CONDITION: Slouching Towards Utopia

The Full Slouching Tweetstorm:

First: Yes, Hayek’s Macro Is Bonkers

I must say that the von Hayekian view here has always struck me as completely bonkers, and I would love someone who would elucidate it to me. And I don’t think that the very sharp Nicholas Wapshot does a good job here at characterizing it:

Nicholas Wapshot: When Milton Friedman Sided With Keynes Over Hayek on Inflation: ‘Friedman’s belief that the money supply should be controlled by the central bank to keep prices in check put him firmly on the Keynesian side of the argument over whether governments should manage the economy. Hayek would never forgive him…

LINK: <https://promarket.org/2022/01/23/milton-friedman-keynes-hayen-inflation-wapshott/>

Friedman thinks that a central bank should use the tools at its disposal—discount rates and purchases, open-market operations, forward guidance, reserve requirements, other safety-and-soundness regulations—to keep the total flow of purchasing power in the economy growing smoothly at a rate consistent with medium- and long-term effective price stability. Friedman takes this to be accomplished by setting and meeting a target growth rate for M2. But if the M2 target does not do the job, Friedman thinks the central bank should get the job done, and so create a stable environment in which producers and consumers, buyers and sellers, can make their plans and decisions and then carry them out.

That, Friedman claims, is a “neutral”—a pro-free-market—monetary policy.

Von Hayek says… nothing coherent. For example, in Prices and Production (page 23):

It is perfectly clear that, in order that the supply and demand for real capital should be equalised, the banks must not lend more or less than has been deposited with them as savings. And this means naturally that they must never change the amount of their circulation. At the same time, it is no less clear that, in order that the price level may remain unchanged, the amount of money in circulation must change as the volume of production increases or decreases. The banks could either keep the demand for real capital within the limits set by the supply of savings, or keep the price level steady; but they cannot perform both functions at once…

I think I understand this. Hayek believes that there is income, which amount people divide between their spending on consumption goods and their new deposits in banks; there are bank loans, which banks fund out of new deposits plus the bank notes they print (or the balances they credit); and then their is spending on capital goods, which is equal to bank loans. If banks thus ever expand the “amount of money in circulation” (either by printing up bank notes or increasing balances they credit) they have created a distortion, fictitious capital, an excess demand for new spending on capital goods which does not conform to either the preferences of the people in the economy or the productive capacity of the economy.

Then, Hayek goes on, what happens if there is technological progress? The prices of commodities should fall. Suppose that the operations of the banking system are such as to keep the price level stable. The only way that can happen is for the banks (or a central bank) to print up more bank notes or to credit borrowers with amounts in excess of new deposits. That creates an excess of demand for new capital goods over desired savings—and that has to cause trouble in the long run.

Hence the money supply must be constant, deflation must proceed at a rate equal to population plus productivity growth, and nominal spending must be unchanged, or there will be big trouble.

This big trouble will be inflation, hubris, which of necessity will be followed by inescapable depression, nemesis, which must be accepted and suffered through lest there be even more trouble in the future: the market giveth, the market taketh away: blessed be the name of the market. It does not matter, in Hayek’s schema, whether the money creation that powers the inflationary rise in nominal spending is impelled by the actions of a central bank, the enthusiasm of bankers seeking extra profits by credit expansion, or a fortunate gold discovery: all are bad, all are dangerous, all are destructive, and all are—once you have embarked on them—the source of inevitable and unavoidable future depression.

Now, anybody not a great idiot will notice that this way of thinking was disapprobated, was in fact totally demolished, by John Stuart Mill back in 1829. Behind Hayek’s words lie a cash-in-advance model with a constant, rigid velocity of money. But we don’t have a pure cash-in-advance economy. And we don’t have a constant rigid velocity of money.

People and businesses hold cash balances, which are not rigid, constant fractions of their spending flow. People and businesses can decide to build up or to draw down their cash balances. If people and businesses in aggregate decide to build up their cash balances, then either the banking system responds by supplying them with increased money or there is a general glut—a depression. If people decide to draw down their cash balances, then if the banking system does not compensate, there will be too much money chasing too few goods—unexpected inflation, as people find themselves unable to buy in the quantities and at the prices they had expected they would be able to.

