Yes: Pre-Modern Economies Were Meaningfully "Malthusian" (Which Does Not Mean Incomes Were Stable); & BRIEFLY NOTED: For 2023-03-07 Tu

Contra Rafael Guthman; what a Malthusian economy looks like; Twitter is falling over; don't lazily dismiss the worth of really-existing democracy; Maurice Obstfeld, Haonan Zhou, Gautam Mukunda, Tim...

FOCUS: Rafael Guthman Says on the Internet That I Am Wrong!

This is, of course, wonderful: a smart and thoughtful person disagreeing with me on the internet. He is, of course, wrong. But now I get to revisit my trains of thought, and explain why he is, in his turn wrong.

Rafael R. Guthmann: The Great Waves in Economic History: Malthusians are wrong: far from being stagnant, in western history, living standards had three “supercycles” of rise and fall of economic activity over the past 4,000 years…. DeLong (2022)… claims that modern economic growth only began in earnest in 1870, with the growth from 1770 to 1870 being very small in comparison, and that there was absolutely no growth in real incomes for ordinary people before 1770 (but he admits that living standards could have varied over pre-modern history for a tiny elite)…. This model of economic history is plain wrong…. Three major very-long-run economic cycles in the Western world that featured increasing incomes and then very long periods of decreasing incomes. These cycles of expansion and contraction lasted for several centuries…

