CONDITION: No, We Do Not Know What Is Going on in China Right Now

FOCUS: Elon Musk Does Not Look Like He Is Rage-Tweeting to Me…

I think Matt Yglesias misses the main story here.

It is not so much that Elon Musk is a victim, but rather he has been a beneficiary of the social media ecosystem. He has drawn lessons as to what plays to run. And so now he is trying to rerun his plays because they worked in the past. But he is trying to rerun them in an enviroment where they are unlikely to work.

Engineers at Tesla and SpaceX have done great things. Auto competitors took the plague-years chip shortage not as a problem to be solved but as a convenient way to organize a cartel to cut their production, and so did Tesla a great favor. But those did not make Musk a 100-billionaire. Musk became a 100-billionaire via social-media celebrity and the meme-stock channel—not by virtue of owning large chunks of companies that saw the greatest jumps ever in the rationally-expected present value of their properly discounted future earnings. Think of him as a walking, talking, tweeting DogeCoin:

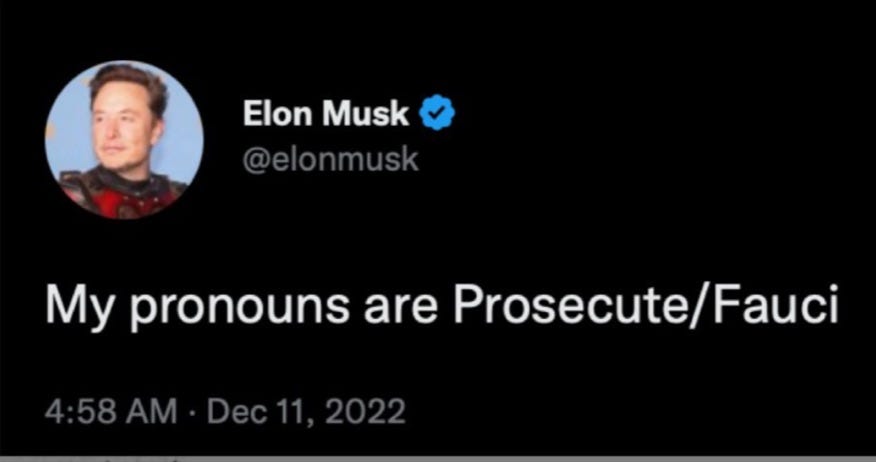

Matt Yglesias: Elon Musk is the latest victim of the online ragetrap: Don’t spend all day nursing grievances and making yourself miserable: ‘The other day, Elon Musk joked on Twitter that “my pronouns are Prosecute/Fauci.” It’s a mean spirited joke from Musk, who we already know enjoys mean jokes about trans people—the suspension of the Babylon Bee for making a mean joke about Rachel Levine was an important motivator of Musk’s decision to buy Twitter…. The pronouns thing references a genuine dispute in American politics and culture. Small numbers of people really are using they/them pronouns or socially transitioning from she/her to he/him, and if someone wants to spend their time being angry about that then I think that’s a weird decision, but they are, in fact, choosing to be angry about a thing that is happening…. But if you’re sitting here in mid-December 2022 getting mad at Fauci and Biden for imposing repeated rounds of lockdowns, then you’re getting mad about something you made up. A pseudonymous wag using the handle @ToiletGun quipped a couple of years ago that “Twitter is 90% someone imagining a guy, tricking themselves into believing that guy exists and then getting mad about it”…

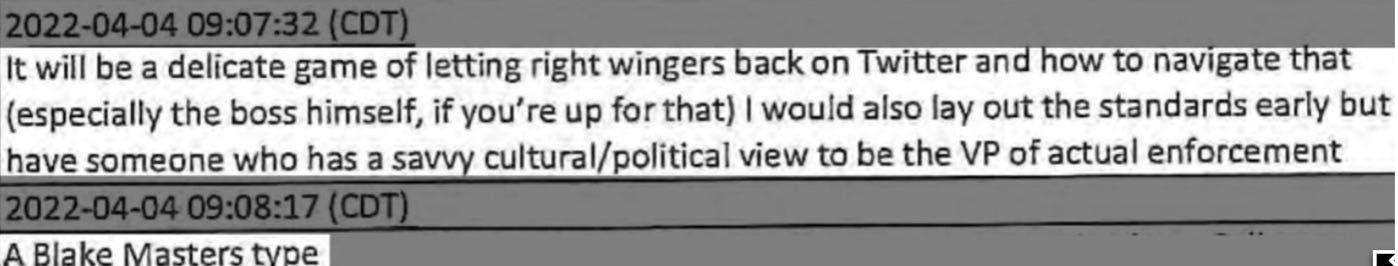

As Chance pointed out, Musk’s rage-tweets appear to be following a script set out last April, when somone whose name was redacted by the Delaware Court of Chancery sent him what I think is a Signal message:

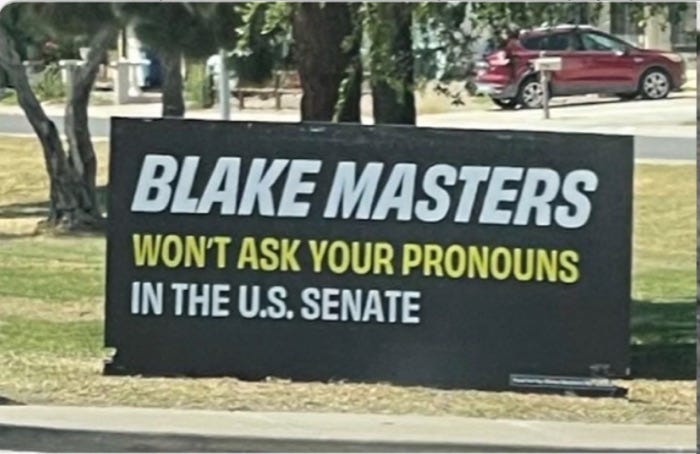

Who is Blake Masters? He is a sycophant of right-wing Silicon-Valley nutcase plutocrat Peter Theil, who ran a strange unsuccessful campaign for Governor of Arizona backed by oodles and oodles of Theil’s money. And when I say “strange”, I mean “strange”:

Elon Musk appears to have taken the April advice of his still-unknown interlocutor seriously, but to have decided to cut out the middleman. Here is what Matt calls the ragetweet:

Taking Blake Masters as a model, and doing so seriously, is, I think, the only way one could ever think including “pronouns”, “prosecute”, and “Fauci” in a five-word sentence.

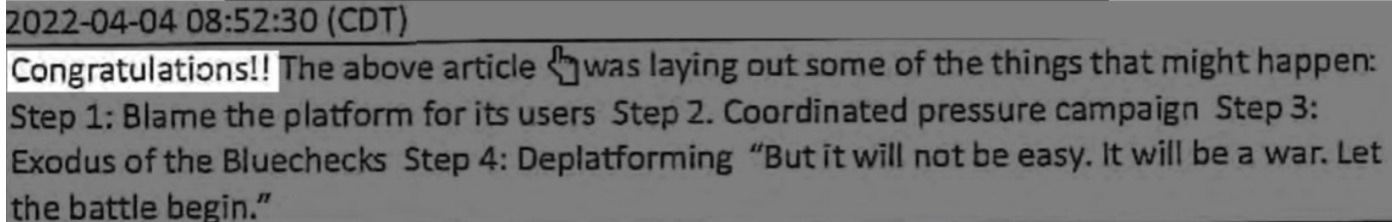

“Emulate Blake Master” and “delicately let the neo-Nazis back on Twitter” are not the only pieces of advice Musk was given. The interlocutor had, 15 minutes before the “Blake Masters” signal, advised Musk thus with respect to his takeover of Twitter:

“Blame the platform”, check.

“Coordinated pressure campaign”, check.

“Exodus of the Bluechecks”, well, Musk is certainly trying.

“Deplatforming ‘But it will not be easy. It will be a war. Let the battle begin’”. It certainly looks like it is underway.

Chance reports that the “above article” is this unhinged antisemitic provocation:

<https://www.revolver.news/2022/04/elon-musk-buy-twitter-free-speech-tech-censorship-american-regime-war/>: “Transforming Twitter back into a real free speech platform would represent nothing less than a declaration of war against the Globalist American Empire…. If Elon Musk bought Twitter and did nothing more than return it to the speech norms it had ten years ago, that act alone would constitute a ‘national security threat’, The threat posed to America’s joke institutions and the clowns who run them would be, in fact, existential…”

And sums up: “It's actually kind of banal how closely [Musk] is hewing to this timeline that [redacted] sent to him back in April…”

Two obvious conclusions:

Chancery Daily is very much worth paying for…

Tesla’s market capitalization rocketed from $15 billion in July 2019 to a peak of $400 billion and now down to $140 billion; SpaceX’s non-market valuation appears to be around $150 billion, up from, well, not very much in 2019. Forbes guesses Musk is currently worth $180 billion—a 33% ownership share of both companies. Musk is a billionaire, yes, but Musk is a hyperbillioniare only because he, personally, became a meme stock during the plague. Ownership and use of Twitter is a way to maintain that meme-stock celebrity position. In short, this is not “capitalism” as we have known it.