All this was cutting-edge macro once. In 1829. For John Stuart Mill.

From this perspective, the task of a central bank is clear: keep there from being either an excess demand for or an excess supply of money by offsetting shifts in private demand for liquidity, and so keep there from being either a general glut or an inflationary outburst.

Now the light-handed planning of a central bank may fail to accomplish this. But there is no mechanism whatsoever by which any form of catallaxy would successfully accomplish this.

Along at least one dimension, this is quite puzzling on the part of von Hayek. Only the true weirdos on the fringiest of libertarian fringes call for private police forces, private courts, and the complete collapse of civil society into feudalism. Central-bank management has, since 1815, been a successful part of the most extraordinary upward leap in human wealth ever, without bearing any resemblance at all to the constant nominal GDP economy that Hayek proclaimed was the one true libertarian configuration. Central Bank management is only one small bridge beyond public courts and public police. It was not Hayek versus Keynes here, it was Hayek versus reality. That Milton Friedman was on the side of reality was not to his discredit.

Plus there is a huge conceptual problem in inconsistency at the heart of this claim that anything—anything at all—that increases the nominal money stock must set in train a subsequent depression. For Van Hayek, the market is supposed to be an ever-wise thing of amazing power and flexibility. It assembles and processes information on a scale impossible and incapable by any other way. And yet it cannot figure out that an inflationary signal is not a real signal that should guide resource allocation? And, even if it has reacted by shifting resources in response to an inflationary signal, it cannot figure out how to un wedge itself without mass unemployment? We are supposed to believe that?

I oscillate back and forth between thinking that Joan Robinson here is cruelly and unfairly parodying Hayek, or whether she hits the nail exactly on the head:

[Lionel] Robbins sent to Vienna for a[n]… Austrian… to provide a counter attraction to Keynes…. Hayek… covered a black board with his triangles… confusing the current rate of investment with the total stock of capital goods…. R. F. Kahn… asked in a puzzled tone, "Is it your view that if I went out tomorrow and bought a new overcoat, that would increase unemployment?" "Yes," said Hayek, "but," pointing to his triangles on the board, "it would take a very long mathematical argument to explain why." This pitiful state of confusion was the first crisis of economic theory…

LINK: <https://www.jstor.org/stable/1821517>

Joan Robinson (1972): The Second Crisis of Economic Theory (American Economic Review 62:1 (Mar.): 1-10

One Audio:

Tooze: Wages of Destruction Talk:

<https://github.com/braddelong/public-files/blob/master/2022-02-17-tooze-slides.pdf.pdf>

One Picture:

Very Briefly Noted:

Sohee Kim: Samsung, Hynix & Micron Focus on ‘Protecting Profit’: ‘Memory Chipmakers Don’t Want This Boom to End in Another Bust. “Protecting profit” is the new industry mantra“Protecting profit” is the new industry mantra… <https://www.bloomberg.com/news/newsletters/2022-02-15/samsung-hynix-and-micron-focus-on-protecting-profit?cmpid=BBD021522_TECH>

Robert Armstrong and Ethan Wu: A Third Option in the Inflation Debate: ’Today’s inflation is weird. It is high, which is bad. But it is coming with fast growth, which is good. Weirder still, it stems from pandemic disruptions to supply (bad) as well as surprisingly strong demand (good). It’s a mixed bag… <https://www.ft.com/content/41c62537-04ee-49f6-9e41-8248dc239a79>

Lex: Apple: Tim Cook Is Worth Every Penny: ‘The chief executive has steered the company to a record market valuation and stable balance sheet… <https://www.ft.com/content/533deed1-7143-40b2-8854-84a138e1e510>

Casey Newton: Why You Can’t Rebuild Wikipedia with Crypto: ‘Q&A with Molly White of Web 3 Is Going Just Great…

Oliver Willis: Debunking Can’t Defeat Disinformation

Paragraphs:

Paul Krugman: Trump’s Big China Flop & Other Failures: ‘Chad Brown… a final assessment of that deal…. “China bought none of the additional $200 billion of exports Trump’s deal had promised.” So Trump was a chump; the Chinese took him to the cleaners…. Trump’s haplessness in dealing with foreign leaders is actually a minor part of the story. Far more important is the fact that the shocks we’ve been experiencing since the pandemic began make the Trumpian view of trade look even more economically foolish than it did when he took office…

Gillian Tett: In Russia & elsewhere, the Fog of War Has Partially Lifted. But to What End? | Financial Times: ‘Thirty-something years ago, as a rookie reporter in the Soviet Union…. The emergence of films such as Putin’s Palace also reveals something uplifting about modern information flows…. [THEN] everyone, including journalists, lived in a profound information fog…. Today a veritable army of citizen journalists is producing and sharing texts, pictures and videos from Ukraine and the surrounding regions. Satellites are beaming details about troop movements on to websites that ordinary citizens can access. Western governments are trying to turbocharge this information flow in a bid to counter Russian misinformation. Transparency has become not just the norm but a weapon of war, in a way that was inconceivable three decades ago. Yet increased transparency does not always produce the results that we might like. One consequence of this tsunami of information and misinformation is a rise in distrust and cynicism…. Yet even if we live in an age marred by misinformation and cynicism, it is still better than the information fog that existed three decades ago…. Let’s also hope that the internet keeps working, even amid cyber hacks. It truly is a modern miracle…

LINK: <https://www.ft.com/content/46f501db-974f-452f-9254-a91f1f83b5a5>

Colin Grabow: 5 Years Later the United States Is Still Paying for Its TPP Blunder: ‘The TPP… was also an attempt by the United States—along with like‐minded allies—to help shape the rules governing trade in the Asia‐Pacific region. As Asia’s center both geographically and economically, China is already assured of having a significant say in such matters. The TPP was meant to ensure the United States had a prominent seat at the table when such rules were being hammered out—before it opted to push away…. If the TPP was deemed a useful tool in countering China’s influence during the years it was being negotiated, it would be even more of an asset now given the bilateral relationship’s increasingly acrimonious nature…. The United States should return to the TPP/CPTPP. That, however, will require both vision and leadership, two commodities that are unfortunately currently lacking in Washington…

LINK: <https://www.cato.org/blog/5-years-later-united-states-still-paying-tpp-blunder>

Chad Orzel: Horseshoe Theorem: ‘the worst Math Education Take of the past week… Quillette, which attempted to tap into Super Bowl traffic by running a piece with the title “It’s Time to Start Treating High School Math Like Football.” “Like football” in this case means making it entirely optional, because some people just aren’t good at math…. I hate this so very, very much. It’s really tempting to just say “All you assholes deserve each other” and walk away from this, but unfortunately they’re doing this “horshoe theory” thing where both extremes converge on the same terrible solution: less math for everyone. Which isn’t good for anyone…

LINK:

Twitter:

John-Baptiste Oduor: ’Writers new and seasoned, I’m commissioning articles and book reviews for @Jacobin so dm or email me if you have any ideas you want to work on. I’m particularly interested pieces on global politics, political economy, and contemporary film and literature…

Senator Kantian-Leninist: ’i have 4 articles: - kant was a socialist; - hegel was a socialist; - marx was a kantian; - marx was a hegelian. we will write whichever one causes the most outage and clicks…

Liam Bright: “When Aristotle talked about Natural Slaves He Meant White Men”…

Brad DeLong: ’Actually, the woman–Mnesarete of Thespiai–who was the consensus pick for the most beautiful woman in Aristotle’s Athens, was nicknamed “Phryne”—“Toad”—because of her highly attractive yellowish-brown skin, the color of a toad’s. It was much more beautiful than the ghastly corpse-like skins of the melanin-deprived Thracian and Gaullish barbarians from the north. Needless to say, nineteenth-century paintings of Mnesarete have been… whitewashed. <https://t.co/E90lDzOZ0R> <

PAID SUBSCRIBER ONLY Content Below:

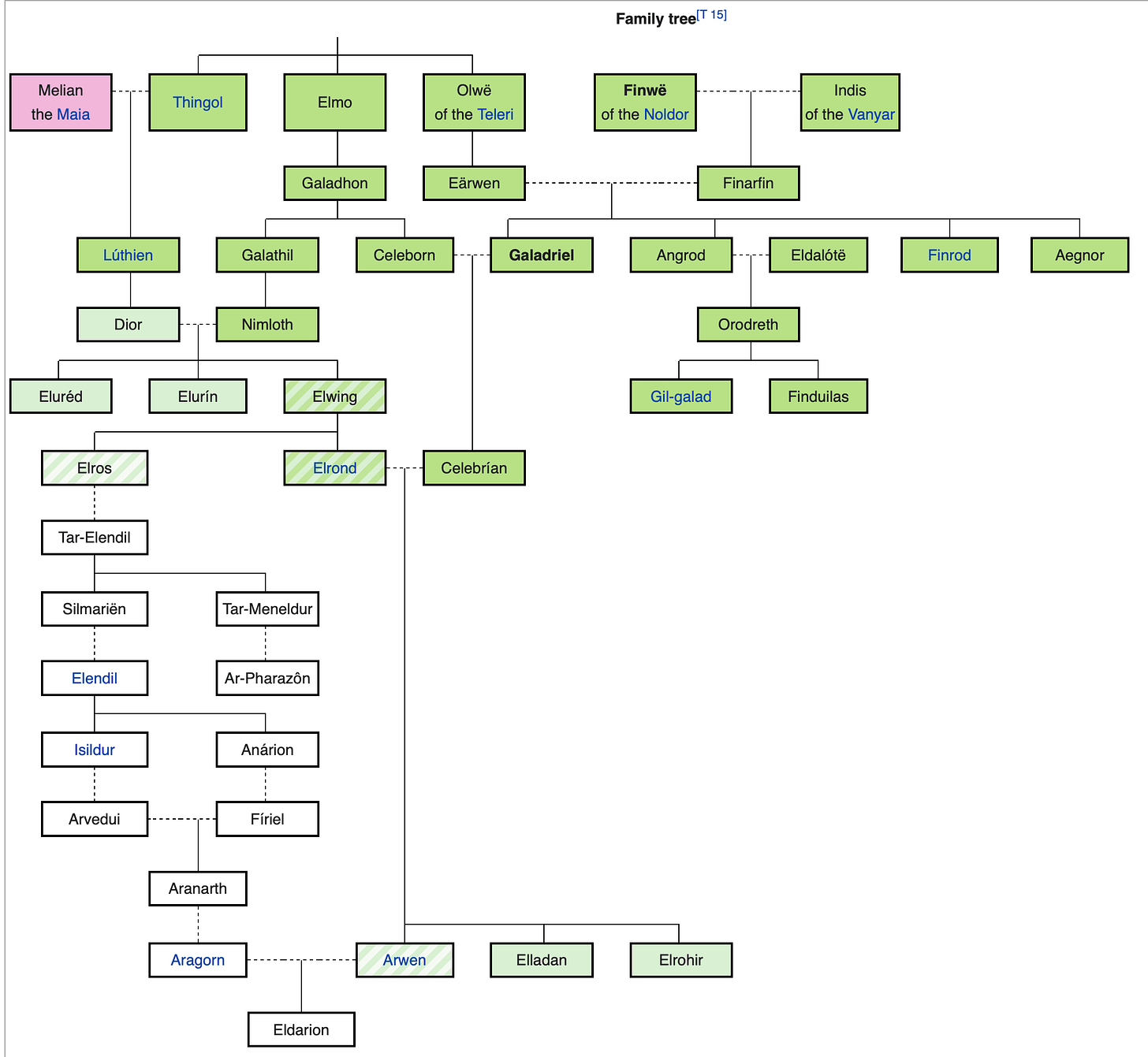

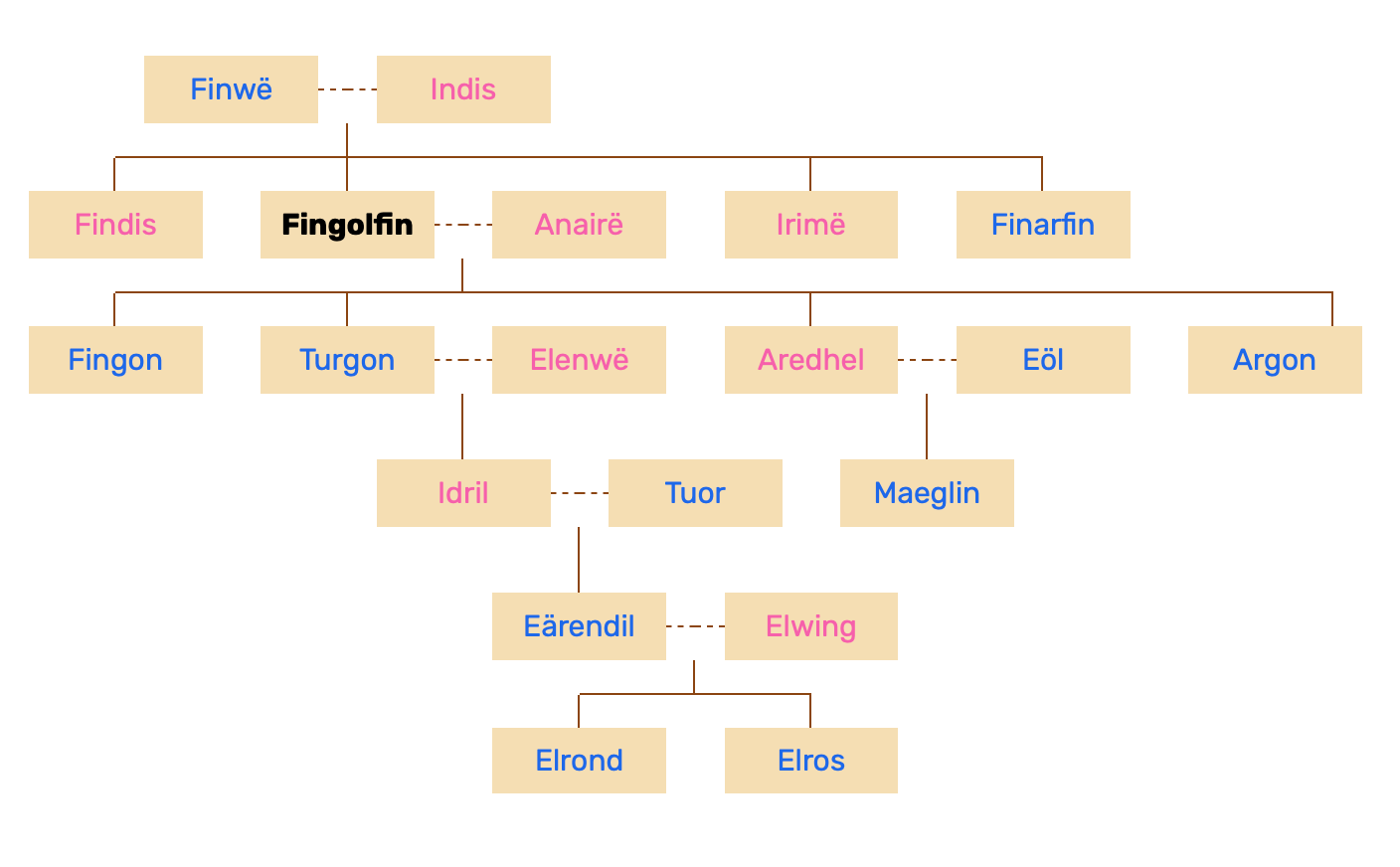

Subject: “Greatest of the Noldor, except Fëanor maybe, though… wiser… and her wisdom increased with the long years…”

You are never impelled to write fanfic without being greatly moved, and your fanfic is extremely unlikely to gain attention unless many others have been greatly moved by the original as well; and when there is lots of money potentially to be harvested the situation becomes incredibly dangerous.

