[U.S.] Federal Debt: Frog in the Pot?

My article in the 2024Q2 "Milken Review"; yes, I know Jim Fallows hates the "frog in a pot" trope as simply wrong—a real frog would hop out of the pot long before danger time. But a country's...

My article in the 2024Q2 "Milken Review"; yes, I know Jim Fallows hates the "frog in a pot" trope as simply wrong—a real frog would hop out of the pot long before danger time. But a country’s political system?…

By this time, you must know the drill: the federal debt held by the public (which excludes debt held by government agencies) reached $26.5 trillion at the end of 2023. That’s a whole lot of money – enough in $100 bills laid out end to end to reach two-thirds of the way to Mars (admittedly, only at Mars’s closest approach to Earth). So when is the whole Rube Goldberg structure of borrowing more to recycle a growing debt going to collapse? And what would that mean for the stability of the economy, not to mention the government? ¶ Start with a somewhat reassuring clarification. If you owe $1 million, have no valuable assets and your income is $50,000 a year, the repo man may soon be at the door. But if you owe $1 million, own a 12-bed-room home in Beverly Hills free and clear, and are taking home $600,000 a year from the family business, well... lucky you.

Ups and Downs & Ups

Likewise, the federal debt needs context. And the most useful rough-and-ready way is to compare the debt to annual GDP across the decades. So here we go.

Over at Milken Review: <https://www.milkenreview.org/articles/federal-debt?IssueID=53>

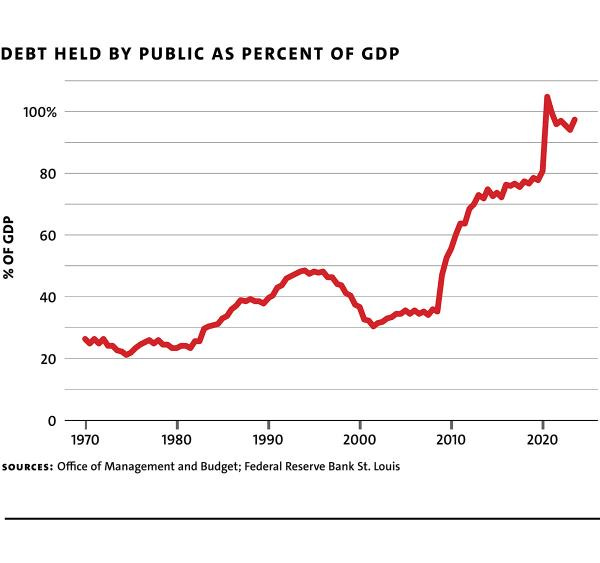

At 22 percent, the debt-to-GDP ratio reached a low point for the post-World War II era in 1974. When Ronald Reagan’s first budget year began in 1981, it had ticked up to 25 percent. At the end of the Reagan-Bush years, Bill Clinton faced a debt-to-GDP ratio of 48 percent. Clinton moved political mountains – and permanently alienated the left wing of the Democratic Party – to trim the ratio back to 32 percent. But Bush II promptly blew it back up, bequeathing a 53 percent ratio to Barack Obama. Then, efforts to buffer the worst effects of the Great Recession with cash, bailouts and jobs drove the ratio to 74 percent at the start of Trump’s first budget year.

Debt-to-GDP reached a peak of 103 percent in the middle of the Covid-19 plague in mid-2020 but ratcheted back down to 94 percent by the start of President Joe Biden’s first budget year. Today, it stands at 95.4 percent and counting.

What's The Problem?

Well, the trend (save for the years in the White House of that famous Democratic spendthrift, Bill Clinton) is definitely up, which probably leaves you feeling even queasier about all those trillions in debt than when you started reading. But step back a little. For starters, Wise Men (yes, they were all men) seemed just as worried about the debt ratio when it was 22 percent in the 1970s as the current generation of Wise Persons seems to be as the ratio approaches 100 percent. That’s not an adequate reason to stop worrying and learn to love the red ink. But it should leave you scrambling for a convincing analysis that better predicts when the debt will become a problem – and how big a problem.

