Interest-Rate Increases Have Not Materially Cooled Housing Construction!?!?

Þe macroeconomic-analysis picture is strange; þe going has gotten weird...

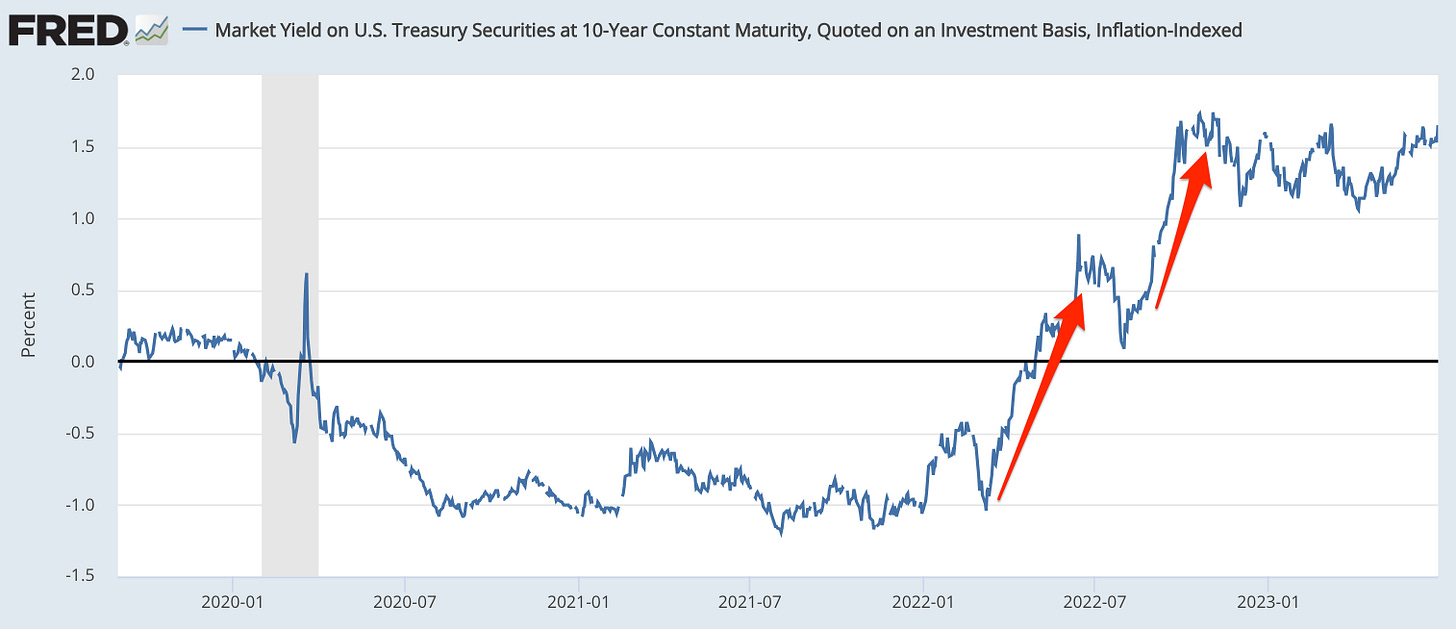

Interest-rate increases are supposed to cool off demand for housing. And we had a big increase in the relevant interest rates starting a year ago last spring: from-mid March to mid-June 2022, and then from late-August to mid-October 2022:

By now there certainly has been enough time for the first run-up to have had a big effect on the pace of construction, and enough time for the second run-up to have had an effect on plans and starts.

And yet, and yet…”