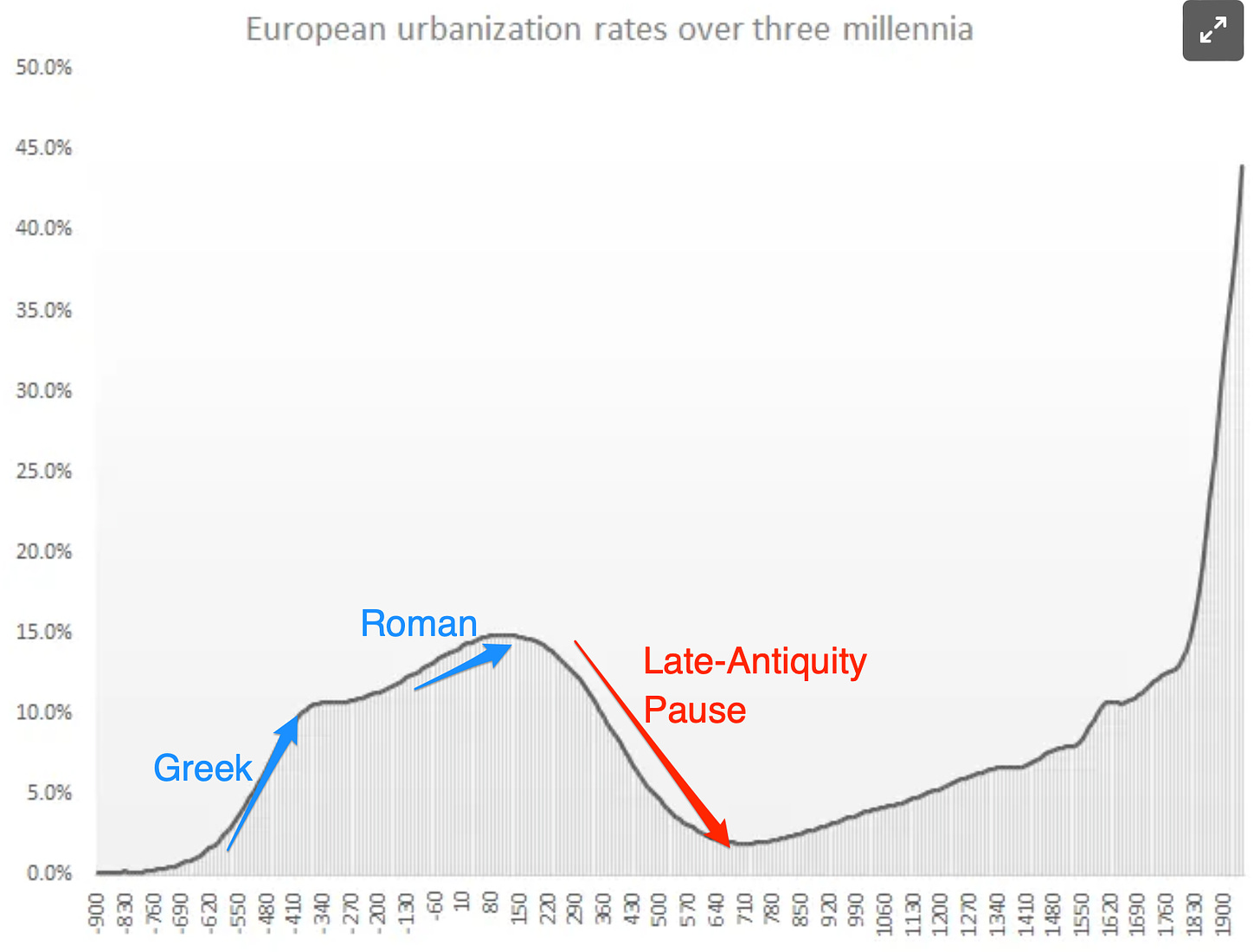

The three cycles are (1) the Bronze Age Near East starting in -3000, followed by the late -1000s civilizational collapse; (2) the Classical and Hellenistic Greece plus Roman efflorescence from -700 to 150, followed by what I politely call the “Late-Antiquity Pause” from 150 to 700; and (3) the long mediæval and early modern ascent, followed by the industrial revolution and modern economic growth breakthrough.

The support is (1) the assertion that urbanization—even in cities as small as 5000—is closely correlated sith living standards an productivity levels, and (2) our guesses about the share of Europeans living in cities of 5000 or more:

Rafael says:

There is no evidence of any tendency for the rate of urbanization to stabilize around a level consistent with the Malthusian model’s “subsistence level.” Instead, the urbanization rate suggests that over the last three millennia of the history of Europe, there were long and sustained periods of economic progress and regression and that modern economic growth has been a dramatic acceleration compared to the pre-modern trend, instead of a complete break from it...

But what would we expect to see if we were, in fact, observing a Malthusian economy?

What is a Malthusian economy anyway? I write it down in four equations:

The first and second equations are simply definitions: The first says that the proportional growth rate of living standards and productivity levels—the proportional growth rate of the output per worker y variable on the left-hand side—is equal to g, g for growth. The second says that the proportional growth rate of population and the labor force variable L, L for labor, on the right-hand side is equal to n, n for numbers.

The third and fourth equations are behavioral relationships: The third says that g—the proportional growth rate of living standards and productivity levels—on the left-hand side is equal to the proportional rate of growth h of human ideas about technology, minus the proportional rate of growth of population and the labor force n divided by a parameter ɣthat tells us how salient ideas about technology are in generating productivity vis-à-vis resource scarcity, plus a random shock term. It is human ingenuity versus resource scarcity. And resource scarcity is made more dire by population increases. The fourth says that the population growth rate variable n on the left-hand side will be such that population will grow if living standards y are above, and shrink if living standards are below, some “subsistence” level y^{sub}. It says that population will do so linearly, depending on a parameter βthat tells us how responsive fertility and mortality are to want and deprivation, plus a random shock term. Twice as big a gap between living standards and subsistence will produce twice as fast a population response, with the value of the β parameter calibrating how much. As people get poorer, fertility drops: women become sufficiently skinny that ovulation becomes hit-or-miss. And as people get poorer, mortality rises: it is not just that some people starve to death, it is that the malnourished have compromised immune systems, and malnourished children, especially, are easily carried off by the common cold.

