Discover more from Brad DeLong's Grasping Reality

Restore Elon Musk (& Tesla) to Greatness

This week I get rights to pull my "Restore Elon Musk (& Tesla) to Greatness" piece out from behind the "New York Times" paywall; so here it is; originally published June 11, 2024, 5:03 a.m. ET in...

This week I get rights to pull my "Restore Elon Musk (& Tesla) to Greatness" piece out from behind the New York Times paywall; so here it is; originally published June 11, 2024, 5:03 a.m. ET in the New York Times. Let me start, however, by hoisting something I wrote two years ago, asking the long-term stock-market investors in Tesla (if there are any) exactly what they think they are doing…

Tesla’s Valuation(s)

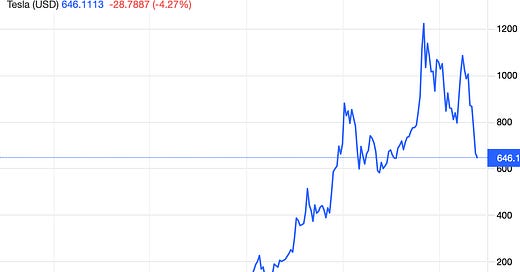

There I was, noodling around, sitting outside in the morning California sunshine (66F, going up to 80F at 5 PM), picking up scraps of information for tonight’s “Hexapodia Podcast” taping with Noah Smith on “crypto”. I found myself looking at Tesla’s stock price: after all, “crypto” today appears highly correlated in its stock market valuation with “tech”, and Tesla is now looking like a tech-factor stock rather than a manufacturing-factor stock. That is, Tesla is trading as if it is constructing a walled garden within which it will then leverage a piece of software written once that runs everywhere and harvests the activity of its users for some chain of actions vague in the middle that ends with “PROFITS LARGE FOREVER!”. It is not trading like a company whose profits depend on large-scale efficient execution of manufacturing processes—a company that makes large things out of metal using technologies for which the knowledge is widely distributed.

And I ran across a tweet thread by the highly estimable Brianna Wu:

Brianna Wu: ’What gets me about Tesla fanatics. It’s not just the death threats and personal attacks for asking eminently reasonable questions about a stock valued more than every other car company combined. It’s the men who assume questioning it means you’re too stupid to understand.

Well, I do question why a company with a P/E of 90 is worth so much more that Ford, which has a P/E of less than 4 AND sells more than 4x as many cars, AND has a killer electric truck in market. I DO question why Tesla is worth so much when it currently has 85 percent of the EV market and can barely squeeze a profit without resorting to bitcoin speculation, which by the way has plummeted in value.

I DO question how many people are going to continue to have faith in a founder that announces some wild new idea every four seconds, and can’t seem to bring any of it to market. Battery swaps, solar charger SuperChargers, Cars moonlighting as autonomous Taxis.

All these questions are reasonable. Sexist horseshit assuming I don’t know what I’m talking about is not. You can send armies of anonymous accounts to scream at me till the cows come home. I don’t care. But you can’t delay the market from asking these questions forever…

LINK: <https://twitter.com/BriannaWu>

Consider: At its current stock price of $675/share, and with more than a billion shares outstanding, Tesla is “worth” $675,000 for each of the million cars it manufactured in the past year—it is selling, even now, at not just 90 times earnings, but 11 times trailing annual revenue. Think that, as equities, Tesla shares to have a long-run permanent earnings yield of 5%/year in order to support stock valuations. Thus the company’s realistic projected permanent earnings have to be $35 billion/year. Selling all the cars sold in America, and selling each for a profit of $20,000 per car, and getting there very quickly (for money in fifteen years is worth half of money today at standard equity discount rates)—that is what the marginal Tesla shareholder right now is “thinking” about Tesla and its prospects. (If you think it is going to take ten years for Tesla to reach market dominance, you need $30,000 profit per car.)

Or they could do it with a quarter of the American car market, with profits of $80,000 per car.

Or they could do it with a quarter of the American car market, with profits of $160,000 per car if it took them 15 years to get there.

It could happen. But do note that these numbers have your profits calculated after taxes and debt interest: this is not EBIT, let alone EBITDA.

Or some one of Tesla’s other future businesses could catch fire, at 1/4 of the iPhone scale of profitability—but what incentive does Elon have not to tunnel the valuable intellectual property out of Tesla and into another one of his vehicles as that happens?

