PROJECT SYNDICATE DRAFT: Why So Much Premature Fear of an Inflationary Spiral?

An early take at this month's column

In the past three years the advance of technology has provided about one percentage point of warranted real wage growth each year—half, admittedly, of its pace in the Old Days, but still something. Yet real wages right now are four percent below their values of the fall of 2018. Does that sound like a “high-pressure” labor market to you?

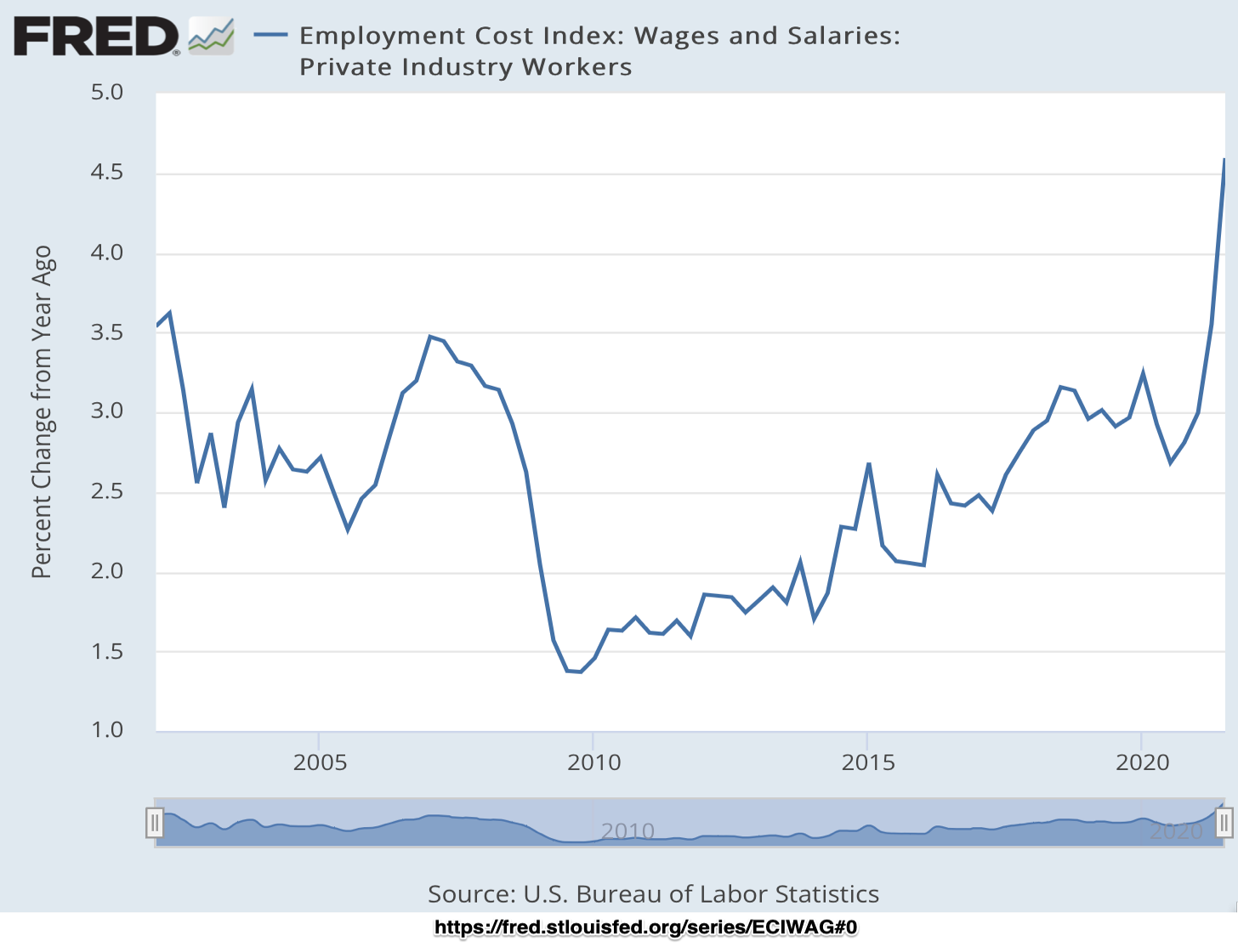

Believers that the labor market is in some sense “tight” respond by pointing to the Employment Cost Index: up now some 4.5 percent from its value a year ago, 1.5 percentage points per year faster than the 3 percent per year rate-of-growth it had settled into in the pre-plague Trump administration years.

