CONDITION: MOAR Nice Praise for Slouching Towards Utopia!

Slouching Towards Utopia: The Economic History of the Twentieth Century <bit.ly/3pP3Krk>:

Saadia Zahidi: Most Recommended Books of 2022: ‘In this sweeping overview of the period stretching from 1870 to 2010, DeLong explains the forces that drove the modern era’s unprecedented progress in technology and expansion of wealth…. Only through the shotgun marriage of Friedrich von Hayek and Karl Polanyi – a marriage blessed by John Maynard Keynes – have we been able even to slouch toward utopia, and that marriage has failed its own sustainability tests…. We got climate change, economic depressions and recessions, perpetual uncertainty, inequality, and deepening social polarization…”

My guess, trying to use Amazon Sales Rank as a daily indicator, is that worldwide all-format sales of Slouching Towards Utopia will cross 29,000 tomorrow, and I am very much hoping to hit 30,000 by Christmas…

FOCUS: Me in Time: When Will Interest Rates Stop Rising? Now Would Be Good:

<https://time.com/6241841/federal-reserve-interest-rates-stop-rising-now/?xid=homepage>

The Federal Reserve raised interest rates by 0.5%-points last week. That should be the last such raise.

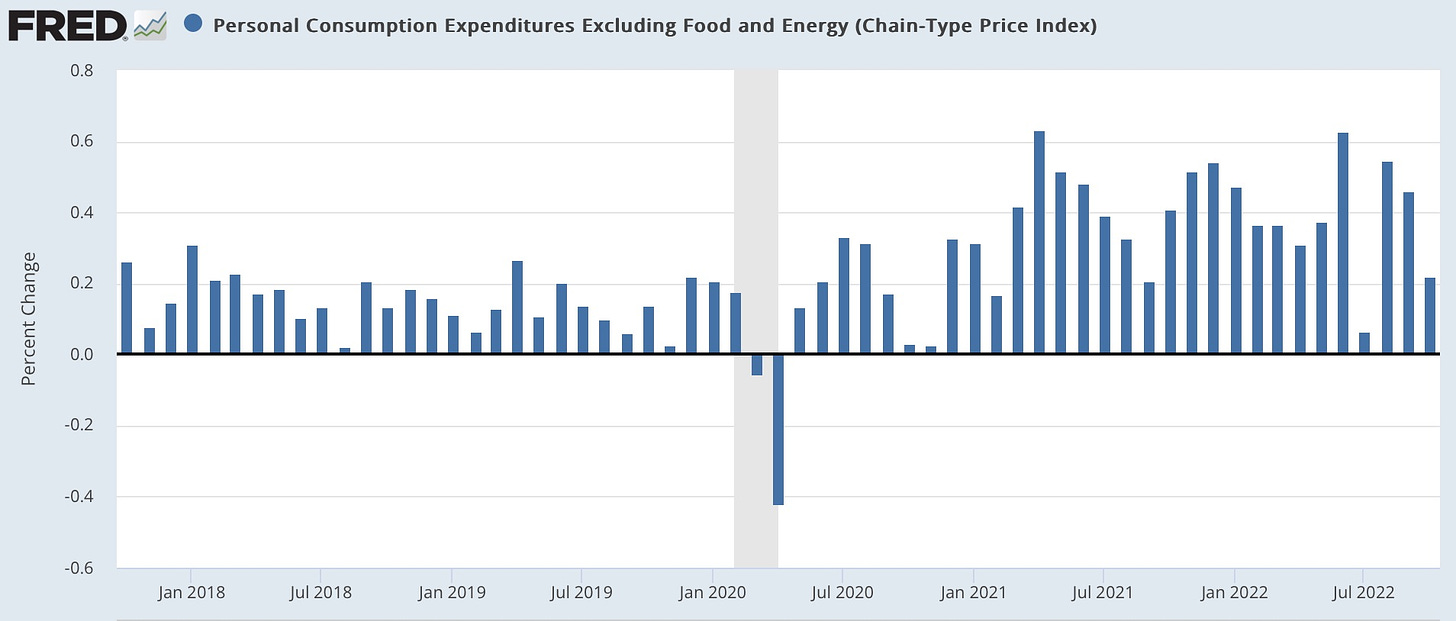

The Core CPI—consumer prices with the volatile food and energy sectors taken out—rose by only 0.2% in America in November. That would be a 2.4% annual rate. Food and energy inflation came out lower. The Headline CPI—the entire index—rose by only 0.1% in November. That makes two months of very surprisingly lower-than-expected inflation rates. The reduction in inflation has been powered by good prices: goods prices have now fallen over the past two months by a total of 0.9%.