I will try to deliver. But, cutting to the chase, I believe there is no reason for the debt we have accumulated so far to reduce our economic stability or prosperity. The economy of the United States is a mighty engine of wealth and income. And it remains the destination of choice for people and governments all over the world to lend money or park it for safekeeping. Happily, then, the U.S. Treasury can borrow at sufficiently low real interest rates such that the debt accumulated so far is simply not a problem.

If the United States manages to roughly match government spending to taxes in the future, while rolling over its debt as it matures and borrowing more money to pay the interest, the debt is highly likely to gradually diminish – even fade away.

Before we go any further, though, let me emphasize what I just wrote: if the United States matches spending to taxes – or in the parlance of economics, if it manages to sustain an average level of zero for the primary deficit.

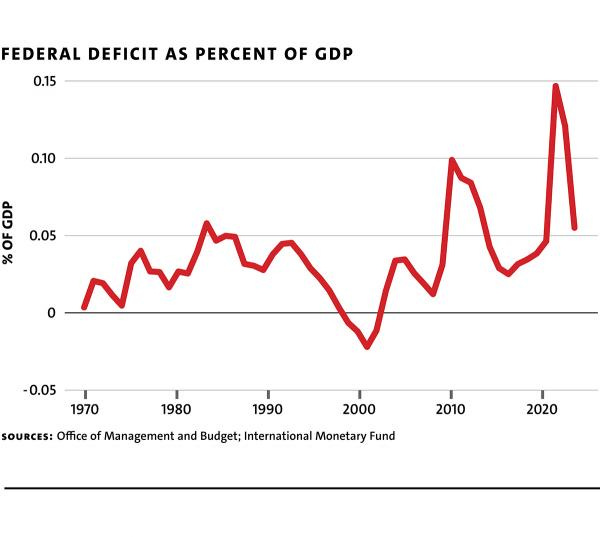

That does not mean a balanced budget. It means borrowing more only to pay the interest owed on what had been borrowed before. Today, this means a current cash deficit of around 3 percent of GDP – of approximately $800 billion a year.

But there is a problem here. Our current deficit is $1.7 trillion a year – not 3 percent but 6 percent of GDP – with no prospects of a change in political dynamics that would lead to a reduction to 3 percent. Now that is a real problem. What ought to be manageable may well end in tears – but, if so, not because of the deficits we have run in the past, but rather because of the deficits our broken political economy will produce in the future.

Let me now circle back and expand on why. First, I will explain why I do not believe the current level of debt is a problem. Second, I will recount the political history of how we arrived at a place where there is insufficient will to assemble a legislative coalition to attain a zero primary deficit before something important breaks.

Debt and Deficit Arithmetic

Why is the debt we have accumulated so far unlikely to be a problem? To answer that requires a little intuitive arithmetic.

The ratio of the debt-to-GDP will rise if the proportional impact of deficits on the debt (the numerator) exceeds the proportional impact of GDP growth on GDP (the denominator). Putting that another way – and yes, I’m skipping some steps here to save you the heavy going – the debt-to-GDP level won’t change as long as the average real interest rate paid to service the debt times the primary budget deficit (spending minus taxes) equals the rate of growth of GDP times the GDP.

So it turns out (with a smidgen of algebra that I finessed here) that if you take the negative of the deficit and divide it by the difference between the real interest rate that the government must pay to service its debt and the growth rate of the economy, you get a level of debt-to-GDP that remains constant.

If debt is lower than this sustainable level, then every year the government will find that after paying for programs and interest it has some money left over to pay down some debt – or at least borrow more slowly than the economy is growing – and so the debt-to- GDP ratio will fall. On the flip side, if debt is higher than that sustainable level, then the debt-to-GDP ratio will rise. And at some point, something will have to give.

But what rising ratio of debt to GDP will break the cycle, with no one willing to lend the money to Washington? At this point it has become traditional for economists to shrug their shoulders and fall back on the words of the late Rudi Dornbusch of MIT: “It will last longer than you would think conceivable, and then break faster than you would have thought possible.”

But Not for America?

There is, however, a problem with this analysis that we teach our students. It certainly applies to Argentina (my, does it apply to Argentina!) and to nearly all other countries and governments of the world. But it does not seem to apply to the United States.