But the Consumer Price Index is up 5.4 percent from a year ago: the ECI-basis real wage has fallen by 0.9 percent over the past year. Does that, really, sound like a “tight” and a “high pressure” labor market to you?

Nowcasting is extremely difficult, and hazardous. But the “Now” that I see outside my window right now is the “Now” that I did forecast back two and three quarters ago: one in which we would leave inflationary skidmarks on the asphalt, but in which those should not concern us, because “burning rubber to rejoin highway traffic [at speed] is not the same thing as overheating the engine” <https://www.busiweek.com/is-the-us-economy-recovering-or-overheating/>.

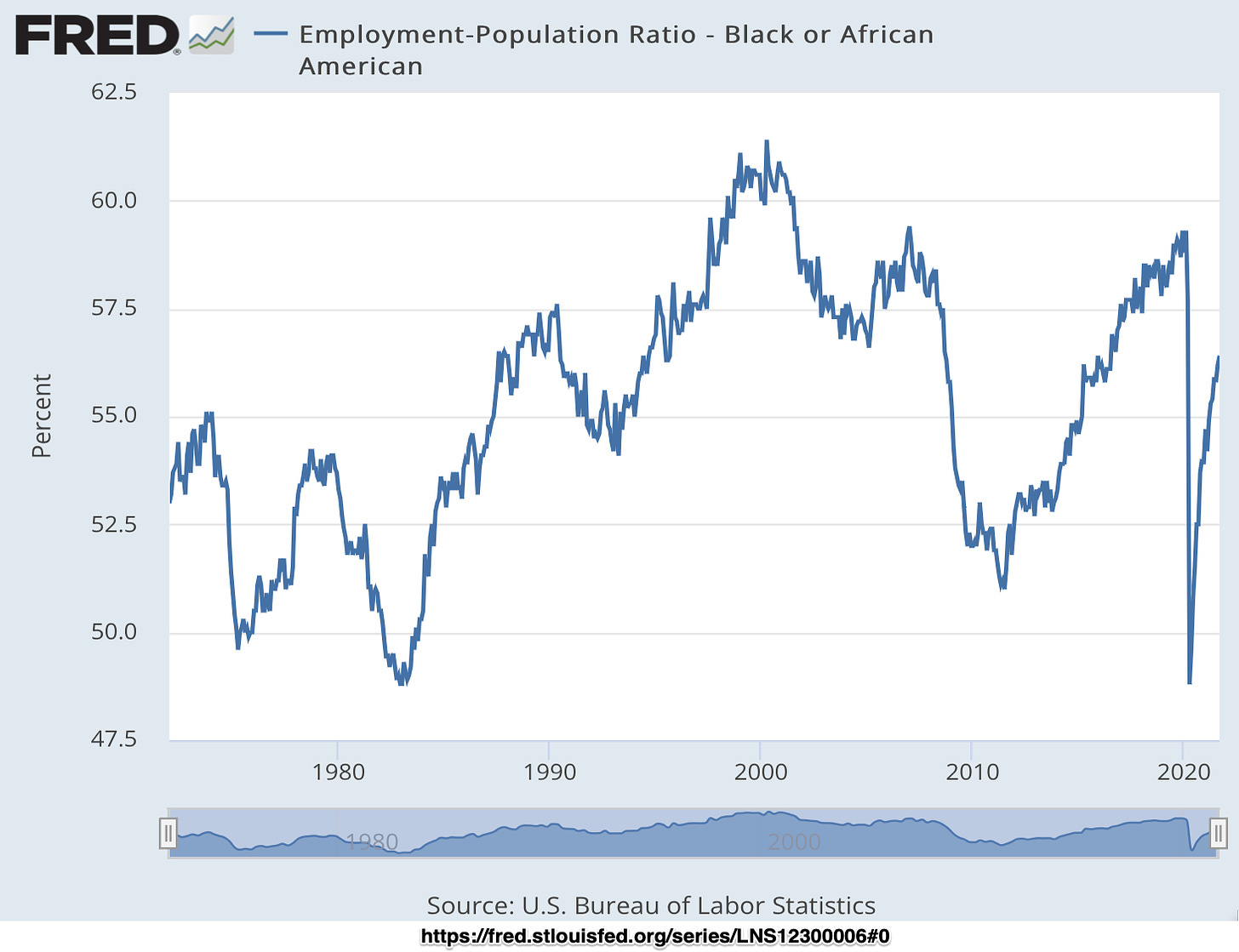

We do not, right now, have too much money chasing too-few goods leading to an inflation spiral-provoking overdemand for labor. This is the case even though the plague continues, and its associated disruptions continue to give us a substantial undersupply of labor: women are 5, African-Americans 4.5, blue-collar workers 4, and the economy as a whole 3 percentage-points below what we used to see as the full-employment level of the employment-to-population ratio. In a high-pressure economy with a tight labor market, workers’ bargaining power would be strong enough to get them real wage increases.

