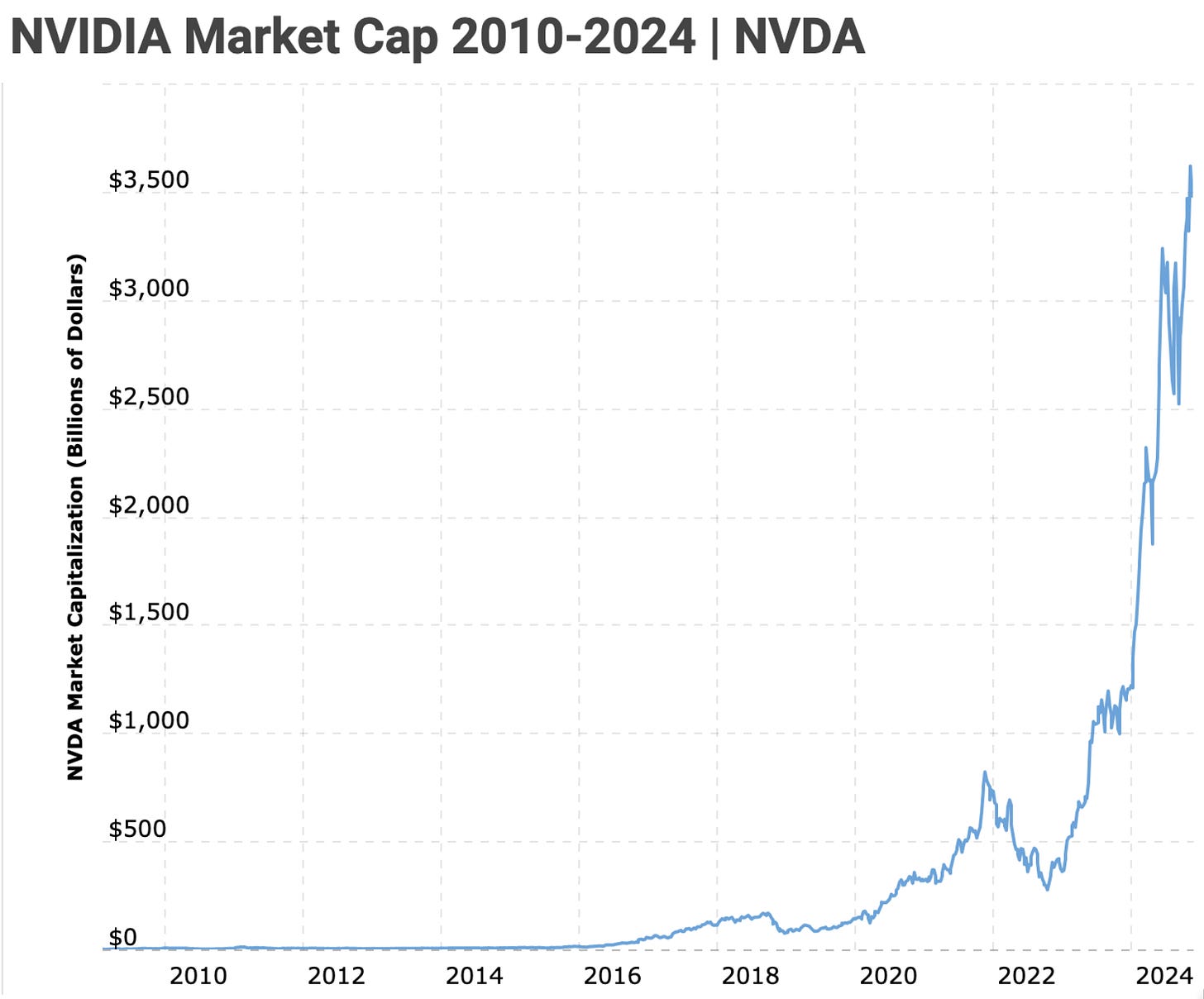

ONE SLIDE: NVIDIA Market Capitalization, & What I See as Its Likely Implications

My guess? NOT INVESTMENT ADVICE: When NVIDIA's fundamental equity value goes up by $1.00, the fundamental equity value of the tech sector as a whole goes down by -$.67. There is a positive consumer...

