Were Alan Greenspan Ever to Let His Hair Down...; & BRIEFLY NOTED: For 2021-11-28 Su

Things that went whizzing by that I want to remember:

First: If Alan Greenspan Were Ever to Let Down What Hair He Has:

Bob Reich complains that when he was in the Clinton administration he never asked Alan Greenspan the questions and never got the answers he wanted to.

Now when I was a not very senior Treasury Department official during the Clinton administration, I did get to ask Alan Greenspan the questions that Bob wanted to ask him. And I got answers. You see, every week a bunch of us senior Treasury Department staff would go over to the Federal Reserve for a lunch. (Food quality: 1 out of 10.) And, since about 1/3 of my job was fed watching and such, I went most of the time. And Greenspan was there, maybe 1/5 of the time, if I recall correctly. Sometimes he was quiet. Sometimes he was witty. And sometimes he let what little hair he had down, regarding himself as among, broadly, friends:

Robert Reich: Personal History: My Lunch with Alan Greenspan: ‘Our lunch was pleasant, our conversation easy. He deftly avoided talking about the deficit, jobs and inflation. I left feeling pampered and charmed. Greenspan got out of the lunch exactly what he wanted. Yet I never asked him the questions I intended to ask and never got the answers I imagined he’d give…

LINK:

So let me give my version of what Alan Greenspan's monologue about the issues Bob Reich had wished he would have opened up to him, only written not in Greenspanese but instead in plainer language:

“Here I am! A lifelong disciple of Ayn Rand, and yet the US and the world economy’s central planner! Isn't that rich? But somebody has to do this job. And I am certain I am the best person to do this job, largely because I really wish this job did not have to be done. But it does. What happened to all the magic of the marketplace, and the enormously productive creative-destructive acts of unfettered entrepreneurs like my teacher Ayn Rand’s characters Howard Rourk and John Galt? Why are we here?

[shrugs shoulders]

“But we are here. It is a fact that the interest rate financial markets on their own generate is not a good guide for the economy. What is it not a good guide to? To the ‘neutral’ Wicksellian rate: the rate at which the rewards to building businesses are high enough that entrepreneurs hire workers not employed making consumption goods—so that there is no cyclical but only structural and frictional unemployment—but at which the perceived rewards to building businesses are not so high as to be unrealizable given limited numbers of potential workers and resources not already committed to satisfying current demand for consumption goods. Fall away from the Wicksellian “neutral” rate on the interest-rates-too-high side, and you get mass unemployment. Fall away on the interest-rates-too-low side, and you get an acceleration of inflation as the market has to allocate in the fact of a demand for more than 100% of possible production.

“But I have to do more than hit the sweet spot. Inflation rises if the interest rate is below neutral, yes. But inflation also rises if businesses feel that they need to insure themselves against any material risk that the Federal Reserve will start leaning on the ‘interest rates too low’ side.

“Thus my job requires that I appear to be Dr. Doom: that businesses feel certain that my principal concern is for ‘effective price stability’, and that there is no material risk that I will lean on the ‘interest rates too low’ side.

“And now we come to the paradox of central banking: if I play the public role of Dr. Doom, then I can actually set interest rates on the technocratic merits—and if there is a case that the ‘neutral’ interest rate is lower than financial worthies believe, I can lower it and find out. If I didn’t play the role of Dr. Doom, I would never have that freedom of action.

“And, indeed, three times the financial worthies cried that I was an inflationista—in 1993, when I kept from raising interest rates until well after the moment that not just Republican but Democratic financial worthies thought I should start; in 1995-6, when I cut short the tightening cycle to see if the dot-com boom was indeed a thing that had lowered the ‘neutral’ rate (over moderately strong protests from some recent Democratic Fed Governor appointees, I must say); and in 2003-4, and in this last I went so far that a surprising number of people who should know better blame me, falsely, for the Great Recession.

“Was I perfect? No.

“I could have gotten in front of and tried to stop the Bush 2001 tax-cut train, and if I could have done so it would have been good for the country. But Republican party loyalty is a mighty force—I would have failed. And I had already crossed Republican worthies three times: in not lowering interest rates faster in 1990, in not raising interest rates in early 1993 and thus disrupting Bill Clinton’s chance to make sensible economic policy, and in not raising interest rates further in 1995 and so giving Bill Clinton a very strong recovery on which to run for reelection. I made these decisions on the monetary-policy merits. But in 2001 I was on the point of being thrown out of the Republican Party (just as Ben Bernanke was to be a decade later) and had only a little influence, that I had to husband. After 1992, the Bush family and its retainers really, really, really did not and do not like me at all.

