FIRST: Matt Levine on Wonders of the Invisible Crypto World:

The South Sea Company at least had a business plan:

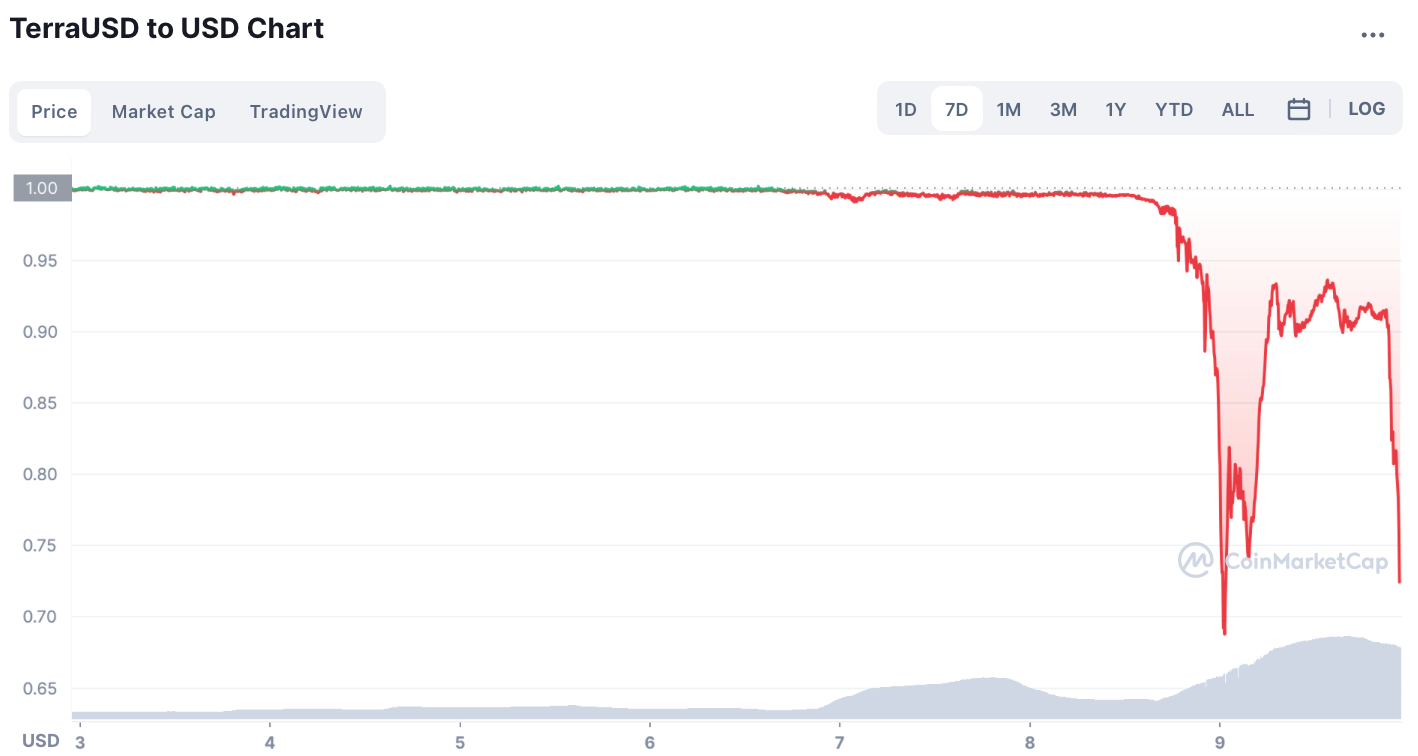

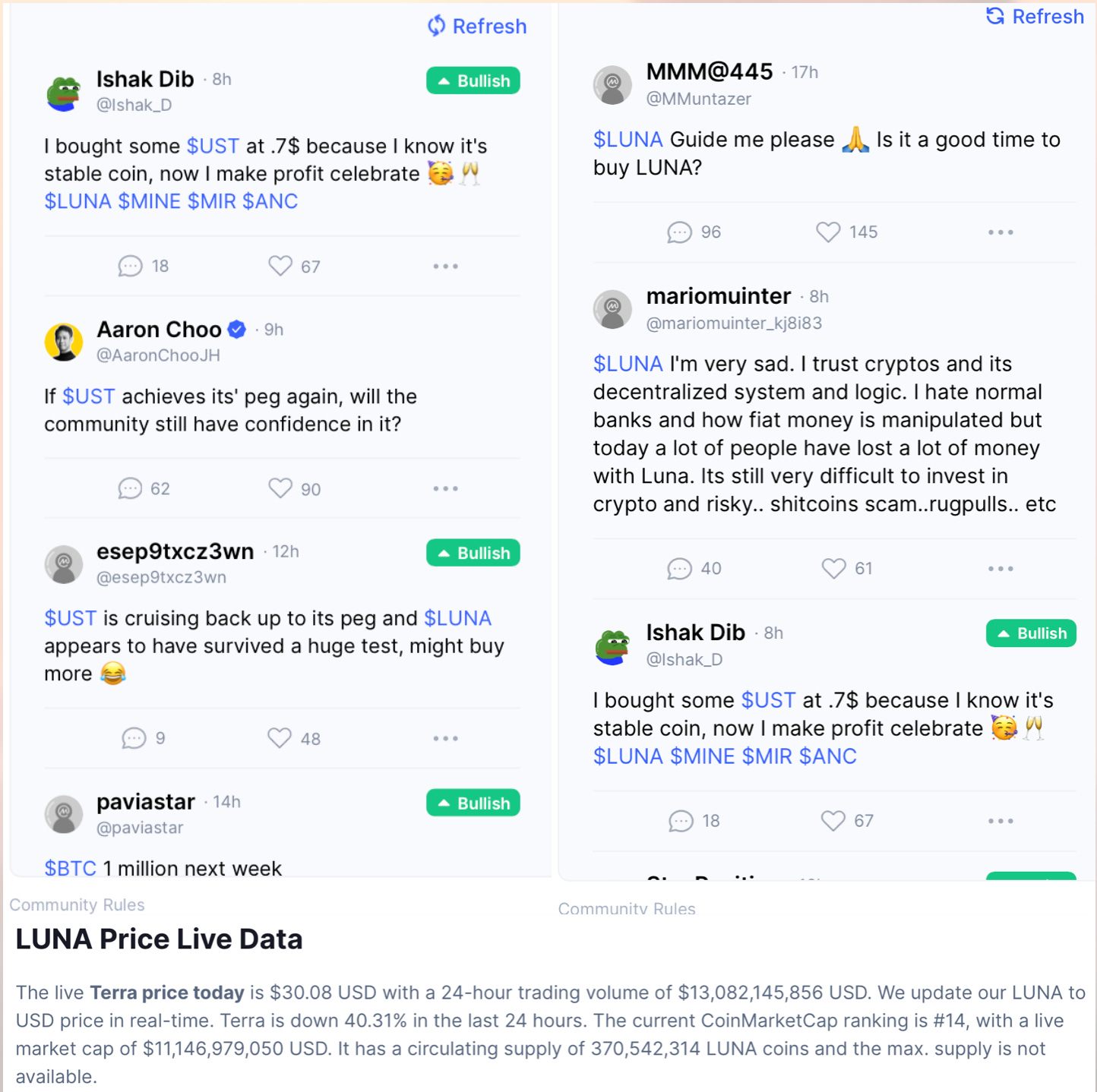

Matt Levine: Another Algorithmic Stablecoin Isn’t: ‘Terra…an algorithmic stablecoin…. One UST can always be exchanged for a floating quantity of Luna with a market value of $1…. On first principles this is insane…. If Luna trades at $0.01, you can print 10 million of them and buy 100,000 Terra and push the price up. But if Luna trades at $0.00… it cannot be used to support the price of Terra. And because you just made it up, there is no particular reason for [Luna] to be worth anything, so there is no particular reason for [Terra] to be worth a dollar….

Nonetheless! It works?… Terraform Labs… pays 19.5% promotional interest on UST deposits. People want a stablecoin that is worth a dollar, so they are inclined to treat Terra as though it’s worth a dollar, which makes it worth a dollar. They buy lots of Luna to turn into Terra, which means that the price of Luna goes up, which means that there is plenty of valuable Luna to support the price of Terra, which means that Terra is robustly worth a dollar. Ha, well, oops…. A bank run is a fairly mild event compared to a death spiral….

Meanwhile, the mechanism that LFG is using to defend the peg is interesting. It has loaned Bitcoin to market makers to use to protect the UST peg to the dollar…. This means that… market makers… [are] selling Bitcoin to buy UST…

LINK: <https://www.bloomberg.com/opinion/articles/2022-05-10/another-algorithmic-stablecoin-isn-t>

Okay…

The ultimate crypto line is: gold does not carry a coupon, and central bank-issued cash does not carry a coupon, so why shouldn't we be able to issue things that do not carry a coupon and still hold value? The standard response is that central bank-issued cash carries value not by the "fiat" of the central bank, but because they serve as anticipatory tax receipts. You can show them to the tax authority, which takes them, and lo and behold! Your assets are not confiscated by the Treasury!