Complicating matters is that Elon Musk is not a prudent fiduciary seeking to maximize the fundamental value of the payouts to shareholders from companies he is involved in. Elon wants to have fun and change the world: payment systems, electric cars, batteries, subways, travel to Mars, satellites! High stock market valuations are useful tools for that: they gave Elon social power in the form of wealth, and he then leverages that into social power in the form of celebrity influence. But if you own stock in an Elon company, he does not work for you. You are, if anything, his prey—or, at best, a spear-carrier in the background on the stage, not even part of the chorus.

Tesla is… unlikely to be near its fundamental value today. Five years ago it was valued at 1/10 as much—that would be, if it obtained maturity fifteen years (now ten years out, in 2032), a quarter of the American car market with a profit of $8,000 per car: the equivalent of the old Ford Motor Company in its glory days, in a boom year.

Let me hasten to add that just because it is unlikely that Tesla shares are valued near their fundamental values, when Tesla is assessed as a profit-making enterprise, does not say much about the true value of Tesla.

In particular, it does not mean that Tesla is in any sense unworthy as a productive enterprise—on the contrary: it is an extraordinarily valuable enterprise, considered from the appropriate point of view.

But shareholders are unlikely to receive a great deal of that value.

We all have learned enormous amounts from Tesla’s attempts to profitably make electric cars at scale. In particular, all of Tesla’s present and future competitors have learned. The world in the future would be a poorer place if Tesla had not taken the plunge.

But the ultimate valuable product of Tesla is not likely to be cars sold in the future for more than the cost of materials and labor.

The ultimate valuable product of Tesla is likely to be the public good of all the engineering and social-organizational learning that Tesla-as-an-experiment is generating right now.

Elon Musk is not just another inconsequential Silicon Valley billionaire.

Most of his inconsequential peers have two primary accomplishments: showing up at the right place at the right time and being sufficiently arrogant to continue the course rather than diversify. Had their shoes been empty, someone else would have stepped into them, and things would have been much the same.

But Mr. Musk changed the world.

He wanted to jump-start the decarbonization of human civilization’s energy. He succeeded. He drove Tesla to create the electric vehicle industry as we know it. Yes, he overpromised. But he often overdelivered and overdelivered spectacularly. Truly wonderful things happened with Tesla’s performance as a technology inventor, deliverer and deployer.

But “happened” is in the past tense. Much has changed since 2018, the year Tesla dreamed up an unorthodox pay package that, in theory, tied Mr. Musk’s pay to the company’s performance. Problem is, the performance was not for making high-quality cars or making affordable cars or making cars at scale. The performance was for pushing Tesla’s stock price up.

This pay package was, I think, bad for Mr. Musk. And it was, I am sure, bad for Tesla and, by extension, our nation’s crucial fight against global warming, by far. Tesla is now asking its shareholders to reapprove this pay package, which would hand Mr. Musk an eye-popping roughly $46 billion, making him, the world’s richest man, one of its highest-paid executives.

I have a recommendation for Tesla shareholders: Vote no.

The board promised Mr. Musk — at his urging — that if he made the board and the shareholders truly wealthy by boosting the stock price, by whatever means, he could have 12 percent of the company. Yet I believe this pay package helped drive his descent from visionary business leader to bizarre carnival barker. And that set of incentives and responses should not be validated.

Here I need to back up and tell you what meme stocks are. The standard example is GameStop, a company that runs about 4,000 video game and electronics stores. Trading at $5 a share at the start of December 2020, its price rose to a staggering roughly $150 a share at the end of January 2021. Mr. Musk joined the fun by tweeting one word — “Gamestonk!!” — and the shares soared to $483 two days later, before beginning a long, jagged decline. As of the start of 2024, it was almost $17 a share, far above the $5 of 2020, even though nothing much had changed about its (struggling) business. And a recent revival of GameStop mania has since pushed it up to $30 a share.

Who is behind all of this crazy? It is not people who want to invest in a slice of Gamestop’s business over the long term. It is, rather, that people who are buying GameStop as a way of pledging allegiance to an idea, a meme, a cultural-technological movement of some kind — and a few hoping to get rich by tagging along and selling at the top. Past stock manias and bubbles involved people who believed that the company involved would be profitable or at least that they would be able to make money selling their stock to a greater fool than them who had just arrived in the marketplace and still believed. But GameStop stock became all but disconnected from the profit-and-loss statements of the 4,000 GameStop stores.

