BRIEFLY NOTED: For 2024-05-04 Sa

Estimated illegal border crossings since 1960; 1984 Apple Macintosh launch commercial; very briefly noted; Matthew Klein on practical nominal GDP growth targeting; surprise! a culture-war thing is...

Estimated illegal border crossings since 1960; 1984 Apple Macintosh launch commercial; very briefly noted; Matthew Klein on practical nominal GDP growth targeting; surprise! a culture-war thing is not, in fact, a thing; FTAlphaville makes fun of Tesla meme-stock boosters; & Macroeconomy Soft Landing Watch: Still in the Groove; PROJECT SYNDICATE: Musk Has Made Tesla a Meme Stock; Tesla Needs Its Tim Cook Now!; & BRIEFLY NOTED: For 2024-04-30 Tu…

ONE IMAGE: Estimated Illegal Border Crossings:

ONE VIDEO: Apple 1984 Macintosh Launch Commercial:

Very Briefly Noted:

Economics: Gillian Tett: How to tell good industrial policy from bad: ‘Experience shows that encouraging exports rather than slapping tariffs on imports works best…. Cherif and Hasanov… [say] there is an important difference between policies that try to create growth by shielding domestic companies from foreign competition and those which help those companies compete more effectively…. The former “import substitution” strategy… has given industrial policy a bad name… undermine[d] growth in the long term… excessively coddled, inefficient industries…. Insofar as western politicians are now increasingly happy to utter… “industrial policy”… is the goal to exclude competitors… via tariffs… make domestic producers more competitive and innovative… or… something else? Investors and markets need clear answers. So, more importantly, do voters… <https://www.ft.com/content/ef12d3a7-fbe6-4794-870d-53cd6ad1f4e8>

Robert Armstrong: The Frozen Fed: ‘The Fed… is utterly frozen… wants to be absolutely clear that there will be no cuts until the news on inflation improves… [but] not coming within commuting distance of the idea that a rate increase might be needed…. What justifies… confidence that policy is already tight enough?... First, the labour market continues to loosen…. Next, Powell is keeping the faith that rent inflation on new leases has fallen, and that this will show up in official measures of housing inflation, which are tilted to older leases, eventually... <https://www.ft.com/content/61a294d1-2038-48e4-bb57-775df1ecd63d>

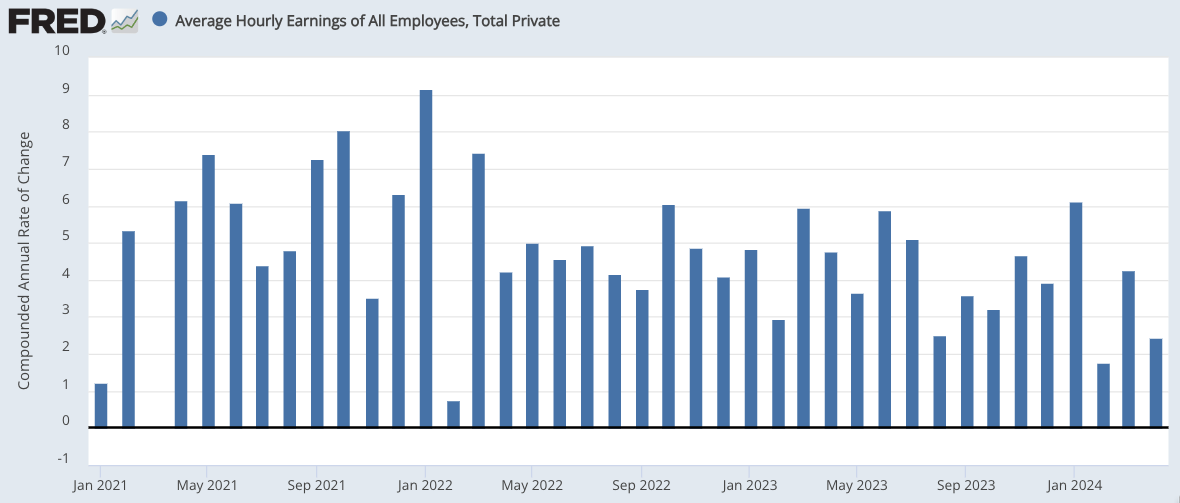

Matthew Klein: Is Nominal Wage Growth Starting to Slow?: ‘U.S. inflation may be much closer to normalization than I had previously thought. While it is too early to say it conclusively—among other things, the most recent numbers could be revised—the past few months of data on hourly wages are looking more and more like a break from the 2022H2-2023 pattern in which nominal wages steadily grew faster than what would be consistent with 2% yearly price increases… <https://theovershoot.co/p/is-nominal-wage-growth-starting-to>

