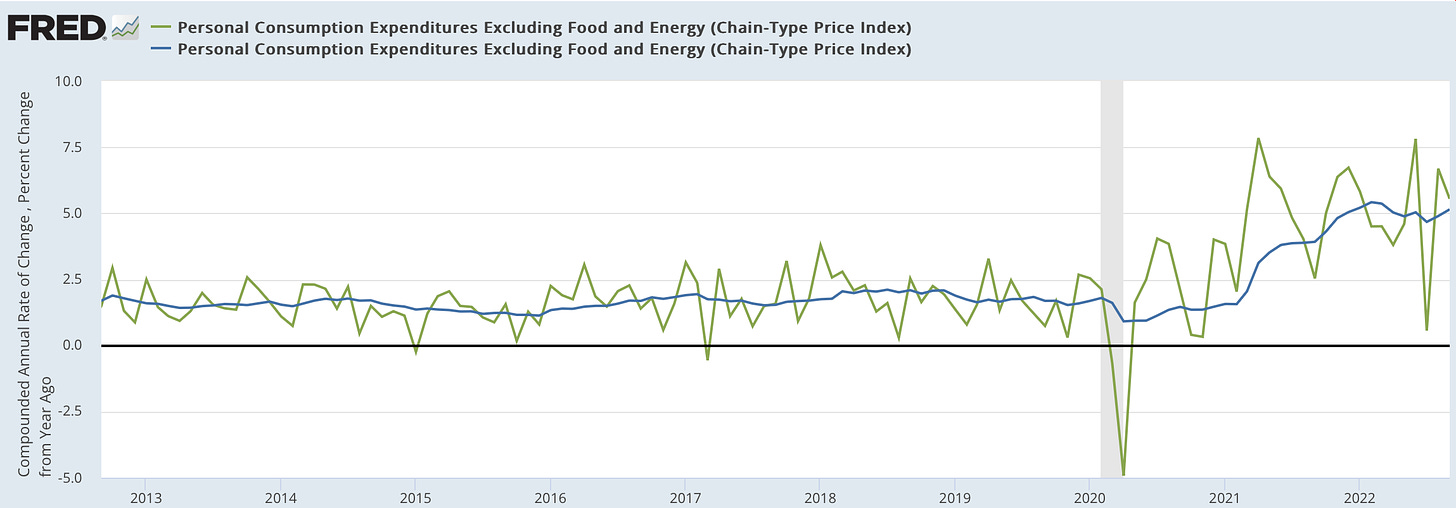

CONDITION: Core CPI & Core PCE: Last Month’s & Last Year’s Inflation Rate:

It looks to me that, were not for Vladimir Putin, Team Transitory would be looking pretty good right now, no? The argument against the way, macro economic policy has been conducted since January 2021 after hinge on a claim for policymakers, should've expected, or at least acted as though they expected, Vladimir Putin.

Of course, saying that policy was reasonably conducted in 2021 does not help us right now. But it is important to register that we have a Putin inflation problem, not a miss managed-recovery inflation problem.

FOCUS: The Old Story: The Fall of Sam Bankman-Fried:

Must reads for this:

Charles Kindleberger; Manias, Panics, and Crashes: A History of Financial Panics <https://archive.org/details/maniaspanicscras0000alib>;

Tom Levenson: Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich <https://www.amazon.com/dp/0812998464>;

and perhaps Daniel Davies: Lying for Money: How Legendary Frauds Reveal the Workings of the World <https://www.amazon.com/dp/1781259666/>.

For we have all seen all of this before…

From the excellent Matt Levine of Bloomberg, who all by himself has me on the verge of becoming a paid subscriber:

Matt Levine: FTX Had a Death Spiral: FTX issues a token called FTT…. FTX periodically uses a portion of its profits to buy back FTT tokens. This makes FTT kind of like stock in FTX: The higher FTX’s profits are, the higher the price of FTT will be. It is not actually stock in FTX… but it is a lot like stock… a bet on FTX’s future profits. But it is also a crypto token, which means that a customer can come to you and post $100 worth of FTT as collateral and borrow $50 worth of Bitcoin, or dollars, or whatever, against that collateral, just as they would with any other token…. If you think of the token as “more or less stock,” and you think of a crypto exchange as a securities broker-dealer, this is completely insane. If you go to an investment bank and say “lend me $1 billion, and I will post $2 billion of your stock as collateral,” you are messing with very dark magic and they will say no. The problem with this is that it is wrong-way risk. (It is also, at least sometimes, illegal.) If people start to worry about the investment bank’s financial health, its stock will go down, which means that its collateral will be less valuable, which means that its financial health will get worse, which means that its stock will go down, etc. It is a death spiral. In general it should not be possible to bankrupt an investment bank by shorting its stock. If one of the bank’s main assets is… a leveraged bet on its own stock — then it is easy to bankrupt it by shorting its stock.

