My weekly read-around...

The Extreme-Weather Threat from Global Warming; Decarbonization Has Begun Over the Past Generation Here in the Global North; VergeCast: The AI Garage Door Mystery; Is Passive Investing Hurting Financial Market Structure?; Adolf Hitler's Speech on the Seventh Anniversary of His Seizure of Power in Germany; Very Briefly Noted; SubStack Notes; Feral Joe Series; Recent Notes Series; Sundowning in America Series; CROSSPOST: 23 Economics Nobel Prize Winners for Kamala Harris; DRAFT: Five Afterthoughts on "Slouching Towards Utopia": Friedrich von Hayek, Michael Polanyi, & Company; Trump Madison Square Garden Rally; CROSSPOST: Timothy Snyder: How to Stop Fascism; CROSSPOST: Alexandra Petri: It Has Fallen to Me, the ["Washington Post"] Humor Columnist, to Endorse Harris for President; Once More Telling People That They Should Take Nate Silver for Their Guru on Question; & WEEKLY BRIEFLY NOTED for 2024-10-24 Th…

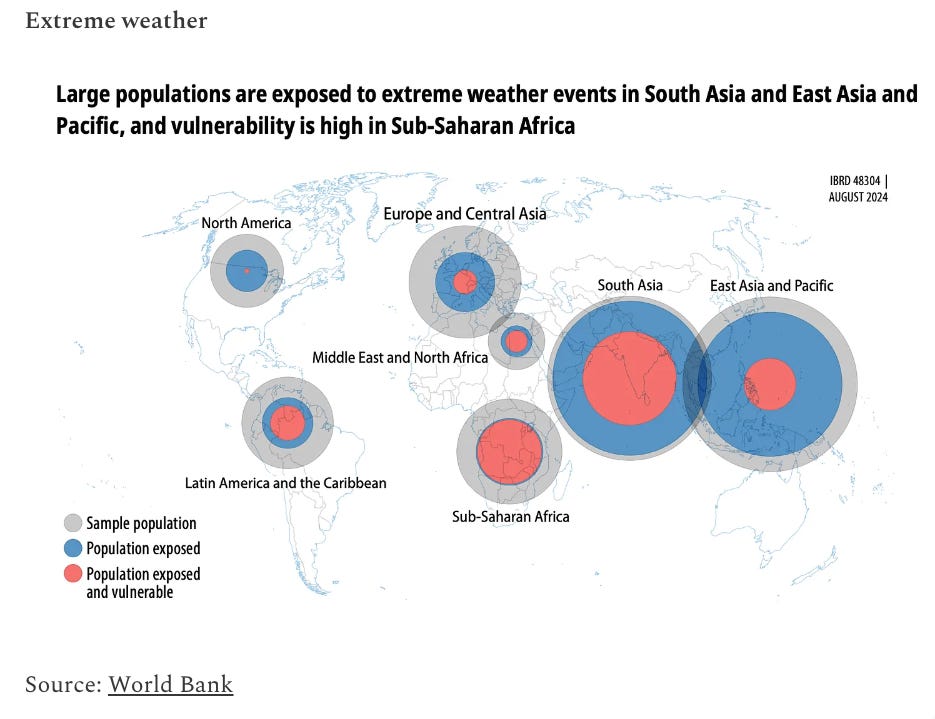

ONE IMAGE: The Extreme-Weather Threat from Global Warming:

I had not recognized how large a proportion of the total the exposed population in sub-Saharan Africa is and I had not internalize how its poverty leaves it without resources to deal with adjustment:

World Bank <https://openknowledge.worldbank.org/bitstreams/ea01aa05-2f15-4ebe-aa94-0e4a8cc82406/download>, via Adam Tooze