Yet economists I respect talk as if the economy is in serious inflationary trouble. Jason Furman speaks of how the “original sin was an oversized [Biden] American Rescue Plan”. In his view, it would have been better to have been less aggressive and had a slower employment and growth recovery this year, for the ARP he sees as oversized “contributed both to higher output but also higher prices”, and Larry Summers thinks that, in Jim Tankersley’s paraphrase, “inflation now risks spiraling out of control” <https://www.nytimes.com/2021/10/26/business/economy/biden-inflation.html>.

The next move in the argumentative chess game is to say that the plague years have permanently damaged the supply-side of the economy: caused a lot of early retirements, and disrupted permanently the lean-and-mean supply chains on which a good deal of productivity and prosperity had depended. Perhaps. But the same arguments were made in the early 2010s, as an excuse justifying policies that did not put the pedal-to-the-metal and attempt to rapidly reemploy those than called “zero-marginal-product” workers <https://marginalrevolution.com/marginalrevolution/2010/07/zero-marginal-product-workers.html>. One consequence of not putting the pedal-to-the-metal was Donald Trump, his rise fueled by the rage of those who saw the system as caring more about immigrants and minorities than it did out of blue-collar workers whose opportunities had never recovered to the pre-2008 normal. Putting restoring full employment at the back of the bus of one’s priorities is not just un-woke because of its disproportionate effect on minorities, it adds to the dangers to and difficulties of democracy as well.

