BRIEFLY NOTED: For 2024-04-22 Mo

Substantial monetary tightening since mid-2023 even as real economic strength and more rapid inflation reduction than expected offset each other; Dani Rodrik in 2019 on Industrial Policy; very...

Substantial monetary tightening since mid-2023 even as real economic strength and more rapid inflation reduction than expected offset each other; Dani Rodrik in 2019 on Industrial Policy; very briefly noted; Keynes was concerned with income & wealth inequality; Tej Parikh against the inflation freak-out; Trump’s claim not to be bound by any laws whatsoever; & Understanding Book-Classification ISBN Numbers & the Current Limits of MAMLMs; ScratchPad: John Maynard Keynes Was too Concerned with Wealth & Income Distribution...; & Why Is the Apple Vision Pro Going to Get Its Shot, While the Humane AI Pin Is Not Going to?…

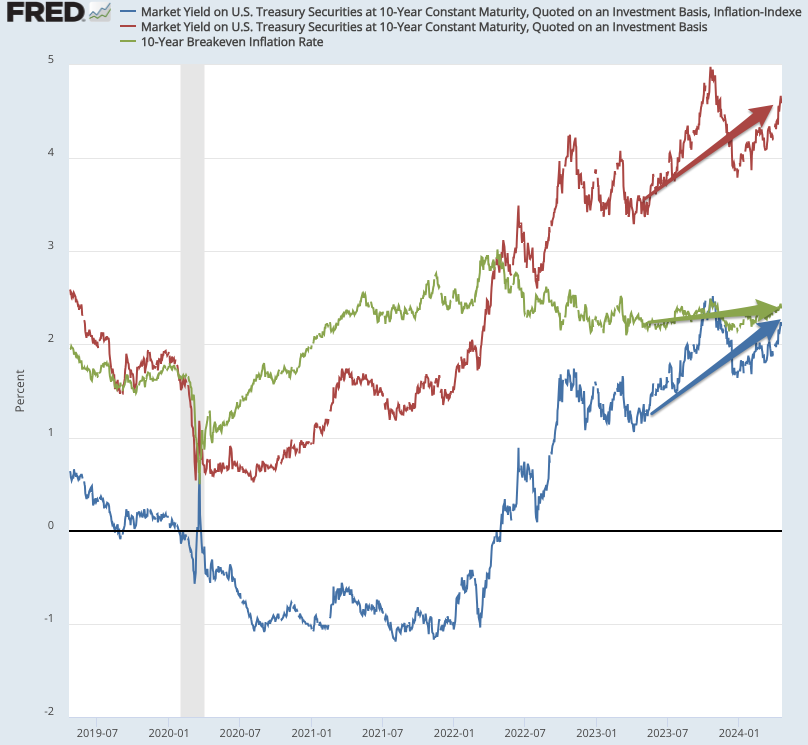

ONE IMAGE: U.S. Long-Term Ten-Year Treasury Interest Rates:

A remarkably substantial tightening of monetary conditions since mid-2023 as (a) the economy has proven much stronger than people had forecast while (b) inflation has come down much further and more rapidly than people had forecast:

ONE VIDEO: Dani Rodrik (2019) on Industrial Policy:

Very Briefly Noted:

Economics: Dani Rodrik: America’s Manufacturing Renaissance Will Create Few Good Jobs—PROJECT SYNDICATE: ‘Manufacturing… plays a disproportionate role in driving innovation and productivity…. The pandemic highlighted the risks of far-flung cross-border supply chains…. Heightened geopolitical competition…. Then there is the goal of creating good jobs…. [But] one looks in vain around the world for successful examples of reversing the de-industrialization of employment. Germany… South Korea…. Boosting manufacturing employment is… chasing a fast-receding target. The world has moved on, and the nature of manufacturing technologies has changed irrevocably… <https://www.project-syndicate.org/commentary/us-manufacturing-employment-falling-despite-investment-policies-by-dani-rodrik-2024-04>

Bryce Elder: Tesla’s Q1 is going to be a wreck. Will anyone care?: ‘Dan Levy says that cancelling Model 2 in favour of a purpose-built robotaxi “would further drive a wedge between the ‘rational’ and ‘exuberant’ Tesla bulls.” The “rational” bull case argument for Tesla is primarily based on “the expectation that it will see an iPhone style consolidation of the auto market…. Model 2 was set to be the big step forward in taking additional share…” The thing with Model 2, says Levy, was that it could realistically be delivered as early as next year…. Without it, investors can only look forward to a collection of binary bets (AI and energy storage stuff as well as the robot chauffeurs and butlers). Throwing more resources at moonshots might be encouraging for those who see Tesla’s car manufacturing business as the stub of a Jetson’s-based investment case but everyone else is likely to be “increasingly uncomfortable in underwriting the story”… <https://www.ft.com/content/5acd4a61-be31-49b4-bbdd-2542784a7b18>

