Well! That Escalated Quickly! A Bad Fed Call Last Wednesday Appears to Have Had Consequences

Increasingly, it is clear that my standard question—why is the FOMC keeping monetary policy substantially restrictive when the economy is near-target with no inflationary shocks on the horizon?—simply

Increasingly, it is clear that my standard question—why is the FOMC keeping monetary policy substantially restrictive when the economy is near-target with no inflationary shocks on the horizon?—simply does not have a good answer. Move late but then move fast was optimal in 2021-2022 when you feared that a mistake might land you back at the ZLB. But there has been no reason at all for such asymmetry over the past year…

But do not overreact, as these people do:

Niall Ferguson: Welcome to Pandemonium: ‘Bored by the throng… inanely taking identical bad photographs of the Mona Lisa, we stumbled upon… [the] largely forgotten… Milton’s Pandemonium by… John Martin. “Take a good look, lads,” I said. “That’s where we’re headed.”… The idea that all this can be explained by a so-so [U.S.] jobs report is obviously absurd…. Reality has begun to bite…. The end of the AI bubble…. Warren Buffet’s… slash[ing his]… Apple [position]… slowdown in the U.S. labor market… the Federal Reserve has waited too long to cut interest rates… Labour doesn’t mean a “return to stability”… the bait-and-switch that put Kamala Harris in for Joe Biden as the Democratic nominee… substantially raising the probability that Trump is reelected… the very likely escalation of conflict in both Ukraine and the Middle East…. Maybe Kamala Harris will get lucky, and she won’t be left to carry the can for a foreign policy that repeatedly failed to deter the Chinese-Russian-Iranian-North Korean axis, and an economic policy that gave us an inflation surprise in 2022 and an AI bubble in 2024. But my money—dollars not yet—is on more pandemonium… <https://www.thefp.com/p/niall-ferguson-welcome-to-pandemonium>

And:

Ruth Carson, Lu Wang, Vildana Hajric, & Bailey Lipschultz: $6.4 Trillion Stock Wipeout Has Traders Fearing ‘Great Unwind’ Is Just Starting: ‘“Falling knives everywhere”…. The Nikkei… down 12%… the Kospi sank 9%… the Nasdaq plunged 6% in seconds. Cryptocurrencies sank; the VIX… skyrocketed…. Pillars that had underpinned financial-market gains for years… look, in hindsight, a bit naïve: the US economy is unstoppable; artificial intelligence will quickly revolutionize business everywhere; Japan will never hike interest rates—or not enough to really matter…. The July jobs report was feeble in the US. So too were Big Tech’s AI-driven quarterly earnings. And the Bank of Japan hiked rates for the second time this year. The one-two-three punch jolted investors into suddenly seeing the peril inherent in, say, bidding Nvidia Corp. shares up 1,100% in less than two years or loading up on junk-rated loans bundled into bonds or borrowing money in Japan and plowing it into assets paying 11% in Mexico. In the span of three weeks, some $6.4 trillion has now been erased from global stock markets…<https://www.bloomberg.com/news/articles/2024-08-05/-6-4-trillion-wipeout-sows-fear-great-unwind-is-just-starting>

Even though there is a “to be sure…” sandwiched in the middle of the latter:

Whether Monday’s wild gyrations mark the final bang of a global selloff that started to build last week or signal the beginning of a protracted slump is impossible to know…