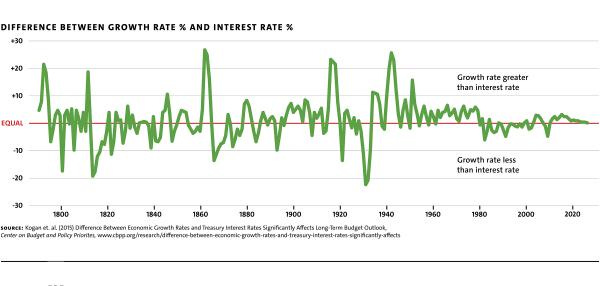

Why not? Because the analysis takes as one of its underlying assumptions that the real interest rate the government must pay on its debt is greater than the growth rate of the economy. But, historically, this has not been true for the United States – quite the reverse. Back in 2015 Richard Kogan and his co-authors at the Center on Budget and Policy Priorities calculated that since 1792 the annual growth rate of the U.S. economy had exceeded the real interest rate the U.S. federal government owed on its debt by an average of 0.9 percentage points per year.

Most of this excess of growth over interest comes during major wars plus the Great Depression. But even excluding the big war and depression episodes, the typical growth of the U.S. economy has exceeded the interest rate the federal government pays by 0.2 percentage points per year since 1792 and a whopping 1.3 percentage points since 1947. Indeed, of the 76 years from 1947 to 2023, only in the middle 1978-to-1995 period did interest rates exceed growth rates.

Look what this implies. If government-debt interest rates are typically lower than economic growth rates, then economists’ standard debts-and-deficits math turns topsy-turvy. For any level of the debt, and for any deficit, the debt-to-GDP ratio is going to fall over time and become less salient. You can, this year, borrow an extra amount equal to the growth rate times that debt, and the debt you owe will stay in proportion to the size of the economy.

The right analogy for the U.S. government since 1792 is not the standard one of a debtor in thrall to a moneylender. A better analogy is to something like the Renaissance-era Medici Bank. We think of banks as paying us interest to attract our cash so that they can use it to make loans to productive, interest-paying customers. But the Medici were there to keep your money safe and liquid, so you paid them a fee for these services. And that is, indeed, what U.S. government debt does. Except for the period from 1978 to 1995, holding U.S. government debt is much more a way for people and organizations to keep their money safe than an investment aiming at substantial returns.

Thus, except for 1978 to 1995, the U.S. national debt has been more a profit center for Washington than a drag on its finances. Yet another example of how – as Otto von Bismarck probably did not say – “God has a special providence for fools, drunks and the United States of America.”

Many have objected to this, of whom perhaps the most incisive was French politician Valéry Giscard d’Estaing’s February 1965 complaint about what he called America’s privilège exorbitant.

Past Performance Is No Guarantee of Future Results. But ...

Is this exorbitant privilege stable? The United States’ debt-to-GDP ratio is currently 100 percent: the debt held by the public is almost exactly equal to one year’s GDP. Britain ran its debt-to-GDP ratio up to more than 250 percent twice – once at the end of the Napoleonic Wars, and a second time at the end of World War II. Nothing important broke either time – although something might have shattered after World War II had the United States not been willing to supply financial assistance.

Thus there’s good reason to believe that the world’s largest and most stable economy still has enormous borrowing power. The United States, it seems, is far, far away from any point at which buyers of U.S. debt will start to demand a serious increase in interest in return for bearing the risk of default or depreciation. Such a demand would drive the average Treasury interest rate above the economic growth rate, putting an end to the aforementioned exorbitant privilege for the United States.

Then the U.S. would no longer be in the lucky position of being able to borrow and simply watch the debt melt away relative to the size of the economy. It would become a normal country, subject to normal debt arithmetic. And it would have to turn its fiscal policy around, raise taxes, cut spending and run substantial primary budget surpluses. But the example of Britain in and after its heyday as the linchpin of the modern world economy strongly indicates that the U.S. debt level today is far below any such point.

Britain ran up some mighty debts. However, after both the Napoleonic wars and World War II, its governments were strongly committed to prudent debt management. The people who owned the debt, after all, were in substantial part the members of Parliament who voted on the budget, plus their relatives. They were not going to take steps that might lead to national bankruptcy risk of any kind.

