Toward a Theory of þe Natural Rate of Inflation, & BRIEFLY NOTED: For 2023-01-23 Mo

Some sense of how much our “reopening” and now our “attack on Ukraine” supply shocks have raised the natural rate of inflation over the past two years would have been a great help in understanding...

FOCUS: Toward a Theory of the Natural Rate of Inflation:

The paper is “Inflation in Times of Overlapping Emergencies: Systemically Significant Prices from an Input Output Perspective”, by Isabella M. Weber & al.:

Isabella M. Weber: ‘We are trying to do here is to think of prices as kind of an interconnected network where, since one sector's output is another sector's input, and therefore one sector's output prices are the cost of another sector, you can kind of trace the price movements across the whole production network, which input-output tables allow you to do…. If we can identify these points of vulnerabilities, then we can actually kind of know what the potential sources of these ripple effects that can create macro outcomes could be… if some prices matter more than others…. Input-output is one method of trying to identify these systemically significant sectors…. We have to make assumptions on how industries hand over cost increases…. One is that it's just a passthrough of 100%…. [The other is] they… protect their profit margin…. The sectors that we identify as systemically significant are basically in three groups… basic necessities… housing, food… utilities and of course also energy… basic production inputs… fossil fuels… but also chemical products and… circulation infrastructure… wholesale trade…. These sectors are so important that if there are large price movements in these sectors that this has implications way beyond these specific sectors...

I have been complaining recently about the absence of work on the “natural rate of inflation” since Akerlof, Dickens, and Perry back in the 1990s <https://www.brookings.edu/wp-content/uploads/1996/01/1996a_bpea_akerlof_dickens_perry_gordon_mankiw.pdf> <http://www.bassarsson.com/Akerlof_dickens_perry_2000.pdf>, with follow-up by Akerlof and Dickens <https://www.brookings.edu/wp-content/uploads/2007/09/2007b_bpea_akerlof.pdf>. Now, lo and behold, along come Isabella Weber and company to actually make some progress.

As I understand Weber and Company, the question is this: We have a supply shock. That supply shock is, in our real world in which wages and prices are sticky downwards, going to be most efficiently managed by allowing the overall price level to drift upwards so that the relative price changes to accommodate the supply shock and return to equilibrium, do not involve deflation in any sector or for any group of workers in which wages and prices happen to be sticky downwards. How much of an increase in the price level will be needed for smooth accommodation of the supply shock?

Weber and company use the economy’s input-output table to try to figure this out. It is ingenious. It is quite promising. They conclude that the economy will need more inflation in order to accomodate efficiently when the supply shock hits one of:

basic necessities,

basic production inputs, or

the logistics chain.

What I would text if I were them would be to attempt to classify industry and worker groups by some guess at their degree of downward, stickiness, and try to see how that would change their analysis. It is important to look at more than just at the industries and worker groups where price rises produce a substantial increases in nominal costs throughout large chunks of the economy as a whole. It is important to look at the industries and worker groups where relative prices need to fall in order for adjustment to be complete.

Some sense of how much our “reopening” and now our “attack on Ukraine” supply shocks have raised the natural rate of inflation over the past two years would have been a great help in understanding our macroeconomic situation. It would still be a great help today.

MUST-READ: Ezra Klein’s Take on Republicans:

As I understand it, the Democrat leadership’s decision not to push for a debt ceiling increase before the election or in the lame duck was due to their belief that (1) they had other things to do that they could not do later on, (2) the Republicans would not make an issue of the debt ceiling because they understood that they needed to plaster over rather than greatly widen the cracks between their Donor Class and their anti-American Handmaid Base, and (3) that in the event that Republicans did make an issue of the debt ceiling increase, it was good political ground to fight on without, in the end, any risk of negative policy consequences.

Maybe. These guys are very unpatriotic, and quite crazy:

Ezra Klein: Three Reasons the Republican Party Keeps Coming Apart at the Seams: ‘[1] An awkward alliance between a donor class that wants deregulation and corporate tax breaks and entitlement cuts and guest workers and an ethnonationalist grass roots that resents the way the country is diversifying, urbanizing, liberalizing and secularizing…. It’s caught between a powerful business wing that drives its agenda and an antagonistic media that speaks for its ethnonationalist base, and it can’t reconcile the two…. [2] The problem for the Republican Party… is that it is, in fact, an institution. And so the logic of anti-institutional politics inevitably consumes it, too, particularly when it is in the majority…. [3] Republicans need an enemy…. Sam Rosenfeld… told me. “The conservative movement is oriented more around anti-liberalism… [which] opens] their movement to extremist influences and makes it very difficult to police boundaries.”… McCarthy has… traded away many of the powers he would have had… agreed to spending caps and budgetary guarantees that will commit House Republicans to the kinds of brutal cuts and dangerous showdowns that make them look like a party of arsonists…. And most important, he was proved weak before he ever held the gavel. “All McCarthy has is the title on the door above his office,” Skocpol told me. He’s a hollow speaker for a hollow party…