The only piece of inflation news that does not show a clear and significant declining trend is services inflation. But even in that there appears to be signs of good news: services inflation averaged 0.6% per month—7.1% per year—over the six months before November. It was 0.4%—4.8% per year—in November. We can guess that the decline in services inflation will continue for the next six months. Rent increases have moderated and may be disappearing, but the change in the housing-cost trajectory, although baked in the cake, is not yet in the November numbers at all.

And it is not as though wage pressure is pulling services inflation up: nominal wage inflation has been less than services price inflation for pretty much all of 2022. While the labor market is “overheated” in the sense that nominal wage increases are still running above 5% per year, this appears more a response to price inflation than a driver of it. Even at today’s low unemployment rate, workers in aggregate do not appear to have the market power to demand a larger share of the income pie.

The inflation we have had over the past two years has been, largely, a good thing—or, rather, a necessary consequence of a very good thing. Not to have had an inflation surge as we reopened the economy after the plague—that would have been to run unacceptably high risks of a repeat of the disastrously slow recovery of the Obama years. Moreover, we needed wage inflation in the goods-producing, logistics, and information sectors in order to pull workers returning to work into the sectors that needed to expand to get the economy to full employment given the altered post-plague shape of demand. And we needed inflation at the bottleneck breaks in supply chains to incentivize their repair.

The Team Transitory narrative of 2021 was that we needed to re-join the highway at speed, that when you accelerate you leave rubber on the road, and that it is silly to be surprised by and then complain about the skidmarks. A central bank with credibility should not obsess about hitting its inflation target every single year, but rather let inflation vary from year to year in whatever pattern, maximizes, employment, purchasing power, and growth. The Team Transitory narrative of 2021 was that the pattern looked like what we had seen in the late 1940s when we wheeled the economy away from war and into civilian production, and then again what we had seen in the early 1950s when we wheeled the economy into the configuration necessary to fight the permanent Cold War: in both those cases inflation spiked and quickly receded.

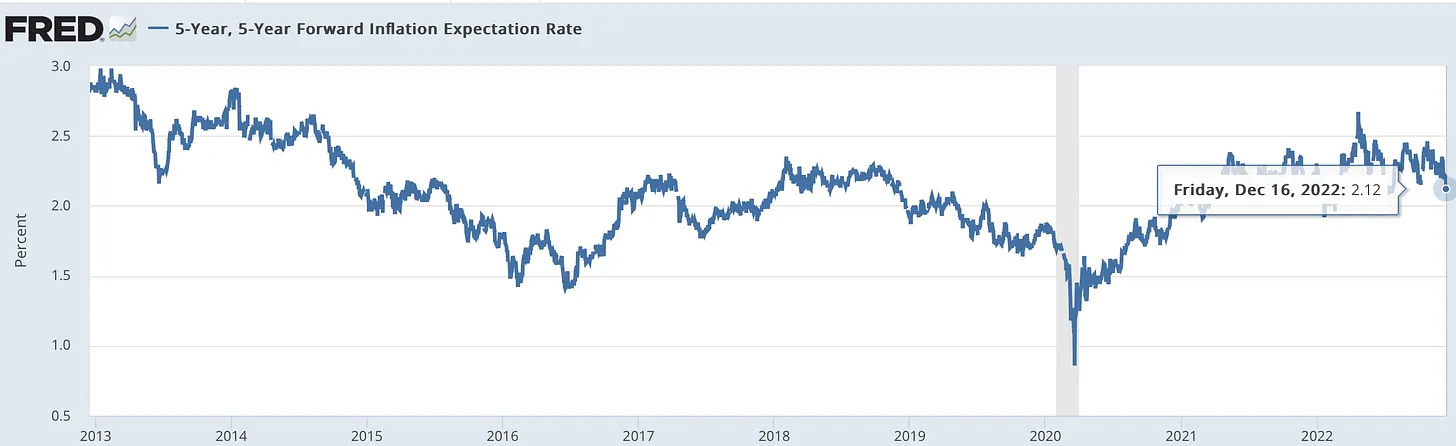

The fear in 2021 was that the inflationary spike would get incorporated into expectations of future price changes, and lead to its entrenchment in worker demands for continual wage increases, and so return us to the stagflation of the 1970s.

This fear gained great urgency in 2022, when Vladimir Putin’s attack on Ukraine produced substantial energy and food price shocks. The double whammy of commodity supply-shock and after plague-reopening shocks greatly raised the risks that expectations of inflation would become entrenched, generate a repeat of the 1970s, and require a 1982-magnitude recession to restore the economy to balance.