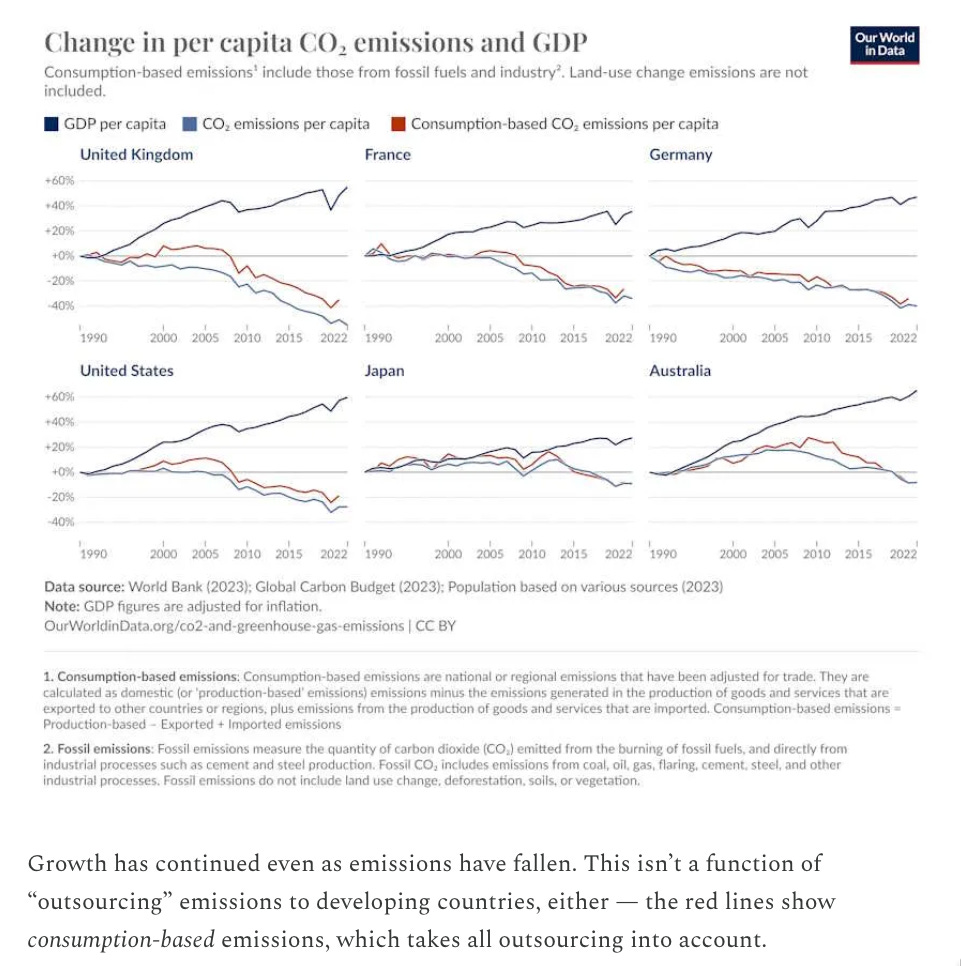

ANOTHER IMAGE: Decarbonization Has Begun Over the Past Generation Here in the Global North:

ONE AUDIO: VergeCast: The AI Garage Door Mystery:

The VergeCast: the Flagship Podcast of Searching Using “Artificial Intelligence”:

Nilay and David… Wall Street Journal columnist Joanna Stern joins the show to talk about Apple Intelligence, Apple's week of Mac launches, and why Siri still can't open her garage...

It turns out that determining how Apple executives use Apple’s home-automation and voice-command systems as part of a software stack is a substantial mystery:

<https://overcast.fm/+AAQN1qa8ndw>

ANOTHER AUDIO: Is Passive Investing Hurting Financial Market Structure?:

The point is that passive investing is only passive when you look at the stock rather than the flow of asset demands. When you look at flow changing demand for assets, passive investing is very unpassive indeed, and massively sentiment-driven—plus dumb-beta rebalancing as people try to mimic indexes in a transaction-efficient way is a very powerful shock amplifier. And in such an environment, in which attracting money involves trying to sell people cheap-index and Dutch Book-arbitrage products, is anybody left to actually do real price discovery?