My guess? NOT INVESTMENT ADVICE: When NVIDIA's fundamental equity value goes up by $1.00, the fundamental equity value of the tech sector as a whole goes down by -$.67. There is a positive consumer surplus offset, although Katie Martin’s rant on how “ lived everyday experience… remains, honestly, rubbish…. AI widget[s]… rewrite my emails… with material scraped from other emails…” suggests that that offset is not (yet?) large…

My view NVIDIA’s extraordinary market-cap gains are casting long shadows over its customers’ long-term profitability. Each extra $1.00 of its market cap is bad news for tech-sector profitability as a whole...

Katie Martin is almost always excellent, but not, I think, this time, which is why I am picking on her.

She asks (or rather her headline writers ask): “AI stocks: what if this time it really is different?”

The quick answer: It isn’t.

Or, at least, it is very unlikely to be. But that does not mean “AI” is not very interesting. It is.

But what comes after this is for the TL;DR bucket unless you are simultaneously all of a financial-valuation, industrial-organization, and silicon-technology nerd:

As I see it, there are at least nine different things going on, where the money flows meet the technologies and the production lines:

There are the giant Tech Oligopolists, coining money in a rate that gives them equity valuations in the trillions. Their reaction to “AI”? They fear that they need to provide cutting-edge MAMLM services—natural-language interface, and more sophisticate ultra high-dimensional ultra-data regression and classification—in order to keep their current money flow going. Yet they see no clear path to charging for “AI”. (Can you say, “dollar auction <https://en.wikipedia.org/wiki/Dollar_auction>”?)

Great (or at least good) for consumer surplus, not so good for long-run investors and for executives who cannot get highly complaisant boards to reprice their options.

There are all the up-and-comers hoping to create businesses people will pay serious money for, or at least to exit before investors wise up. They do not believe that they can afford to delay a second in order to build a more efficient and cost-effective tech stack and value chain, hence they are giving all their money as fast as they can raise it in cloud-computation rental fees to those selling themselves space on GPUS.

There are the Big Guys—highly overlapping with the Tech Oligopolist—selling cloud-digital shovels to (2), and so anxious to build out their cloud-shovel capacity that they will pay whatever the market will bear to NVIDIA for chips.

There is NVIDIA, selling chips to (1), (3), and (4) for all that the market will bear because their buyers do not dare to say: “We are going to build out a much cheaper tech stack where we do not have to pay the NVIDIA tax, and so we are going to be a year or two behind in this”.

Only Apple is willing to say “we are going to be behind to avoid paying this NVIDIA tax. (Although Microsoft, Google, and Amazon are casting wishful looks in that direction.) And Apple is only able to say this—I guess—because of a fortunate conjunction between the requirements of MAMLM computation and their long-ago decided-upon Apple Silicon hardware-design strategy.

You almost surely do not remember that Apple’s chip-design team’s raison d’etre is to design world-leading performance per watt. You almost surely never knew that, originally, for each Apple Silicon generation, there was to be a base chip, a full chip called JadeC-die, an intermediate chip called JadeC-chop, and then the bigger beefier with interposers Jade2C-die and Jade4C-die. The first of these have been the M1, M2, M3, and M4 chips. The second have been the “Max” versions. The third have been the “Pro” versions. The fourth have been the M1 and M2 Ultras (but no M3 Ultra). And there they have stopped: the “2C” chips have been very hard to get working efficiently; and the “4C” chips have apparently been, so far, impossible.

Thus have never seen the 4C versions—Extreme?—although fanboys are hoping to see it as the M4 Extreme around May 2025. Even if so, it won’t be competitive with NVIDIA Blackwell in anything but performance per watt. But it may well be enough—if, by lucky coincidence, Apple finally got the 4Cs working with a high-enough efficiency to make producing them worthwhile at the very moment that they have a huge internal Apple data-center demand for such things.