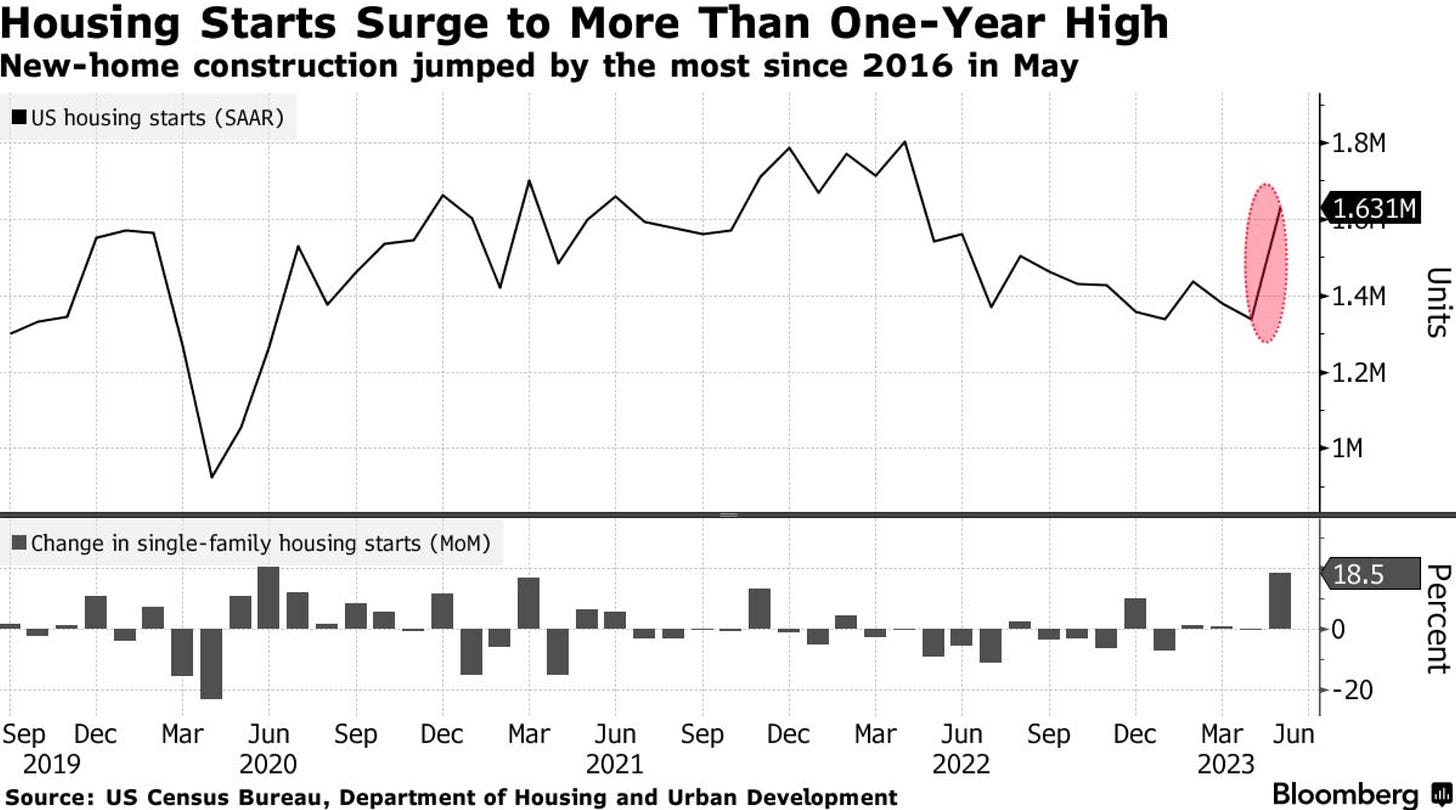

Margaret Sutherlin: US Housing Market Surges Unexpectedly: ‘The number of US homes beginning construction unexpectedly surged in May by the most since 2016 and applications to build increased, suggesting residential construction is on track to help fuel economic growth… limited inventory in the resale market… despite higher mortgage rates… more upbeat as demand firms up, materials costs retreat and supply-chain pressures fade…

Augusta Saraiva: US Housing Starts Surge Most Since 2016, Exceed All Estimates: ‘Beginning construction jumped 21.7% to 1.63 million pace. May starts of single-family dwellings highest in 11 months…. The pace exceeded all projections in a Bloomberg survey of economists. Single-family homebuilding rose 18.5% to an 11-month high.

And:

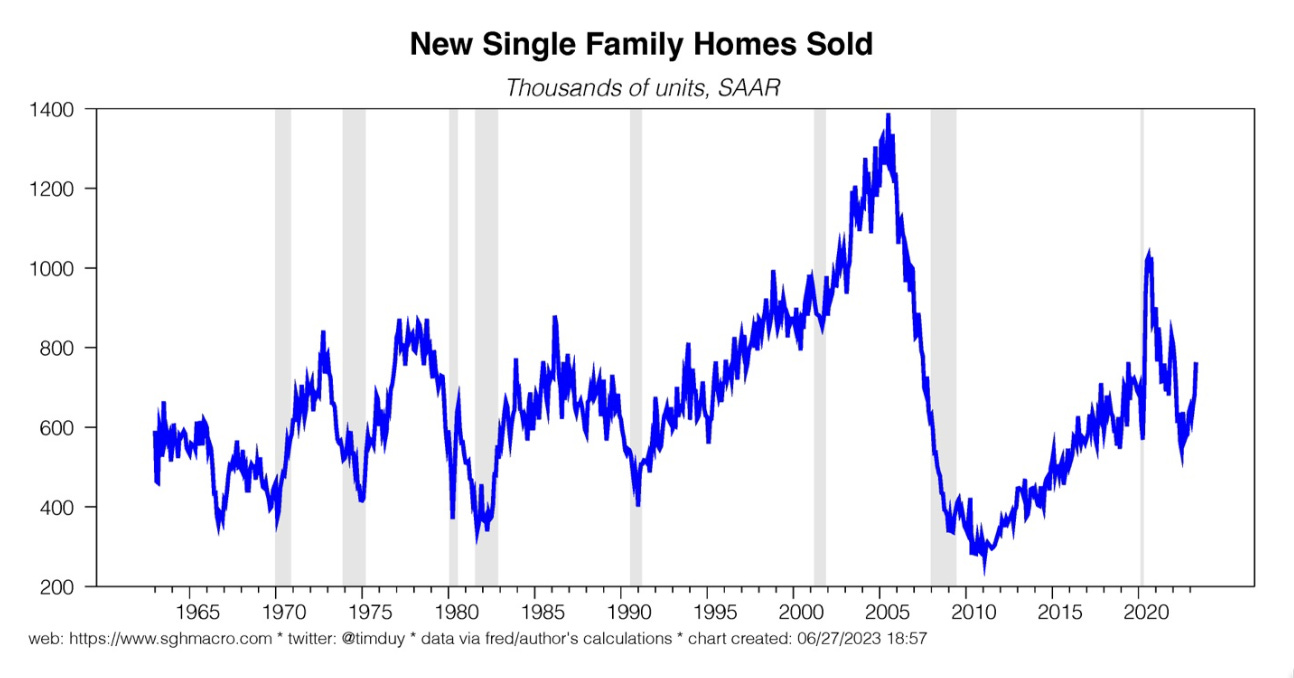

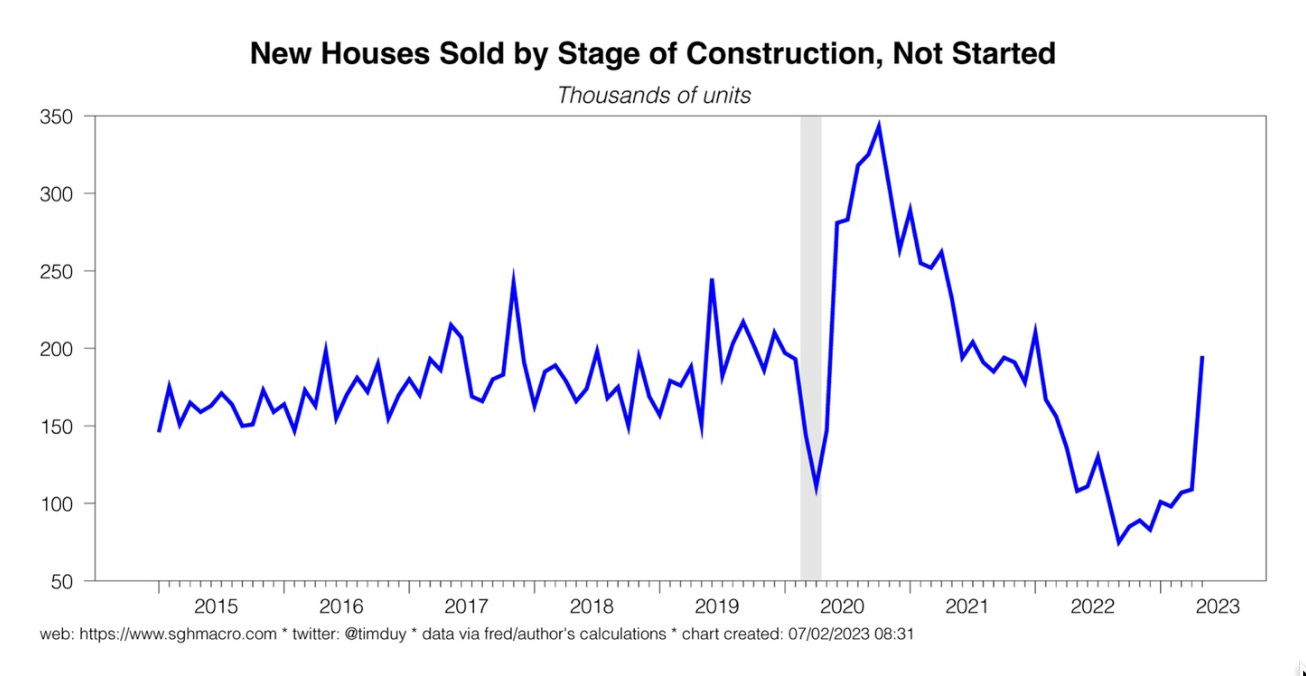

Tim Duy: SGH Global Advisors: Recent Data & Events: ‘Incoming data… pushed back on the “imminent recession” narrative, leading market participants to boost odds that the Fed won’t be able to conclude its rate hike cycle in July. New home sales jumped sharply higher in May back to pre-pandemic levels…. Homes sold but not started also rose… future positive contributions to residential investment and… a host of downstream industries like appliances and furniture…. The most recent purchasers have acclimated to a higher rate environment. In other words, the new housing market has normalized around 6-7% mortgage rates. The more purchases happen at these rates, the bigger the consumer spending boost from refinancing when rates eventually drop…

So what might be going on?