BRIEFLY NOTED:

ONE AUDIO: Þe Macro Outlook on Odd Lots:

Tracy Alloway & Joe Wiesenthal: Where Things Stand Now With Inflation and the Fed: ‘Last week was a big one. On Tuesday, we got a CPI report that came in substantially cooler than expected. Then on Wednesday, the Fed hiked 50 basis points, which was a step down from the series of 75 basis point hikes that we had been getting at recent meetings. So where do things stand now? When will we get a proper pivot? When will the Fed feel confident that inflation has been defeated. We spoke with two macro guests: Jon Turek, founder of JST Advisors and author of the Cheap Convexity Blog, as well as Tim Duy, Chief US Economist at SGH Macro as well as a Professor of Practice in economics at the University or Oregon. They gave as their readings on inflation, the Fed, and what to watch at the start of 2023…

<https://overcast.fm/+5AWM0p0s0>

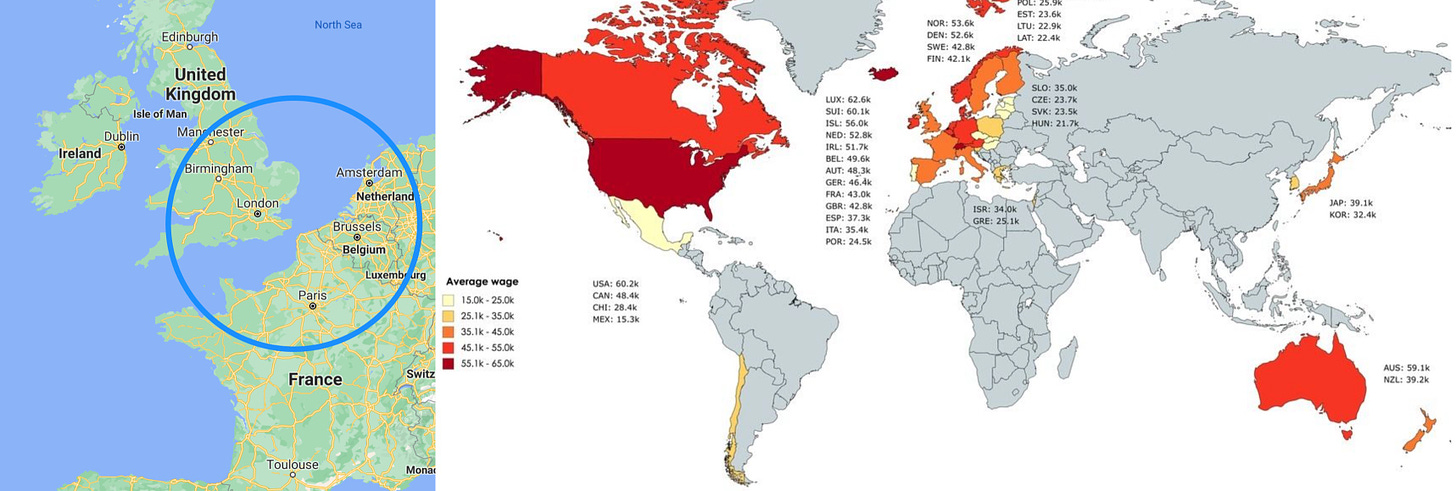

ONE IMAGE: The Dover Circle—& Þose Places Its People Have Settled, or Where People Have Thoroughly & Successfully Emulated Its Culture & Institutions:

MUST-READ: A Nice Review of Blinder’s Monetary & Fiscal History:

James Surowiecki: Taming the Economy: The story of fiscal and monetary policy over the last 60 years is the story of what government can and should do to the economy: ‘It’s hard to imagine a better moment for Alan Blinder’s new book, A Monetary and Fiscal History of the United States, 1961-2021…. That book offers pretty much exactly what the title promises, a blow-by-blow chronological history of the evolution of American monetary and fiscal policy over the last 60 years, along with short biographical sketches of key figures in that history, and sharp analytical riffs…. [The] narrative is, on the whole, one of progress, however halting. That’s especially the case when it comes to monetary policy…. One of the most striking things about Blinder’s book, in fact, is its reminder that the Fed in the 1960s and ‘70s seemed to be very much flying by the seat of its pants…..

