BRIEFLY NOTED: For 2023-05-07 Su

Youtube wants to send me to the nuthouse; no, we do not have a wage-price spiral; our slow-motion banking crisis; Sipahutar on riding the AI wave, Levine on forcing banks into a mark-to-market acco...

ONE VIDEO: My Youtube Recommendations Have Started Going Down the Drain into the Nuthouse of the Panic-Clickbait Cycle:

Dr. Jordan B. Peterson and economist Peter Schiff discuss the gold standard, the corruption and impending failure of the fiat system in the wake of inflation, why politicians are pushing inflation to astronomical new levels, and why they’re lying about it. Peter Schiff is an economist, financial broker, author, frequent guest on national news, and host of the podcast, "the Peter Schiff Show." Starting in 2005 Schiff took notice of the red flags signaling that economic unrest was looming, and correctly predicted the 2008 housing crisis. His attempts to warn the general public across a multitude of news and radio networks earned him the nickname “Dr. Doom,” and ever since then he has been looked on as a source not only to watch, but heavily consider…

Google’s algorithms need a very large brainscrub if it is to be a net social positive in the future. As of right now, it is not.

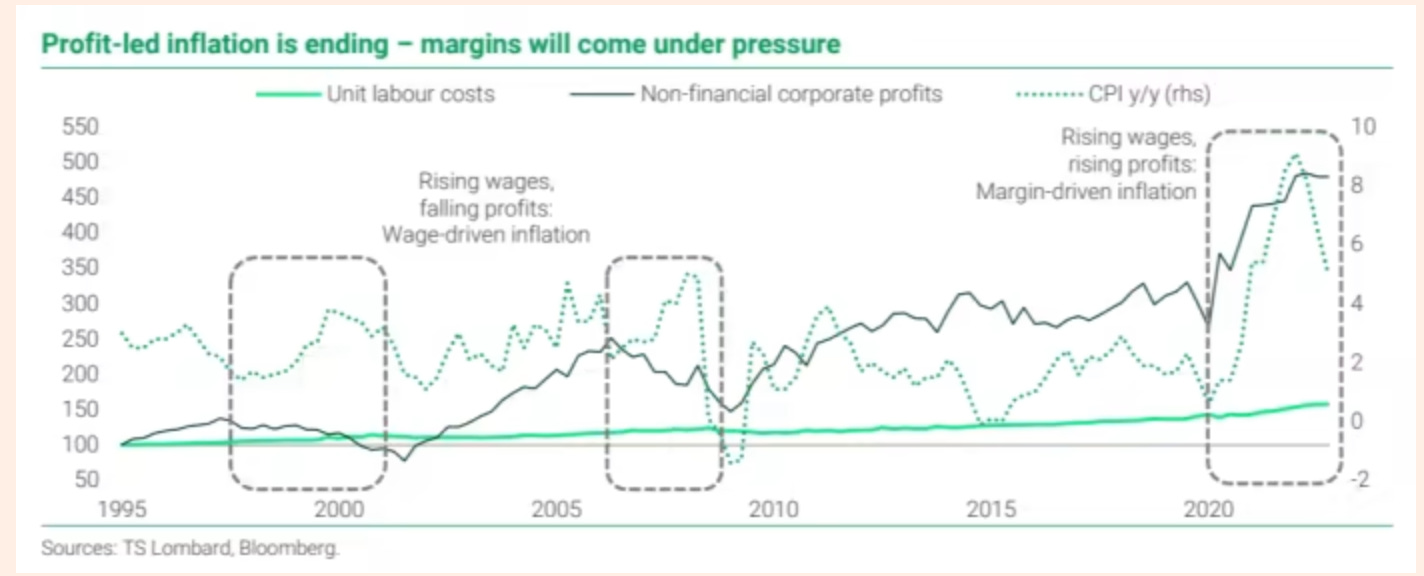

ONE IMAGE: Þis Is Not a Wage-Price Spiral:

MUST-READ: Slow-Motion Banking Crisis Continues:

Weak banks now find it impossible to recapitalize themselves on terms current equity holders will accept:

Robert Armstrong: Unhedged: ‘There is, in other words, a lot to be said for the “mindless lemming-like freakout” theory of the recent [bank shares] sell-off. But the freakout is not utterly mindless and lemming-like, for two reasons. The banks that are getting beat up do have weaknesses: PacWest’s exposure to the venture capital industry, securities and loan losses at Zions and KeyCorp, uninsured deposits at Comerica, and so on. Autonomous Research bank analyst Brian Foran calls what we are seeing “the weakest gazelle problem”: the market is coming after the banks with the most vulnerabilities, even if under normal circumstances those vulnerabilities would not be fatal. The other problem is that deposits are always vulnerable to flight. It’s always possible to imagine that, even if deposit levels are holding up now, something awful will happen tomorrow. There is just enough reality behind the banking mini-crisis to allow the freakout to persist…

Very Briefly Noted:

Jessica Karl: Regional Banks Have a Romaine Lettuce Problem: ‘Just as diners don’t want to risk getting sick from bad vegetables, so bank customers don’t want to risk leaving their money at an unhealthy bank…

Karthik Sankaran: How do emerging markets get into trouble? Let me count the ways: ‘‘The different kinds of balance of payments problems that EMs run into; the feedback loops among real activity, financial conditions, and investor perceptions; and… global collective actions problems that lurk beneath the issue…