There are the upstream TSMC and ASML, green with envy that a lot of the money which they think should be theirs going into NVIDIA’s pockets, and hoping to renegotiate some contracts someday soon, Their market capitalizations yesterday were $3.5 trillion, $1.0 trillion, and $250 billion, respectively. Yet all are equally essential to and irreplaceable in the GPU production line. So why is the Lion’s Share that NVIDIA gets be so much greater than the shares of the others, TSMC and ASML investors wlnder.

Thus as I see it, at the margin, NVIDIA’s revenues translate one-for-one into other tech companies’ future write-offs, With an operating margin of around 60%, that means an extra $1.00 of NVIDIA market cap ought to carry with it -$1.67 of other tech companies’ market cap, for a net value loss to the tech sector as a whole of $0.67 for every marginal dollar of NVIDIA market cap:

Katie Martin: AI stocks: what if this time it really is different?: ‘Some investors worry we’re in bubble territory, but others think a new paradigm has arrived….

Our lived everyday experience of this technology remains, honestly, rubbish. No, I do not want an AI widget to rewrite my emails, or my LinkedIn posts, with material scraped from other emails and LinkedIn posts. Thanks, Mr Customer Service Robot, but I would like to speak to a human, please. It is still a leap of faith to imagine the potential productivity benefits are as vast as the tech bros tell us. Believing that the delightful ride higher in US stocks can keep on running does demand some pretty heroic assumptions….

Nonetheless, some market watchers are starting to wonder whether something fundamental has shifted here. One reason is that companies like Nvidia are walking the walk. The earnings match the hype, which means price-to-earnings ratios are still reasonably tame, in contrast to the dotcom boom and bust… <https://www.ft.com/content/6e893618-d75e-4e67-9876-249540a27d13>

References:

Freedman, Andrew E. 2021. "Report Details Apple's Next Processors for Laptops, Mac Pro." Tom's Hardware. May 18. <https://web.archive.org/web/20210518120000/https://www.tomshardware.com/news/report-details-apples-next-processors-for-laptops-mac-pro>.

Martin, Katie. 2024. "AI Stocks: What If This Time It Really Is Different?" Financial Times, November 26.< https://www.ft.com/content/6e893618-d75e-4e67-9876-249540a27d13>.

Shilov, Anton. 2024. "Nvidia Publishes First Blackwell B200 MLPerf Results: Up to 4X Faster Than Its H100 Predecessor, When Using FP4." Tom's Hardware.August 28. <https://web.archive.org/web/20240828000000/https://www.tomshardware.com/tech-industry/artificial-intelligence/nvidia-publishes-first-blackwell-b200-mlperf-results-up-to-4x-faster-than-its-h100-predecessor-when-using-fp4>.

Shilov, Anton. 2024. "Nvidia's Next-Gen AI GPUs Could Draw an Astounding 1000 Watts Each, a 40 Percent Increase — Dell Spills the Beans on B100 and B200 in Its Earnings Call." Tom's Hardware. March 2. <https://web.archive.org/web/20240302000000/https://www.tomshardware.com/tech-industry/artificial-intelligence/nvidias-b100-and-b200-processors-could-draw-an-astounding-1000-watts-per-gpu-dell-spills-the-beans-in-earnings-call>.

Wikipedia. 2024. "Dollar Auction." Last modified June 15, 2024. < https://en.wikipedia.org/wiki/Dollar_auction>.

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

Back a couple of years ago I read of NVIDIA's plans for expansion in San Jose. My son in law was working on the completion of the "Apple flying Saucer" at the time as a facility engineer. I told him to apply for a job with NVIDIA. He didn't, but, he did buy NVIDIA stock. That may have been why he could buy a 4M house in Saratoga.

I am concerned about how incorrect some of these AIs are. Google's Gemini in the search results and Amazon's Alexa assistant repeatedly provide incorrect answers to questions that should be known. I have seen answers with the wrong units, and Alexa seems to pick answers "From a comment". Very untrustworthy. Given how people seem to unquestionably quote these sorts of answers in blog comments, this is not good.

If this is not solved, then we will enter the "trough of disillusionment" and stock prices will decline.

When has "This time really is different" ever proven correct?