Worthy Reads from Equitable Growth:

1) Past discrimination in America has created a legacy of present inequality in wealth, income, access to education, and so on. Present discrimination amplifies these inequalities inherited from the past and ensures that they are transmitted into the future. We do not know nearly as much as we should about how these processes are working out on the ground in the United States today. And if we are going to attain equitable growth, we very much need to collect much more data on how these processes are working:

Shaun Harrison: The Imperative of Focusing on Racial Equity in U.S. Economic Statistics: ‘The coronavirus pandemic and resulting sharp recession put a glaring spotlight on the importance of data disaggregation. During the early stages of the pandemic, most states were not reporting coronavirus infections and COVID–19 fatalities by race. Consequently, policymakers did not know—but do now—that Black people in the United States died at 1.4 times the rate of White people from COVID–19, and that in certain states, Latinx people were 3.7 times more likely to have tested positive for the virus than their White neighbors. This lack of data disaggregation made it more difficult for policymakers to understand the contours of the pandemic…. Data disaggregation is likewise critically important for better understanding the many racially disparate aspects of the U.S. economy and considering policies to address those disparities. Racial and ethnic discrepancies in economic outcomes have long been known, but improvements to data disaggregated by race and ethnicity by federal statistical agencies can help improve policymakers’ understanding of economic and social outcomes for all communities of color…

LINK: <https://equitablegrowth.org/the-imperative-of-focusing-on-racial-equity-in-u-s-economic-statistics/>

2) If the history of the past 50 years has taught us anything, it is that the hope that the effects of discrimination would rapidly wither away once it no longer had the supporting authority of the state was either naïve or dishonest. Yet this assumption underlies a great deal of our public policy. And in the lack of sufficient data as to what is actually happening, we are largely flying blind into the future:

Danny Yagan: ‘Before I was chief economist at OMB, I was a professor doing research using tax data. I could cut the data in myriad way, but not by race, a huge blind spot and a major hindrance for achieving racial equity…

LINK: <https://twitter. com/dsmitch28/status/1404863217407610882>

3) I knew back in 2010 That the Republican and Democraticic-Right’s refusals to accept that more needed to be done to hasten the recovery were disastrous. And I knew at the time that the Obama administration’s decision To rhetorically accommodate that belief—the belief that it was time to take your foot off the gas—was appalling. But with each passing year it seems that I get more information about just how disastrous those decisions actually were:

Austin Clemens: New Great Recession Data: Congress Should Go Big: ‘Undershooting the policy response would be a far more dangerous prospect and could lead to a repeat of the slow and inequitable economic growth that followed the previous U.S. recession….. After the Great Recession of 2007–2009, then-President Barack Obama and the U.S. Congress passed an insufficient stimulus, then pivoted too quickly to debt reduction. This was a crushing mistake that left many U.S. workers and their families stuck in the doldrums for years, facing stagnant, or even declining, incomes. The slow and uneven recovery was the direct result of these policies…. A new data series from the U.S. Department of Commerce’s Bureau of Economic Analysis—its Distribution of Personal Income series—shows just how devastating this pattern was for most U.S. workers and their families…

4) From four years ago. But still, I think, the best and most lively thing I have participated in on the current state of globalization and of it effects:

Gillian Tett, Steven Ciobo, J. Bradford DeLong, John Hagel, Alejandro Ramirez Magaña, & Stephen Schwarzman (2017): Globalization in the Crosshairs: ’In the 20 years leading up to the financial crisis, international trade grew at twice the rate of global output. Since then, trade has struggled to recover. Recent data is more worrying still, suggesting that trade’s share of global GDP is falling. With mainstream political support for multilateral trade deals diminishing and populist movements on the rise in the U.S. and Europe, it is time to examine the future of globalization. Panelists will consider the following questions: Has international trade—and globalization more broadly—entered a period of stagnation or even reversal? Once unleashed, can globalization ever reverse or are we just seeing a slowdown in a normal cycle? What are the implications for the global economy and the international economic order?…

Worthy Reads from Elsewhere:

1) The plague year is not over. It may be only half-over, depending on what the Delta variant and subsequent variants do; and depending on how much Republican politicians and their media-grifter allies continue to find advantage in trying to suppress vaccination:

Bob Wachter: Covid (@UCSF) Chronicles, Day 453: ‘I know everybody’s sick of playing 3-dimensional Covid chess. Sorry, but the Delta variant forces us back to the chess board…. If you’re fully vaxxed, I wouldn’t be too worried, especially… in a highly vaxxed region…. If you’re not vaccinated: I’d be afraid. Maybe even very afraid…. Sadly, ~50% of the U.S. (>age 12) remains unvaccinated, and in certain states (mostly southern & right-leaning), it’s more like 2/3rds…. This is the most dangerous moment to be unvaccinated…. The virus… is better at infecting people…. 3 things… about variants… a) are they more infectious? b) are they more serious? (ie, are you likelier to get very sick) & c) are they vaccine (or prior Covid-based immunity) resistant?… For Delta, Pfizer dose 1 is only ~33% protective…. What to do? For a vaccinated person, watch the Delta %…. If you’re seeing more cases & more Delta, I’d restore some precautions… indoor mask wearing…. If you’re unvaxxed, get your shots!… If your strategy was “I’ll consider a shot if I see an uptick in cases,” that’s also a loser, since once a surge begins, you won’t be well protected against Delta for 4–6 weeks…. For unvaxxed, I wish you well but my sympathy is flagging. Your bad choice is looking worse…

LINK: <https://twitter.com/Bob_Wachter/status/1404151502864883713>

2) No. We do not know how to get 8 million people hired in six months. But we should try everything to see if we should get it accomplished, and we should be sensitive to not ripping holes in families finances while we try to do so:

Lauren Bauer, Arindrajit Dube, Wendy Edelberg, & Aaron Sojourner: Examining the Uneven & Hard-to-Predict Labor Market Recovery: ‘Any effects of expanded unemployment insurance benefits on labor supply will dissipate quickly as the benefits expire nationally in early September and before then in an increasing number of states. Indeed, policymakers should be on high-alert for whether the expiration of those benefits results in extraordinary financial hardship for some workers unable to find jobs. There are many signs that the U.S. labor market is on the mend. For example, the average net increase in payroll employment from February to April was over 500,000. Initial unemployment insurance claims continue to decline. The number of unemployed people per job opening has fallen sharply. Teens are working in the labor market at higher rates than at any time in the past decade. Nonetheless, policymakers must be vigilant—continuing to increase easy access to vaccines and helping to make working safe and rewarding…

3) A very nice interview here about what good anthropologists can bring to economics. The answer is: a lot. A standard economists assumption that everyone in the economy is thinking like Adam Smith imagined people would is really far from adequate:

Gillian Tett: Listen to the Silence: ‘How anthropology helps make sense of the world. The FT’s Gillian Tett tells Merryn Somerset Webb why what people aren’t talking about is just as important as what they are, and why combining anthropology with economics can help us make sense of asset prices, markets and the world in a way that pure hard science can’t…

LINK: <https://www.youtube. com/watch?v=uN9YDE5JUbc>

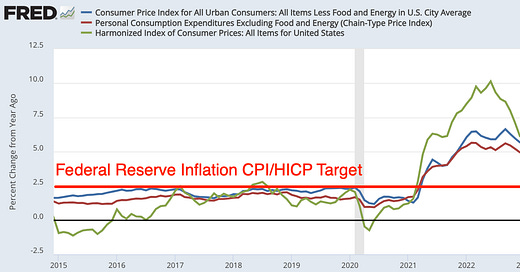

4) I must say: the claim that those of us who say we are happy with current fed and fiscal policy in terms of their Macro economic affects are lying–that claim really, really annoys me. It is false.

And about Mervyn King’s claim that there are a bunch of people who are quiet in public but tell him in private that they agree with him about his worries? That annoys me as well. Mervyn: you Have established that the second group is two-faced. Why are you so sure that the face they have turned to you in private is the truth face? A much better heuristic that I have always found reliable is to listen only to those who have the courage of their convictions, and dismiss the two-faced as of no interest or account:

Mervyn King: Make No Mistake, the Risk of Inflation Is Real: ‘Price stability is when people stop talking about inflation and their decisions reflect genuine economic factors. It has been a long time since inflation was a talking point but, especially in the United States, it has reentered public debate…. Rising input prices and higher output prices reflecting shortages…. Some of these increases may well prove transitory. For the first time since the 1980s, though, two factors make inflation a serious risk: excessive monetary and fiscal stimulus, and weak political resistance…. Many economists are reluctant to criticize the Biden stimulus plans because they share his concerns about the country’s social and political problems. But I’ve seen few challenges to the proposition that the degree of stimulus is out of all proportion to the magnitude of any plausible output gap. And the same logic applies to other advanced economies…. Central-bank independence will be tested over the next few years…. A combination of political pressure to assist in financing budget deficits, promises not to tighten policy too soon, and a growing involvement by central banks in political matters all point to a growing risk that central banks will respond too slowly to higher inflation.

5) A truly excellent window into what the Biden administration is thinking right now about fiscal policy. I highly recommend that you watch it:

Kim Clausing: Fiscal Policy for Today’s Economy

6) Can China’s government judge what activities it might support will generate the largest positive engineering externalities? Can it actually run a successful high-tech industrial policy? Japan did not: when its MITI started trying to push the technological frontier rather than simply judging that companies whose products were approved by purchases on foreign markets were worth subsidizing, Japanese high-tech industrial policy stopped succeeding.

