What Factors Do We See That Might Upend America's Soft Macroeconomic Landing?

Hint: the big threatening factor is not that the Federal Reserve is likely to reduce interest rates too much too soon. It is, rather, the threat of a Trump-led Fed War next year...

Hint: the big threatening factor is not that the Federal Reserve is likely to reduce interest rates too much too soon. It is, rather, the threat of a Trump-led Fed War next year...

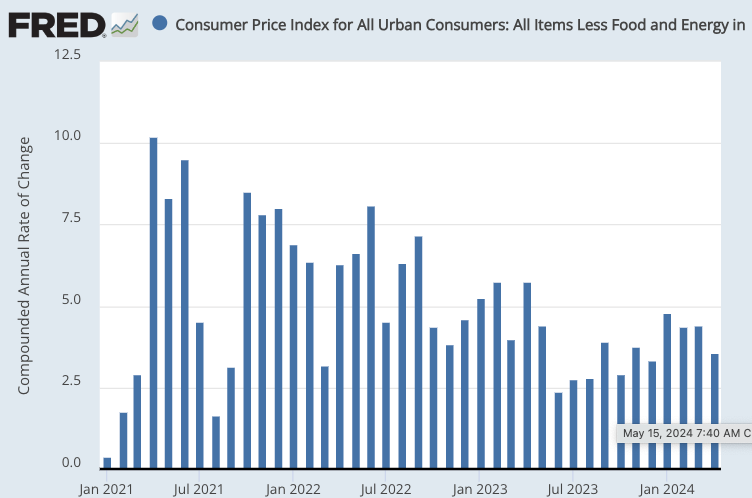

Yes, Virginia, core-CPI inflation is lower than it was a year ago:

And there still remains the slowdown in shelter inflation we expect coming from (a) the role of precontracted rent renewals in providing inertia to shelter inflation, plus the lags between economic events and their reporting contained in the Owners’-Equivalent Rent measure.

And there is the substantial economic weakness outside the United States that is driving foreign central banks to want to cut rates as much as they can without deranging currency markets. Thus the claim that monetary policy in the U.S. is not restrictive—that r* has risen markedly over the past decade—does not seem to have (much) empirical support in the tracks of inflation from any perspective that does not overreact to month-to-month noise. Shelter and transportation—mostly insurance—appear to be the reasons why core-CPI inflation over the October-April half-year was not lower than inflation over the preceding April-October half-year. Yet those inflation components do not seem to have legs.

Thus I continue to see a world eighteen months from now in which the Federal Reserve is much more likely than not to wish that it had started cutting interest rates in January 2024.

Thus I continue to see the United States not just on the soft-landing path, but on the runway and slowing—in fact, in the middle of the groove—although with the monetary-policy rudder to the contractionary right, rather than the straight-ahead as I believe it should be.

So, then, what are the many who strongly think the Federal Reserve needs to keep interest rates at their current relatively high levels thinking?

The answer is that they think that history often rhymes, and they are reaching back into the past and remembering an earlier time, the years 1977-1979 to be specific, and viewing it as a cautionary tale. Back then a near-stabilized inflation spiraled out of control.

I once had the privilege of listening to President Carter’s Chief Economist Charles Schultze recount the year that their nominal GDP forecast had been dead-on—but economic growth came in two full percentage-points low, and inflation came in two full percentage-points high. Then followed the Iranian Revolution and the second major oil-price spike of the 1970s, and the stage was set for the end-of-1970s economic crisis, the Neoliberal Turn, the Volcker Disinflation, and Latin America’s Lost Decade of the 1980s.

To those who see history as potentially rhyming in this way, keeping the rudder substantially right and thus keeping rates in a configuration that is ex post likely to be judged too high for too long is a relatively minor consideration in order to buy insurance against what they see as a very possible repeat of 1977-1982.

However, suppose you are an inflation hawk. Is Jay Powell prematurely lowering interest rates, and thus running some risk of his tenure rhyming with what happened over 1977-1982, the thing you should be most worried about? Is that the risk that you should spend your time persuading people to guard against?

No.

The big risk is elsewhere. The big risk is in the return to the presidency of Donald Trump. Trump has promised much higher tariffs than Biden. While Biden at least has an argument that his tariffs have valid national-security and industrial-policy growth rationales, Trump does not: his tariffs have been and likely will be random chaotic interventions in the process of waging and losing trade wars. Thus Trump’s tariffs are, in all likelihood, going to be substantially inflationary.

