In “Þhe Market vs. Social Justice”, Remember Þt þe Ruling View of Social Justice Is Often (Usually?) Very Unjust Indeed

& BRIEFLY NOTED: For 2022-10-24 Mo

FIRST: In “Þhe Market vs. Social Justice”, Remember Þt þe Ruling View of Social Justice Is Often (Usually?) Very Unjust Indeed:

There was an interesting note on Twitter about Slouching Towards Utopia <bit.ly/3pP3Krk> yesterday AM:

Peter Baird: ‘DeLong’s view of human rights: Hayek: only accrue to holders of valuable property; Polanyi: popular revolt adds ”moral" rights . This seems to ignore society getting up in the am, splashing its face, and saying ‘what rights shall we affirm today?’ then watching Fox:

Well: yes. And also: no.

I did not intend to ignore that mode of "society" at all—hence the quotation marks around “moral”. A political movement’s view of what “social justice” is can be something that is very unjust, and usually (almost always, by our lights?) is. The Polanyian-rights reaction against the market—against the catallaxy’s insistence that the only rights that count are property rights—can take forms that are: reactionary, socialist, authoritarian, social democratic, fascist, fundamentalist, nationalist, militarist, democratic, cultist, and probably more; moreover, such movements can often be captured or partially captured by those whose social power is based on the catallaxy’s past rewards to them gained by luck, force, and fraud.

Do remember: Jake Soll’s <https://t.co/VRln7S91JZ> book begins with Aristotle, Cato, & Cicero scared of and trying to grapple with the consequences of the mercantile catallaxy that they see disrupting the social justiice of the city-state of the oligarchic republic via its elevation of those devoted to chrematistike over the proper wielders of social power

One big difference between Jake’s book and mine is that the period he covers—well, my index of the value of the stock of human technology deployed-and-diffused in the world economy stands at:

0.2 in -300 (“ancient mode of production”, as Freddie from Barmen would say),

0.4 in 1400 (“late feudal”), and

0.8 in 1800 (“late gunpowder-empire”). It then stands at:

1.6 in 1895 (“late steampower/early 2nd Industrial Revolution”),

3.2 in 1935 (“mass production”),

6.4 in 1970 (“mass consumption”),

12.8 in 2000 (“global value chain”),

and now we are moving into the “info-biotech” economy.

It is not just one movement from status to contract and one grappling with the form and requirements of modernity. It is repeated technological revolutions that change how we live and, indeed, who we are. But it took 1700 years to go from ancient to feudal, 400 from feudal to late gunpowder-empire, but only 100 to go to late-steampower, and then 35 each for mass production, mass consumption, global value-chain, and on into the future. And with each transformation of the mode-of-production trhe von Hayek-Polanyi tension takes a different form, and requires new ways of… not of “resolving”, but rather of “papering it over”.

Because the changes in the forces-of-production hardware since 1870 have been so fast and so furious, the chances of being able to land on a rough cobbled-together running socio-econo-political software code to create a stable society are rather low. This is in contrast to what happened before, in the times that Soll’s book covers, when there was a lot of time to repurpose, old furniture, construct new, and in general adjust the relations-of-production (and -communication, and -domination) software to the forces-of-production hardware.

No, this does not mean that back before 1870 things were in any sense at all "better". They were perhaps more stable, in the sense that the structure of society was rarely abandoned. But there was lots of a differnet form of instability, in the sense of different potential élite factions spending nearly all of their attention and their energy elbowing each other out of the way.

And, of course, back before 1870 the principal end toward which societal energy was directed was not advancing knowledge and deploying technology to uncover “the knowledge of causes, and secret motions of things; and the enlarging of the bounds of human empire, to the effecting of all things possible”. It was, rather, running the force and fraud mechanism by which the elite grabbed enough for its members and their families, since there was no prospect of there being enough for all.