“Was I perfect? No.

“I had no idea that the bankers were as crazy in 2004 and after as they were. I judged that the Federal Reserve could handle anything the housing sector threw at us and keep it from becoming a depression. I was wrong. And I judged that there was no way I could get in between lenders who wanted to lend and borrowers who wanted to borrow, tell them they could not do so, and make it stick—congress, all of congress, Republicans and Democrats alike, would have had my scalp if I had tried to do so over 2003-5.

“But the stock market crash of 1987—my Fed kept that from badly disrupting the U.S. economy. The S&L crisis of 1990 that came about because politicians like John McCain ran interference for grifters—my Fed kept that from badly disrupting the economy. The Mexican financial crisis of 1995—my Fed kept that from badly disrupting the economy. The East-Asia and Russia crisis of 1997-8—my Fed kept that from badly disrupting the economy. The dot-com crash of 2000—my Fed kept that from badly disrupting the economy. 9/11—my Fed kept that from badly disrupting the economy. My monetary policy during the 1990s was such that current Treasury Secretary Janet Yellen calls it “The Fabulous Decade”. And I tried my best to balance interests and risks and went the extra mile in keeping interest rates low to try to get America in the first half of the 2000s back to the macroeconomic sweet spot of maximum employment consistent with effective price stability.”

Needless to say, if Greenspan ever sees this and is asked about it, I expect him to respond the same way that he did to Bush Treasury Secretary Paul O’Neill’s claims that Greenspan joined him in private opposition to the 2001 tax cut: “I am afraid that my memory and my friend Paul’s differ.”

One Picture:

Very Briefly Noted:

Joe Conason: In A Pandemic, Hesitation Is Doom <https://www.nationalmemo.com/vaccine-patent-suspension>

x0machos: Eradicating .DSStore from Git: ‘What if we could globally ignore .DSStore rather than adding it to every repository’s .gitignore file?… <https://0xmachos.com/2020-01-22-Eradicating-.DS_Store-From-Git/>

Hunter Walker: Jan. 6 White House Rally Organizers Were ‘Following POTUS’ Lead’: ‘Rally planners coordinated closely with the White House before Jan. 6 and readied a dinner party while the Capitol was under siege, according to leaked group text messages obtained by Rolling Stone… <https://www.rollingstone.com/politics/politics-features/j6-white-house-rally-organizers-trump-cooperate-1260849/>

Lara Williams: Give Thanks for Vaccines, Economic Improvement and Safe Gatherings <https://www.bloomberg.com/opinion/articles/2021-11-21/give-thanks-for-vaccines-economic-improvement-and-safe-gatherings?sref=r4AzvICB&cmpid%3D=socialflow-twitter-view>

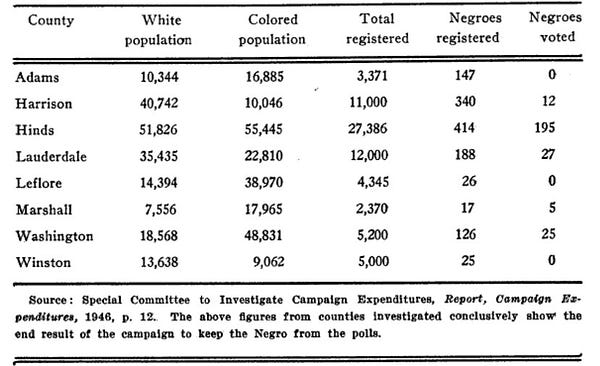

Trevon D Logan: ’American democracy is very, very young. It is not even 60 years old. Look at voting registration and voting by race in Mississippi counties in 1946–in some cases no Black people voted. None. When people are nostalgic for the “good old days,” this is what they mean…