Is the political economy of the United States similar? Hardly. Tomorrow you might be able to assemble a critical mass of Democrats in Congress who would be willing to reduce the deficit via tax increases without spending cuts. But they would insist on restricting the tax increases to such a small slice of America’s population that it would be impossible to raise truly serious sums.

Republican worthies claimed the big Trump-Ryan-McConnell tax cut of 2018 would pay for itself – which it did not. To what degree proponents actually believed what they were saying is not clear.

Alternatively, you might be able to assemble a critical mass of Republicans willing to reduce the deficit via spending cuts alone. But if recent history is any predictor, the next time Republicans have even narrow control of the Congress and the White House, they will gleefully vote to cut taxes by the full amount of the previous spending cuts – and more.

Could one assemble a bipartisan group willing to cut both taxes and spending? Good luck with that one. The factor that kept British public finances secure the two times the debt took off into the ionosphere was confidence that public finance would revert to prudence as soon as the military emergency was over. There is no such assurance of future prudence for the United States today. And that may someday make a big difference.

How’d We Get Here?

Here is a brief subjective history:

Reagan: Original Sin

The United States began down the road that has led to the current state with the decision of the Reagan administration to go for a massive tax cut as its signature initiative, along with a lesser but still large increase in defense spending, with little attempt to offset either with cuts in other spending. At the time (and since) those involved in these decisions had and have taken three, or maybe more, different positions:

That the tax cuts were too large because of a miscalculation that inflation would not come down rapidly. (But when inflation did come down rapidly in the early 1980s, few called for rolling back any of the tax cuts.)

That the idea was to do tax cuts first and then, once confronted with the magnitude of the deficit, a congressional majority could be assembled to “starve the beast,” savagely cutting domestic spending by eliminating programs that politically powerful interest groups with weak moral claims to government support had rammed through in the past. (This turned out to be naive: politically powerful interest groups are – surprise, surprise – politically powerful.)

That, following Arthur Laffer, the pied piper of supply-side economics, the tax cuts would pay for themselves because they would unleash a tsunami of entrepreneurial energy. (There was never any evidence that this might be the case. And it wasn’t.)

Reaganomics has proved tenacious. We saw this most recently in claims by Republican worthies that the big Trump-Ryan-McConnell tax cut of 2018 would pay for itself – which it did not. To what degree proponents actually believed what they were saying is not clear. Occasionally it would seem that the mask drops. The conservative intellectual Irving Kristol, for example, endorsed such claims not because he thought they were true but because:

The task, as I saw it, was to create a new majority, which evidently would mean a conservative majority, which came to mean, in turn, a Republican majority – so political effectiveness was the priority, not the account- ing deficiencies of government. ... This explains my own rather cavalier attitude toward the budget deficit and other monetary or fiscal problems.

Once the magnitude of the structural deficits caused by the Reagan tax cut became clear in the years before 1985, Congress might have been willing to do something to restore fiscal prudence. But the Reagan administration refused to be seen as undermining its signature initiative in any way.

George H.W. Bush: “There Comes a Time When You Have to Govern”

George H.W. Bush and his speechwriters had a little fun at the 1988 Republican National Convention. In the middle of drawing a bunch of partisan contrasts in his acceptance speech, Bush said:

I’m the one who won’t raise taxes. My opponent now says he’ll raise them as a last resort, or a third resort. When a politician talks like that, you know that’s one resort he’ll be checking into. My opponent won’t rule out raising taxes. But I will. ... Read my lips: no new taxes.

Given the state of the economy, no half-competent budget analyst would have approved of the “read my lips” pledge. But the political and campaign staffs – and George H.W. Bush himself – decided that they really needed a “Clint Eastwood moment.”

In actual fact, with Democrats in a position to block spending cuts, the price for controlling the deficit was raising taxes. So in 1990 when Congress demanded higher taxes, Bush succumbed. Half the cuts in the deficit came in the trajectory of domestic spending and half in tax increases on gasoline, alcohol, tobacco and top-bracket income-tax payers.

