BRIEFLY NOTED: For 2023-11-19 Su

Memories of economic policymaking during the Carter administration; from goods-focused engineering to human capital as the primary urban growth engine; the rise in the 10-Yr Treasury rate...

Memories of economic policymaking during the Carter administration; from goods-focused engineering to human capital as the primary urban growth engine; the rise in the 10-Yr Treasury rate substantially reverses itself; Zeke Faux continues his book tour for his truly excellent Number Go Up; very briefly noted; & Hoisted from the Archives: Why you should be happy about inflation and worried about something else top economist Brad DeLong says, & BRIEFLY NOTED: For 2023-11-17 Fr…

SubStack Notes:

Economic History: Communication and coordination between the Federal Reserve and the Executive Branch during the Carter administration, as narrated by then-CEA Chair Charles Schultze. By the Clinton administration things were different—there was a lot of explicit from-the-Fed “we operate inside your decision loop, so we need to tell you what our reaction function is because you have to do the advance and the long-run planning”. And I suppose it is an index of how much Schultze was not a Macro but a Budget Guy, but Macro Guys do not describe the FOMC as a “committee of 12” because it is a committee of 19 with 12 voting members at any moment (so rigged as to give the senate-confirmed members a majority); and Macro Guys do not say that the Fed Chair “answers” to either the Board of Governors or the FOMC—that is not at all the culture of the Fed:

Economic History: It used to be that the transportation links to the raw materials and to the customers got you the factories that brought the engineers who were the key generators of the externalities that powered the good kinds of economic growth. More recently? It has been not the factories and the mechanical and power engineers but the colleges and universities that nurture the human-capital engineers and entrepreneurs:

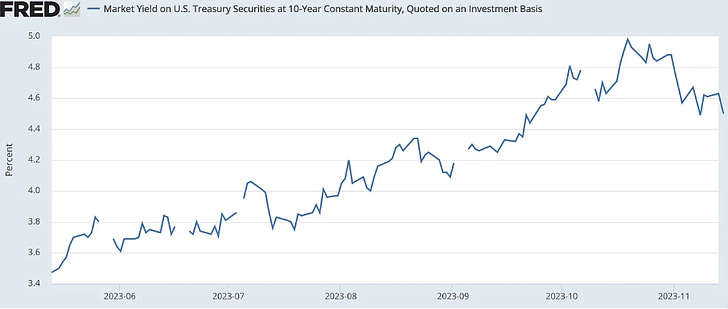

ONE IMAGE: The Rise in the 10-Yr Treasury Rate Partially Reverses Itself:

As I wrote a week and a half ago: The gyrations of the long-term bond market since mid-September—if not before—[have been] very weird. There has been little in economic news or in Federal Reserve chatter over the past year that would lead one to think that fundamentals are changing… r* is shifting… [or] whether the Fed’s bias with respect to aiming a bit higher or lower than r* over the next decade is shifting. And yet the Ten-Year Treasury has been all over the place…. My bet is that a bunch of the 100-basis point runup in the safe long bond inflation-adjusted rate is going to be reversed.

And, indeed, it has proved to be so:

ONE VIDEO: Zeke Faux & Francine McKenna: “Number Go Up!” at the Pen & Pencil Club:

Very Briefly Noted:

Economics: OMB: Biden-Harris Administration Releases Final Guidance to Improve Regulatory Analysis: ‘Today, the Office of Information and Regulatory Affairs (OIRA) is issuing revisions to Circular A-4, the government-wide guidance on regulatory analysis…. The discount rate… a new default estimate of 2%…. Expanded guidance for agencies on how to determine the distributional effects of regulations…

George Akerlof, William T. Dickens, & George L. Perry (2000): Near-Rational Wage and Price Setting and the Long-Run Phillips Curve…

Soumaya Keynes: The ‘greedflation’ question: what have we learnt?: ‘A quest for evidence… mixed success…. Within the eurozone… those with more pre-pandemic pricing power and facing high demand did find it particularly easy to raise prices amid the supply chain disruption… once inflation expectations were elevated, even if they didn’t face any supply bottlenecks at all…. The better (boring) version of the greedflation story… is that in trying to maximise profits some companies helped a cost shock to propagate through the system. Something to watch, not dismiss out of hand…

