Would Somebody Please Tell Me What Number I Should Pencil in for þe “Natural Rate of Inflation”?, &

2022-05-14 Sa:

FIRST: Would Somebody Please Tell Me What Number I Should Pencil in for the “Natural Rate of Inflation”?

What do you have to do to keep your philosopher’s license in good standing? Asking for Matt Yglesias…

“The Fed… should have started moving to tighter money sooner.” To get from a description of what happened in the world to an evaluation of an actor’s actions—to get to that should—you need three things:

A metric mapping outcome-states-of-the-world onto their desirability (either their desirability in the eyes of the actor or in the eyes of some impartial spectator, depending on the scope of that "should).

A counterfactual as to what would have been the outcome-state-of-the-world had the actor in fact done what you say they shouldhave done.

A switch telling us whether this is a look-back or a look-forward should: Is it an ex-ante should—the actor had or did not have but could have gathered the information to let them conclude that the counterfactual world would have been a better outcome-state than what actually happened? Or is it merely a look-back ex-post should: given what was later revealed (but that the actor at the time did not know and could not have learned then) it would have been better to take the counterfactual action?

Matthew Yglesias: The Problem with Flexible Average Inflation Targeting: ‘What the Fed needs to do next…. Frankly, the Fed kind of dropped the ball on inflation. They were too slow to react last year and should have started moving to tighter money sooner. But what’s past is past, and now the Fed has to thread the needle and bring inflation back down without triggering a recession. Fortunately, Powell has acknowledged his oversight and the Fed raised rates by a quarter of a percentage point last week, with six more rate hikes expected in 2022…

LINK:

I don’t see any of those anywhere in Matt’s argument. It is true that he is not an economist, and was not an economics major, and was not even a social studies major. But these counterfactual, evaluation-framework, and potential-knowledge issues are philosophers’ bread-and-butter.

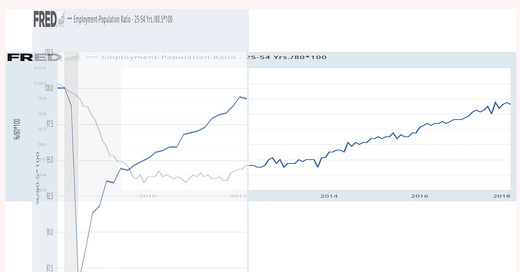

As to the counterfactual, one possibility would be one in which inflation was still below 2%, and in which the labor-market recovery from the Plague Recession of 2020 was as slow as the labor-market recovery from the Great Recession of 2008:

Would that be a better world? Should the Fed have done that? I really do not think so…

It is at this point that I do have to admit that the economists I most respect are not doing much better:

Emi Nakamura: Noah Smith: Interview: ‘The recent increase in inflation is much more than historical experience would have predicted (which is about an increase in inflation of 1/3% for every 1% decrease in unemployment)…. Supply shocks are back!… There has been a historic shift in demand from services to goods: <https://fred.stlouisfed.org/graph/?g=LnYU>… [and] secular shifts in demand can lead to the same inflationary pressures as supply shocks…. Third… a very rapid recovery and a lot of government support…. Households have a huge buildup in savings <https://fred.stlouisfed.org/graph/?g=Lo1j>, and spending this down is no doubt contributing to demand. Conceptually, one might expect these demand pressures to be captured by the unemployment rate…. One thing that hasn’t contributed much to inflation so far is an unhinging of longer run inflation expectations…. Market expectations are predicated on what the market expects the Fed to do. There is a self-fulfilling prophecy element in this, as in many things in macroeconomics. So long as the market expects the Fed will do what it takes to contain inflation, we won’t see much movement in longer run inflation expectations. The Fed is working very hard to preserve this. But we can’t take this for granted…

LINK:

One way to put it is this: There has been much discussion of the NAIRU or the “natural rate of unemployment”—the unemployment rate below which you should not try to push the economy—but there has been little discussion of any “natural rate of inflation”—the rate of inflation below which you should not try to push the economy. All competent macroeconomists agree that there is a positive natural rate of inflation: we have high costs of nominal wage cuts in terms of the destruction of worker-boss trust, very high costs of bankruptcy workouts, and very very sticky nominal debts. Given those institutional-structural features of the economy, a positive natural rate of inflation to grease the gears of the labor market and of the debt market is an inescapable necessity. But how high is the natural rate of inflation in normal times? And how does it alter in times of supply shocks and of sectoral-rebalancing demand shocks? Not enough economists have spent not enough time on these issues.