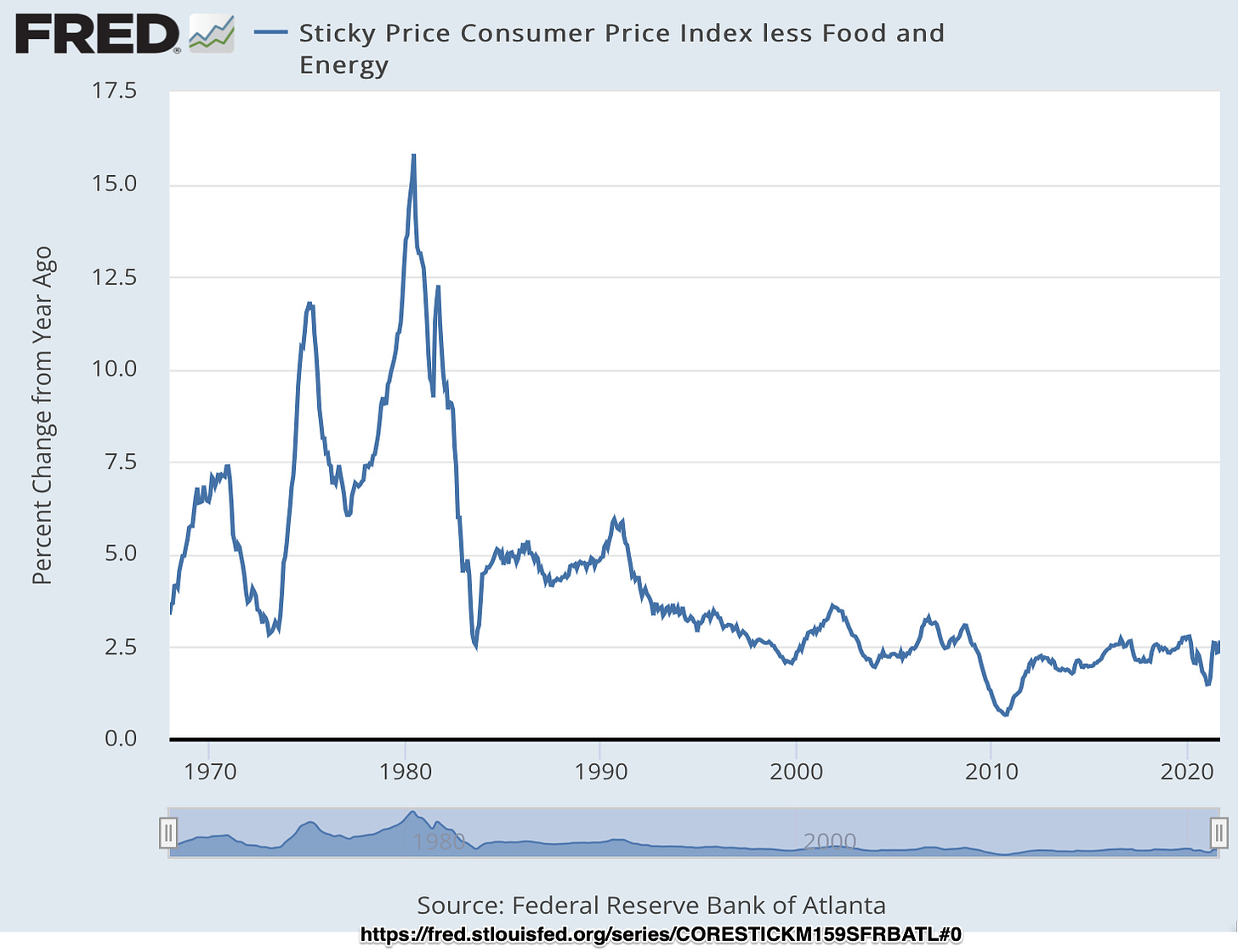

There is a last move in the argumentative chess game: the claim that whether or not the labor market is “tight”, inflation—whether supply- or demand-side driven—is high and salient enough that it will be rapidly incorporated into expectations. Thus the snake has to be scotched now while it is small, rather than dealing with it postponed until it hath fed further upon meat. Yet to date inflation has not been incorporated into the patterns of any of the “sticky price” in the economy, at least not according to the measure constructed by the Atlantic Federal Reserve <https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL>.