Economic History: Alan Blinder & Janet L. Yellen. 2001. The Fabulous Decade: Macroeconomic Lessons from the 1990s…

Arthur Burns (1960): Progress Towards Economic Stability…

Charles L. Schultze (2000): Oral History, Economic Adviser.” Interview by Stephen G. Knott and Martha J. Kumar. Miller Center…

Moore’s Law: Paul Cantrell: ‘I’m a reluctant hardware upgrader, but finally got an Apple Silicon machine. And I’m really, really noticing what others have said: It’s snappy. Very snappy. It’s snappy in a way that raw speed can’t explain. My perfectly fast Intel machine has lots of little pauses and lurches and burbles that are just… gone. Waking, launching things, plugging in the external display, all just poof! happen. Why? Again, it’s not just CPU/GPU speed. It feels like there was some OS resource contention, some gear-shifting, some human-scale try-and-wait timer, that’s now eliminated. Anyone have insight into why this is? I’m genuinely curious…

Public Reason: Matt Yglesias: Slow Boring's fourth year: ‘Most red states have liberal cities, and you’d like to see at least some mayors of those liberal cities be viable candidates for statewide office. But for that to work, the mayor in question can’t be a dyed-in-the-wool progressive who spends his time catering to the national constituency of progressive nonprofits. It has to be a moderate reformist mayor… who fixes problems and is about to take that same pragmatic approach to Washington or the governor’s mansion…. Building more media outlets that actually care about pragmatic, workable politics is a necessary part of fixing the overall landscape—there is (I hope) a flywheel between media work, policy work, electoral work, and organizing and fundraising…

GPT-LLM-ML: Alex Heath & Nilay Patel: OpenAI board in discussions with Sam Altman to return as CEO: ‘Altman was suddenly fired on Friday, sending the hottest startup in tech into an ongoing crisis…. OpenAI is in a state of free-fall without him…. Greg Brockman, OpenAI’s president and former board chairman, resigned…. A string of senior researchers also resigned… more departures are in the works…. OpenAI’s investors weren’t given advance warning or opportunity to weigh in…. A spokesperson for OpenAI didn’t respond to a request for comment

Political Régimes: Samo Burja: What Botswana Can Teach Us About Political Stability: ‘Botswana is actually an unofficial adoptive monarchy around the old royal family…. The head of state picks the successor and gives him the junior position…. Botswana avoided Cold War–driven instabilities by aligning with the West, but positioning itself such that the USSR had no interest in overthrowing it. Botswana was a thorn in the side of South Africa, and useful to the USSR…. The marriage of President Seretse Khama… was controversial at the time, likely an act of love rather than intentional statecraft. However, it was read by the white minority as a credible commitment to ethnic peace….. The family is thus reassuring for the white minority, while simultaneously legitimate to traditionalist Tswana…. We model power and power succession unrealistically, if at all. Hand-picked successors and political dynasties are overlooked as viable solutions, or regarded as a sign of corruption. Thus we usually miss or shrug at Botswana’s success…. The world, including its functional governments, is a lot more dynastic than we like to admit, and dynasties work a lot better at securing institutional continuity and good government than we like to think…

Wanna point out that universities do more than create directly productive human capital. They create social capital as well: music, bookstores, restaurants, etc.. People with a lot of human capital and mobility prefer to live in university towns if they can. Prosperous retirement communities are often built around colleges.

MY: "Public Reason: Matt Yglesias: Slow Boring's fourth year: ‘Most red states have liberal cities, and you’d like to see at least some mayors of those liberal cities be viable candidates for statewide office. But for that to work, the mayor in question can’t be a dyed-in-the-wool progressive who spends his time catering to the national constituency of progressive nonprofits."

Notably lacking: examples. After almost 30 years of this "I'm the real sensible centerist in the room and you lefties need to follow my [conservative] preferences or DOOM" do they really think that we don't see through them? MY should just take that job on the No Labels campaign, then from there join the Wall Street Journal editorial staff after the election.