Robin Wigglesworth: Small stocks, big problems: ‘The fact that US small caps have now underperformed the broader stock market since the 1980s—when research first showed that they over time outperformed—cannot be laid at the feet of Nvidia and Microsoft, or a single rate-hiking cycle…. Volatility and heightened transaction costs for… funds that have to rebalance… add up to 0.86 per cent… annual…. [Perhaps] the relative quality of smaller US companies has for some reason atrophied…. Yes yes, it’s trendy and facile to blame private equity for absolutely everything, but hear us out…. Small- and mid-cap[s are]… where private equity likes to play… <https://www.ft.com/content/abfbf19e-f963-4c1b-b69e-7bef8896e8cd>

Plutocracy: Frederik Gieschen: Lessons from the Ultra-Wealthy: ‘Six years working for two of New York’s ultra-wealthy families…. Master your relationship to money or watch it master you…. Because mastering the money game typically comes at the expense of other interests and relationships, there are no other games to fall back on…. Devising tax schemes. Is that how one wants to spend their wealthy old age? Wrong question. It’s what the mind wants to do. Master your mind lest it master you…. By the way, the status games never end…. Wealth taints relationships.… Three kinds of relationships are less affected by this: relationships that preceded making a fortune (if you’re self-made)… among the wealthy, and… where the role of money is clearly defined (I pay you, you listen to me)…. <https://alchemy.substack.com/p/things-i-learned-working-for-the?publication_id=71425&post_id=143549129>

Central Country: Stephen Roach: China’s Rebalancing Imperative—PROJECT SYNDICATE: ‘A major downturn in the Chinese property sector, amplified by a huge debt overhang, has eroded the potency of any investment offset…. That puts the focus squarely on the Chinese consumer…. Xi’s emphasis on “new productive forces” to drive higher-quality economic development…. No matter how it is framed, a focus on total factor productivity (TFP) growth is music to my ears… <https://www.project-syndicate.org/onpoint/china-economic-rebalancing-increase-consumption-productivity-by-stephen-s-roach-2024-04>

Ben Landau-Taylor: The Three Chinese Civilizations: ‘The Qin/Han state[s]… institutions and culture don’t seem more than usually different from the preceding eras…. Ancient Chinese Civilization… did not dissolve until about 300-400 AD, as the Cao Wei/Jin state crumbled…. “Medieval Chinese Civilization” arose in the 600s with the Sui/Tang state… [with] manorial landlords and provincial officials… mobilizing the local peasantry to construct local irrigation works and land reclamation projects. (In contrast, Ancient Chinese Civilization’s instrument of expansion probably was centralized irrigation megaprojects organized by national authorities.)… Medieval Chinese Civilization’s most distinctive institutions and cultural features… the imperial examination system and the scholar-bureaucrats (displacing the scholar-courtiers of Ancient Chinese Civilization)…. [With] the dividing line somewhere around 400 AD… history makes a lot more sense…. <https://www.benlandautaylor.com/p/the-three-chinese-civilizations>

Kyle Chan: Why Chinese EVs will not take over the world: ‘Other automakers can leverage the same Chinese supply chain as well as manufacturing innovations like gigacasting. Plus, image and brand matter as much as price and performance. Look at Japanese cars… <https://www.high-capacity.com/p/why-chinese-evs-will-not-take-over>

Neofascism: John Elledge: An incomplete list of things which failed British Prime Minister Liz Truss blames, hates or has threatened to abolish: ‘The OBR. The Treasury. The Bank of England. Andew Bailey, the governor of the bank of England. The Supreme Court. The Human Rights Act…. [41 items omitted] The people who blame her ("they're either very stupid or very malevolent"). The war in Ukraine. Dilyn the Dog…. More—quite possibly much more—to come…. “Why me?” Liz Truss reports thinking…. “Why now?” The event in question was the death of the Queen… [which] was not, in fact, about Liz Truss… <https://jonn.substack.com/p/an-incomplete-list-of-things-which?publication_id=255975&post_id=143676152>

Journamalism: Jim Romanesko (2011): Memo from 1970: ‘A Plan for Putting the GOP on TV News’: ‘John Cook found “a remarkable document buried deep within the Richard Nixon Presidential Library” that addresses how to circumvent the “prejudices of network news” and deliver “pro-administration” stories to heartland television viewers… <https://www.poynter.org/reporting-editing/2011/memo-from-1970-a-plan-for-putting-the-gop-on-tv-news/>