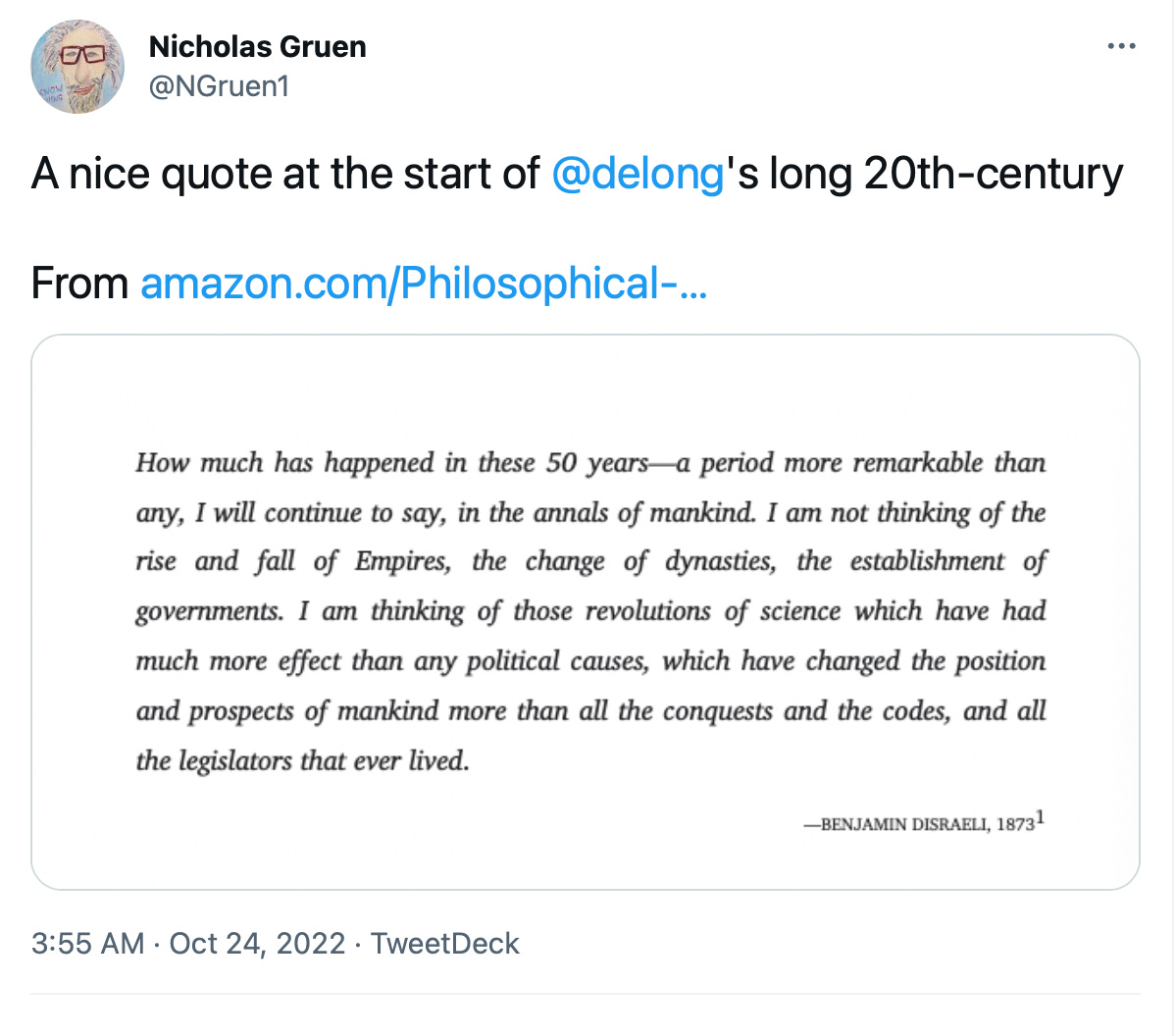

One Image: Benjamin d’Israeli, 1873:

One Video: Bell’s Theorem:

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Margaret Sullivan: There Are Only Five Media Stories: ‘Evils of Facebook... the tragedy of local newspapers’ decline... Fox News damage-to-society... ‘don’t magnify political lies’ column... the mainstream media’s intransigent flaws...

Phillip Coggan: Free Market — the boundary between state and the economy: ‘A timely and erudite history traces our ambiguous attitudes towards moneymaking and laissez faire trade…. Free Market: The History Of An Idea by Jacob Soll…

Chad Orzel: Never Tell Me the Odds: ‘To repurpose a famous sports cliche, the chances of success for risks you don’t take are identically zero. The odds of academic career success are long, but they’re better than that. Sometimes it’s worth just tossing the dice…

Dexter Roberts: Trade War: ‘Yeah, this is complete, total dominance…. Politburo Standing Committee… Xi himself… Li Qiang, Zhao Leji, Wang Huning, Cai Qi, Li Xi, Ding Xuexiang…. No designated successor. (Ding is 60, whereas heirs are typically appointed in their early to mid 50s)…

Xiao Zibang, Sarah Zheng, & Krystal Chia: The Seven Men Who Will Lead China Into Xi’s Third Term: ‘Li Qiang gets No. 2 seat despite chaotic Shanghai lockdown…

¶s:

Andrew B. Abel & Stavros Panageas: Running Primary Deficits Forever in a Dynamically Efficient Economy: Feasibility and Optimality: ‘Government debt can be rolled over forever without primary surpluses in some stochastic economies, including some economies that are dynamically efficient. In an overlapping-generations model with constant growth rate, g, of labor-augmenting productivity, and with shocks to the durability of capital, we show that along a balanced growth path, the maximum sustainable ratio of bonds to capital is attained when the riskfree interest rate, r[sub]f, equals g. Furthermore, this maximal ratio maximizes utility per capita along a balanced growth path and ensures that the economy is dynamically efficient…

Azeem Azhar: Climate tipping points ‘One example of a huge grid-scale battery: CATL is building a 1.4 GWh battery in Nevada for solar storage (enough to power more than 50,000 American homes for a day.) Why this matters: Shifting the narrative around the clean transition is critical to driving more adoption and greater investment. Here is the story I tell: the clean transition is happening rapidly, and it is getting cheaper and cheaper. There might be the occasional bump in the road as supply wobbles and commodity prices rise, but the overall trend is ineluctable...

Catallaxy? New word to me. Is that the word we use when we want to say "economy" but make fun of righties at the same time?

Re Margaret Sullivan's piece: James Fallows has a useful reflection on his Substack "Breaking the News": https://fallows.substack.com/p/there-are-only-five-media-stories?utm_source=substack&utm_medium=email

"Shifting the narrative around the clean transition is critical to driving more adoption and greater investment." It SHOULD. It implies that the integral of the function o the optimal tax on CO2 emissions is smaller. In turn, that SHOULD reduce opposition to the tax or it's dual. Whether it does, or not depends on the political messaging: less paint thrown on fewer art works, fewer lumps of coal brandished about in fewer parliaments.