My view is that there is no—none—zero—case for not accommodating supply and sectoral-rebalancing shocks until they threaten to destabilize long-run inflation expectations. After they threaten to do so, there is a trade-off to be dealt with. Before they threaten to do so, there is not.

One Image:

One Video:

mmhmm: Introducing mmhmm for Web <https://www. youtube.com/watch?v=ROuKrzETRuc>:

Very Briefly Noted:

Bartosz Ciechanowski: Blog Archives <https://ciechanow.ski/archives/>

John Crace: Sociopathy & Stupidity Worn Like Badges of Honour in Cabinet of All the Talents: ‘PM and assorted underlings continue to astonish on another day in the life of a necrotic government… <https://www.theguardian.com/politics/2022/may/12/sociopathy-and-stupidity-worn-like-badges-of-honour-in-cabinet-of-all-the-talents>

James G. MacKinnon: Cluster-Robust Inference: A Guide to Empirical Practice: ‘A thorough guide on what to do and why, based on recently available econometric theory and simulation evidence… <https://www.sciencedirect.com/science/article/pii/S0304407622000781?via%3Dihub>

David Gauke: Why Britain Lacks an Emmanuel Macron: ‘The problem for UK centrists is that the median voter in the median British constituency would have voted for Le Pen in France… <https://www.newstatesman.com/comment/2022/04/why-britain-lacks-an-emmanuel-macron>

Jennifer Chayes & Tsu-Jae King Liu: California’s Math Education Needs an Update, But Not the One Proposed<https://www.latimes.com/opinion/story/2022-05-12/california-math-education-framework-test-scores>

Zeke Faux: Crypto Mystery: Where’s the $69 Billion Backing the Stablecoin Tether?: ‘A wild search for the U.S. dollars supposedly backing the stablecoin at the center of the global cryptocurrency trade… <https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether>

John Dizard: Where the Next Financial Crisis Could Come From: ‘Private equity has become a group of self-dealing oligarchs… <https://www.ft.com/content/328bc269-d836-4ca6-991a-029ed25e9e82>

Carlos Javier Charotti & al.: American Treasure & the Decline of Spain <https://voxeu.org/article/american-treasure-and-decline-spain>

Matthew Boyle: Wall Street, Silicon Valley Return-to-Office Plans Unravel in Hot Job Market <https://www.bloomberg.com/news/articles/2022-05-11/wall-street-silicon-valley-return-to-office-plans-unravel-in-hot-job-market>

Jonathan Malesic: My College Students Are Not OK: ‘In March 2020, essentially all of U.S. higher education went remote overnight…. Students learn less online than they do in person, in part because online courses demand considerable self-discipline and motivation… <https://www.nytimes.com/2022/05/13/opinion/college-university-remote-pandemic.html>

Felix Salmon: Musk’s Endgame for Twitter May Be a Lower Buyout Price <https://www.axios.com/2022/05/14/the-musk-twitter-endgame>

David Gauke: The Economic Cost of Brexit Is Only Getting Worse <https://www.newstatesman.com/comment/2022/05/the-economic-cost-of-brexit-is-only-getting-worse>

Twitter & ‘Stack:

Project Syndicate: ’If the bond market is right, the US Federal Reserve should be taking a victory lap, argues DeLong. It has done precisely what it is supposed to do. <https://www.project-syndicate.org/commentary/bond-market-medium-term-inflation-currently-on-target-by-j-bradford-delong-2022-05>…

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.