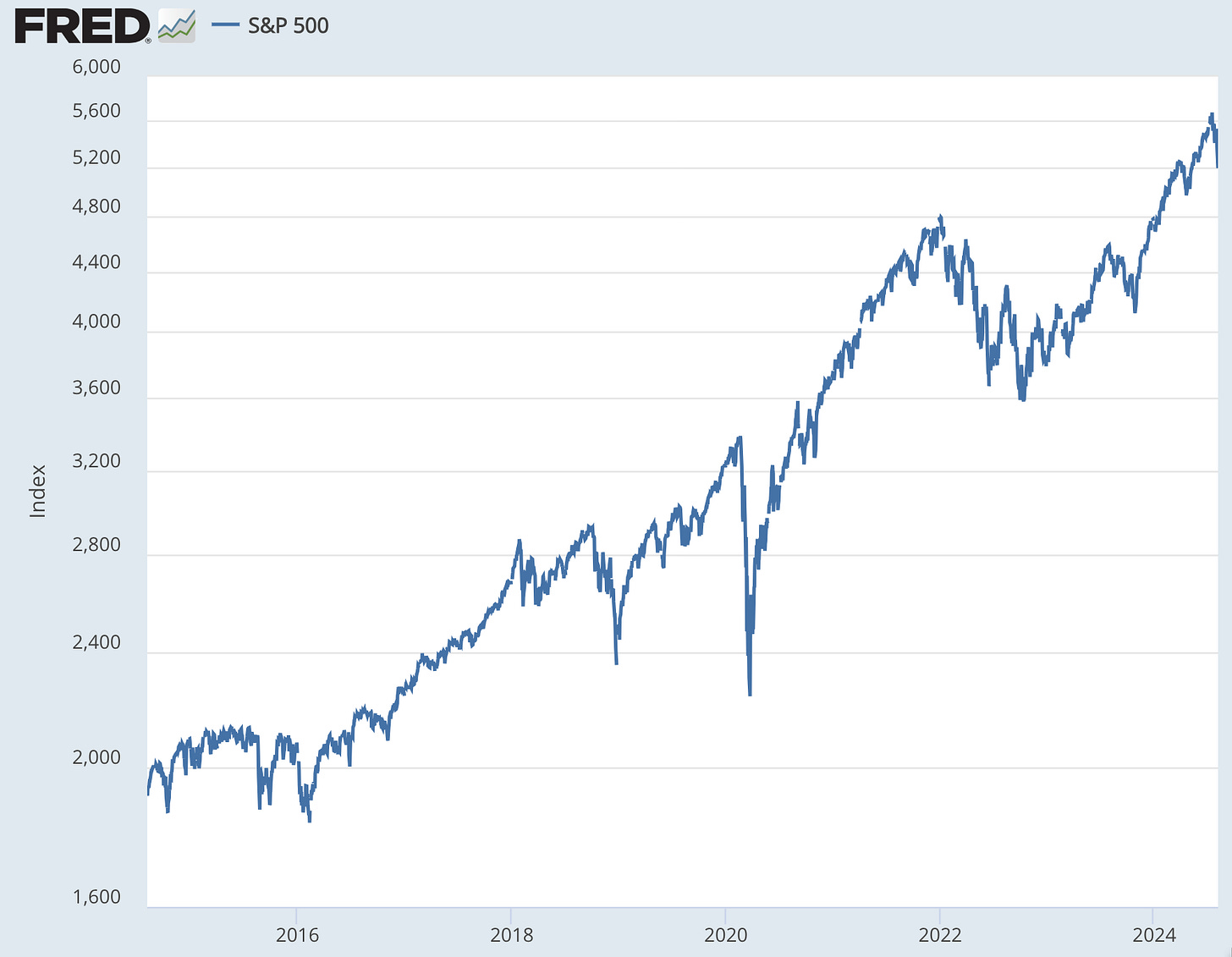

Yes. It is truly terrifying, momentous, and world changing. A $6.4 trillion wipeout that puts us… (checks notes) back to where we were at the end of March, four long months ago. The largest single-day percentage decline in… (checks notes) two and years.

Much more sensible are Robert Armstrong & Aiden Reiter:

Robert Armstrong & Aiden Reiter: Anatomy of a rout: ‘The perception of increasing recession risk… unwinding of the yen carry trade… dynamics in a market dominated by momentum trading, risk parity strategies, passive investors and other wicked inventions that suppress volatility before suddenly releasing it… unwinding of… [the] Big Tech trade…. James Athey…. “Investment styles which are systematic or technical in nature use price and volatility triggers… create lots of momentum, which ‘value’ investors might try and oppose but rarely succeed at first, which creates a survivorship bias for investors willing to go along with the momentum”… <https://www.ft.com/content/573cfb74-54e4-448f-a8ba-02d59a4b079f>

concluding with:

Robert Armstrong & Aiden Reiter: Anatomy of a rout: ‘An expensive market in a slowing economy does not need any particular reason to fall, just as a cheap one in an accelerating economy needs no special reason to rise… <https://www.ft.com/content/573cfb74-54e4-448f-a8ba-02d59a4b079f>

My view is that you have to understand six things in order to make sense of the past week’s financial turmoil—and the journalistic reaction to it:

A Federal Reserve interest-rate level that made little fundamental sense.

Positive-feedback trading—buying when things have gone up and selling when things have gone down—is inherent in many modern portfolio strategies that somehow end up imitating very old-fashioned stop-loss orders, and so beware whenever such become fashionable.

A Japanese carry trade that made little fundamental sense.

A US MAMLM equity bet that made little fundamental sense.

A bunch of commentators who want to post clickbait.