And so it appeared that normal, budgeting politics had resumed, with a bipartisan commitment to linking taxes and spending so that the government would raise taxes to pay for all, or almost all, of what it had decided to spend. Governing, after all, is profoundly different than campaigning.

Or it was. Newt Gingrich took the right wing of the Republican House caucus into opposing the 1990 balanced budget requirement. And Pat Buchanan, the sort of right-wing populist so familiar today, stoked base-cadre anger against breaking the “read my lips, no new taxes” pledge to try to unseat Bush in the 1992 primaries.

What sticks in my memory is Bush’s budget director, Richard Darman, trying unsuccessfully to read the riot act to Republicans who had taken (or were pretending to have taken) George H.W. Bush’s convention speech seriously: “There comes a time when you have to govern.”

But Gingrich and Buchanan won the hearts of the Republican Party. Even before Bush’s loss in 1992, it was clear which way the tide was flowing. Bush shamelessly blamed his economic team – Treasury Secretary Nicholas Brady, Budget Director Darman and Council of Economic Advisers Chair Mike Boskin – the three Svengalis who had convinced him to break the pledge, and two weeks before the 1992 election promised to fire them.

Clinton: “Eisenhower Republicans”

So when Bill Clinton came into office in 1993, he found not a single Republican vote in either chamber of Congress for a 50-50 spending-cut tax-increase deficit-reduction bill modeled after Bush’s compromise. Indeed, from that day forward, not a single Republican politician running for office has dared say a single good thing in public about Bush’s balanced budget law.

Nevertheless, Clinton bulled ahead and barely assembled a Democrats-only legislative coalition that put the U.S. budget on a path to surpluses by the end of the 2000s. In the process he submerged other priorities dear to his heart, turning himself (in his words) into an “Eisenhower Republican.”

Three decades later, I am personally split on whether this was the right thing to do. On the one hand, the power of the U.S. government to borrow at low interest rates and then watch debt melt away is, as history has confirmed, truly remarkable. So, one must ask whether the threat of the deficit was really urgent enough in the 1990s to justify making budget austerity the priority.

On the other hand, the analyses I ran for the Clinton transition team in late 1992 did strongly indicate that a risk premium on Treasury debt had popped up and was growing. Back then, the real interest rate definitely appeared to be higher than the economic growth rate, so the no-tears, growing-out-of-the-debt logic hardly seemed a sure thing.

The hope was that the move to a balanced budget would induce the Federal Reserve to keep interest rates low and would divert financial flows from funding the debt to funding productive investment. With the assistance of the high-tech internet boom that arrived at exactly the right time, it worked: the 1990s were, as economists Alan Blinder and Janet Yellen wrote, a “fabulous decade.” And come 2000, the idea that America’s national debt was a problem appeared gone.

George W. Bush and After: Rerunning the Reagan Playbook

Gone, perhaps, until George W. Bush won the presidential election of 2000 by a vote of 5 to 4. And his major initiative – aside from invading Iraq – was another round of tax cuts to please his supporters and in the process recreate the deficit as a problem. The pattern was set. Reagan, Bush II and Trump blew up the deficit in order to deliver tax cuts skewed toward the “job creators.” Clinton, Obama and Biden dutifully sought ways to reduce the deficit at the expense of federal program recipients.

True, under the Biden administration the push for deficit reduction has been much weaker than the thoroughly successful deficit-elimination effort under Clinton and the partially successful effort under Obama. But the Democrats-only legislative coalition willing to act as the grown-ups in the room is no longer there. And the Biden administration’s heart is not in it. There is just no mojo to submerge other priorities to achieve more deficit reduction. Democratic politicians, analysts, staff and policymakers ask: what is the point to taking very hard, difficult and painful steps to further reduce the deficit when we know that Republicans are itching to increase it again with another round of tax cuts in the future? I do not have a good answer to that question.

Through A Glass Darkly

I wish I could tell you that America was on a path on which government programs will be roughly covered by taxes, and that the growth rate of the economy is likely to be higher than the real interest rate, so debt growth will not be a problem. Wishes won’t cut it, though, unless America’s political economy fundamentally changes.

