Note to Self: Producer Price Index Inflation Ended a Year Ago

& now þe Federal Reserve has not "paused" but rather "skipped" an interest-rate increase

Brief notes as I try to think through where the macroeconomy is likely to be going over the next two years…

Þe Current State of Inflation:

The month-to-month changes in the PPI (at annual rates). PPI inflation has been over for a year now:

And CPI inflation is now a “services” thing:

From the 2023-06-14 We PPI release:

BLS: Producer Price Index News Release Summary: ‘The Producer Price Index for final demand declined 0.3 percent in May, seasonally adjusted…. Final demand prices rose 0.2 percent in April and fell 0.4 percent in March…. The index for final demand moved up 1.1 percent for the 12 months ended in May. In May… prices for final demand goods… fell 1.6 percent… final demand services increased 0.2 percent…. Final demand energy… dropped 6.8 percent…. Final demand goods less foods and energy increased 0.1 percent…. Sixty percent of the May decline in the index for final demand goods can be traced to a 13.8-percent drop in prices for gasoline…. The index for final demand services moved up 0.2 percent in May…. Margins for final demand trade services rose 1.0 percent…. Prices for final demand services less trade, transportation, and warehousing edged up 0.1 percent…. Over 40 percent of the May increase in prices for final demand services can be attributed to margins for automobiles and automobile parts retailing, which rose 4.2 percent…

Þe Current State of Monetary Policy:

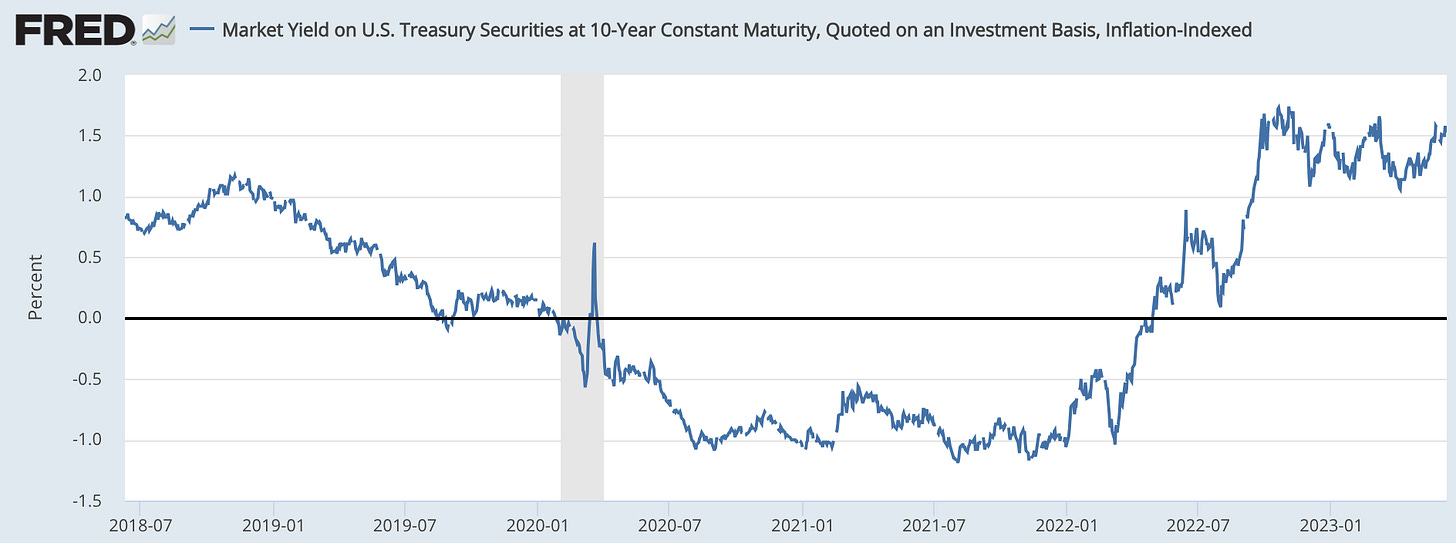

The effective real interest rate that the long-term investment sectors of the economy (and the exchange-rate dependent sectors of the economy) “see”, and the Federal Reserve’s policy rate:

Do not confuse the policy rate at the moment with the stance of monetary policy! The only monetary-policy tightening since last October has been the result of our mini-banking crisis and the micro-credit crunch that has followed it!

Þe Red Signal:

And the Conference Board’s Leading Indicators series:

I do confess that if I were on the FOMC I would be cutting now. It does not seem smart to me to simply stand by sucking your thumb while you watch the LEI go below its value of 2001.

I prefer to look at TIPS in relation to target.

I really do not like the concept of "stance." The Fed is steering a massive vessel through a narrow passage between insufficient and excessive inflation. Its only "stance" should be hands on the wheel, leaning slightly forward peering out into the fog.

"Do not confuse the policy rate at the moment with the stance of monetary policy!" Bingo!