Why Isn’t Þere an Inflation Non-Panic?

& BRIEFLY NOTED: FOR 2022-01-11 Tu

CONDITION: Plague

First: Why Isn’t There an Inflation Non-Panic?

I read:

Mohamed El-Erian: The Key to 2022 Will Be How Inflation Is Brought Down: ‘For more than a decade, large-scale central bank purchases of assets boosted not just those being bought in markets but also virtually all other assets, be they financial or physical (such as housing, art and other collectibles). This was particularly the case in 2021…. As the new year unfolds, both the Fed and markets have a huge stake in inflation coming down in an orderly way. But the window of opportunity for policy to achieve this is rapidly closing. The alternative is a disorderly drop, which would involve the even bigger Fed policy error of having to be too abrupt in tightening monetary policy after being way too slow previously…

LINK: <https://www.ft.com/content/20e0857b-99cb-4495-8677-8746d97db836#myft:my-news:page>

And:

Robert Armstrong: How to Panic About Inflation: ‘High levels of panic will be appropriate if we see sharp acceleration in services prices, especially outside healthcare and transport…. This would indicate that the strong wage gains we have seen recently are spreading pervasively though the economy, in ways that could (in theory) scare everyone into thinking inflation is here to say, and trigger the dreaded wage-price spiral…. If the Fed gets to its target two per cent rate in 2023—that still means negative short-term rates…. “That is not going to constrain the cost of financing anything”…. The Fed might have to get much more hawkish than it is now, with heavy consequences for markets. Unhedged is not there yet, because we’re just not convinced demand will be strong for long, and the bond market supports our doubts. But Michele’s argument frightens us all the same…