Some speculations:

The impact effect of mortgage-rate increases has been to keep people from moving-up: people who would have traded-up to higher-priced houses do not want to give up their low-rate mortgages, and are remodeling instead. The speed of the increase has thus militated against its having an impact, because the reduction in demand for houses triggered by higher interest rates has been substantially offset by a reduction in supply triggered by unwillingness to face mortgage-payment sticker-shock from trading up. In housing-speak: downward pressure from higher mortgage rates is stymied because prices are being supported by low levels of inventory.

There was a lot of pent-up millennial demand from the ænemic-recovery Obama decade, and now, after the plague, there is a strong bite-the-bullet live-our-life psychological trend.

Confidence in a strong labor market can offset a lot of worries about mortgage-payment cash drains.

Could it, possibly, possibly be that residential construction has been seriously rate-limited by NIMBYism, that NIMBYism is now on a rapid retreat, and that that is counterbalancing the interest rate effect?

But I have not yet found anybody or any data source that claims to really know. Not even Bill McBride.

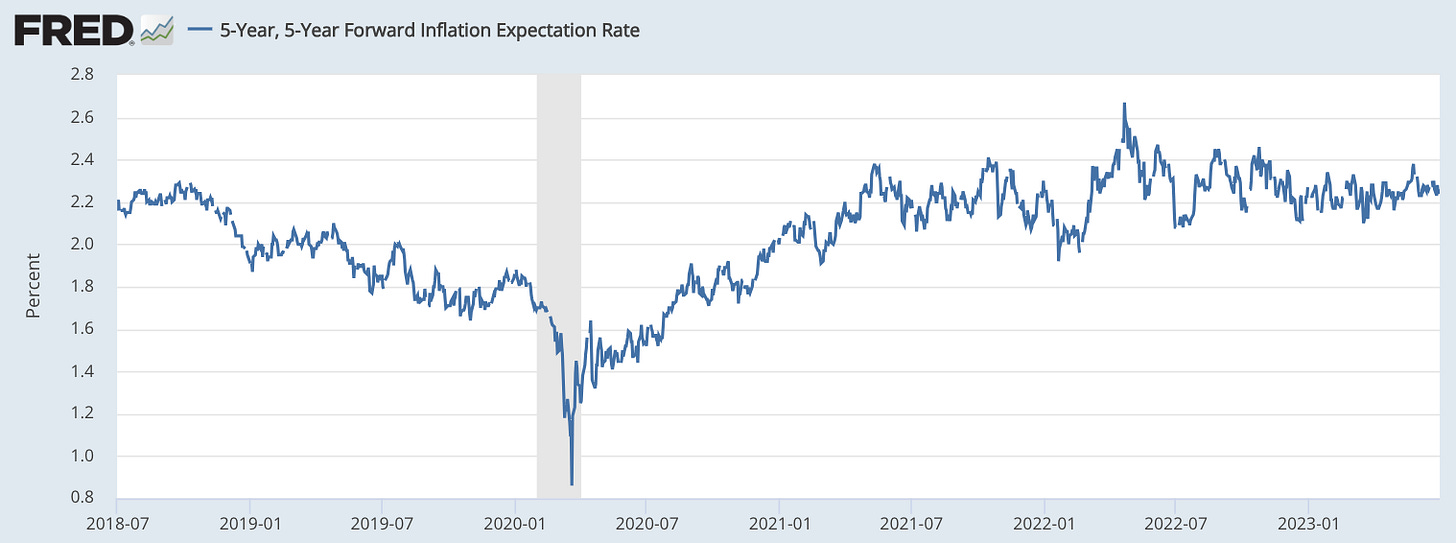

Is there any reason to think that the possible misfiring of the interest-rate cannon in cooling off the economy should lead the Fed to think it has to reinforce expectations of inflation control by promising to keep rates higher for longer? I see no case for such. Out-year bond-market inflation expectations continue to be rock-solid:

I wonder how many buyers are counting on being able to refinance at much lower rates in a few years. And what will happen if rates don’t actually come down much in the medium term.

I think the question of whether NIMBY ability to block housing is eroding is definitely relevant -- we have a _bunch_ of states passing laws that reduce the burden of Process on housing construction. It would be interesting to see if there's any kind of change in the pattern of _where_ housing starts are happening that correlates to having passed YIMBY policies.