And so it has become with Tesla. It was no longer about getting better at making high-quality electric vehicles for which there was strong demand. For Mr. Musk, incentivized by his pay package, it became about a stock price that must go up.

After 2018, Mr. Musk went all in. He made noise, particularly on Twitter. He still overpromised, but he no longer overdelivered; instead he jumped from moonshot theme to moonshot theme to boost the meme-stock association of Tesla. Humanoid robots! Cybertrucks! Fleets of Tesla robotaxis! An artificial intelligence supercomputer whose brain would be all the idle Teslas in the world, networked! And the share price did zoom, making him the richest man on earth, from about $20, give or take, around 2018 to over $400 in late 2021 before beginning a jagged and often interrupted decline to its still lofty $174.

Tesla had always had build-quality problems. But it used to have a road map for fixing them. And it used to have a road map for gaining manufacturing expertise, adding capacity, introducing models to crawl down from the rarefied technoexperiment and luxury car markets into the enormous market of providing what Americans see as their basic transportation. But those seem to have fallen away. The idea that there would soon be a truly affordable mass-market Tesla receded from real soon to maybe someday. Instead we got the Cybertruck, for which demand is rather limited, as it is not set up to do the things that people who use pickup trucks need them for. And meanwhile, in China, BYD’s blade-battery technologies and process-manufacturing expertise grew by leaps and bounds.

Unlike GameStop, Tesla sells products a bit more critical to our future than games like Call of Duty. For the world, Tesla has been nothing short of a beacon of hope, a carbon-transition technological spearhead to a more sustainable future with less damage from global warming, via a rapid build-out of electric vehicles and power. For our shared future, the world very badly needs to return to the Tesla before 2018, when it was creating the societal knowledge of how to design and efficiently build electric vehicles at a truly ferocious rate.

A management focused on the actual business Tesla is engaged in is far better for society than a management focused on what the pay package incentivizes Mr. Musk to focus on every hour he spends working on the company: continuing the run of Tesla as a meme stock.

John Maynard Keynes wrote in 1936, with characteristic British understatement, “When the capital development of a country becomes a byproduct of a casino, the job is likely to be ill done.” Voting for the pay package would validate this focus, and that is a damned shame, for Elon Musk is truly consequential. And that is a big deal.

Or perhaps shareholders should vote for the pay package out of fear: If Mr. Musk regards himself as betrayed, he may no longer spend time talking up Tesla and its share price — and without his meme stock mojo, the shares could falter. Toyota makes generally higher-quality cars and has revenue that in 2023 was more than four times Tesla’s but commands only about three-fifths of its total market capitalization. That is how far down Tesla stock could go.

But I argue that we must accept the possibility of short-term pain for a forever payoff. Tesla almost certainly accounts for a plurality of Mr. Musk’s fortune. SpaceX makes up the bulk of the remainder. And SpaceX appears to be in very good hands, as he trusts the awesomely competent Gwynne Shotwell, who, as chief operating officer of SpaceX, has managed the marriage of fire and ice, building an organizational culture that combines an astonishing attention to detail with a willingness to experiment beyond the limits of what had been thought possible. She proves that Mr. Musk is capable of far better business judgment. Business judgment that Tesla desperately needs. Right now.

J. Bradford DeLong teaches economic history at the University of California, Berkeley, and is the author of “Slouching Towards Utopia: An Economic History of the Twentieth Century.” He was a deputy assistant secretary of the Treasury in the Clinton administration and is on the advisory committee of Birnam Oak Advisors, an investment adviser.

Reference:

DeLong, J. Bradford. 2024. "Restore Elon Musk (& Tesla) to Greatness." New York Times, June 11. <https://www.nytimes.com/2024/06/11/opinion/tesla-elon-musk-pay.html>.

Mr Musk has become an icon to, and attracted capital from, precisely investors who might take issue with the claim that the latest iteration of "Call of Duty" were less important than (as they might have it) 'the fake need for decarbonisation'—oil and the drilling for it are _much_ more butch than wind- and solar and hydro-power, so any scheme suggesting that the latter were preferable was probably dreamt-up by women—a suspiciously effeminate bunch—and other untrustworthy types.

Tesla accelerated the adoption of EVs by 2-3 years: a great boon to humanity. But that was in the past. I don't see what Tesla can do in the future that can't be done by somebody else at about the same time. It's just another car company, now. Elon Musk is a genius self-promoter, but is not a genius engineer. Most of his other enterprises (SpaceX aside) have been flops, if not pure vaporware.