Now, as long as bond investors still see U.S. Treasuries as sufficiently safe to accept interest rates averaging below the growth rate of the economy, this is sustainable. But a risk premium on Treasury debt will emerge someday, when the debt-to-GDP ratio finally reaches some yet unknown figure, won’t it? Things cannot go on as they are forever, can they? As Nixon economic advisor Herb Stein said: “If something cannot go on forever, it will stop.”

But when? And how?

Bernstein, Jared, & Richard Kogan. 2015. “Bumpy deficits, smoother ride: The historical evolution of budget deficits & growth rate”. Vox. August 18. <https://www.vox.com/policy-and-politics/2015/8/18/9168417/budget-deficits-growth-rate>.

Blinder, Alan S., & Janet L. Yellen. 2001. The Fabulous Decade: Macroeconomic Lessons from the 1990s. New York: Century Foundation Press. ISBN: 978-0-87078-467-5. <https://tcf.org/content/book/the-fabulous-decade/>.

DeLong, J. Bradford. 2024. "Federal Debt: Frog in the Pot?". Milken Institute Review. 2024Q2, April 29. <https://www.milkenreview.org/articles/federal-debt?IssueID=53>. 4422 words.

Eichengreen, Barry. 2011. Exorbitant Privilege: The Rise and Fall of the Dollar & the Future of the International Monetary System. New York: Oxford University Press. <https://archive.org/details/exorbitantprivil0000eich>.

Kogan, Richard, Chad Stone, Bryann Dasilva, & Jan Rejeski. 2015. “Difference Between Economic Growth Rates and Treasury Interest Rates Significantly Affects Long-Term Budget Outlook”. Center on Budget & Policy Priorities. February 27. <https://www.cbpp.org/research/difference-between-economic-growth-rates-and-treasury-interest-rates-significantly-affects>.

Rockwell, Keith. 2023. “An Exorbitant Privilege Now at Risk? The Once (and Future?) Almighty Dollar“. Wilson Institute. May 1. <https://www.wilsoncenter.org/article/exorbitant-privilege-now-risk-once-and-future-almighty-dollar>.

Stein, Herbert. 1985. "My Foreign Debt." The Wall Street Journal, May 10.

Excellent explanation.

My fear is that Trump (aka King of Debt) becomes President and decides to "renegotiate" repayment of Treasury debt with foreign owners, in particular with China. Then nations who have run trade surpluses no longer want US debt and their exports wither. The value of the US Dollar plummets, inflation rises, and interest rates soar far above GDP growth. All because a weak man wanted to look strong.

An excellent piece. I've been working (slowly, I'm retired!) on trying to write something along the same lines. And yes, the “wise people” have been bemoaning debts and deficits since I started in this business in 1977. The sky should have fallen many times by now. In 2004 , Peter G. Peterson published “Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About It.” Here we are 20 years later and there is still no obvious crisis—but we keep hearing that a crisis is imminent and we are robbing the next generations.

The g>r phenomenon, though, is not just for the US. See Phillip Barrett: Interest-Growth Differentials and Debt Limits in Advanced Economies, IMF Working Paper, April 2018 WP/18/82, tables 2 and 3. For data from 1880-2015, he estimates g-r for US, UK, France and Germany. All point estimates are for averages between a low of 1.63% (UK) and a high of 2.16% (US).

For the US, we also have estimates from Ball, Laurence, Douglas W Elmendorf, and N Gregory Mankiw. 1998. "The Deficit Gamble." Journal of Money, Credit and Banking: 699—720. With data from 1871 to 1992 their estimates are of g-r between 1 and 2 %.

Larry Ball has a new paper that is less sanguine: DID THE U.S. REALLY GROW OUT OF ITS WORLD WAR II DEBT? Julien Acalin Laurence M. Ball Working Paper 31577 http://www.nber.org/papers/w31577. He points to financial repression as a key factor (something likely true for Japan).

Nonetheless, simply look at the 30-year CBO predictions, and it is hard to see why one would think a crisis is at hand: they predict g>r = .5% (on average) over this period.

But for me, what I think should puzzle the fiscal fearmongers is: why are we not having a bond crisis right now, if fiscal policy is not sustainable?