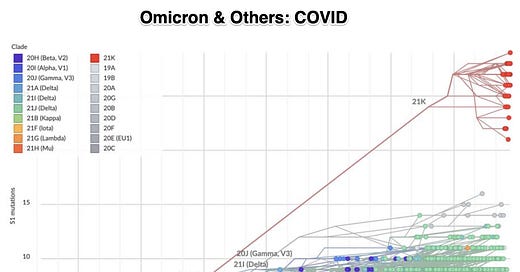

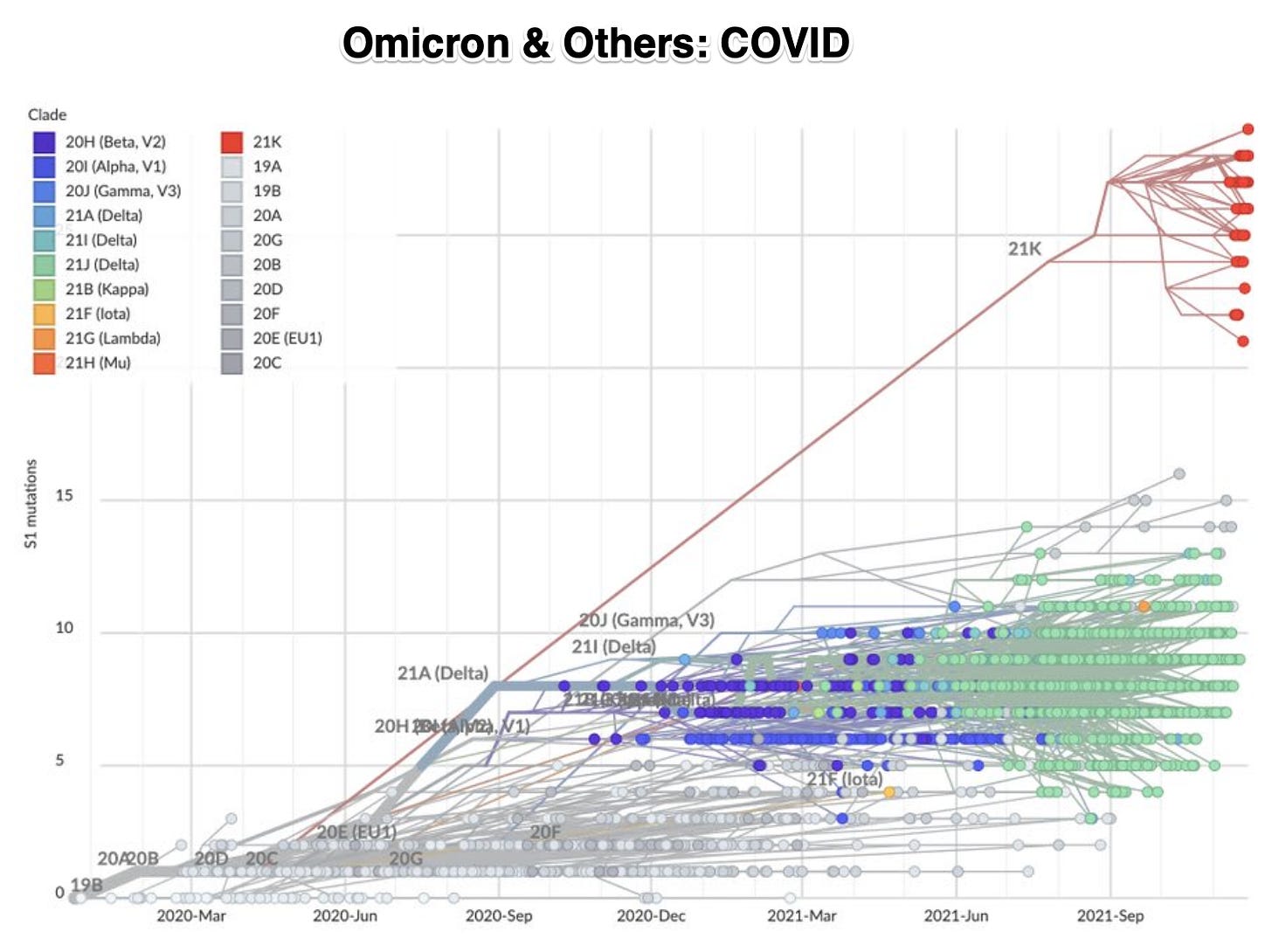

Gerald Friedman: ’Germany, Italy join list of countries with detected cases of omicron COVID–19 variant…

Max Kennerly: ’Part of what makes Fox News so distressing is the incoherence. “The variant is fake, but Trump would already have a new vaccine for it, but vaccines don’t work.” Anyone who can accept all of those together—millions of Fox News viewers—is impervious to reason. They’re in a cult…

Erin L. Thompson: ’Just met someone who’s a set designer and keeps $500k in fake movie money in her medicine cabinet to f— with her Tinder dates…