More important, Trump is visibly itching to rerun Andrew Jackson’s Bank War, with Jay Powell cast in the rôle of Nicholas Biddle, the president of the Second Bank of the United States that Jackson ultimately killed. The historians of the New-Deal Era whom I read when young approved of Jackson and of his Bank War—they saw Andrew Jackson as playing the rôle of John the Baptist to Franklin Delano Roosevelt as the Messiah. The Bank War brought financial disruption, commercial bankruptcies, deflation, and thus the destruction of some national wealth and a shift in the rest of wealth from entrepreneurial debtors to already-rich creditors. The argument was that it prefigured FDR’s New Deal-Era warring against “economic royalism”. Perhaps this is true with respect to the wealth and the political and social power of a very small oligarchy of Philadelphia bankers gathered around Nicholas Biddle himself. But, overall, nothing is better for economic royalism, wealth inequality, and in particular wealth inequality that favors non-entrepreneurial already-rich heirs and heiresses than general deflation of the kind Jackson’s Bank War triggered.

The forthcoming—should Trump worm his way back into office—Fed War is no more likely to have a pro-growth pro-prosperity outcome than Jackson’s Bank War. But the Bank War was popular among Jacksonians. And the Fed War will at least paint a picture of economic saboteurs who can be blamed among Trumpists.

What Trump is itching for is the chance to claim to have defenestrated Jay Powell from his office as Chair of the Federal Reserve, name a new interim chair until he nominates and Congress acts to approve a new permanent Chair, and either shape Fed policy toward a more preferred Trumpist configuration or at least have a large and public political fight in which Trump can appear strong. Win or lose in his legal fight to have a court issue a writ obliging Jay Powell not to sit in the Chair’s seat at FOMC meetings, Trump is also itching to mobilize social-network mobs against Federal Reserve governors and bank presidents who refuse to lower interest rates. And behind that mobilization is the threat of stochastic terrorism. There is a very nice passage on point here from McKay Coppins’s book Romney: A Reckoning:

McKay Coppins: Romney: A Reckoning: One Republican congressman confided to Romney that he wanted to vote for impeachment, but declined out of fear for his family’s safety. The congressman reasoned that Trump would be impeached by House Democrats with or without him—why put his wife and children at risk if it wouldn’t change the outcome?

Later, during the Senate trial, Romney heard the same calculation while talking to a small group of Republican colleagues. When one senator, a member of leadership, said he was leaning toward voting to convict, the others urgently encouraged him to reconsider. You can’t do that, one said. Think of your personal safety, said another. Think of your children. The senator eventually decided they were right. There were too many Trump supporters with guns in his state, he explained to Romney. His wife wouldn’t feel safe going out in public.

As dismayed as Romney was by this line of thinking, he understood it. Senators and congressmen don’t have security details. Their addresses are publicly available online. Romney himself had been shelling out $5,000 a day since the riot to cover private security for his family—an expense he knew most of his colleagues couldn’t afford… <https://www.amazon.com/dp/1982196203>

Prosperity rests on peace and predictability. Prosperity does not go well with risk, especially incalculable political risks.

Bill Dudley, in his recent Bloomberg article, downplays Trump as a significant threat to Federal Reserves operations. Trump will not succeed in bending the Fed to his will, he thinks:

Bill Dudley: Could Trump Take Over the Fed? It’s a Scary Thought: Of the 12 voting members of the… Federal Open Market Committee… [Trump would appoint] only two… between 2025 and 2029…. Moreover… more compliant replacements… would still need Senate approval…. [And] firing Powell would be tough…. [Even] if Trump nonetheless managed it… the members of the FOMC could vote to reinstate him as the committee chair… <https://www.bloomberg.com/opinion/articles/2024-05-15/could-trump-take-over-the-federal-reserve-it-s-a-scary-thought>

I am much less sanguine. Fed governors—and bank presidents—who did not feel like spending $5000 a day on security could be induced to resign. The law as interpreted in Humphrey’s Executor may state clearly that the Federal Reserve chair can only be dismissed from office “for cause”—inefficiency, neglect of duty, or malfeasance—but since the Supreme Court’s 5-4 Bush v. Gore installation of George W. Bush as president at the start of the 2000s, it has been very clear that precedent, original intention, or black-letter meaning hold only as long as a majority of the Supreme Court are willing to say that they hold, and that there is no majority behind any of those principles when the chips are truly down.