Barry Ritholtz speaks to Mike Green, portfolio manager and chief strategist for Simplify Asset Management Inc. He previously served in the same roles for Logica Capital Advisers LLC. Prior to Logica, Michael managed macro strategies at Thiel Macro LLC; founded Ice Farm Advisors LP, a discretionary global macro hedge fund seeded by Soros Fund Management; and founded and managed the New York office of Canyon Capital Advisors, a $23 billion multi-strategy hedge fund

<https://overcast.fm/+AA4_yDPEjR4> <https://ritholtz.com/2024/08/mib-mike-greene/>

ONE VIDEO: Adolf Hitler’s Speech on the Seventh Anniversary of His Seizure of Power in Germany:

Very Briefly Noted:

Economics: The interest-rate lockin is dying away, reports from ASML are a sign that the MAMLM exuberance is cresting, and fiscal policy needs to become easier and easier to continue to have a stimulative effect. The sharp-slowdown r>r* scenario is definitely still out there, and still very worrisome. It would be very good for the Fed to get back to neutral on monetary policy as soon as possible:

Torsten Slok: What Happened to Long and Variable Lags?: ‘30 months since the Fed started raising interest rates… [no] sign of a slowdown… GDP growth… third quarter… 2.8%… estimate for fourth quarter GDP… 2.3%…. First… consumers and firms locked in low interest rates during the pandemic. Second… a big structural boom in AI and data centers. Third, fiscal policy is easy with a 6% budget deficit…. Tailwinds combined have offset the mildly negative impact of Fed hikes on highly leveraged consumers and firms… <https://www.apolloacademy.com/what-happened-to-long-and-variable-lags/>Dan Drezner wants to be optimistic today. Yes, overall violent and property crimes are low. Yes, we seem to be getting a handle on our latest Purdue and Sackler-generated opioid crisis. Yes, the murder spike appears to be behind us. On the economy: as far as prosperity is concerned, the US has never been more prosperous. On the economy: economic growth has not been faster since the Clinton-Gore 1990s, and the Obama-Biden and Biden-Harris years have given some powerful mojo to forces reducing income and wealth inequality as well. But all this assumes that American democracy as we have known it is not severely degraded by Handmaid Kleptocracy over the next eight years. And that is not a tail risk:

Dan Drezner: What if the United States... Continues to Get Better?: ‘The two thirds of Americans who believe the country is getting worse are wrong. Categorically, objectively, undeniably wrong…. The economy…. It does not matter which metric one looks at — economic output, productivity growth, employment, the stock market — the United States outclasses the rest of the world…. The Economist… “Even more striking is how America has outperformed its peers…. In 1990 America accounted for about two-fifths of the overall GDP of the G7 group of advanced countries; today it is up to about half…. Per-person… American economic output is now about 40% higher than in western Europe and Canada, and 60% higher than in Japan… twice as large as the gaps… in 1990…. Since the start of 2020, just before the covid-19 pandemic, America’s real growth has been 10%, three times the average for the rest of the G7 countries. Among the G20… America is the only one whose output and employment are above pre-pandemic expectations…”. Inflation has continued to cool… falling back to where it was in 2018…. Murder is declining at the fastest rate ever…. Violent and property crime remain at the modern low levels…. Decline in opioid-related overdose deaths…. A plausible scenario… [is] years from now, we will see 2024 as the moment in which the United States fully absorbed the myriad shocks of the last fifteen years and moved forward… <https://danieldrezner.substack.com/p/what-if-the-united-states-continues>Signs that the MAMLM exuberance is near its peak:

John Foley: Silicon Valley super-spenders leave too much in the cloud:‘Amazon, like its peers, is fuzzy on its investment plans, and the potential payback…. In a moment of commendable self-knowledge, Mark Zuckerberg admitted this week that Meta Platforms’ colossal artificial intelligence investment is “not what investors want to hear”. He might be speaking for any of the big technology companies lately reporting earnings…. The era of being truly asset light is probably gone forever. Jassy suggested on Thursday that the AI race is a once-in-a-lifetime opportunity, and if all goes well, “shareholders will feel good” about it. Good feelings keep share prices aloft. A more tangible marker of success would not hurt either…<https://www.ft.com/content/10a92439-14bb-4080-b47e-2b21038f0c86>

As long as you utilize the same counterparty twice—or utilize a counterparty that fits into the same sociological slot as your last counterparty—you are already moving away from the transactional world. The transactional world is a very odd place of societal gift-exchange relationships turned into one-shot everyone-is-square via the invention of money. And as far as humans are concerned, that is a very unnatural repurposing of the very strong natural human (or is it constructed Yamnana?) drive to cement social bonds via repeated gift-exchange:

Dan Davies: How to End Up in Someone's Pocket: ‘The key thing to understand is that, as a rather good coverage banker once told me, “nothing is transactional. Transactions aren’t transactional”…. Getting things and paying for them… is absolutely not how it goes down in the world of very large sums of money. People don’t look at restaurant bills, they don’t send invoices and they don’t keep score. To suggest that someone owes you an advisory mandate because you gave them a load of free research would be bad enough—to try and link it to a golf tournament would be just awful behaviour. But somehow, people do business with people they know and trust. The very best relationship bankers don’t even realise they’re in a sales job—they just think of themselves as someone who’s very lucky to have so many friends who are capable of putting business their way…. [No] real correlation between the value of the freebies and the strength of the relationship…. Good bankers take clients to expensive restaurants, very good bankers take clients to very expensive restaurants, but great bankers meet clients for a sandwich in the pub. This is what people ought to be worried about with respect to lobbying…. It’s the amount of face time, and importantly, repeated face time with the same people…If Tesla needs to be of value for humanity, it needs to be a car company—a technology forcer and a productive stakeholder network. It does not need to be a ball in a speculative roulette wheel or a right-wing transhuman nerd meme. Musk needs to be moved out, and Tesla needs to find its Gwynne Shotwell immediately:

Lex: Tesla is not a car company but it does a good impersonation: ‘Tesla’s car business is worth… about $240bn today…. That leaves more than $500bn unaccounted for. Batteries… self-driving robotaxis…it is hard to say what that version of Tesla is worth…. Then there is Optimus… that Musk believes could be worth at least $10tn in long-term market value…. The real point about Tesla… at $750bn… [is that it] is largely an investment in Musk’s imagination. While the likes of Volvo, Volkswagen and General Motors battle to sell cars, Tesla sells chutzpah—and investors are still buying… <https://www.ft.com/content/c6086aa2-23bf-4f6e-aaef-1156830b6264>Neofascism: Obeying in advance, our plutocrats are. They have started to notice that kleptocrats regard them as prey, and are hoping to avoid the eye by aggressive precompliance:

Harold James: Fascism in Our Time: ‘With top officials from Donald Trump’s previous administration publicly warning that he fits the definition of a fascist, reflections on interwar Germany’s descent into barbarism have inevitably come to the fore…. Plenty of worrisome parallels…. [A] United States will lurch toward a radical militarized authoritarianism that would establish a new norm for despots elsewhere…. Episodes of democratic collapse always give rise to the same anguished question. Has some particular feature of the culture gradually eroded the political system, or are we dealing with a deeper, innate human tendency that can only ever be held in check by the right institutional arrangements?... Hitler… owed his political ascent to the response from traditional institutions: the army, the bureaucracy, the police force, and above all the business community…. In this context, it is stunning to hear prominent financial figures like BlackRock’s Larry Fink argue that the US election “really doesn’t matter” for markets… reproducing the behavior of German business leaders before January 1933… <https://www.project-syndicate.org/commentary/trump-fascism-how-it-can-happen-and-what-might-constrain-it-by-harold-james-2024-10>

This is simply bizarre:

Josh Marshall: ‘We have a nice addition to the emerging library of reporting on Republican ground operations from Ryan Cooper at The American Prospect. Cooper actually lives in one of the swingiest parts of Pennsylvania. So he’s not only a very sharp political reporter and commentator, he’s there on the ground as a recipient of the door-knocking and mailering and all the rest — both lab-coated scientist and guinea pig, as it were. So it’s a unique view. The gist matches what I’ve come up with. There just doesn’t seem to be much if any GOP ground operation in the sense of door knocking, dropping off pamphlets or much of anything else. There’s a slew of mailers. And there you’ve got the other issue I’ve been obsessed by: Cooper is a left-leaning Democrat who I’d assume has seldom or ever voted for a Republican. So why is his mailbox bursting with GOP mailers?… <https://public.hey.com/p/UMJksqapSWkemsuaFix9AvM1>Yes: this is simply bizarre:

Ryan Cooper: Trying to Find Trump’s Ground Game in Pennsylvania: ‘Four and eight years ago, there was a major Republican get-out-the-vote effort. This time is different…. While I have gotten entire forests’ worth of conservative mailers, especially from local GOP Assembly candidate Dino Disler, I have only been door-knocked by liberals—four times and counting, at the time of writing—twice from the Harris campaign, and twice from the Progressive Turnout Project. The lack of Republicans canvassing me could be because I’m in their databases as a reliable Democrat. But if so, why am I getting so many conservative mailers? Furthermore, as I’ve walked and driven around town, it’s clear that Wilkes-Barre is simply crawling with liberal canvassers…. But I have not seen a single Trump canvasser anywhere… <https://prospect.org/politics/2024-10-24-trump-ground-game-pennsylvania/>Public Reason: The Washington Post tries to sanewash Donald Trump yet again, to the max. And Noah Smith objects:

Noah Smith: Against Steelmanning: ‘It's usually not a good idea to try to make arguments look stronger than they really are. The other day, an editor at the Washington Post called me up and made a proposal. She wanted me to write a series of articles “steelmanning” Donald Trump’s economic policy proposals—in other words, making the strongest case I could possibly make for Trump’s ideas. Her rationale—like that of many proponents of steelmanning—was that if people are going to be persuaded that Trump’s ideas are bad, it will be more persuasive to first present the very strongest version of those ideas, so that people know Trump’s opponents are arguing in good faith, and would therefore find criticisms more persuasive. I politely refused, and I told her that when the series came out, I would use it as an occasion to write about why I think steelmanning is usually a bad idea. But why wait?… <https://www.noahpinion.blog/p/against-steelmanning>

SubStack NOTES:

SubStack Posts:

CROSSPOST: Timothy Snyder: How to Stop Fascism

<https://braddelong.substack.com/cp/150174198>

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

![CROSSPOST: Alexandra Petri: It Has Fallen to Me, the ["Washington Post"] Humor Columnist, to Endorse Harris for President](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fad0c779b-9011-49d4-8c5d-cdae5afceb75_1168x990.png)

LOL "Yamnana" drive. Your autocorrect is a music fan! https://www.youtube.com/watch?app=desktop&v=JqTwlM3lvfU

The thing about betting on Musk's imagination is that it's the suckers bet: tails you lose, heads you don't win. If one of his dreams works out, he'll spirit it out of Tesla and into a vehicle that he owns completely. Like Levine says, a basket of options is worth more than an option on a basket.

Tesla. It has been in a price bubble for a long time. Less car company and more tech stock. Given his performance on self-driving cars, I wouldn't expect any self-driving "taxis" to be safe. Who is going to accept accident liability and class-action lawsuits. As for optimus robots. Don't make me laugh. Smoke and mirrors.

It is good that Shotwell manages SpaceX, the only business that is truly exceptional.

Musk may find himself eventually facing a lot of lawsuits over his business practices. No wonder he is supporting Trump who may give him cover for as long as he is in powert.