Sam Ro: 10 Truths About the Stock Market: ‘1. The long game is undefeated. 2. You can get smoked in the short-term. 3. Don’t ever expect average. 4. Stocks offer asymmetric upside. 5. Earnings drive stock prices. 6. Valuations won’t tell you much about next year. 7. There will always be something to worry about. 8. The most destabilizing risks are the ones people aren’t talking about. 9. There’s a lot of turnover in the stock market. 10. The stock market is and isn’t the economy…

LINK:

Paragraphs:

A Friend: ‘[I see] no signs… Republicans (beyond Mitt Romney and a few quiet and ineffective House back-benchers) are interested in concrete policy agendas of any kind—Trumpist or otherwise. Performative culture war theater takes up most of the political oxygen… [and] crazed opposition of whatever Democrats are forwarding [takes the rest]. In short, there is no significant Republican demand for… policy agendas peddled by [any one on the center- or far-right]…

James Crugnale: Someone Unearthed a 1997 Wired Article Predicting ’10 Things That Could Go Wrong in the 21st Century’—& Nearly All Of Them Came True=: ‘In a listicle attached to the story, [Peter] Leyden and [Peter] Schwartz predicted “ten scenario spoilers” that would “cut short” the economic boom of the 1990s. – Tensions between China and the US escalate into a new Cold War — bordering on a hot one. – New technologies turn out to be a bust. They simply don’t bring the expected productivity increases or the big economic boosts. – Russia devolves into a kleptocracy run by a mafia or retreats into quasi-communist nationalism that threatens Europe. – Europe’s integration process grinds to a halt. Eastern and Western Europe can’t finesse a reunification, and even the European Unification process breaks down. – Major ecological crisis causes a global climate change that, among other things, disrupts the food supply - causing big price increases everywhere and sporadic famines. – Major rise in crime and terrorism forces the world to pull back in fear. People who constantly feel they could be blown up or ripped off are not in the mood to reach out and open up. – The cumulative escalation in pollution causes a dramatic increase in cancer, which overwhelms the ill-prepared health system. – Energy prices go through the roof. Convulsions in the Middle East disrupt the oil supply, and alternative energy sources fail to materialize. – An uncontrollable plague - a modern-day influenza epidemic or its equivalent takes off like wildfire, killing upward of 200 million people. – A social and cultural backlash stops progress dead in its tracks, human beings need to choose to move forward. They just may not…. The infographic went viral on Reddit and Twitter, with many commentators reacting incredulously to the nearly 25-year-old predictions…

LINK: <https://digg.com/2021/wired-article-future-predictions-came-true>

Wikipedia: Somerset v Stewart: ‘Somerset v Stewart (1772) 98 ER 499 (also known as Somersett’s case, v. XX Sommersett v Steuart and the Mansfield Judgment) is a judgment of the English Court of King’s Bench in 1772, relating to the right of an enslaved person on English soil not to be forcibly removed from the country and sent to Jamaica for sale. Lord Mansfield decided that: “The state of slavery is of such a nature that it is incapable of being introduced on any reasons, moral or political, but only by positive law, which preserves its force long after the reasons, occasions, and time itself from whence it was created, is erased from memory. It is so odious, that nothing can be suffered to support it, but positive law. Whatever inconveniences, therefore, may follow from the decision, I cannot say this case is allowed or approved by the law of England; and therefore the black must be discharged…”

LINK: <https://en.wikipedia.org/wiki/Somerset_v_Stewart>

Jerry P. Weir & Marion F. Gruber: An Overview of the Regulation of Influenza Vaccines in the United States: ‘=Influenza virus vaccines are unique among currently licensed viral vaccines. The vaccines designed to protect against seasonal influenza illness must be updated periodically in an effort to match the vaccine strain with currently circulating viruses, and the vaccine manufacturing timeline includes multiple, overlapping processes with a very limited amount of flexibility. In the United States (U.S.), over 150 million doses of seasonal trivalent and quadrivalent vaccine are produced annually, a mammoth effort, particularly in the context of a vaccine with components that usually change on a yearly basis. In addition, emergence of an influenza virus containing an HA subtype that has not recently circulated in humans is an ever present possibility. Recently, pandemic influenza vaccines have been licensed, and the pathways for licensure of pandemic vaccines and subsequent strain updating have been defined. Thus, there are formidable challenges for the regulation of currently licensed influenza vaccines, as well as for the regulation of influenza vaccines under development. This review describes the process of licensing influenza vaccines in the U.S., the process and steps involved in the annual updating of seasonal influenza vaccines, and some recent experiences and regulatory challenges faced in development and evaluation of novel influenza vaccines…