This model captures three features of a pre-modern Malthusian economy:

There is (slow) progress in technology

A more prosperous society has higher population growth

Resource scarcity matters

What consequences do those features have? Well, let us set up a toy economy—a simulation—with these features, and only these features, and see how history evolves. Let us set h = 0.0005—5% growth in technology over a century. Let us set β= 0.25—if real living standards are 40% over “subsistence”, population grows at 1% per year, or doubles in three generations. And let us set ɣ = 2—ideas about technology are twice as salient as resources in generating productivity. And we also need to add a random term, an ε term, for plagues, bountiful harvests, mild winters in which babies do not die of pneumonia, and all the other non-systematic accidents that affect the growth of population. We do this in Python. Here is our first simulation run: the level of income per capita:

We see, in this simulation, a 500-year advance in civilization as measured by living standards, and then a sudden following crash into a dark age. There is then a 400-year period during which little appears to happen.

Would Rafael Guthman say of this that there “no evidence of any tendency… to stabilize around a level consistent with the Malthusian model’s ‘subsistence level’”? Would he point to it as strong evidence against the Malthusian economy hypothesis? Quite possibly. I would even say: probably. And yet there it is. There is nothing non-Malthusian going on here.

We find patterns even where there are no patterns—where there is only the random buffeting of the society by plague and good harvest.

Now, actually, I think there is much more going on with the Classical and Hellenistic Greek efflorescences, and with the Roman efflorescence, than just the random chances of plagues and good harvests.

But that more is happening than can be captured in my very simple model is not, I think, dispositive. A society can see considerable advances in average living standards and considerable increases in population without thereby ceasing to be Malthusian.

A society that acquires a substantial taste for luxuries—for expenditures on things that do not directly contribute to making women more fertile and children more likely to survive—will raise the average standard of living even in a Malthusian economy. So will customs, like late female first marriage or female infanticide, that will have the effect of diminishing reproduction. And the coming of a large commercial trade zone or an imperial peace—something that greatly increases the rewards of investing in tools and infrastructure and other forms of social, public, and private capital—will raise the average standard of living in the short run, and raise population in the long run, but note that it can take up to half a millennium for the long run to arrive.

So I regard Rafael’s figure as a striking illustration of how a Malthusian economy does not have to be stagnant. But it does not shake my confidence in the proposition that before 1870 the world economy was Malthusian. It does not shake my confidence in that at all.

ONE (ACTUALLY MORE THAN ONE) IMAGE: Twitter Is Falling Over:

MUST-READ: ????

I confess I really do not know what to make of this:

Tim Burke: The News: It's His Turn to Fail: ‘I don’t know what to say about political transitions in much of sub-Saharan Africa…. It’s hard to know what to say is that the political outcomes of most elections plainly do not reflect the political aspirations of the residents of many African democracies. That’s not unique to sub-Saharan Africa, mind you: it is just as hard to feel as if American politics has much to do with what national and regional majorities actually want in terms of governance outcomes…. Nigeria’s government is not so much one that needs to catch up to international norms as it is a window into the near-term international norm of paralysis, incompetency, corruption, insecurity and spasmodic authoritarianism that many nation-states are hurtling towards, the United States most prominently among them…. The successful people of most nations want from their failing states… something that works most of the time for most of the people. There is nothing harder to explain about our moment that this desire seems more remote with each passing day…

I understand how someone could claim that “most elections plainly do not reflect the political aspirations of the residents of many African democracies.” But that argument needs to be made—that the politicians the voters voted for are not, in fact, the politicians the voters would really, if they were fully infomred, want to have controlling the levers of power.

But to go on to claim that it is “just as hard to feel as if American politics has much to do with what national and regional majorities actually want in terms of governance outcomes…”?

To claim that all of the institutional frameworks for informing voters, counting votes, and getting people to organize and pressure and lobby for public policies is worth nothing?

To work to devalue the institutions and practices of really-existing democracy is an attitude that guarantees that one will be powerless.