Matthew Winkler: In Jamie Dimon's America, the Stock Market Has Already Voted: ‘Investors around the world value US equities more highly than ever before in what John Maynard Keynes might call the psychological referendum on the Bidenomics…. Dimon’s optimism on America is echoed by investors no matter where they are. JPMorgan is one of 17 US-based firms that make up the 20 most valuable companies in the world by stock market value, according to data compiled by Bloomberg. This was not always the case: Most of their superior valuations occurred during the past three years, a period when corporate America, led by Microsoft Corp., Apple Inc., Nvidia Corp. and Alphabet Inc., outperformed the rest of the world's publicly traded equities by a margin not seen since at least 1970, data compiled by Bloomberg show…. Don’t be fooled thinking it’s just about tech. Included in the top 20 biggest companies in the world are conglomerate Berkshire Hathaway Inc., drugmaker Eli Lilly & Co., retailer Walmart Inc., healthcare firm UnitedHealth Group Inc., energy firm Exxon Mobil Corp. and Mastercard Inc.

In other words, a good representation of America. All of which explains why the Business Roundtable’s survey of top CEOs and Duke University's survey of chief financial officers both show rising confidence in the last year of Biden's first term… <https://www.bloomberg.com/opinion/articles/2024-05-02/in-jamie-dimon-s-america-the-stock-market-has-already-voted?srnd=opinion>

Central Country: Dexter Roberts: ‘A 6,000-word profile of Xi Jinping that presents him as a market reformer comparable to Deng Xiaoping, the paramount leader credited with launching “reform and opening,” has been published by Xinhua, China’s official news agency. The article in English seems aimed at reassuring spooked foreign business and convincing them to continue to invest in China. Beijing is deeply worried following last year's extremely poor showing for growth in fdi, at a 30-year low. Calling Xi “another outstanding reformer in the country after Deng Xiaoping,” the profile notes that “the two leaders faced the same mission—to modernize China, but against strikingly different backdrops”… <https://substack.com/@dexter/note/c-51861262>

Neofascism: Simon Kuper: There are two Donald Trumps—but which is the real one?: ‘There’s another Trump… invisible to liberals… described by people who are themselves sensible conservatives. They think that we liberals with Trump Derangement Syndrome should put aside what Trump says and concentrate on what he does…. which is the real Trump—the dangerous narcissist or the sensible conservative?…. [The] American conservatives who are least keen on Trump: those who worked for him…. Only four of Trump’s dozens of former cabinet members publicly supported his re-election…. Trump is a “threat to democracy”, said former defence secretary Mark Esper. He’s “unfit to be president”, said former national security adviser John Bolton. Trump “admires autocrats and murderous dictators”, said former chief of staff John Kelly. Trump’s re-election “could mean the end of American democracy as we know it”, said former White House communications director Alyssa Farah Griffin…. These people are conservatives… courting ostracisation by their tribe. Cassidy Hutchinson… says: “It’s not easy . . . there are a lot of consequences that you have to brave when you make the break with Trumpworld.”… Mitt Romney describes a room full of Republican senators who greeted Trump with a standing ovation, listened to him respectfully, then “burst into laughter” the moment he left. There’s also an entire nonfiction genre of anonymous officials telling terrifying stories about his presidency… <https://www.ft.com/content/a9a305a9-278b-4226-b027-2d1641e955bc>

Justin Fox: Illegal US Border Crossings Aren’t Really Breaking Records: ‘Federal agents used to catch only a third of those trying to enter the country unlawfully from Mexico. Now it’s close to 90% as most simply turn themselves in…. By this measure, illegal crossings of the Southwest border were lower in 2023 than in most of the 1980s, 1990s and 2000s…. It’s a much different sort of illegal immigration than that of the 1980s to 2000s. Rather than mostly Mexicans trying to get past border agents, it’s people from all over the world turning themselves in and hoping they’ll be allowed to stay… <https://www.bloomberg.com/opinion/articles/2024-03-20/illegal-us-border-crossings-aren-t-really-breaking-records>

