Trump as a Chaos Monkey: Fed Independence Edition

I realize that The value of Fed independence, and Trump’s threat to it, is something that people should stop, register, and take action on. I realize that practically no information about what...

Near-total silence from the macroeconomists who have chosen to be professional Republicans speaks very loudly indeed right now. The value of Fed independence, and Trump’s threat to it, is something that people should stop, register, and take action on.I realize that practically no information about what Trump II policies would be and how much damage they would do is getting through. To some degree this is because the coverage of Trump is, basically, what so much of political coverage is—Hollywood celebrity journalism, but the people are ugly. But it is also because Trump II policies will be what Trump I policies were: (a) tax cuts for the rich, and (b) chaos monkey breaking random stuff in a way calculated to make Trump look mean—we saw this on Twitter Monday night, where Trump appeared to get most excited at how great Elon Musk was at firing people who worked for him. And since nobody knows anything about how they will be mean and stupid, it is hard to focus. The threat to Fed independence, and the value of Fed independence, is, however, worth focusing on…

Now comes Chris Anstey of Bloomberg News:

Chris Anstey: Fed Becomes Campaign Issue as Trump, Vance Seek Political Input: ‘Donald Trump said the president should have some “say” over Federal Reserve policy, which really came down to a “gut feeling.” What Trump is saying… JD Vance said… is “really important and actually profound—which is that the political leadership of this country should have more say over the monetary policy of this country. I agree with him. That should fundamentally be a political decision,” Vance said…. Kamala Harris… [said] she could not disagree “more strongly…. The Fed is an independent entity, and as president, I would never interfere in the decisions that the Fed makes”….

History shows the value of [Fed independence]…. In the US itself, then-President Richard Nixon in the early 1970s famously pushed the Fed chair of the time, Arthur Burns, into easier monetary policy, triggering a costly inflationary boom-bust cycle…. Public pressure by the president would feed through to public expectations for inflation… Lawrence Summers… said last week. “Long-term interest rates go up with inflation expectations, and so you end up with higher inflation and a weaker economy…” <https://www.bloomberg.com/news/newsletters/2024-08-13/fed-independence-becomes-campaign-issue-as-trump-vance-seek-political-input>

I have talked about this before, not rarely, and not to excess. Last May:

Brad DeLong: The Threat of Trumpflation & a Fed War: ‘Trump is keen to remove Fed Chair Jerome Powell through untested legal means, so that he can either install a loyal crony or at least set off a fight with Congress in which he can appear to be challenging the “establishment”… a MAGA rerun of Andrew Jackson’s Bank War in the 1830s… [which] brought financial disruption, commercial bankruptcies, and deflation, thus destroying some share of national wealth and shifting the rest from entrepreneurial debtors to already-rich creditors.… Inflation hawks… serious about price stability and the long-term economic outlook… should be much more worried about the return of Trumpism… <https://www.project-syndicate.org/commentary/trump-inflation-fed-war-would-be-economically-financially-disastrous-by-j-bradford-delong-2024-05>

And last June:

DeLong, J. Bradford: Shadow Fed Conference: Comments on Orphanides & on Levy & Plosser (Expanded): “It may be all that I have talked about so far is just rearranging deck chairs on the Titanic. Perhaps there are other much more important problems we need to address immediately and thoroughly if we seek a central bank that will make Say’s Law true in practice even though it is false in theory. The big such problem is the forthcoming nomination of Donald Trump as Republican Party presidential candidate. The Donald Trump who writes such incoherent and erroneous word-salad as: “VOTE FOR TRUMP! BitCoin mining may be our last line of defense against a CBDC…. We want all the remaining BitCoin to be MADE IN THE USA!!!! It will help us be ENERGY DOMNANT!!!!” … <https://braddelong.substack.com/p/shadow-fed-conference-comments-on>

Consider that there are at least four solid and there may well be six votes on the Supreme Court today extremely, extremely eager to say that there is a unitary executive—which would include the Federal Reserve—so all these congressional carve-outs of independent agencies are, in fact, “unconstitutional”, which means, today, no more and no less than annoying to Republican justices. After all, if the Affordable Care Act’s Medicaid-program expansion was found to be “unconstitutional”, literally anything can be so found if the justices are motivated enough.

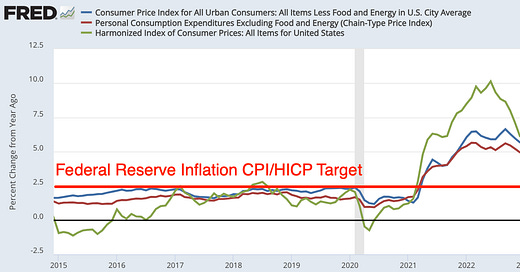

Markets are not pricing a Trump Fed War inflation scenario. Markets see inflation undershooting the Fed target by a cumulative amount of 2.6%-points over the next five years.

Maybe this is because markets have thought it through, noted that none of the Governors’ terms expire until 2028, recognized that none of the seven current Governors appears to be a Fed patsy, and believes that not even a “unitary executive” Supreme Court would interpret the legal requirement that Governors can only be removed for office “for cause” to mean that Trump can dismiss them because he does not like their faces.

But every single year starting in 2000 in American governance, something has happened that I would have, beforehand, characterized as way, way, way out in the statistical-distribution tails. The fall of Federal Reserve independence in a Trump-launched analogue to Andrew Jackson is certainly way out in the tails. But there are a lot of people who want to be in the Trump orbit right now reading the standard biographies of Andrew Jackson.

And, of course, what I hear as near-total silence from the macroeconomists who have chosen to be professional Republicans speaks very loudly indeed.

References:

DeLong, J. Bradford. 2024. “Shadow Fed Conference: Comments on Orphanides & on Levy & Plosser (Expanded)”. Grasping Reality. June 14. <https://braddelong.substack.com/p/shadow-fed-conference-comments-on>.

DeLong, J. Bradford. 2024. “The Threat of Trumpflation & a Fed War”. Project Syndicate. May 22. <https://www.project-syndicate.org/commentary/trump-inflation-fed-war-would-be-economically-financially-disastrous-by-j-bradford-delong-2024-05>.

Fred. 2024. “5-Year Breakeven Inflation Rate”. Federal Reserve Bank of St. Louis. <https://fred.stlouisfed.org/series/T5YIE>.

Trump corrupts everything he touches. He has corrupted the Republican Party, and he has corrupted the Supreme Court. If elected, he will surely corrupt the Fed as well.

"And, of course, what I hear as near-total silence from the macroeconomists who have chosen to be professional Republicans speaks very loudly indeed."

They will not speak up, because doing so needs some spine. And I wouldn't be too sanguine about any of the Fed Governors' terms. They can be intimidated to leave "voluntarily." In that type of world, security for self and family can play a major role. (I entertained that possibility only after reading the debates here). Further, how many journalists have covered the contrasting positions (along with implications) of the two campaigns on the Fed's independence on monetary policy?

On another issue, why does the media insist that she should show her economic policy platform when so little is known about his potential economic policies? They're sounding very fair and balanced aren't they? What a farce.