Very Briefly Noted:

Olivia White & Jonathan Woetzel: Reimagining Global Integration | by Olivia White & Jonathan Woetzel: ‘Globalization is not in retreat…. Trade flows linked to knowledge and know-how, including data, intellectual property, services, and talent, have replaced manufactured goods, resources, and capital as the primary drivers of interconnection, and firms of all sizes should be able to benefit…

Ezra Dyer: A 120-Year-Old Company Is Leaving Tesla in the Dust: ‘Tesla had me convinced, for a while, that it was a cool company. fundamentally, its cars had no competition. If you wanted an electric car that could go more than 250 miles between charges, Tesla was your only choice for the better part of a decade…

Charlie Warzel: The Vindication of Ask Jeeves…

The Lionel Gelber Prize: Announcing the shortlist for the 2023 Lionel Gelber Prize: ‘Chip War: The Fight for the World's Most Critical Technology, by Chris Miller; Overreach: How China Derailed Its Peaceful Rise, by Susan L. Shirk; Revolution and Dictatorship: The Violent Origins of Durable Authoritarianism, by Stephen Levitsky and Lucan Way; Slouching Toward Utopia: An Economic History of the Twentieth Century by J. Bradford DeLong; Spin Dictators: The Changing Face of Tyranny in the 21st Century, by Sergei Guriev and Daniel Treisman…

Will Douglas Heaven: The inside story of how ChatGPT was built from the people who made it…

Ethan Wu: ‘On the merits, though, the case for a higher inflation target—perhaps 3 per cent—is strong. First, it lets prices adjust more flexibly…. People like price cuts but hate wage cuts, an asymmetry that makes downturns more violent…. Running inflation a touch hotter gives prices more room to move…. Second, and more importantly, a higher inflation target keeps rates further from the dreaded zero lower bound…

Noah Smith: Why do education, health care, and child care cost so much in America?: ‘When Timothy B. Lee looked at service industries overall, he found that there are a lot that have actually gotten a bit more affordable.... When there’s no simple explanation, we go with a complex one...

Dylan Patel, George Cozma, & Afzal Ahmad: EUV Requirements Halved? Applied Materials' Scuplta Redefines Lithography And Patterning Market: ‘Applied Materials… the Centura Sculpta tool, a new tool that can perform a new process step, “pattern shaping”… to reduce the use of EUV lithography by as much as HALF for some layers…

Baratunde Thurston: Me, Myself, and A.I.: ‘I got better, accurate results after I resubmitted the request with this addendum: “Do not invent quotes. Provide only examples and quotes you can support with clear attribution.” I think I’m also going to start adding “...and please don’t kill all the humans” to each prompt from now on, just to be safe. You’re welcome…

Sally Weatherly: The AI Exchange…

Martin Wolf: The EU’s future in a world of deep disorder: ‘The bloc needs to decide whether it wishes to be an ally, a bridge or a power…. The Kantian dream has not proved exportable. We live in a world characterised by disorder, nationalism and great power conflict…. If [the EU’s] leaders wish to preserve their great experiment in peaceful relations, they need to strengthen it for the storms…

Dan Drezner: How is Fox News Different From All Other Media?: ‘All news outlets have their biases. This is something different…. It is not hard to imagine the likes of Carlson, Ingraham, and Sean Hannity saying whatever they could to keep their audience engaged. What is striking about Baker’s story is that this is also how Fox News’ ostensible “straight news“ reporters felt as well…

Paul Campos: The very long con: ‘If it’s OK with you, I’m going to continue to hate both the game and the player: Ron Filipkowski: “Guilfoyle is now at CPAC selling gold and silver. She says to stop doing business with woke companies that hate you, and to go to ‘KimsMetals’ to invest for your retirement...