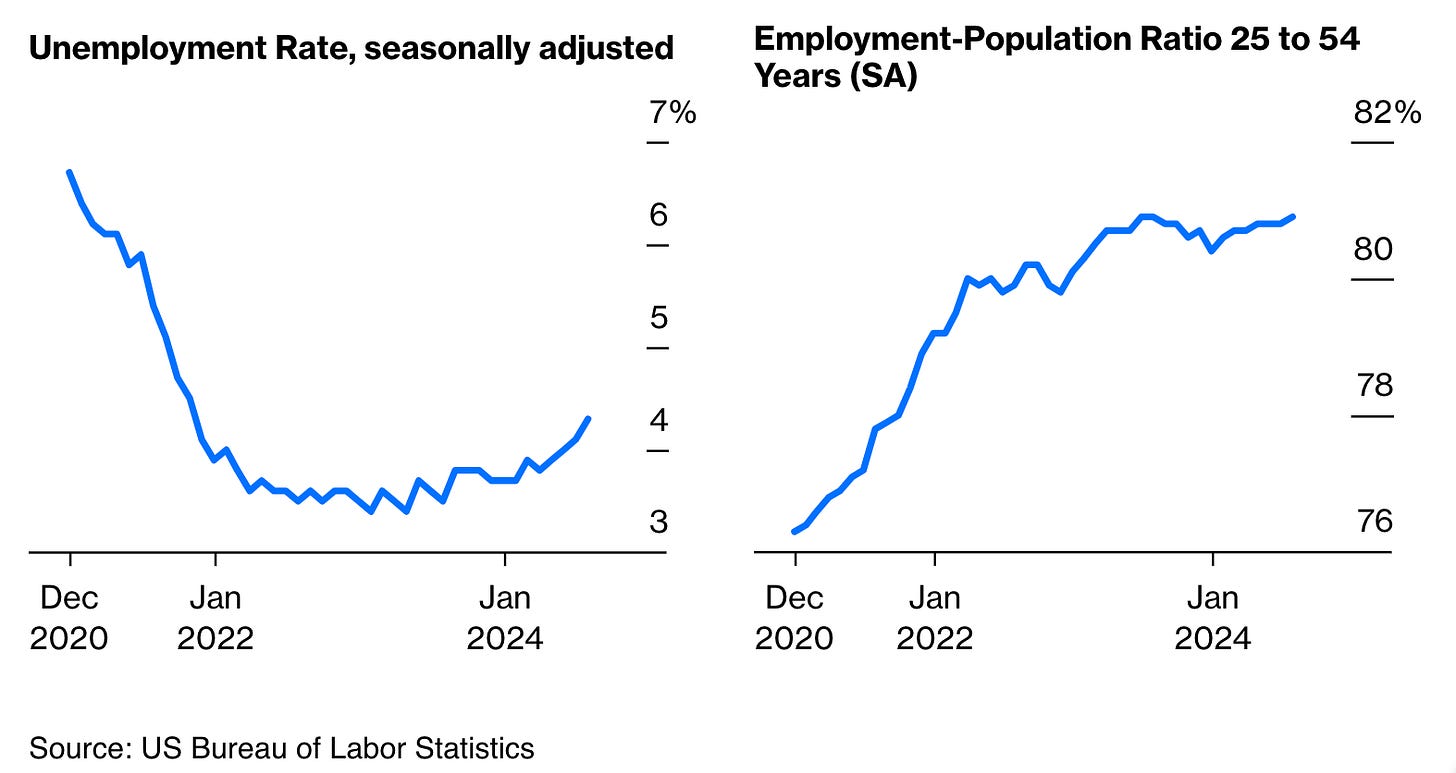

A market focus on Claudia Sahm’s “Sahm Rule”—that we are in big trouble and the government should start taking steps like extending unemployment insurance whenever the unemployment rate rises more than 0.5%-points from its previous low—without noticing that the Sahm Rule is about unemployment-rate increases that come from falling jobs, not new entrants into the labor force.

Apropos of this last (6):

As Claudia Sahm wrote:

Claudia Sahm: Sahm-thing more on the Sahm rule: ‘The story is not as simple as the usual rules of thumb….A recession is not imminent, even though the Sahm rule is close to triggering. The Sahm rule is likely overstating the labor market's weakening due to unusual shifts in labor supply caused by the pandemic and immigration. [However,] the risk of a substantial weakening or a recession in the next several months is elevated… <https://stayathomemacro.substack.com/p/sahm-thing-more-on-the-sahm-rule>

But how did the Sahm Rule become so much of a focal point for financial markets over the past couple of years?

And what about the other five factors?

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.