And gold? Gold is a special case: time-honored. Devotees of BTC say that they are the first mover into this space, and so they are time-honored too. They also say that there are lots of places and times in the world where you want your wealth to be at least somewhat hidden, and—even though most people’s BTC is very visible to the authorities now—eventually it will be sold to those who have a demand for security and opacity.

Could be—for BTC.

But I cannot see that holding true for Terra…

One Video:

Nathan Nunn (& Paola Giuliano): Understanding Cultural Persistence & Change: Distinguished Speaker Seminar <https://www.youtube.com/watch?v=Mjb6Mq-I1ZE>:

One Image:

Very Briefly Noted:

Tracy Alloway: Tweets with Replies <https://twitter.com/tracyalloway/with_replies>

Jessica Brain: The Real Dick Whittington <https://www.historic-uk.com/HistoryUK/HistoryofEngland/Richard-Dick-Whittington/>

Barry Eichengreen: Shaping a Marshall Plan for Ukraine <https://www.project-syndicate.org/commentary/shaping-marshall-plan-for-ukraine-by-barry-eichengreen-2022-05>

Joshua M. Brown: Attitude Adjustment <https://thereformedbroker.com/2022/05/04/attitude-adjustment/>

Dani Rodrik: A Better Globalization Might Rise from Hyper-Globalization’s Ashes <https://www.project-syndicate.org/commentary/after-hyperglobalization-national-interests-open-economy-by-dani-rodrik-2022-05>

Twitter & ‘Stack:

Michael Shurkin: ’The Russian military’s shabby performance should not be taken as proof that Europe and the US need not worry about Russia…

Jeff Maurer: Trying to Un-Muddle the Twitter/Free Speech Debate

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.