LINK: <https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4947948/>

The Economist: China’s Communist Authorities Are Tightening Their Grip on the Private Sector: ‘Its growth model is at risk…. China Internet Investment Fund…. [Its] 1% stake in a ByteDance subsidiary gives it the power to appoint one of three board members in a unit that holds key licences for operating its domestic short-video business. A similar bargain has been struck with Weibo, which is listed in New York, with CIIF picking up 1% for just 10.7m yuan ($1.5m). The firms hardly need more capital. Nor is CIIF, with plans for a 100bn yuan fund—enough to rival a big Silicon Valley venture-capital firm—overly concerned with the outsize returns its investments will certainly deliver. That is because the outfit… is itself mostly owned by the Cyberspace Administration of China (CAC), a powerful internet watchdog. The arrangement is akin to America’s Federal Communications Commission taking discounted stakes in tech groups such as Facebook and Twitter, appointing board members, then steering them in the direction it sees fit…. Under the aegis of President Xi Jinping, regulators in recent years have unleashed a sustained attack on the technology sector, deeming it to have gained too much influence and strayed too far from the Communist Party’s core values. Tech magnates such as Jack Ma, the co-founder of e-commerce giant Alibaba, have been subdued. Entire business models have been rewritten from on high—and the tenor of the Chinese economy altered as a result…. An uncomfortable prospect for Mr Xi’s new era of party control of the economy: fear by state-capitalists of falling foul of ideological diktats could lower investment returns and throttle corporate dynamism. CIIF’s board appointee to ByteDance has no clear business experience on his résumé, according to Ms Li, but a background in communist propaganda. For doing business in China these days, an insider’s steer on how not to run afoul of the Party may prove invaluable…

LINK: <https://www.economist.com/business/chinas-communist-authorities-reinvent-state-capitalism/21806311>

Brad DeLong: ’@davidfrum @gcaw @TheAtlantic: Forgive me for saying this: But land acknowledgements help people who never think about their predecessors at all to think about them a little. Making an acknowledgement does not mean you shouldn’t think more; but that you should think more does not excuse thinking less…“ / Twitter_: ‘Forgive me for saying this: But land acknowledgements help people who never think about their predecessors at all to think about them a little. Making an acknowledgement does not mean you shouldn’t think more; but that you should think more does not excuse thinking less. To say that land acknowledgements are moral posturing and thus should be discouraged because they are ”moral posturing" is inane and stupid when your alternative is to say and do nothing at all, which it always is…

LINK:

Noah Smith: Video Interview: Eric Topol on the Omicron Variant: ‘Delta, though much more transmissible, wasn’t an “escape variant”. The original, unmodified mRNA vaccines worked perfectly well…. The same is probably not true of Omicron. Lab studies suggest that Omicron has evolved ways to escape both acquired immunity and vaccine immunity. That suggests that vaccine companies will need to make new booster shots against Omicron. In fact, this is easy to do…. The key is getting rapid FDA approval and getting the CDC to recommend the boosters. The CDC was slow to recommend boosters against Delta in part because of concern over vaccine availability for developing countries, but mostly because the CDC is very parochial and didn’t trust the data on boosters and Delta that was emerging from other countries like Israel…. In the meantime, Pfizer’s antiviral drug should be effective against most or all Covid variants, and represents a vital addition to our toolkit against new variants like Omicron. In other words, science is advancing rapidly, and we really can end this pandemic once and for all. But we cannot—we must not—rest on the laurels of our initial vaccine achievement. We still have lots of work to do, and our public health agencies are still not doing as good a job as they ought to be doing. The Biden administration needs to immediately kick this effort into high gear…

LINK:

Re: land acknowledgements, the Oregon Shakespeare Festival in Ashland reads an acknowledgement that the land we occupy is the ancestral land of Shasta, Takelma, and Latgawa peoples "who lived here since time immemorial", before every performance. It sinks in, gradually, that it's the least that can be done.

Re: Wired Article. It might almost be considered a modern prediction by Cassandra. American hegemony and techno-utopianism were all on the upswing at that point. The NASDAQ dot.com crash, 9/11, Bush recession, financial collapse, and the current problems of pandemics (and outbreaks - Ebola, MERS, SARS) and the now obvious climate crisis were all ahead of us. No one even wanted to think about any problems that might be ahead as anything more than easily coped with disruptions.