MAMLMs: Evan Armstrong: What happens next with AI hardware?: ‘I very much want these companies to succeed…. [But] to compete with Apple, AI hardware companies have three paths: 1. Get weird… use cases that are fundamentally different from smartphones… [and] markets where phones have proven ineffectual…. Experimenting with unconventional interfaces like brain-computer interfaces, haptics, or augmented reality could also help…. 2. Go screen-free… rely on voice… the Meta Ray-Bans…. Humane may have been right on this count. [3] Rely on the phone…. [Add] a hardware component acting as a supplemental sensor to gather data. Tab and Limitless are taking this approach… <https://every.to/napkin-math/the-ai-hardware-dilemma>

Dan Shipper: What Can Language Models Actually Do?: ‘Part one: Language models as text compressors…. Here’s a concise book summary of A Wizard of Earthsea that Claude created in the style of Scott Alexander from Slate Star Codex: “A Wizard of Earthsea is about the dangers of power without wisdom.

The young wizard Ged, in a fit of youthful pride and anger, summons a shadow creature from the realm of the dead. This goes about as well as you would expect. The shadow hunts Ged across the world and he must flee from it, until finally his old master tells him that he can’t run away from his own shadow. Ged realizes that the only way out is through—he has to turn around, chase down the shadow, and reintegrate it into himself. This is a pretty standard ‘power corrupts’ story, but it's unusually wise in depicting Ged's flaw not as a desire for power itself, but as a lack of education in how to use power. Ged isn't evil, he's just young and dumb. His eventual victory comes from understanding how the universe works, not from overwhelming firepower. The real treasure was the wisdom he gained along the way. Le Guin once said her books were about ‘the journey that is inward, and not the other journey.’ A Wizard of Earthsea literalizes this, as Ged sails further and further away from the known lands in pursuit of his shadow, only to realize he has to integrate it back into himself. We all have to take this journey eventually. The shadow represents the parts of ourselves we try to deny and push away. But there's no escape—in the end, the only way to grow is to acknowledge your shadow, accept it, and become whole…” I don’t know if this is exactly what Scott Alexander would write about A Wizard of Earthsea, but it’s certainly in the neighborhood…. As the cognitive scientist Alison Gopnik has written, language models are cultural technologies. They give us the best of what humanity knows about any topic—in the right form for any given context. In that way, language models are an extension of a trend that started with writing itself and has extended to the printing press, the internet, and finally our present moment with AI. This is a superpower for creatives... <https://every.to/chain-of-thought/what-can-language-models-actually-do>

War: Kamil Kazani: Why is the Weaponry so Expensive?: ‘Complexity and Bullshit…. These two are independent variables…. Complexity is about how easy it is to f--- it all up… an aircraft engine… a cast iron pot…. Bullshit is about suboptimal, cost-inefficient solutions, design & execution-wise… <https://kamilkazani.substack.com/p/why-is-the-weaponry-so-expensive>

SubStack NOTES:

Economics: Has the Fed moved to a 5.5% per year nominal GDP growth target—or whatever is necessary to push the short-term nominal Treasury interest rate to the level at which the Federal Reserve as 5%-points of monetary ammunition to fight a recession? We have thought so since at least 1992. I think the Fed might agree—but I do not think the Fed will act on this proposal until after we have a year of the annual lookback core PCE chain price index at or below 2% per year:

Matthew Klein: The 6% Solution: ’U.S. spending and incomes continue to grow a bit faster than before the pandemic. And that’s okay…. “A monetary framework… should be [one].. that contemplates enough room to respond to a recession… [with] nominal interest rates in the range of 5 percent in normal times.… If I had to choose one framework today, I would choose a nominal GDP target of 5 to 6 percent…”. Larry Summers…. One could be forgiven for thinking that [Summers’s] views have guided [Federal Reserve] actions…. The U.S. economy remains settled in the stable ~5.5–6% yearly nominal growth trend it has occupied since mid–2022…