¶s:

Maurice Obstfeld & Haonan Zhou: The Global Dollar Cycle: ‘The U.S. dollar’s nominal effective exchange rate closely tracks global financial conditions, which themselves show a cyclical pattern. Over that cycle, world asset prices, leverage, and capital flows move in concert with global growth, especially influencing the fortunes of emerging and developing economies (EMDEs). This paper documents that dollar appreciation shocks predict economic downturns in EMDEs and highlights policies countries could implement to dampen the effects of dollar fluctuations. Dollar appreciation shocks themselves are highly correlated not just with tighter U.S. monetary policies, but also with measures of U.S. domestic and international dollar funding stress that themselves reflect global investors’ risk appetite. After the initial market panic and upward dollar spike at the start of the COVID-19 pandemic, the dollar fell as global financial conditions eased; but the higher inflation that followed has induced central banks everywhere to tighten monetary policies more recently. The dollar has strengthened considerably since mid-2021 and a contractionary phase of the global financial cycle is now under way. Owing to increases in public- and business-sector debts during the pandemic, a strong dollar, higher interest rates, and slower economic growth will be challenging for EMDEs…

Gautam Mukunda: Indispensable Newsletter #3: ‘I’m currently reading How the War Was Won: Air-Sea Power and Allied Victory in World War II by historian Phillips Payson O’Brien, and it’s absolutely stunning. I like it because most historians think of WW2 as a massive land battle that consumed much of the globe, but O’Brien posits that in terms of production, technology, and economic power, it was far more a contest of air and sea supremacy. I’ve read more books on World War II than I can count, and on almost every page of this book I learned something that made me think that everything I thought I knew about how the Allies won World War II was wrong...

Tim Duy: Tim Duy’s Fed Watch, 3/7/23: ‘Federal Reserve Chair Jerome Powell dropped the hammer in today’s testimony, making clear that the expected terminal rate will move higher and putting a 50bp rate hike on the table for the March meeting. Realistically, this makes a 50bp rate hike the new baseline, and more importantly puts a 6% terminal rate into play…. The Fed is getting closer to accepting that they aren’t returning inflation to 2% within any reasonable timeframe without inducing a hard landing. As regular readers know, this moves the Fed closer to our position. The Fed will need to induce a recession if it wants to restore price stability…

John Gruber: Josh Marshall: ‘The Deep Archeology of Fox News’: ‘In a broad sense it all comes back to Stephen Colbert’s iconic line from his Colbert Report alter ego: “It is a well known fact that reality has a liberal bias.” U.S. conservatives couldn’t/can’t see that, or refuse to see it, and instead operate on the assumption that all journalism — and science — that points toward liberal conclusions is ideological. Daniel Patrick Moynihan famously quipped, “You are entitled to your opinion. But you are not entitled to your own facts.” The foundational element of the modern U.S. conservative movement is that facts and opinions are interchangeable, that their opinions not only can trump our facts, they do, purely by the force of their convictions. Whoever shouts loudest wins, not whoever presents the best evidence. Hence the other defining difference between Fox News and all non-rightwing TV news organizations: anger…

W.r.t. your argument with Guthman. Let's pull back a moment. Your "Malthusian" equation for $n$ is $\beta [ y / y^{sub} - 1 ] + \epsilon_2$. Your recent book points out that after 1870 this equation doesn't fit the data for $ y >> y^{sub} $ anywhere in the world whenever $ y >> y^{sub} $. Rather there was a demographic transition. We have 150 years of strong evidence that as income increases $n$ flattens out then decreases to close to 1 as $y$ increases.

Isn't Guthman just pointing out that there's no reason to believe that the equation for $n$ changed suddenly after 1870? Why is it so hard to believe that there could have been demographic transitions In the bronze age and greek/roman efflorescences?

Brad is being way too hard on Tim Burke. There is a big difference between claiming that really-existing democracy is worthless and claiming that really-existing democracy is far too biased toward the minoritarian desires of the wealthy and fervent. The latter claim--which is that of Tim Burke--can be made by any opponent of Citizens United, Dobbs, or Heller.