CONDITION: Waiting for TapBots’s Mastodon Client, Ivory:

FOCUS: Industrial Strategy for a Rich, Leading-Edge, Economy:

The smart Yakov Feigin points out that almost none of the literature on successful industrial policy applies to an economic-leader country. It is all, since the days of Alexander Hamilton, about how to be at best a fast second. The problems of pushing forward the technological frontier and then applying it are much more difficult.

Moreover, the experience of Japan suggests that institutions and practices that are very good at generating fast-followership and catch-up flop on their face when even a highly competent and technocratic government attempts to direct the process of innovation and frontier development.

Can we do more than simply throw huge bushels of money in the general direction of as many kinds of institutions as we can think of that might have purchase on the problem? That would be a depressing conclusion. That may be what we should do—we are, after all, massively certain that we are underinvesting in R&D and then downstream in technology deployment:

Yakov Feigin: Problems of an American Industrial Strategy I: Kindleberger's Dilemma and the Development State: ‘Gerschenkron's most famous idea is that states that are “backward”… have an advantage in achieving rapid growth.… You have a large population that is effectively under-employed in a low-productivity sector…. If the technology is already known… there are problems that they will hit along the way and a challenging political economy, but let's leave it at that. There is no equivalent theory for an advanced, developed country like the United States. Moreover, no theory can account for the unique features of the American economy vis-a-vis the rest of the world. Many of us who advocate for industrial policy see it as a way to quickly upgrade our capital stock to the challenge of climate change and geopolitical threats. As of yet, we have had no theory about how to do this in a country where you already have the world's largest economy. At most, what we have is a theory of innovation….

The East Asian developmental model… land reform first… entering world markets… giv[ing] your firms more experience and, most importantly, the feedback of a market where they are not as protected…. Successful developmental states use market prices generated by consumer demand for feedback. Michael Pettis describes this as exporting their forced savings and importing foreign demand!…

And Yakov has another very interesting thing to say:

Kindleberger[’s] system of hegemonic stability requires that the country at the top of the hierarchy accept… free ridership…. It can spend as much as it wants and tell bond vigilantes to shove it where the sun doesn't shine…. Yet… you need to open your capital and current accounts… lose the ability to have substantial control over the real economy and its growth…. I call the Kindleberger dilemma the tradeoff between monetary and real-side sovereignty…. If you try to make the US a trade superpower, you will have to decrease American consumption and export the surplus. This breaks the bank, and the world descends into depression and instability…

Which is primary? Maintaining a global trade-and-development system aimed at helping the world gallop toward peace-and-prosperity? Or grabbing the lion’s share of the gains from new technologies for one’s own people? Over the long 20th century, so much of the second was happening anyway in the United States, because of the existing pattern of industrial and technological development, that the United States could, for much of the era, focus on the first. But I see no reason to think that that is true any more.

MUST-READ: Þe Balance of Risks Is Þt þe Fed Has Now Overdone It:

It is, IMHO, touch-and-go with respect to whether we will be able to avoid another round of secular stagnation with interest rates at their zero lower bound:

Colby Smith & Caitlin Gilbert: US unemployment rate set to surpass 5.5%, economists predict: FT/IGM poll suggests waning optimism the Fed can tame inflation without causing material job losses Of the 45 economists surveyed, 85% project that the National Bureau of Economic Research — the arbiter of when recessions begin and end — will declare one by next year: ‘Despite Fed chair Jay Powell’s and other top officials’ insistence that a “soft or softish landing” is possible given the historically tight labour market, the bulk of the economists polled see a period of pain on the horizon…. “A soft landing is extremely difficult and it almost never happens in history,” said Giorgio Primiceri… An overwhelming majority see the central bank wrapping up its rate rises in or before the second quarter of next year and for the bulk of the economic effects to be felt in the latter half of 2023 or early 2024…. Brad DeLong, a survey participant at the University of California, Berkeley, said he is far more confident today that price pressures are not becoming entrenched in the economy, not least because expectations of future inflation still remain under control. The bigger concern, he said, is the Fed overreacting at this stage and causing unnecessary economic damage. “The major risk is on the downside — that the Federal Reserve overdoes it and we wind up back in secular stagnation with interest rates back at zero and no one able to get the economy moving again”…

ONE VIDEO: Immersed!:

I’m starting to really want my Apple AR headset:

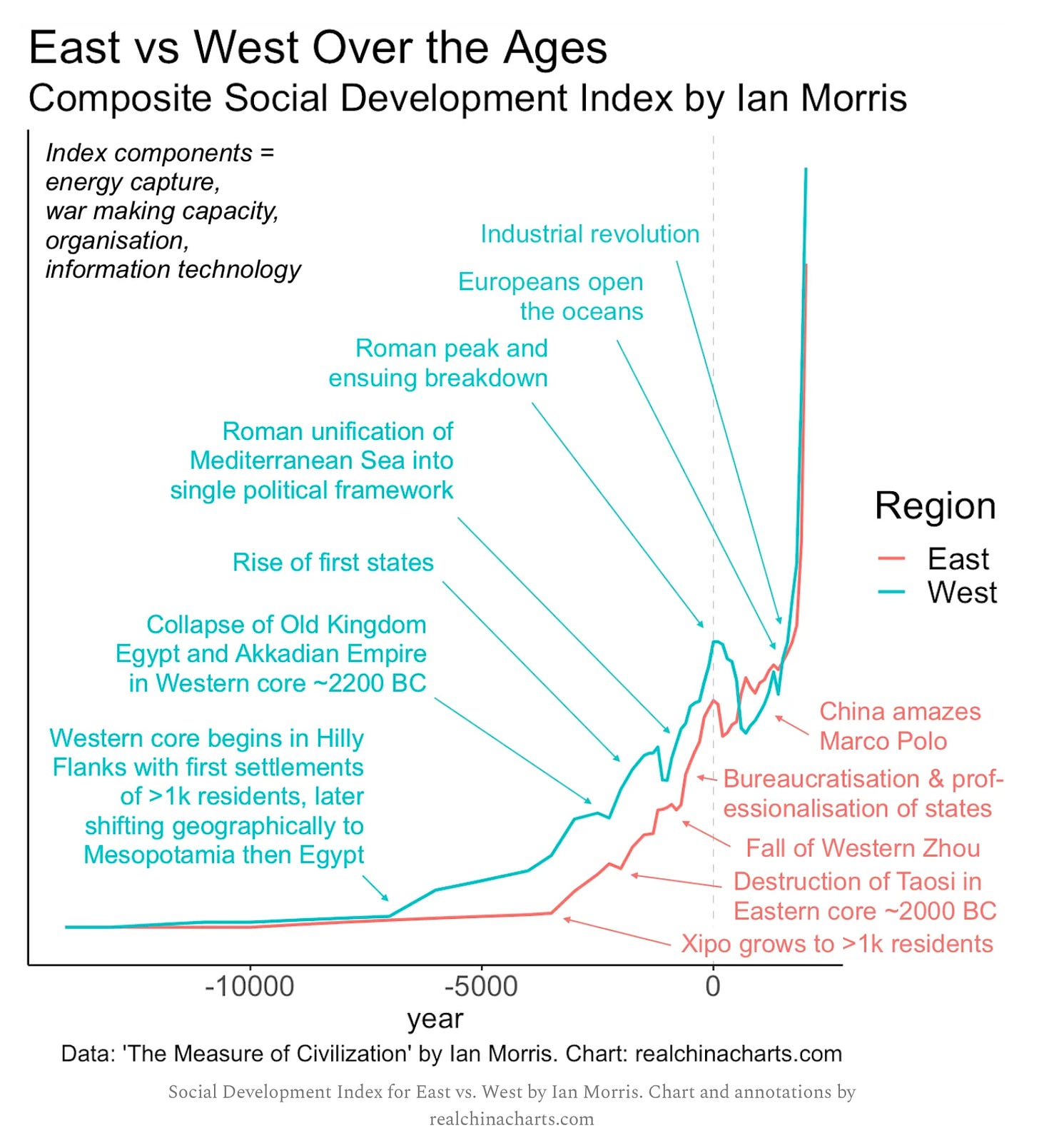

ONE IMAGE: I Appreciate Ian Morris’s Trying to Do Þis, But…:

Isn’t “energy capture” after the year -2000 largely wheat vs. rice? And what is this “western core” that travels so far across the ages, while the “eastern core” remains two neighboring river valleys? In what sense is it the “core” of a “civilizational tradition”? That Victorian Englishmen thought they wanted to be and claimed they were the sole legitimate heirs of Cicero and Demosthenes is interesting, but does not make it so:

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Economist: These are The Economist’s best books of 2022: ‘Slouching Towards Utopia. By J. Bradford DeLong…. Written with wit, style and a formidable command of detail, this book places the successes and disasters of the 20th century in their economic context. In doing so, it provides insights into how things have gone wrong in more recent years—and what must go right if catastrophe is to be avoided in the current century…

Wikipedia: Aneutronic fusion…

Noah Smith: The dream of bringing back Bell Labs: ‘Was America's most famous corporate lab a product of its time, or something that can be reproduced?…

Nate Cohn: Turnout by Republicans Was Great. It’s Just That Many of Them Didn’t Vote for Republicans: ‘No, the main G.O.P. problem wasn’t prioritizing Election Day voting over early voting…

Yuan Yang: We need an honest east-west discussion about industrial policy: ‘Europe and the US are breaking a taboo that east Asia was never afraid of…