It is the United States that has managed, from Eli Whitney to today, to successfully use government levers—public investment in education and infrastructure, subsidies, and procurement guarantees—to actually make the thing work. And yet we do not have a good big picture of how this was actually accomplished.

Now it is going to be China’s turn in the barrel:

Economist: The Chinese State Is Pumping Funds into Private Equity : ‘Serving a higher purpose. The Chinese state is pumping funds into private equity. It sounds too good to be true to private investors—and it might be…

7) Ah. So that is where this comes from. But when and how does “Before Time” shift to the “Before Times”, plural, which is what I hear today?:

Ben Zimmer: ‘The Before Time’: A Sci-Fi Idea That Has Made Its Way to Real Life: ‘We likely owe the “Before Time” label to an episode of the original “Star Trek” series broadcast in 1966, in which the crew of the Enterprise encounter a planet populated by children who survived a man-made plague. A young girl name Miri (whose name also serves as the title of the episode) explains how the planet’s grown-ups, known as “Grups,” disappeared: “That was when they started to get sick in the Before Time. We hid, then they were gone.” In 2000, an episode of “South Park” parodying “Star Trek” repopularized the expression, with lines like, “That was in the Before Time, in the Long Long Ago.”… The… trope makes it feel like we’re living through our own post-apocalyptic science-fiction plotline…

8) “Inform your readers“ should be the watchword for the media. But, instead, it is still much more: “Pretend to be a neutral observer from nowhere giving equal time to all sides so that we can sell classified ads to everybody”. That still rules. And that, I think, makes most American journalists I run into willing accomplices of a lot of bad actors. If you cannot judge which people are talking to you in bad faith and then call them out in a way that makes it obvious to all your readers, I do not think you have any business being in journalism. And I am heartened that the smart Charlie Warzel agrees:

Charlie Warzel: What Newsrooms Still Don’t Understand About the Internet: ‘Ed Zitron wrote an important piece on coordinated online attacks against reporters… a fascinating paper… by… Alice E. Marwick on “Morally Motivated Networked Harassment.”… The larger audience of harassers is usually convened (sometimes unwittingly, often purposefully) by an amplifier, which is usually a high profile or well-followed social media account or community. The important function of the amplifier is that they tend to take a person’s comment or idea and move it from the author’s original context and audience and into their audience… context collapse…. “The Twitter staff might recognize it as harassment if one person sent you 50 messages… but it’s always the one person [who] posted one quote tweet… and then it’s 50 of their followers who all independently sent you those messages, right?”… Serial amplifiers—especially the savvy ones who don’t themselves harass but signal their disapproval to their large audiences… tend to get away with launching these campaigns, while smaller accounts get in trouble. A good amplifier knows how to create plausible deniability around their behavior. Often they say they are ‘just asking questions’ or ‘leveling a fair critique at a person or public figure’…

LINK: <https://warzel.substack.com/p/newsrooms-dont-understand-the-internet>

Re: Globalization

We should remember that in the 20th century, international trade as a %age of global GDP peaked in 1913, just before WWI, and declined until 1945. It then rose and recovered its peak ratio in the 1970s. Was popularism the cause then, or was it more about instability and risk of supply lines? Why did international trade not recover in 1918, but continue to fall even though the beggar-thy-neighbor policies did not get enacted until the Depression starting in the late 1920s and extended throughout the 1930s?

I am reminded of advice from conglomeration Harry Figgie that it was important to overstock expensive and critical items as any disruption in replacement would halt production. Covid and China's international aggressiveness may be increasing supply risk. We are seeing this already in microchip supply. Reduced orders in 2020 reduced supply, and China's moves to threaten Taiwan, a major global supplier, are the likely causes, but while the former will be resolvable, the second might increase the risk of supply. Huawei experienced this with the previous administration's blocking of US IP products. With the controversy over the ownership of ARM, there is the possibility of increased risks to using the ARM architecture. IMO, the America First approach to trade by the previous administration seemed to follow the Nazi party approach to trade before WWII. Will this unwind, or will the threat of a new nationalist administration in a few years maintain the higher risk of international supplies?

For me, it isn't "populism" that is the issue, as much as nationalism (unless one equates the two terms as effectively being the same).

We may not have a complete understanding of how to "generate the largest positive engineering externalities", but I think that the basic framework is reasonably clear, from things like Bell Labs, DARPA, NIAC, and even the actions of venture capitalists. That framework seems to be "let 1000 flowers bloom", then nurture the ones that are successful. That is: give a bit of support to anything that looks at all promising - recognizing that most of these will not pan out - and then more support for things that do.