somebody else reminded me of it over the weekend:

J.B. Heaton and M. Todd Henderson: Twitter’s Lawsuit Against Elon Musk Looks Like a Loser: As Elon Musk abandons his $44 billion purchase of Twitter, the only winners are progressives who support the social media platform's censorship of views that don’t conform to their own: ‘Twitter has sued Elon Musk, seeking to compel him to buy the company for $54.20 a share. Many… think the company will prevail, or that… Musk is likely at least to pay the $1 billion breakup fee. They’re wrong. He is likely to walk away largely unscathed…. It is hard to imagine a court would force the purchase of a $44 billion corporation…. Delaware courts have rarely ordered specific performance in merger agreements…. What happens if the court orders specific performance?… Musk could play a high-stakes game of chicken that ultimately reveals that courts are extremely limited in cases like this if the parties don’t want to play along. Damages are easier to enforce…. [But] it isn’t clear how Twitter is made worse off by Mr. Musk’s walking away…. Shareholders aren’t party to the agreement…. Twitter would have to prove harm, such as lost profits, and that’s an uphill battle…. The issue of the $1 billion breakup fee…. Breakup fees are supposed to reflect damages caused by a breach of contract. They aren’t supposed to act as a penalty. Given that Twitter isn’t obviously worse off by $1 billion—if at all—a court might balk at imposing such a high fee…. Either Mr. Musk’s lawyers were too smart for that or Twitter’s weren’t smart enough.

Let’s run down the claims here:

The people who think Twitter will prevail are wrong.

Delaware courts are unprepared to order specific performance.

There is no realistic way to compel specific performance in this case, and Musk is likely to play chicken if specific performance is ordered.

There are no damages, because shareholders are not a party to the agreement, and Twitter will not lose financially from the cancellation of the deal.

The breakup fee provision is invalid because it is a penalty, not compensation for damages.

Twitter’s lawyers weren’t smart enough.

They are all false.

In fact, I went back through the whole thing, looking for passages that were not false. I came up with:

Twitter has sued Elon Musk, seeking to compel him to buy the company for $54.20 a share…

Many observers think the company will prevail, or that Mr. Musk is likely at least to pay the $1 billion breakup fee…

This case will be a good lesson on the limits of boilerplate merger agreements and the difference between a corporation and its shareholders…

The merger agreement in this case could be read in a way that permits a court to order Mr. Musk to buy Twitter—he and two entities he controls agreed they would “not oppose” such an order—through a remedy known as “specific performance”…

If one agrees to sell Hearst Castle, but tries to back out when a higher bid emerges, a court may specifically enforce the contract. There is only one Hearst Castle, and no other remedy can make the jilted buyer whole. But where alternatives exist, other remedies usually make more sense. Imagine the contract was to paint Hearst Castle, and the painter walked away. A court would be reluctant to force the painter to do the job. No one wants to have his house painted by someone under court order. A coerced painter might skimp on quality, which could require the court to get involved again…

There are also other potential buyers for Twitter.

Damages are easier to enforce. The court could order the painter who walked away to pay the difference between the price agreed and the price of hiring a replacement.

But the shareholders aren’t party to the agreement. Only Twitter Inc. is a party, and it is a separate and distinct legal entity.

In that case, the shareholders could have sued for the difference between the amount Mr. Musk agreed to pay and the price any other suitor would pay—like the homeowner finding another painter. But the merger agreement doesn’t give shareholders this remedy.

That is it. No other sentence is correct.

How many changes would we have to make to the world for this article to be right? And how different would our history have to have been compared to its actual path?

I mean: These people have jobs? Relatively high paying ones? And the University of Chicago unleashes them on students without warning stickers?

One Video: Intel’s Pat Gelsinger:

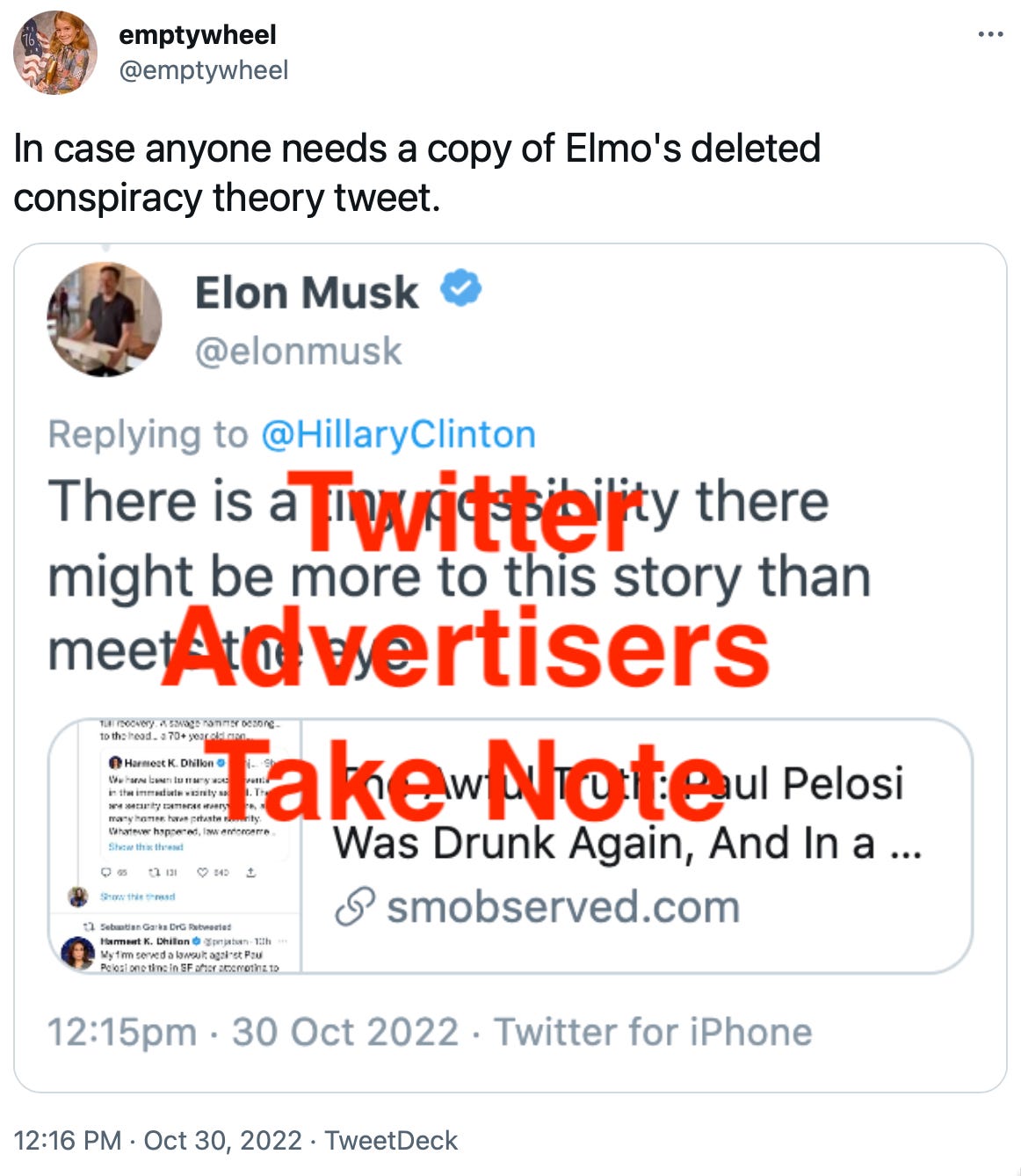

One Image: The Chief Twit:

It is more likely that Elon Musk is a highly carnivorous shapeshifting-lizard than are some of the things Musk gives positive credence to

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Matthew Winkler: California Poised to Overtake Germany as World’s No. 4 Economy: ‘The Golden State has proven resilient, outperforming its US and global peers…

John Burn-Murdoch: Britain and America’s electoral geographies are broken: ‘Why would Labour stalk the Tories on immigration, you ask? Because Britain’s skewed electoral geography, in which progressives are packed into highly inefficient super-majorities…. Britain and America like to see themselves as the standard bearers of liberal democracy, but on the evidence presented, there is still some way to go…

Jason Stanley: One Hundred Years of Fascism: ‘For fascist parties and politicians to win elections, they usually must attract support from people who, if asked, would loudly reject the fascist label. But this need not be so difficult: voters merely have to be persuaded that democracy is no longer serving their interests…

Bucco Capital: ‘Facebook threw up such a bad quarter it made Jim Cramer tear up and apologize to his viewers for being so wrong. That’s something.This video is a modern classic…

Chris Stokel-Walker: Students Are Using AI Text Generators to Write Papers—Are They Cheating?: ‘Teachers are struggling to catch up...

¶s:

John Thornhill: Forget the humanoids — it’s industrial robots that willl transform the world: ‘Societies need all the imagination of science fiction writers to use proven functional skills rather than replicate our own…. Societies will have to become far more creative than most science fiction writers in imagining how we can best collaborate with robots. Rather than constantly benchmarking them against humans, we should exploit their complementary capabilities…. Our obsession with humanoid robots replicating what humans can already do represents the assertion of form over function. Far better for function to inform form. Start with the human need and reverse engineer the robot to do what they do best…

Nilay Patel: Welcome to hell, Elon: ‘You f—-ed up real good, kiddo. Twitter is a disaster clown car company that is successful despite itself, and there is no possible way to grow users and revenue without making a series of enormous compromises that will ultimately destroy your reputation and possibly cause grievous damage to your other companies. I say this with utter confidence because the problems with Twitter are not engineering problems. They are political problems…. The asset is the user base…. The problem when the asset is people is that people are intensely complicated, and trying to regulate how people behave is historically a miserable experience…. You are now the King of Twitter… personally… responsible for everything that happens on Twitter now.… Absolute monarchs usually get murdered when shit goes sideways.

Paul Krugman Wonking out: It’s a lagged, lagged, lagged, lagged world: ‘So far, however, there hasn’t been much evidence of economic cooling…. So doesn’t this say that the Fed needs to do more? Don’t the numbers speak for themselves? Well, no. Numbers rarely do…. Is “true” inflation really coming down?…. Wage growth is slowing. Wages are still rising too fast to be consistent with the Fed’s inflation target, but if the economy is really set to weaken, wage growth will probably weaken too. Furthermore, you can argue that past wage growth, like surging rents, partly reflected a one-time adjustment to pandemic-related shocks, which will go away over time. So does the Fed need to do more, or has it already done too much? It’s a judgment call…

Elite law schools? BigLaw and courts take the admissions offices of elite law schools very seriously. Not the professors.

Legal scholarship has little impact on legal practice. It should--practitioners need good guides to technical fields of law, and scholars are good people to provide them. However, the profs are (mostly) removed from practice and want to stay that way. Practitioners must perforce learn from each other. And law students? If a law student actually wants to learn about--say--payment systems, the course will likely be taught by a practitioner adjunct. The schools are getting a bit better at clinical experience, but it is still a low-prestige part of legal academia: perhaps one step above legal writing.