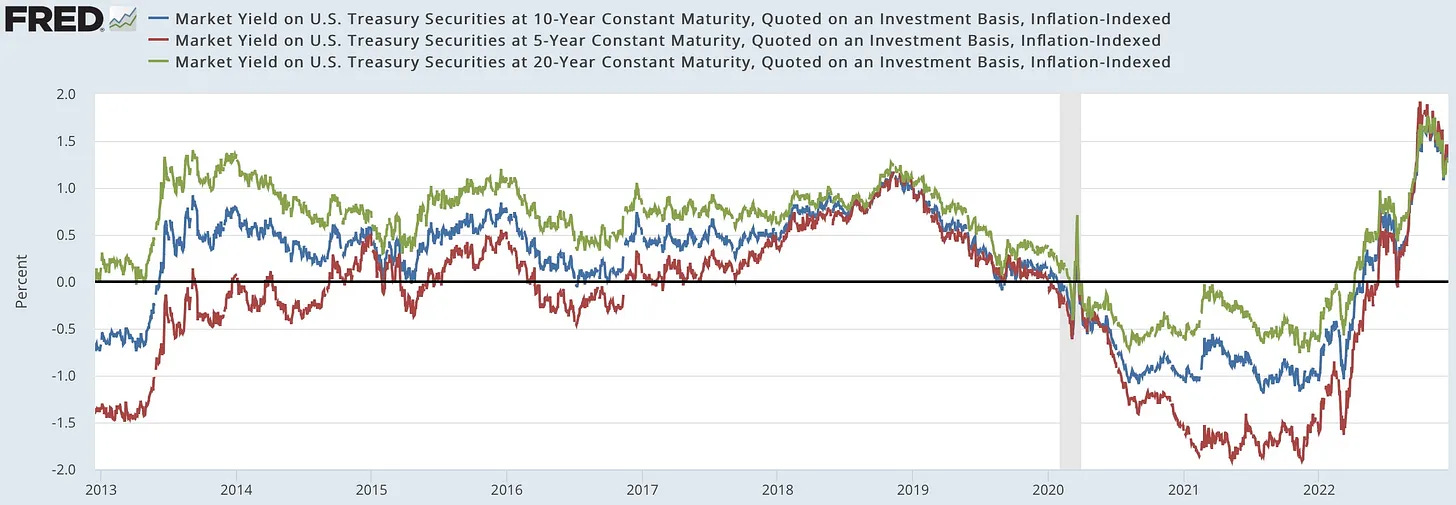

But now it seems that the supply shock and the reopening shock may have passed their peaks. And, so far, there is no sign anywhere in the economy of inflation expectations becoming entrenched.

Thus over the past two months the balance of risks has shifted. There still remain grave risks on both sides. But as of now the principal risk is not that the Fed will do too little in the way of interest-rate increases to generate an economic soft landing, but that it has already done too much.

MUST-READ: Ken White Is a Free-Speech Pedant:

This is very, very good indeed. Ken White is almost always very very thoughtful, and has the good kind of lawyer mind—one that makes very important, very useful, and very thoughtful fine and not-so-fine distinctions:

Ken White: In Defense Of Free Speech Pedantry: ‘FSC [Free Speech Culture] and FSR [Free Speech Rights] are not only distinct, they can conflict. Put another way, FSC arguments often involve asking Group A not to do or say x—which they have the FSR to do—so that Group B is not chilled or deterred from doing or saying y…. That argument… should be made out in the open, and… being precise helps us do that…. When I denounce students for shouting down a speaker and preventing them from speaking, I should be clear that I’m saying that the students’ behavior may exceed their FSR (because reasonable time, place, and manner restrictions are permissible) and that I’m making a FSC appeal for the students to refrain from using their expression to dictate what other people can say and what other people can listen to….

Finally… I think sometimes… “hate speech is not free speech” is an appeal to S[peech ]D[ecency]…. There’s an idealized set of speech that may be controversial or disagreeable but ultimately is not cruel and contemptible, and that racist speech is outside of that set. This is a perfectly legitimate debate. It’s fine to say that using a racial epithet is usually protected by FSR, that in some circumstances it ought to be protected as a matter of FSC (for instance, in allowing “Huckleberry Finn” to be taught to high school children notwithstanding its use of epithets), and that people who use it to belittle and demean ought to be called out as a matter of SD. Once again, clarity about values helps illuminate the different rights and different interests in play…

Yes indeed! The TRR Commission was a trip!

Call me a neo-liberal, but I can see no reason to subsidize the purchase of an EV. It's as crazy as subsidizing solar panels instillation on roof tops. Per EV mile driven or per KwH produced might be a fourth best substitute for a tax on net CO2 emissions, but the up-front purchase? No, please redo the CBA of this policy.