Sam Feldman: Brave vs. Chrome: Which Browser is Better?…

Zvi Mowshowitz: Sadly, FTX: ‘I have seen claims [Alameda] actually lost all the money that was made on the Japan trade through bad trades and recklessness, and that Sam was taking insane risks all over the place, including a likely disregard for legal risks and structures. He was definitely posting Twitter threads justifying exceeding the Kelly criterion…

Alexandra Scaggs: Labor markets look good. US manufacturing does not…

J.M. Berger: My heart is human, my blood is boiling, my brain I.B.M: ‘As long as A.I. is created first for verisimilitude, we’re going to have this problem, an arms race to see who can develop the most convincing generative liar. WHAT COULD POSSIBLY GO WRONG? To its credit, ChatGPT will tell you the truth about itself when asked. Unfortunately, too many people are willing to rush right past its statement of identity…

John Halpin: More Emotions, Fewer Statistics: ‘Politicians are unable to connect with most Americans because they don’t experience economic anxiety on a regular basis...

Meghan MacPherson: Trump's call to suspend Constitution not a 2024 deal-breaker, leading House Republican says: ‘Republican Ohio Rep. Dave Joyce said Sunday that... Trump's comment should be taken "in context" but that it wouldn't prevent him from supporting Trump if he ends up winning the nomination...

¶s:

Diane Coyle: The Double Transformation: ‘The world’s advanced economies are in the midst of dual structural transformations… digitalization… [and] the shift to a carbon-neutral economy…. For four decades, the prevailing view among economists has been that… the state… sets the legal framework, builds infrastructure, and funds basic research, while the private sector innovates and creates wealth…. xisting antitrust-enforcement frameworks are ill-equipped to address the challenges posed by winner-takes-all digital markets…. The net-zero transition…. Competition policy typically opposes companies sharing information with each other…. [But] sharing data among firms is essential to reducing waste, increasing energy efficiency across supply chains, enabling autonomous-vehicle adoption and efficient transport management, and reducing entry barriers in digital markets…. Policymakers must be careful when weighing the strategic benefits of technocratic competition and industrial policies…

Andrew Marvell: An Horatian Ode upon Cromwell’s Return from Ireland: ‘Though justice against fate complain,/And plead the ancient rights in vain;/But those do hold or break/As men are strong or weak./Nature that hateth emptiness/Allows of penetration less,/And therefore must make room/Where greater spirits come…

Chance: When the 'Chute Fails: ‘Elon Musk and Donald Trump… have in common… a willingness to flout rules…. In many circumstances throughout history, businesses and individuals chose to do what they had contracted to do, not because there was no feasible way out of the deal, but because it made sense to just be a person of integrity. The rules that might be voted “Most Likely to be Flouted” in high school superlative terms are generally those enforced by societal, reputational, and policy pressures — not by strong, bright-line consequences or rigid and swift application of the legal system…. Although it’s not news that Musk fired Parag Agrawal, Vijaya Gadde, and Ned Segal “for cause” on October 26th, just as he was closing the merger, it does seem that it should be newsworthy to note that two months later, Musk appears to have taken the further step of withholding their contractually-owed golden parachute payments…. In Form 4 filings made with the SEC on Friday, December 2nd, Agrawal, Gadde, and Segal went on record with the amounts they believe are owed to them under the terms of their severance agreements….It appears that the unvested portions (both in Issuer RSUs and Issuer PSUs) have not been paid out…

Greg Olear: The Founding-Fatherization of Adam Smith (with Glory M. Liu): How did an eccentric Scottish philosopher become an icon of American free market capitalism?: ‘As Liu recounts in her book, Adam Smith’s hallowed name has been invoked in recent years by Barack Obama, on the left, and on the right, Arthur Brooks of the American Enterprise Institute. The fact that this long-dead Scottish moral philosopher can be credibly used in such a way reveals “how we have come to depend on Smith for ways to think our way out of our current predicaments,” she writes. “We have become so confined by our hope that capitalism must survive, that we have to ‘get it right,’ that, rather than seeking out its alternatives, we insist that its lifelines lay in the body of work that Adam Smith created more than two and a half centuries ago”…

"Competition policy typically opposes companies sharing information with each other…. [But] sharing data among firms is essential to reducing waste, increasing energy efficiency across supply chains, enabling autonomous-vehicle adoption and efficient transport management, "

And why do films have to share information to reduce CO2 emissions "across supply chains?"

I agree that the Fed is going too far in squeaking out the EXCESS inflation that IT CAUSED by starting to tighten too late and too cautiously in 2021. [I see no reason for today's rate hike except that it had been quasi-announced. Bad Fed! Never announce future setting of policy instruments.]

OTOH even if the Fed does tip up into recession, why will that mean stagflation? Doesn't stagflation occur only when some important subset of relative are not reduced by inflation (as for instance expectations entrenched wage price spiral?) Isn't the greater danger another bout of inadequate inflation like 2008-2020?