FIRST: When the Fed Stops Trying

After Vladimir Putin's invasion of Ukraine, and the consequent disruptions in energy and grain markets, there may be no path forward, no needle to thread, for the Federal Reserve between Scylla and Charybdis—between a monetary polic, so tight that it returns us to secular stagnation, the zero lower bound, and the lost half a decade of growth on the one hand; and a monetary policy so loose that it eventually end up in painful stagflation on the other.

But there might be such a path. And I find it disturbing that, in its rhetoric at least, the Federal Reserve is no longer trying to find it. Claiming that it will keep raising interest rates until after there are clear signs that the labor market is in a substantial downturn is a recipe for subsequent panicked cutting of interest rates back to the zero lower bound, after which the Federal Reserve will have next to no traction to boost the economy, and the chances of a rapid return to full employment will then be very bad:

Brad DeLong: When the Fed Stops Trying: ‘Today it is unclear whether there is still a safe path between Scylla and Charybdis. But following two more 75-bps hikes in July and September, I worry that the Fed has given up on even trying to find it. Instead, like Odysseus, it has intentionally started to hew toward Scylla (secular stagnation), viewing it as the lesser of two evils. One no longer hears Fed officials cautioning that last winter and spring’s tightening has yet to ramify fully throughout the economy. Instead, the Fed has signaled another 1.25-bps’ worth of hikes to come before the end of this year.

US Secretary of the Treasury and former Fed Chair Janet Yellen once told me that the Fed’s rate-setting Federal Open Market Committee will tend to overreact to the immediate news cycle unless it bases its thinking on some transparent formula like the Taylor Rule. But while the Taylor Rule made sense during the Great Moderation, the days of persistently low and stable inflation are gone, and the Fed has no replacement framework to elevate its thinking above the news-driven groupthink…

There are consequences to choosing to have a Republican Worthy—even a highly competent one—rather than a sensible macroeconomist at the head of the Fed.

Must-Read: Josh Barro on Permitting Reform

I think Josh Barrow has this wrong here. "Secret Congress” has only worked over the past two years, when it has worked, because Republicans think that they need to give centrist Democrats enough of a steam valve release to keep them from shifting to the same level of support for Schumer that all Republicans give to McConnell. “Secret Congress” is unstable, and occurs only when Democrats have majorities anyway. And after the midterm, the presidential election is immediately on the horizon:

Josh Barro: Permitting Reform Will Live Another Day: ‘The parties have actually moved closer on these issues, which bodes well for eventual reform…. Why should Democrats invest in trying to block projects like Manchin’s beloved Mountain Valley Pipeline? We need more natural gas production and transmission, both to make Europe’s turn away from Russian gas possible, and in order to support wind and solar projects that rely on natural gas infrastructure…. We need backup gas generation we can turn on when it’s cloudy (or not windy) out, or else we’ll have to rely on coal…. [The] Democrat[ic]… party was overwhelmingly ready to swallow any objections and pass a reform package on the terms Manchin set if Republicans would cooperate. But they wouldn’t—on Tuesday, Mitch McConnell unloaded on Manchin’s proposal in a way I find mostly disingenuous…. McConnell’s overriding motivation here in torpedoing Manchin’s baby was political: to avoid handing Biden and Manchin another big bipartisan win so close to Election Day….

Permitting reform is now the sort of initiative that would be best handled in “Secret Congress”… a lower-profile way to move legislation to their shared ends without anybody taking too much credit or blame…. Republicans will surely want to say this isn’t Manchin’s reform package—Capito has her own competing proposal—and maybe the parties can agree to disagree on whose idea this all was. But the underlying incentives for getting a deal done here, sooner or later, are pretty good…

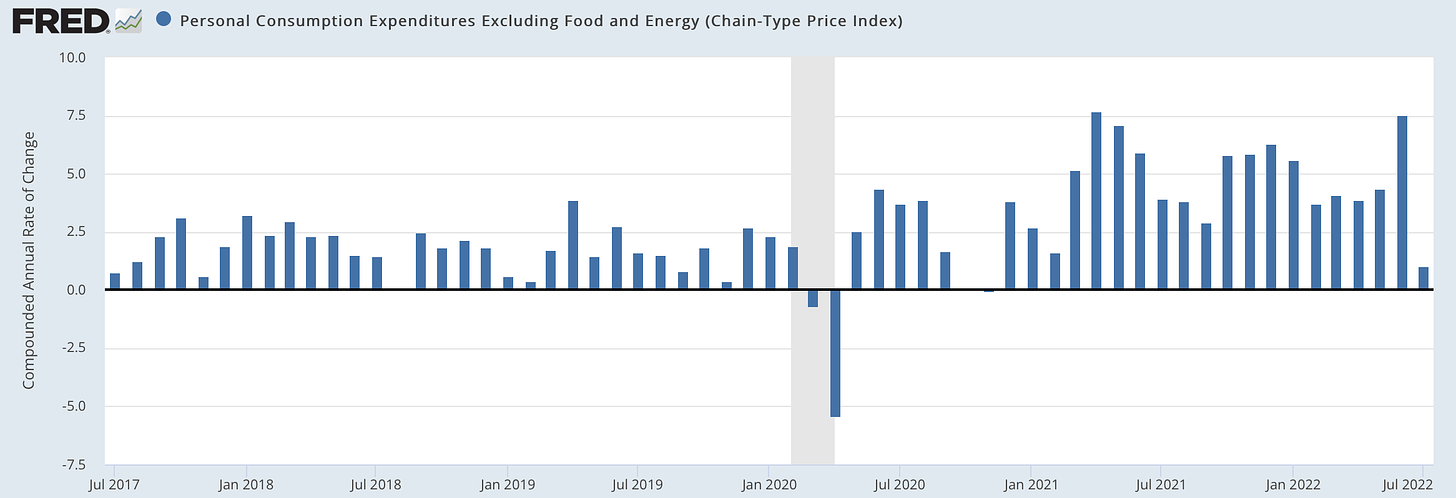

One Image: Inflation:

PCE deflator inflation has been bouncing around 5%/year for a year and a half now, without it leading to any shift in long-term bond market expectations of what out-year inflation is going to be. This is what Federal Reserve credibility is good for—to let inflation do whatever it needs to do to get the economy moving again in the short run, without triggering the expectational spiral that produces medium-run stagflation.