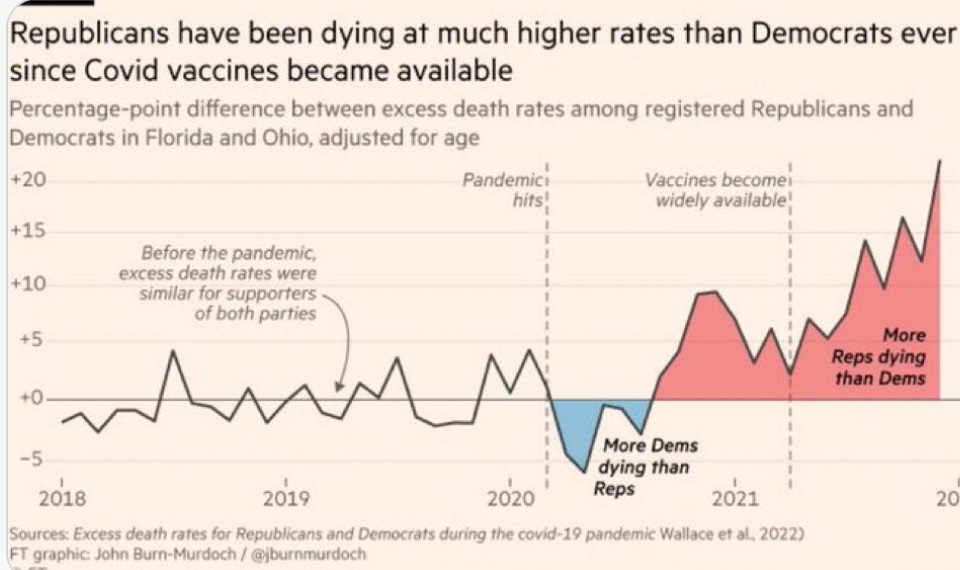

ONE IMAGE: Weaponizing Neofascist Misinformation Against Your Own Supporters:

Very Briefly Noted:

Mack DeGeurin: Elon Musk Tells Jury That 420 Has Nothing to Do With Weed: ‘The Tesla CEO dismissed associations between a $420 share price and marijuana and accused the head of Saudi Arabia's sovereign wealth fund of “ass covering”...

Denitsa Tsekova: JPMorgan Model Shows Recession Odds Fall Sharply Across Markets: ‘Investors return to riskier assets as soft-landing hopes build. S&P 500 still assigns 73% recession bet, from 98% in October

Daniel W. Drezner: The Biden Administration Attempts to Square the Circle on Export Controls to China…

Gideon Rachman: The world’s democracies need to stick together: ‘Maintaining a united front on Ukraine and on China is getting harder…

Jay Kuo: The Kavanaugh Cover-up: ‘I noted how the failure to hold the Justices to the same scrutiny as the Court’s own staff rendered the investigation little more than a performative sham. Then, over the weekend, another bombshell dropped, calling the very legitimacy of the Court’s composition into question. It came in the form of a much-anticipated documentary film, from director Doug Liman, entitled Justice… Brett Kavanaugh…

CEPR: Vasiliki Fouka…

Bocconi: | Mara P. Squicciarini…

Andrew Jack: AI chatbot’s MBA exam pass poses test for business schools: ‘A professor at the University of Pennsylvania’s Wharton School said ChatGPT earned a ‘B to B-’ on his operations management test…

I would also look at the effect of steel and aluminum tariffs on price increases, and limits on downward price declines due to reduced demand since there are constraints on foreign substitution. Also look at Canadian lumber tariffs. Adding the Trump tariffs and Chinese tariffs to the input/output tables might explain why prices go up, and decline more slowly despite a decrease in demand

Webber: Yes, this is what one supposes the Fed is trying to do in deciding how much flexibility above it's average inflation target, which is a just a modification of the calculation it made to decide that 2% PCE was the optimum average.

But that is the easy part. The hard part is to figure out month by month what settings to use for the FF rate, IOR, amounts of QE to buy or sell, etc.

Slightly surprising to read the reference to I-O. I suppose Webber means a fairly highly disaggregated CSGE model.

BTW, _I_ do not like the "natural" appellation. It's a estimate of an optimum and the parameters of estimation are themselves not "natural."