Sam Ro: What Fed Chair Powell said about the relationship between profit margins and inflation: ‘Inflation has yet to cool as profit margins hold up…. The AP’s Chris Rugaber asked Fed Chair Jerome Powell if he saw higher profit margins as a driver of higher prices. Powell essentially said yes…

Tassia Sipahutar: Deepening Rout: ‘PacWest, First Horizon and Western Alliance led a renewed slide in the shares of US regional lenders, adding to concern about a sector that’s been rattled in recent months by the collapse of multiple firms. PacWest plunged 51% Thursday, the most on record, to its lowest close ever after saying it’s in talks with potential investors and partners. Western Alliance tumbled 38%. It pared a drop of as much as 62% after saying a report that it’s exploring strategic options including a potential sale is “categorically false”…

Amanda Marcotte: When the hate comes home: It's not just an act with Tucker Carlson and Steven Crowder: ‘Right wing pundits hide behind “just joking” when called out for bigotry—but no, they really believe in hate…

Simon Kuper: Cities are back. Here’s how to make them work better: ‘London and Paris have never been bigger. But there are endless ways to optimise urban space…. The biggest are now more sought-after than ever before…. Cities such as Miami, Singapore and Berlin are becoming unaffordable. At the same time, global tourism is back with a vengeance…

Mario Gabriele: The History of AI in 7 Experiments: ‘The breakthroughs, surprises, and failures that brought us to today…

Dylan Patel & Afzal Ahmad: Google “We Have No Moat, And Neither Does OpenAI”: Leaked Internal Google Document Claims Open Source AI Will Outcompete Google and OpenAI…

Abraham Lincoln (1858): House Divided…

Dan Pfeiffer: Why Did the Press Cover Up Trump's Meltdown?: ‘The media's bizarre silence about Trump throwing a reporter's phone shows why the industry is in crisis…

¶s:

Tassia Sipahutar: Riding the AI Wave: ‘Microsoft is working with Advanced Micro Devices on the chipmaker’s expansion into artificial intelligence processors, according to people with knowledge of the situation. The companies are teaming up to offer an alternative to Nvidia, which dominates the market for AI-capable chips called graphics processing units, said the people, who asked not to be identified because the matter is private. The arrangement is part of a broader rush to augment AI processing power, which is in great demand after the explosion of chatbots like ChatGPT and other services based on the technology…

Matt Levine: Nobody Trusts Banks Now: ‘I am tempted to say that Theory 1 is correct and Theory 2 is wrong, but that is just because I grew up in a modern-finance, markets-oriented, mark-everything-to-market world. [2] But Theory 2 has a lot going for it, empirically; it probably gives you a better sense of what banks are doing (building long-term relationships, accumulating sticky deposits, investing them in a way that roughly matches their stickiness) than Theory 1 does. [3] You don’t build a bank branch just to attract overnight funding; a branch suggests that you expect deposits to stick around. It’s just that in the US regional banking mini-crisis of 2023 , Theory 1 completely dominates. “We have built long-term relationships with our depositors so we expect them to stick around even as rates rise”: wrong! “We hold our bonds to maturity, so changes in their mark-to-market value don’t matter”: wrong! “Actually rising interest rates are good for us”: wrong! And the bankers and bank regulators, who sort of had Theory 2 rattling around in their brains, were taken by surprise.

Alexandra Scaggs: Is ‘greedflation’ on its way out?: ‘Probably not but apparently you’re more likely to click if the headline is a question: Alphaville loves a good “greedflation” chart, as our readers know. The US’s latest bout of inflation… coincided with a steep increase in profit margins of S&P 500 companies. It has not coincided with a sharp rise in the unit cost of labour, which has climbed but not nearly as fast, as TS Lombard writes Wednesday…

Edward Luce: America’s anything-goes Supreme Court: ‘The country’s top judges are putting the system at risk….A majority of the US public now views America’s highest court as a rigged game…. The manner in which this court has been filled…. The unpopularity of this court’s decisions…. The fact that the justices are not bound by even the flimsiest of ethical codes…. Clarence Thomas… had taken millions of dollars… from Harlan Crow…. Thomas, and his colleagues, can do almost whatever they like without fear of being removed. Hell will freeze over before Congress finds the two-thirds bicameral majority needed to impeach a judge…. Since the judicial system refuses to bend, it is unwittingly abetting forces that would break it. Roberts, who… has in the past shown awareness… this week he cited America’s separation of powers in refusing to testify to Congress on Thomas’s conflict of interest, and other less egregious ones…

On that ONE VIDEO: The number of people who visit the nuthouse is astonishing. By nuthouse I also mean the large following of the investment newsletter business. I was subscribed involuntarily and still get some of their stuff, despite vociferously unsubscribing. I know that Ken Rogoff had speaking engagements and interviews with some of these folk back during the austerity mania. I heard them back then. It was painful. These folk can be entertaining, sometimes even logical, but the premise is usually all wrong (and frankly, too self-serving). I'm not as worried about them; they've been around a while. What worries me are the well-meaning people who are now shouting that the Fed has made a big mistake and continue to reiterate that message despite flimsy evidence. They also allege that the Fed suffers from group think (again without evidence). That publicly boosts the nuthouse folk. And you know that they want to be on the Fed Board, to "diversify viewpoints" if you will. What they really want eventually is to tether us to scarce and shiny "barbaric" metals. So, to those who insist that the Fed has bungled massively and needs a shakedown, I will say this: we want our monetary policy to be made by a Federal Reserve, not Metallica.

Shouldn't we photoshop/AI Chatbot Noriel Roubini into that You Tube video?