Journamalism: Just planting a stake in the ground to say, as Freddie de Boer tries to launch yet another AI-culture war, that you should first check that what Freddie de Boer says is a thing is in fact a thing—and a robust, representative thing. In this case, it does not, in fact, appear to be a thing. My very first three tries:

Freddie de Boer: Why Doesn't AI Want to Show Me Jesus Washing the Feet of His Disciples? it's a conspiracy <freddiedeboer.substack.com/p/why-doesnt…>

Economics: FT Alphaville is making a lot of fun of Morgan Stanley autos unexpected AI companies analyst Adam Jonas:

Bryce Elder: Tesla soul-searching with Adam Jonas: ‘“The AI brain is searching for its robot ‘body.’ And the body is the vessel of the AI ‘soul’”, writes Adam Jonas in an actual note to clients. Morgan Stanley’s autos analyst has been moved to aphorise by Elon Musk’s surprise visit to Beijing. Less contemplative observers might think Tesla shares are being short-squeezed up ~10 per cent today after Bloomberg reported that the company has received tentative clearance to sell full-self-driving in China — a possibility Musk had flagged during last week’s results conference call. More important, says Jonas, is the signal that Musk still loves Tesla…. Titled “He’s Back”, the note reiterates Morgan Stanley’s (recently lowered) $310 share price target on Tesla, of which extant businesses contribute $67… <https://www.ft.com/content/067b0dce-f34a-4853-8bbe-0ce674e36d04>

Jamie Powell: The best of Morgan Stanley's Adam Jonas: ‘Jonas' change of heart comes as a surprise to Alphaville, as for many years he's been a vocal bull on Tesla — projecting it as a future leader in electric vehicles and autonomy. So to commemorate the mood swing, here are five of our favourite Adam Jonas quotes from Tesla's various quarterly conference calls over the years…. “we're thinking proprietary low earth orbit satellite network to enhance the connected autonomous car ecosystem. Just want to get your thoughts on that…”. “is there anything that SpaceX is doing that—or enabling that could be advantageous to Tesla's mission to accelerate sustainable transport?…” “Some argue that SpaceX could offer Tesla a resilient cybersecure pipe for this precious vehicle data and a potential competitive advantage…”. … <https://www.ft.com/content/c7f28e95-c6ca-3d24-b3cf-1f6e7ef57ce5>

Bryce Elder: Adam Jonas explains why Tesla will be better at being Nvidia than Nvidia: ‘A 66 page research report from Morgan Stanley analyst Adam Jonas and six of his colleagues…. Here’s the gist of the argument. Teslas “are sensor encrusted robots making life and death decisions in highly unpredictable environments and situations.” Their next-gen proprietary brain will be the Dojo chip, being developed in-house by Tesla for the specific purpose of ingesting lots of data. Whereas ordinary chipmakers have to think about whether their new silicon will still be able to run Apache Spark and FIFA 23, Tesla’s GPU team has had a Mr Miyagi-like focus on advanced driver assist systems…. Morgan Stanley presumes the Dojo chip will deliver performance six times better than the current-but-one generation of Nvidia A100 GPU boxes, at less than the current $200k-per-unit cost of a single Nvidia box… <https://www.ft.com/content/d7f139d3-aebb-4932-8c0e-034c92bce963>

It is really hard to know what to say, other than that FT Alphaville is right to say that the speed and magnitude of the pivot from “Tesla to the Moon because of variable X!”, where definitely variable X ≠ AI, to “Tesla to the Moon because of AI!” does deserve some sort of a prize.

Reading Freddy deBoer's post makes me wonder what Claude would do with a story where a Ged like character is faced a real external enemy and has to get past his own introspection to fight it? A friend of mine is a veterinarian. There's a saying in vet school, if you hear hooves, think horses not zebras. They had a zebra on the grounds along with the other animals. The zebra, as zebras are, was cantankerous and often broke out of its stall or the corral and went on a zebra rampage. So, while they were taught to think horses not zebras, they learned that when one heard hooves that it was probably that damned zebra.

Kuper: Just looking at the Tax Cuts for the Rich and Deficits Act, PPP, the attempt to repeal ACA, slashing legal immigration, trade wars against our allies is plenty to disqualify Trump from ever holding any elective office again.