LINK: <https://www.ft.com/content/04892b1b-d977-473d-8b54-d34e33a29703>

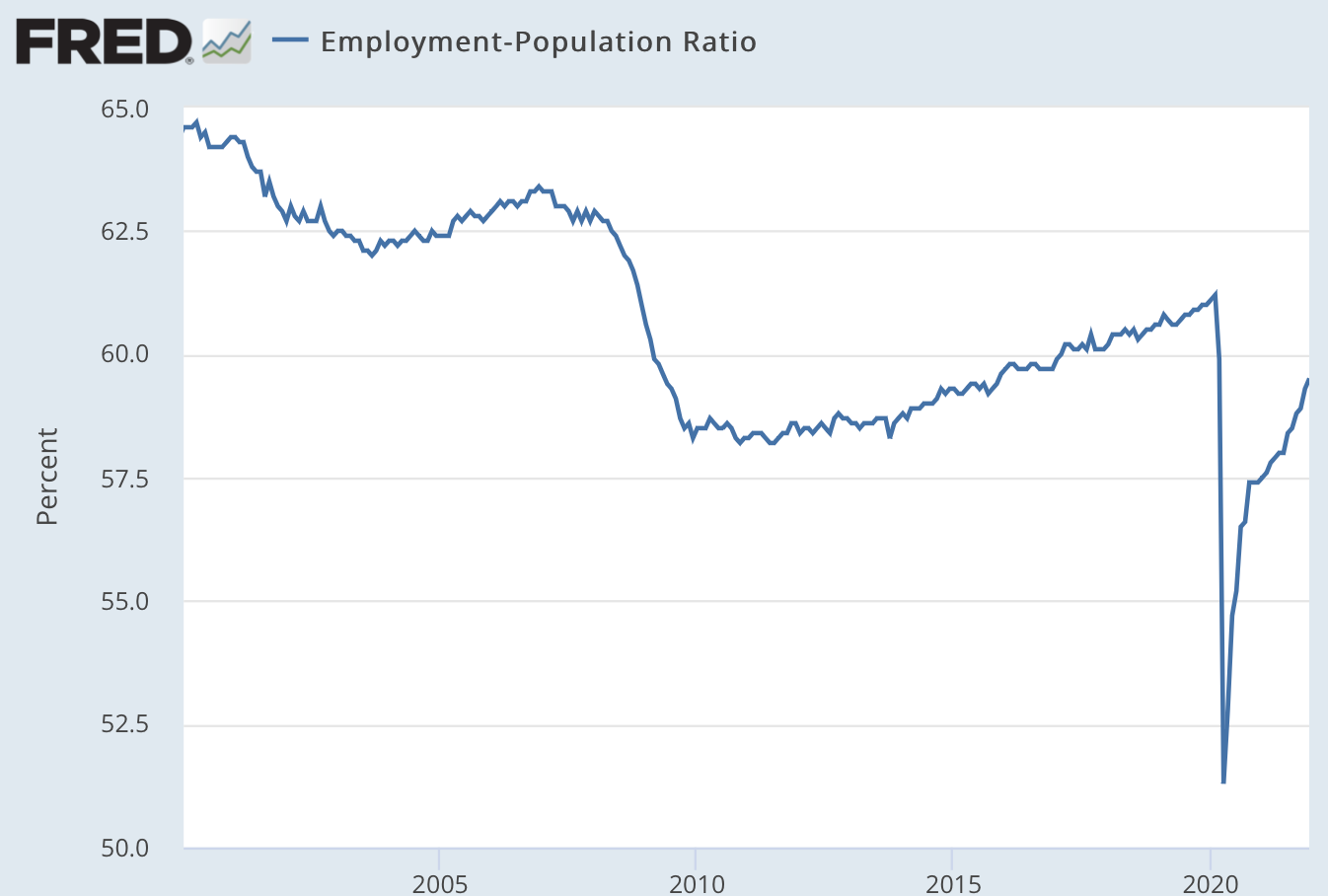

And my immediate first response is to ask the question: In what sense is the Fed supposed to have been "way too slow" in tightening monetary policy? We still are way short of full employment. Some of that is due to childcare and virus-fear bottlenecks. But some of it isn’t. And to the extent that there are important jobs not being done because people can’t afford to make alternative childcare arrangements or fear the virus—well, the inflation that comes from paying people more to see if they will take those jobs is to be welcomed, not fought:

Plus the economy has undergone a great wheel: 6% less relative to trend in personal consumption expenditures on services, and 20% more relative to trend in personal consumption expenditures on goods. Not all of that is going to stick into the post-plague economy, but a good deal of it will. We have an economy in which nominal wages and some nominal prices are really sticky downward. That means that if market prices are to do their job signals of where the value is, prices and wages in industries that need to expand must rise relative to prices and wages in industries that need the contract. With prices and wages in industries that need to contract sticky downward, that means: inflation:

Now it is certainly true that we do not want the inflation now, which we want, and which is an essential part of a rapid restoration of general prosperity, to stick around once we arrive at whatever our new normal is going to be. But I look outside my window now, and I see no new normal.

Thus my immediate second response is to ask the question: Why is it not obvious to nearly everybody questions of inflation control should be postponed until their proper date—which will be when the plague has fallen to an endemic flu-like illness, and when the economy is back to full employment?

Perhaps I should not be surprised at our world of public discourse about finance and economics that does not seem to have thought much, if at all, about the relationship between macroeconomics and rapid structural change. This is, after all, the same world of public discourse about finance and economics that never managed to absorb Paul Krugman's very important 1998 point call if you find yourself at the zero lower bound on interest rates, that means that your inflation target is too low: <https://www.brookings.edu/wp-content/uploads/2016/07/1998b_bpea_krugman_dominquez_rogoff.pdf>

One Video:

The Verge: Springboard: The Secret History of the First Real Smartphone (Full Documentary)<https://www.youtube.com/watch?v=b9_Vh9h3Ohw>:

One Picture:

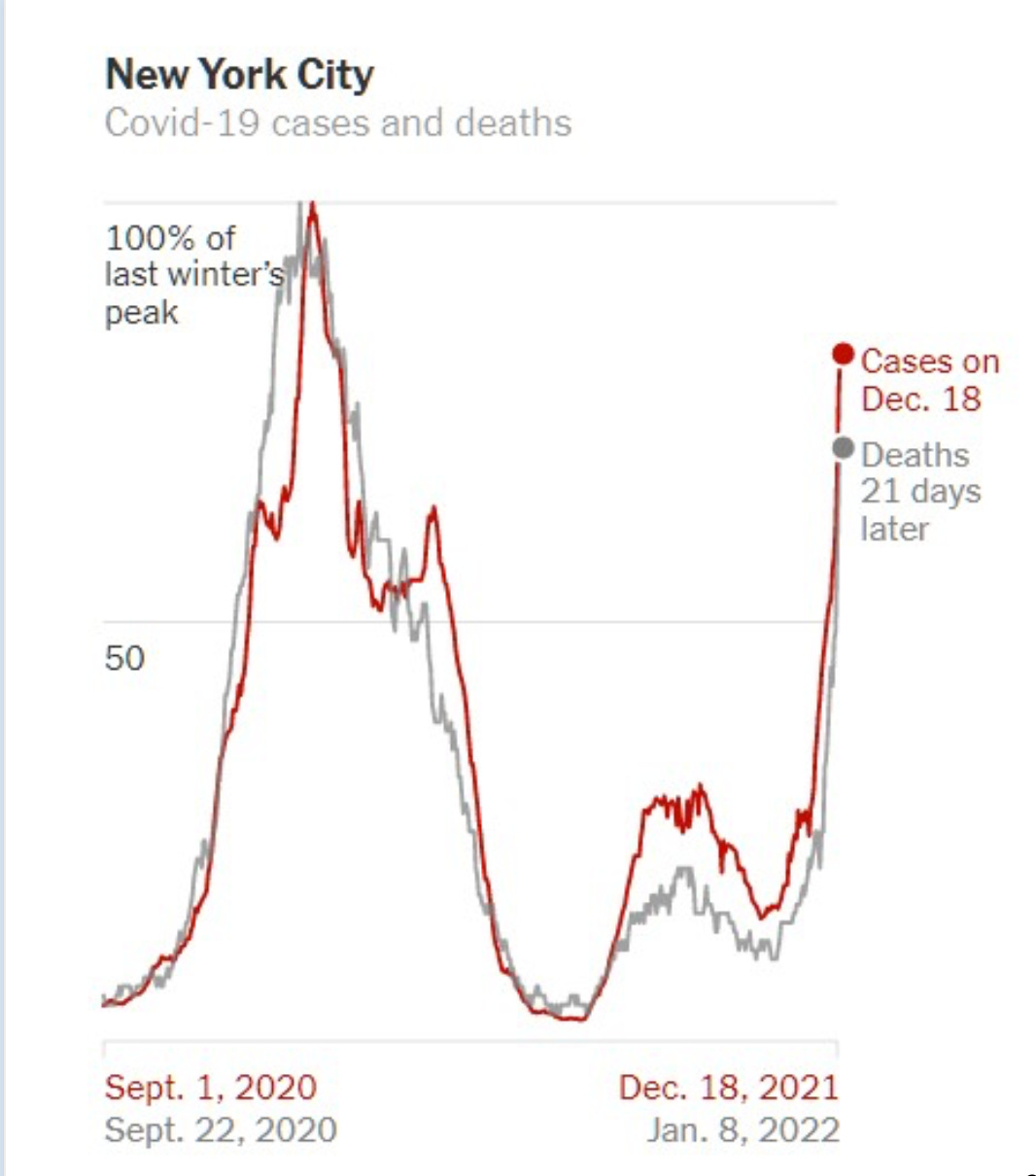

Confirmed case numbers are bullshit, save that there are going to be a lot more of them than there were last winter. But this seems to indicate that, here in the U.S. at least, if you get it bad enough to get recorded in the system, your odds of dying are not materially lower than if last winter you got it bad enough to get recorded in the system.

Very Briefly Noted:

Gérard Roland: The Contributions of Yingyi Qian & Chenggang Xu to Economic Science<http://english.nefchina.org/index.php?id=7>

Kristen V Brown: Will a Fourth Dose Be Needed?: ‘Israel has begun offering a fourth dose, and early results seem promising: A second booster of the Pfizer vaccine appeared to be safe and increase antibodies fivefold… <https://www.bloomberg.com/news/newsletters/2022-01-09/will-a-fourth-dose-be-needed>

Kenneth Rogoff: Why Is the IMF Trying to Be an Aid Agency? <https://www.project-syndicate.org/commentary/imf-acting-like-aid-agency-risks-embarrassment-by-kenneth-rogoff-2022-01>

Joan Didion: Slouching towards Bethlehem<https://archive.org/details/isbn_0679640866/page/n34/mode/1up?view=theater>

GeorgeScialabba: Slouching Toward Utopia <http://georgescialabba.net/mtgs/2018/03/slouching-toward-utopia/print/>

Plutarch: Pyrrhus: ‘There was one Cineas, a Thessalian… <http://classics.mit.edu/Plutarch/pyrrhus.html>