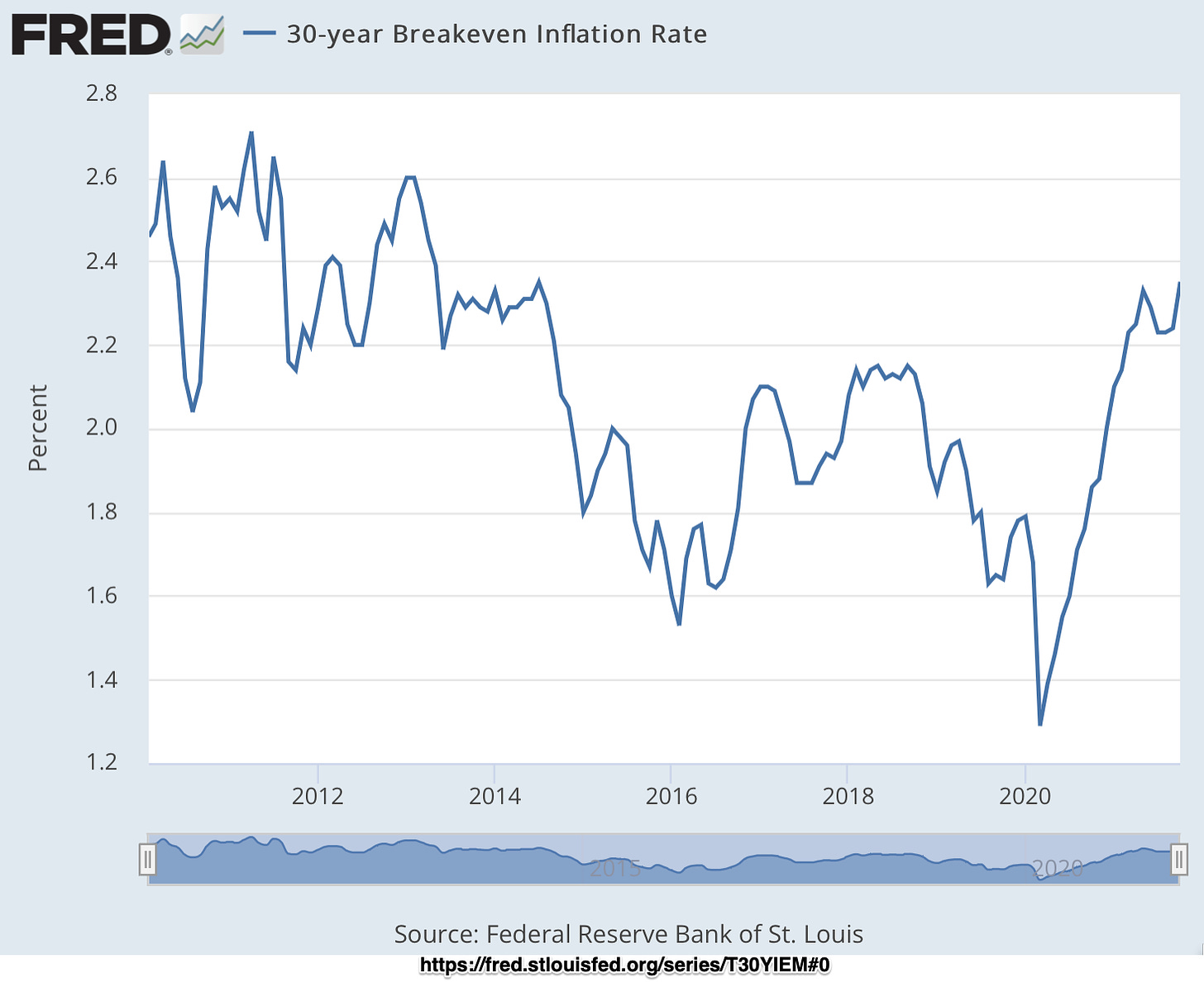

And while the financial market’s 30-year inflation breakeven is more than half a percentage point above where it settled in the second half of the 2010s <https://fred.stlouisfed.org/series/T30YIEM>, it is still only at 2.35%: where it had settled in the first half of the 2010s, and slightly below the level that would be consistent with the Federal Reserve’s 2%/year PCE-Deflator inflation target.

With the inflation we see highly likely to be—perhaps others would say “probably” or even “arguably”, but I call them as I see them—simply rubber-on-the-road from recovery, with no sign that inflation has yet been incorporated into those prices in the economy that are sticky, with the labor market still weak enough that workers are unable to demand substantial increases in real wages, with financial markets blasé about the possibility of rising inflation, and with a substantial fiscal contraction already in train—why would anybody argue that they know that the “original sin” was the “oversized American Recovery Plan”, and that tightening monetary policy starting right now is the proper way to expiate this original sin?

Yet people do. People are. I cannot say that I follow the logic here.

864 words

Why So Much Premature Fear of an Inflationary Spiral?

2021-11-02

Video of my Project Syndicate column for November, 2021. Everything I see still points to our inflation as not a durable and troubling spiral but simply proper and appropriate: rubber left on the road as we rejoin highway traffic at speed. I do not understand what many who say otherwise are thinking.

(06:19)

<https://watch.mmhmm.app/z_KqcyWGXQlWsXw0FbsRxO>

<https://youtu.be/_4VmsX4PFQU>

<https://braddelong.substack.com/p/project-syndicate-draft-why-so-much>

As Dr. Krugman used to say, those folks are the VSP, the "Very Serious People." Always looking for a reason to afflict the afflicted and comfort the comfortable.