Steve Inskeep: How my NPR colleague failed at “viewpoint diversity”: ‘Uri Berliner gave a perfect example of the kind of journalism he says he’s against…. [His] errors… make NPR look bad, because it’s embarrassing that an NPR journalist would make so many…. His defenders—and he has some!—have taken to admitting them, then adding words to the effect of: I hope this doesn’t obscure his “larger point”!… He writes of a dismaying experience with his managers: “I asked why we keep using that word that many Hispanics hate—Latinx.” Why indeed?… NPR does not generally use the term. I did a search at npr.org for the previous 90 days. I found: 197 uses of Latino, 201 uses of Latina, And just nine uses of “Latinx,” usually by a guest on NPR who certainly has the right to say it… <https://steveinskeep.substack.com/p/how-my-npr-colleague-failed-at-viewpoint>

SubStack NOTES:

Economics: This from the extremely sharp Branko is just wrong:

Branko Milanovic: Why not Keynes?: ‘Keynes’ uneasy relationship with income distribution: I was asked several times, and most recently only a couple days ago, why in Visions of Inequality I do not discuss Keynes. He doesn't have a chapter like the other six authors and when I mention Keynes it is only in passing and simply in relationship to the marginal propensity to consume. My answer is twofold. First, I think that Keynes was not interested in income distribution. And, more importantly, at one point where he clearly could have, or even should have, brought income distribution into discussion he declined to do so and decided to ignore it… <branko2f7.substack.com/p/why-not-keynes>

Cf.: The very beginning of Chapter 24 of Keynes’s General Theory:

John Maynard Keynes (1936: The General Theory of Employment, Interest & Money: Chapter 24. Concluding Notes on the Social Philosophy towards which the General Theory might Lead: ‘THE outstanding faults of the economic society in which we live are its failure to provide for full employment and its arbitrary and inequitable distribution of wealth and incomes. The bearing of the foregoing theory on the first of these is obvious. But there are also two important respects in which it is relevant to the second… <marxists.org/reference/subject/economic…>

I think much of Keynes’s argument about the effect of thoroughgoing Keynesian policies on wealth distribution and plutocracy is wrong, but he is concerned with it—” arbitrary and inequitable distribution of wealth and incomes”—and does make an argument. And much of Keynes’s argument about the effect of thoroughgoing Keynesian policies on wealth distribution and plutocracy is right.