Dudley does recognize that even the attempt by a Trump reïnstalled in the presidency to wage a Fed War would be damaging enough:

Bill Dudley: Could Trump Take Over the Fed? It’s a Scary Thought: strong rule of law, deep and liquid capital markets and free movement of capital… [underpin] the country’s economic health…. The relaxed market sentiment about the upcoming presidential election surprises me. Hard as it might be to take indications of Trump’s intentions for the Fed literally, they must be taken seriously… <https://www.bloomberg.com/opinion/articles/2024-05-15/could-trump-take-over-the-federal-reserve-it-s-a-scary-thought>

Right now, Powell and his FOMC team are doing their very best to make marginal adjustments to interest rates and financial conditions to keep the economy in its soft-landing, slowing-on-the-runway groove. Real threats to monetary and economic stability right now come not from marginal moves or failures to move on policy by the FOMC. They, rather, come from the failure of so very many—including America's inflation hawks—to see and mobilize against the danger of a Trumpist resurgence in November’s forthcoming election.

References:

Bureau of Labor Statistics. 2024. "News Release: Consumer Price Index – April 2024." U.S. Department of Labor. May 15. <https://www.bls.gov/news.release/cpi.nr0.htm>.

Coppins, McKay. 2023. Romney: A Reckoning. New York; Scribner. <https://www.amazon.com/dp/1982196203>.

Dickler, Jessica. 2024. "The Fed is determined not to reduce interest rates too soon, experts say — a mistake the central bank has made in the past." CNBC. April 10. <https://www.cnbc.com/2024/04/10/heres-why-the-federal-reserve-is-in-no-rush-to-cut-rates-in-2024.html>.

Dudley, Bill. 2024. "Could Trump Take Over the Fed? It’s a Scary Thought." Bloomberg. May 15. <https://www.bloomberg.com/opinion/articles/2024-05-15/could-trump-take-over-the-federal-reserve-it-s-a-scary-thought>.

Federal Reserve Bank of St. Louis. 2024. "Consumer Price Index for All Urban Consumers: All Items Less Food and Energy." FRED. May 15. <https://fred.stlouisfed.org/series/CPILFESL#0>.

Ghosh, Indradip. 2024. "When will Fed cut interest rates in 2024? Here's what 100 economists say in Reuters poll." Reuters. April 18. <https://www.reuters.com/markets/us/fed-cut-rates-september-maybe-once-more-this-year-2024-04-18/>.

Politi, James, & Kate Duguid. 2024. "US inflation falls to 3.4% in April". Financial Times. May 15. <https://www.ft.com/content/ef0028e6-ec29-4521-80fa-2cb6531adb39>.

Restuccia, Andrew, Nick Timiraos, & Alex Leary. 2024. "Trump Allies Draw Up Plans to Blunt Fed’s Independence." Wall Street Journal. May 15. <https://www.wsj.com/economy/central-banking/trump-allies-federal-reserve-independence-54423c2f. https://www.gata.org/node/23179>.

Rugaber, Christopher. 2024. "Is the Fed going to cut interest rates? What was once a question of ‘when’ is now less certain." PBS NewsHour. April 6.

<https://www.pbs.org/newshour/economy/is-the-fed-going-to-cut-interest-rates-what-was-once-a-question-of-when-is-now-less-certain>.Saraiva, Augusta. 2024. "US Core CPI DCools for First Time in Six Months in Relief for Fed". Bloomberg. May 15. <https://www.bloomberg.com/news/articles/2024-05-15/us-core-cpi-decelerated-in-april-for-first-time-in-six-months?srnd=homepage-americas>.

Schlesinger, Arthur M., Jr. 1945. The Age of Jackson. Boston: Little, Brown and Company. <https://archive.org/details/ageofjackson0000schl>.

Schultze, Charles. 1982. "Oral History." Miller Center. January 8-9.

URL: https://millercenter.org/the-presidency/presidential-oral-histories/charles-schultze-oral-history>.

This shouldn't be a paid-subscriber-only extra edition, it should be an op-ed in the Grey Lady.

ETA: I meant this remark in a positive sense, but belatedly I realize you might not take it that way ...

Is this arguing only against that 5.5% today is neutral? Against the Fed making no change in the EFFR?

I think that when X says policy is "neutral", it means that X thinks no monetary instrument should be changed.