Whoever wrote the Odyssey managed to clear the bar set by the author of the Iliad. Virgil with his Æneid came very close. Other examples of fanfic that has equal or exceeded the original? I confess that right now I cannot think of any.

Moreover, the task may become an order of magnitude even more difficult when the author does not write the story, but leaves it hidden, visible only in glimpses, so that you can only imagine how good the original was. This was, indeed, the problem with Tolkien’s Silmarillion, for the Silmarillion that people had imagined in their minds was an order of magnitude better than the Silmarillion lying flat on the page.

All this is a roundabout way of saying that I have no positive expectations whatsoever for the forthcoming The Rings of Power <https://en.wikipedia.org/wiki/The_Lord_of_the_Rings:_The_Rings_of_Power>:

I accept as a gift that The Wheel of Time did not suck, and expect nothing more.

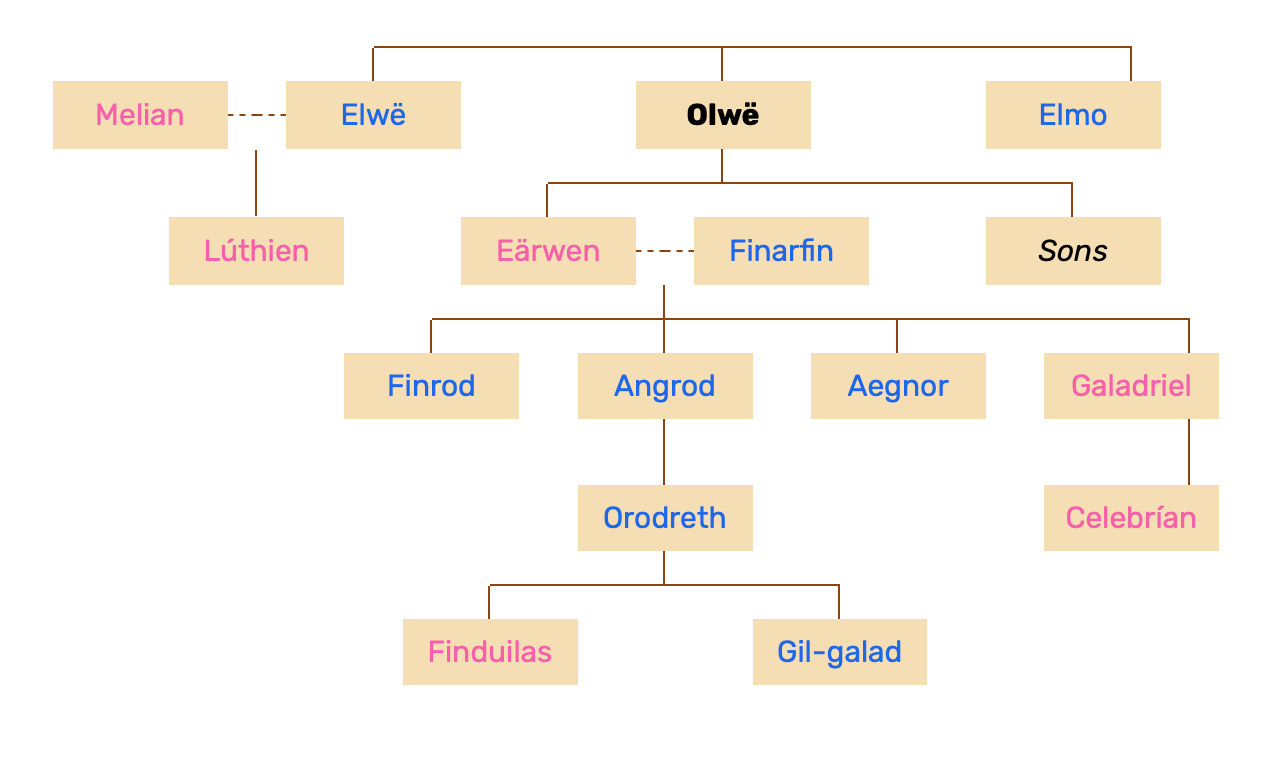

If their task was not hard enough, they have amped up the difficulty of the dive by making their protagonist Galadriel—proud and iron-willed as Satan himself, second-mightiest of the sorcerers and sorceresses of the Noldor (for of the Vanyar we know not, and Luthien was half-Maiar), more lovely than the dawn itself (for the light of the Two Trees was caught in her hair), able to see to the core of the souls of all she gazed upon, yet never judging them save with understanding and mercy—except for her forever-unfriend Fëanor.