The Federal Reserve also used to be far more politicized. The exemplar of this, in Blinder’s account, was Arthur Burns, head of the Fed under Nixon, who kept the President (who was his friend) in the loop about interest rate cuts and, Blinder argues, helped engineer a miniboom before the 1972 election in part in order to get Nixon reelected. But it wasn’t just Nixon…. That changed, really, with Bill Clinton, who despite being angry at Alan Greenspan for raising rates heading into the 1994 midterm election was convinced to hold his tongue (in public, at least). This continued for two decades, until that norm, like so many others, was shattered by Donald Trump….

The Fed has been more patient and less anxious to raise interest rates than it was in the 1980s and early ‘90s. And while we may in part be paying for that now with higher inflation, it’s also the reason unemployment before the pandemic fell to 3.5 percent, lower than it’s been at any point in the last 50 years, and why it returned to that low this year lower than it’s been at any point in the last 50 years. That’s made life materially better for millions of workers who might now be without a job if the Fed had raised interest rates too soon. If the story Blinder tells of monetary policy is, generally speaking, the story of the Fed becoming more technocratic and systematic in its approach, the story of fiscal policy over the last 60 years is, predictably, much messier...

Very Briefly Noted:

Martin Sandbu: Central banks should beware mistaking wage rises for an inflation problem: ‘Profound changes in labour markets since the pandemic may mean that many workers and companies are more productive…

Bill Dudley: Investors Would Be Better Off Believing the Fed: ‘If markets remain optimistic, the central bank will just have to tighten more to achieve its inflation objective…

Bill Gross: The Fed needs to stop raising rates: ‘With too much hidden leverage around, the central bank should wait to see if the punch bowl has been sufficiently drained…

Leticia Miranda: Amazon Is Ubiquitous. But It Isn't Invincible Anymore: ‘The firm has written the rules of modern retail. After a disappointing year, it may not be able to keep winning at its own game…

Jason Garcia: DeSantis Leaves Floridians At The Mercy Of His Insurance Donors: ‘A rewrite of Florida’s property insurance laws will usher in the state’s most sweeping civil lawsuit restrictions since Jeb Bush was in office…

Therese Raphael: View to 2023: Sometimes the Future Is Obvious: ‘Sometimes we don’t need to look beyond the current weather patterns to see a storm is coming. If the last year taught us anything, it was to take the known risks and double them...

Gideon Rachman: The year the strongmen stumbled: ‘Putin’s decision to invade Ukraine demonstrated why authoritarian rule so often ends in disaster…

Noah Smith: Geopolitics and geostrategic competition in 2023: ‘Russia is not winning the war, but it is not yet losing either.

¶s:

Mark Gongloff: With Elon Musk Off the Reservation, Tesla Needs Adult Supervision: ‘An activist investor would do the trick, if only the CEO and his pliant board weren’t in the way…. The world’s largest electric-vehicle company, the value of which had plunged by 60% this year…. At many other struggling companies, an activist investor would have swooped in to clean up this mess by now, Liam Denning notes. But Tesla is a special unicorn, whose CEO is a god-king with robust defenses against investors. One of those is a board made up of Elon Musk’s brother, several mannequins and a life-size cutout of Michael Jordan riding a model train. Good luck getting any influence there…

Ruchir Sharma: How private markets became an escape from reality: ‘The rage for private investing began in the early 2000s, after the success of the Yale University endowment fund led by David Swensen…. Swensen’s definition of “long” was decades…. He looked for private managers who were building companies…. Swensen defined his job as generating multigenerational wealth…. What started as a sound idea has become an escape from something else entirely: reality. In return for the promise of superior returns, private funds typically “lock in” client money for up to 10 years, then report to clients much less frequently than public funds do…. In the new tight money era, with losses spreading across asset classes, private channels have become a way for money managers to conceal losses from clients… who are often content in the dark…

Dan Drezner: The Possible Limits of American Polarization: ‘With Democrats in the Senate and the White House… Republicans] have fewer bargaining chips to play. They can threaten to defund the government or refuse to raise the debt ceiling—but that requires the kind of hostage-taking tactics that will alienate Biden-leaning districts and more moderate Republicans. When Trump tried it in 2019, it ended badly for him…. The House GOP’s other option is to use their oversight powers to investigate and harass the Biden administration…. I’m not saying that Republicans will use their majority to make life easy for Biden. I’m not saying Kevin McCarthy is the second coming of Bob Michel. What I am saying is that for the past decade, many observers have wondered if there is a limit to how far right the GOP can shift. And for the first time in a while, that limit is becoming visible…

Because the auto companies weren’t willing to buy an earlier place in the backlog line during the chip shortage.

I miss reading Tim Duy every day. Thanks for sharing that.