Matthew C. Klein: Are America’s “Excess” Savings Here to Stay?: ‘U.S. consumers saved trillions via lower spending and generous government aid. So far, they have yet to go on a spending binge to make up for lost time or to counteract the impact of rising prices…

Michael Liebreich: Germany’s Nuclear Power Shutdown: ’“It’s absurd,” says Michael Liebreich, energy expert and chairman of Liebreich Associates, of Germany’s nuclear shutdown. “I think it’s an epic, epic mistake. I’ve called it a climate crime”…

Nihal: ’Bought my first temple in my 20s. This is what working 60 hour weeks can get you. We all have the same 24 hrs a day <https://t.co/dZUU8UcZzX>…

Paragraphs:

Bill Bishop: China’s Political Discourse: A New Resolution on History: ‘The 2021 Resolution of the Central Committee of the Chinese Communist Party on the Major Achievements and Historical Experience of the Party over the Past Century…. The… “New Democracy Period” (新民主主义时期) and the “Socialist Revolution and Socialist Construction Period” (社会主义革命和社会主义建设时期)… both defined as being under Mao Zedong’s leadership. The… “Reform and Opening and Socialist Modernization Period” (改革开放和社会主义现代化建设时期), covers not just Deng Xiaoping but also Jiang Zemin and Hu Jintao… the late 1970s all the way up through the end of 2012…. The fourth and final stage is a “New Era of Socialism with Chinese Characteristics” (中国特色社会主义新时代), pioneered by Xi Jinping…. A dedicated chapter in the 2021 Resolution dealing with the “New Era” along 13 different aspects forms the bulk of the resolution text…. 53 percent of a resolution dealing with 100 years of history focusses on barely nine percent of that history. The 13 aspects dealt with in this “New Era” chapter include: “comprehensive strict governance of the Party” (全面从严治党); “economic development” (经济建设); “comprehensive deepening of reform” (在全面深化改革开放); “political construction” (政治建设); “comprehensive law-based governance” (全面依法治国); “cultural construction” (文化建设); “social construction” (社会建设); “ecological civilization construction” (生态文明建设); “national defense and military construction” (国防和军队建设); “preserving national security” (维护国家安全); “one country two systems and national unification” (维护国家安全); and “foreign policy work” (外交工作)…. The way the text deploys the words “established,” or chuangli (创立), and “formed,” or xingcheng (形成)…. The word “established” appears four times in the text of the Resolution, applied once each to Mao Zedong Thought and Deng Xiaoping Theory, and twice to “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.” By contrast, both Jiang’s “Three Represents” and Hu Jintao’s “Scientific View of Development” were “formed.” In the official discourse, the gap between “established” and “formed” is unmistakable, the former suggesting agency and formidable contribution, while the latter suggests relative passivity…

LINK:

PAID SUBSCRIBER ONLY Content Below:

Opening Lecture Slides for Next Week:

Well, we have just—surprise, surprise—been moved off of in-person and onto online instruction for the two weeks starting the 18th, at least. That means I all of a sudden have a lot of work to do and getting course materials up in a vastly expanded hybrid and nonsynchronous way:

Econ 135: S 2022: 1.1. Introduction: The History of Economic Growth:

<https://github.com/braddelong/public-files/blob/master/econ-135-s-2022-1.1-intro-2022-01-18.pdf>

<https://github.com/braddelong/public-files/blob/master/econ-135-s-2022-1.1-intro-2022-01-18.pdf

Econ 135: S 2022: 1.2. Economic Inequality in Historical Perspective:

Speaking as someone with $1M in housing debt on a recent Prop 13 basis, and all my savings in stock, and a tech job where wages are highly competitive, I say bring on the inflation (I may regret this sentiment later, but that is my outlook now; I am not quite so rosy about the political effects of inflation but I think it’ll be good for wage compression).

German nukes: I am a new-nuclear-power skeptic (too much $, not enough water, nobody wants them next door, but go ahead and try if you want) but Germany’s plan to shut down ahead of design life made, makes no sense. You can’t fix design problems in Japan (or Ukraine) by shutting down well-run German reactors. It’s a classic “solve ocean waste by reducing my personal plastic use” non-solution: you cannot solve a problem that exists elsewhere by changing something unrelated to it that you happen to control.