We wish Morfydd Clark and the rest of the team luck. They will need it. But I really do not see how this is to be accomplished…

Galadriel was the greatest of the Noldor, except Fëanor maybe, though she was wiser than he, and her wisdom increased with the long years.... Fëanor beheld the hair of Galadriel with wonder and delight. He begged three times for a tress, but Galadriel would not give him even one hair. These two kinsfolk, the greatest of the Eldar of Valinor, were unfriends for ever....

She was proud, strong, and self-willed…. She had dreams of far lands and dominions that might be her own to order as she would without tutelage. Yet deeper still there dwelt in her the noble and generous spirit of the Vanyar, and a reverence for the Valar that she could not forget. From her earliest years she had a marvellous gift of insight into the minds of others, but judged them with mercy and understanding, and she withheld her goodwill from none save only Fëanor....

She joined the rebellion against the Valar… and once she had set foot upon that road of exile she would not relent, but rejected the last message of the Valar, and came under the Doom of Mandos.... Her pride was unwilling to return, a defeated suppliant.... At the end of the Elder Days after the final overthrow of Morgoth, she refused the pardon of the Valar for all who had fought against him, and remained in Middle-earth. It was not until two long ages more had passed, when at last all that she had desired in her youth came to her hand, the Ring of Power and the dominion of Middle-earth which she had dreamed, that her wisdom was full grown and she rejected it, and passing the last test departed from Middle-earth for ever….

Or:

Galadriel and her brother Finrod were the children of Finarfin…. Her mother-name was Nerwen (“man-maiden”), and she grew to be tall beyond the measure even of the women of the Noldor; she was strong of body, mind, and will, a match for both the loremasters and the athletes of the Eldar…. Even among the Eldar she was accounted beautiful, and her hair was held a marvel unmatched… the light of the Two Trees… snared in her tresses….

The Exiles were allowed to return—save for a few chief actors in the rebellion, of whom at the time of The Lord of the Rings only Galadriel remained. At the time of her Lament in Lórien she believed this to be perennial, as long as the Earth endured. Hence she concludes her lament with a wish or prayer that Frodo may as a special grace be granted a purgatorial (but not penal) sojourn in Eressëa, the solitary isle in sight of Aman, though for her the way is closed. Her prayer was granted – but also her personal ban was lifted, in reward for her services against Sauron, and above all for her rejection of the temptation to take the Ring when offered to her…

[ Celeborn] has dwelt in the West since the days of dawn, and I have dwelt with him years uncounted; for ere the fall of Nargothrond or Gondolin I passed over the mountains, and together through ages of the world we have fought the long defeat...

Ah! like gold fall the leaves in the wind, long years numberless as the wings of trees! The long years have passed like swift draughts of the sweet mead in lofty halls beyond the West, beneath the blue vaults of Varda wherein the stars tremble in the voice of her song, holy and queenly. Who now shall refill the cup for me? For now the Kindler, Varda, the Queen of the stars, from Mount Everwhite has uplifted her hands like clouds and all paths are drowned deep in shadow; and out of a grey country darkness lies on the foaming waves between us, and mist covers the jewels of Calacirya for ever. Now lost, lost to those of the East is Valimar! Farewell! Maybe thou shalt find Valimar! Maybe even thou shalt find it! Farewell!

Fanfic: just now Ada Palmer is talking about Orlando Furioso at Boskone

What about Milton? His fanfic for The Holy Bible defined our modern vision of heaven and hell. It's harder to say with all the Jane Austen fanfic. It defined a new genre, but no author has ever equaled or surpassed the original. Economics is similar. There is a lot of Adam Smith fanfic, but not much in the way of great Adam Smith fanfic.