The only big danger I see springs from Vladimir Putin and Muhammed bin Salman—it is, more often than not, what happens to gas prices at the pump that unhinges inflation expectations when they get unhinged.

Other Things That Flew By:

Annie Lowrey: Teachers, Nurses, and Child-Care Workers Have Had Enough: ‘The burnout crisis in pink-collar occupations puts everyone’s well-being at risk.

Greg Sargent: Dangerous new threats from Trump loyalists require Democrats to act: ‘Nor can Democrats count on Biden succeeding in using the bully pulpit…. We know what’s likely to happen. Republicans are telling us so themselves. Democrats need to protect the country before it’s too late…

John Authers: Gatsby, the Dollar, and Staring Blankly at the World Falling Apart: ‘What if there was a meeting at the Plaza Hotel to air out differences? It’s happened before in truth and fiction, but the money and the will aren’t there for currency markets this time…

Tara Henley: Dingus of the Week: James Madison

Ivan Levingston & Jillian Deutsch: UK Has ‘No Chance in Hell’ of Making Its Own Tech Champs: ARM Founder: ‘Hermann Hauser during the Bloomberg Tech Summit…

Diane Coyle: Review of "Slouching Towards Utopia”: ‘I like that it doesn’t claim there are easy lessons from the history, but insists that there are indeed subtler lessons...

Rakesh Bhandari: ‘These tables of innovations… made by the late Janos Kornai…

Tom Barson: ‘Review: @adam_tooze on @delong…. . Some good points… some odd ones…. Odd… Tooze complains that the 20th century's massive exploitation of "nonrenewable resources" is left out of the drivers of DeLong's "grand narrative.”... But surely the 20th century's resource thirst was a consequence of the forces DeLong mentions. And it's legacy? Well, that will be 21st century history…

Tony Yates: ‘Extraordinary!’ Steve Hou: ‘The leading advocate of the Fiscal Theory of the Price Level rejects a most classic example of FTPL, because what? “tax cuts”?’ Brad DeLong: Theories as neither intuition pumps or filing systems, but just as ideological cudgels?! You don’t say!!!! Nirai Tomass: ‘Very confusing substack post and even more confusing that Cochrane supports it. From what I understood it argues that the fiscal news is, if anything, positive and that investors are being irrational. Especially the latter I wouldn't expect Cochrane to support…

Kalyeena Makortoff and Sarah Butler: ‘The Bank of England’s £65m emergency intervention… stabilised UK government bond prices, supported the pound, and halted a pension fund selloff that threatened to spark a deeper crisis across the City. “After 35 years in the industry, I’d never seen anything like it,” Luke Hickmore, a fund manager… said... However, markets were now “a lot calmer.” “It’s good to finally see the UK [bond] market moving at a similar pace as Europe.”

David Roberts: ‘I need to stop tweeting, but I want to do a quick thread on how the conservative pushback against YIMBY echoes & parallels other RW culture war grievances…

Mark Blyth: The Primacy of Politics: The Past, Present, and Contested Future of Social Democracy

"Claiming that it will keep raising interest rates until after there are clear signs that the labor market is in a substantial downturn is a recipe for subsequent panicked cutting of interest rates back to the zero lower bound, after which the Federal Reserve will have next to no traction to boost the economy, and the chances of a rapid return to full employment will then be very bad:"

Personally, I read the constant banging of the inflation panic drum, which essentially kicked off as soon as it became obvious Biden would be sworn in, as attempting a restoration of the previous secular stagnation regime. Which has obvious benefits for insane & insanely wealthy rich guys: they get bailed out (with no penalty! & no strings attached!) if their idiot financial bets go bad, while their labor costs are kept artificially low, and they get a constant supply of fresh dollars pumped into the market via 'market support'. Why wouldn't they want to go back to that? Aside from the policy doing serious social damage, pissing everyone off, and retarding overall growth. They can escape to their private island, or their former missile silo in Kansas, while society collapses because of said policy! They win! They'll be the richest people in the post-apocalyptic world!

(Does that sound insane to you? Because it seems pretty insane to me, but yet, that's what those guys say/imply all the time: he who dies with the most toys wins. ...wins what? The booby prize in hell?)

I am sticking to my previous position: secular stagnation is not a thing that falls out the sky, it's the result of too restrictive monetary policy. The struggle over economics is a struggle over the social order, because people focused on the most growth would not run such a policy because it demonstrably *does* *not* *provide* *the* *promised* *results* (faster growth for one). It didn't when the same policy was called the gold standard and it won't now, either.

"There are consequences to choosing to have a Republican Worthy—even a highly competent one—rather than a sensible macroeconomist at the head of the Fed."

Powell tends to pick a direction and go too hard at it for too long. He also obviously is keen on what the market thinks (the markets think the Fed should do whatever is necessary to increase market returns, the actions preferred being whatever bug the rich guys have up their butts about this quarter). I guess this means we're in agreement that if another Democrat is elected President with a trifecta that they should appoint Democrats to the key jobs instead of trying to appease unappeasable right-wingers because that never works out?

elm

i mean, it's a thought

Tooze, all too often, seems more interested in showing how smart HE is that the actually analysis suffers. What if the cigar is just a cigar?