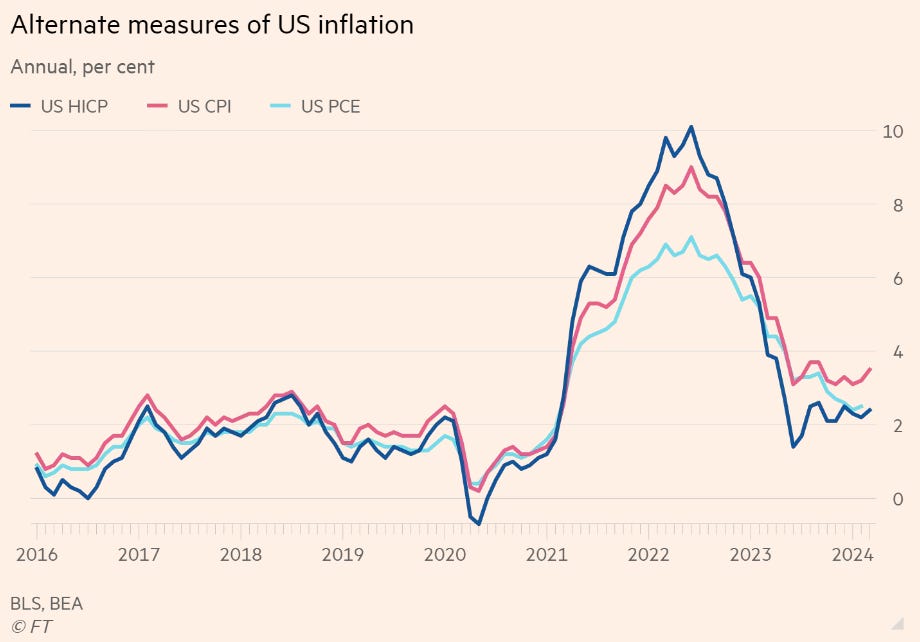

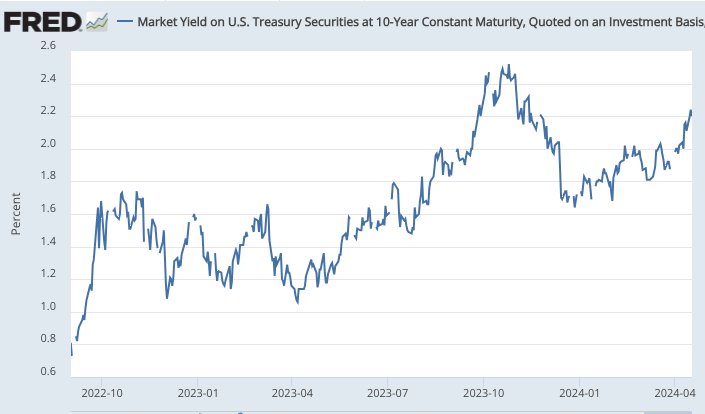

Economics: Trying to look through the monthly dataflow at the underlying economic realities, I think Tej Parikh has got this one right. Wages do appear to be moderating. Higher-for-longer interest rates will produce tighter financial conditions. The laggy shelter data points reported in the future should drag monthly inflation measures down. The Federal Reserve should look through the monthly data and the lags, should have focused in March on where the economy is likely to be in September 2025, and should focus in June on where the economy is likely to be come December 2025. It, in my estimation should have and should cut rates at both meetings, rather than validate the market-driven further tightening of monetary conditions:

Tej Parikh: A contrarian take on the US inflation freakout: ‘Not as bad as it looks—better for the Fed to keep calm, and carry on?…. Last week’s core CPI growth for March came in at a 0.359 per cent month-on-month, against a consensus of 0.3. A ‘whopping’ 0.059 percentage points higher…. Best to understand why it came in higher than expected first…. Shelter is itself driven by “Owners’ Equivalent Rent of Residences”. This is the BLS’ estimate of what owner-occupiers would pay if they rented their homes. It gets a chunky 34 per cent weight in core CPI…. The Fed targets PCE inflation. That measure places less emphasis on OER (core PCE gives it only a 13 per cent weight). It also measures insurance inflation net of claims.… The Fed’s emphasis on data dependence has tied its hands. It is finding it hard to ignore the run of three above expectation CPI prints, despite the detail, forward dynamics, and PCE all looking benign. Given how restrictive real rates are, pockets of economic weakness and where underlying inflation is—excluding all the noise—the Fed probably still needs to cut rates… <https://www.ft.com/content/39af38ed-f493-4ad6-b6e3-3e4777ecdbbb>

I mean: there have now been 75 basis-points of real monetary tightening since late 2022-early 2023. Tell me what things that have changed about inflation outcomes and the inflation outlook would justify that:

Neofascism: All of the cries for Trump not to be prosecuted—for anything—no matter where on the political spectrum they come from are, at base, claims that Donald Trump is the kind of person whom the law ought to protect but ought not to bind:

Josh Micah Marshall: The Dominating & The Dominated: One of Trump’s great powers is that he is like a heavy magnet of distorted thinking. When he comes into proximity people start thinking stupid things, asking stupid questions. What opinion should we, who are not prosecutors, have toward a chronic lawbreaker who is charged with breaking the laws he broke? Will it make him stronger? Were the laws broken enough? On the simplest level the first question has always seemed easy to me…. One of Trump’s accomplices literally already went to jail for this. Indeed, he did so on charges brought by the Trump Justice Department…. This trial… in its substance is less grave than the other three prosecutions. Let’s stop there. How could it not be? Two of the others are tied to an attempted overthrow of the federal government. Perhaps the gravest crime possible. The other is absconding with boxes and boxes of highly classified documents… <https://public.hey.com/p/y8KNXAP4K1z3kdCPFcNV8a7d>

Re: Steve Inskeep:

After all these years (My wife and I got married about the same time Nixon's people were breaking into the Watergate Dem HQ.) I seem to have developed a pattern recognition gestalt for right wing propaganda. One characteristic is projection, accusing others of what you do. But these days I don't even read past the first red flag.

Suggestion: Couldn't we train an LLM on Uri Berliner, David Brooks, Friedman, and Ross Don'tDoThat and their ilk's works to identify crap and built it into a browser extension. (I know it would generate too much white space, but that sacrifice seems worth it.)

I suppose that Dani means that some of the returns on the investments going into the "manufacturing renaissance," net of the returns on the investment diverted by the increase in the deficit that financing those investments [too bad they were not financed with a consumption tax], will go to workers employed in these projects (assuming that wages earned in those activities are greater than in their next best employment), but that these "excess" earnings will not be great.

I agree.