The worst case is something like: 1. You have 100 Customer As… each… [with] 1 Bitcoin in their accounts and ow[ing] you $10,000. 2 You have 100 Customer Bs who… each have $20,000 in their account and owe you 0.5 Bitcoin. 3. You have loaned 50 of the Customer As’ Bitcoins to the Customer Bs, and $1 million of the Customer Bs’ dollars to the Customer As. You keep the other 50 Bitcoins and $1 million as collateral. 4…. You owe clients 100 Bitcoins and $2 million, and that they owe you back 50 Bitcoins and $1 million, and you have 50 Bitcoins and $1 million on hand, so everything balances.

5. You have one Customer C who says “hi I would like to borrow 50 Bitcoins and $1 million, I will secure that loan with 150,000 FTT, each of which is worth $20.” 6. You say “sure, sounds good”…. 7. Now you have 150,000 of FTT, worth $3 million, as collateral (and no Bitcoins or dollars). 8. Your accounts show that you owe clients 100 Bitcoins and $2 million and 150,000 FTT, and they owe you back 100 Bitcoins and $2 million, and you have 150,000 FTT of collateral [on hand], so everything balances. But then if the value of FTT drops to zero, you have nothing….

You just have to call up Customer C and say “hey we need all those dollars and Bitcoins back.” But Customer C will not want to give you back all those valuable dollars and Bitcoins in exchange for now-worthless FTT. Also… Customer C… is an FTT whale, and FTT is now worthless. Has it been borrowing elsewhere against FTT? Are all those debts coming due?…

The reason for a run on FTX is that you think that Alameda is, in my terminology, Customer C. The reason for a run on FTX is if you think that FTX loaned Alameda a bunch of customer assets and got back FTT in exchange. If that’s the case, then a crash in the price of FTT will destabilize FTX. If you’re worried about that, you should take your money out of FTX before the crash. If everyone is worried about that, they will all take their money out of FTX. But FTX doesn’t have their money; it has FTT, and a loan to Alameda…. If, say, the operator of the biggest crypto exchange gently raises one eyebrow and says “FTT, eh?” that can be enough to topple FTX. FTT goes down, leaving FTX undercapitalized, leading to customer withdrawals, leading to ruin….

It is still early and confusing but that seems to be the story of FTX. Coindesk reported on Alameda’s FTT exposure…. Changpeng “CZ” Zhao…raised eyebrows by tweeting that Binance would sell its FTT…. People worried that this would tank the price of FTT and put pressure on FTX, so they started withdrawing…. FTX didn’t have the money, and Bankman-Fried started calling around asking for a loan or a bailout. Eventually he called CZ himself, and they announced a non-binding letter of intent for Binance to acquire FTX and make customers whole. Bankman-Fried’s fortune basically vanished, as did his “ emperor aura.” Venture capital investors in FTX — which last raised money at a $32 billion valuation — are probably getting zeroed, the price of FTT collapsed, and now regulators are investigating….

The most informed view is probably that of CZ himself, who tweeted this morning: “Two big lessons: 1: Never use a token you created as collateral. 2: Don’t borrow if you run a crypto business. Don't use capital "efficiently". Have a large reserve. Binance has never used BNB for collateral, and we have never taken on debt.” “Never use a token you created as collateral” suggests, to me, that FTX accepted its FTT token as collateral, probably from Alameda, probably in exchange for borrowing assets that it owes to customers…. If this is the story, then it is not a liquidity crisis but a solvency one…. FTX took its customers’ money and traded it for a pile of magic beans, and now the beans are worthless and there’s a huge hole in the balance sheet….

It makes for a tricky decision for… CZ: Follow through with rescuing his onetime top rival and shoulder the financial and regulatory burdens, or let FTX crumble and sort through the potential wreckage?… His answer, at least for now, is that the financial hole appears too deep. Binance is unlikely to follow through on its takeover of FTX, according to the person familiar, who wasn’t authorized to publicly discuss the matter.

Seems bad.

One Video: Money for Nothing:

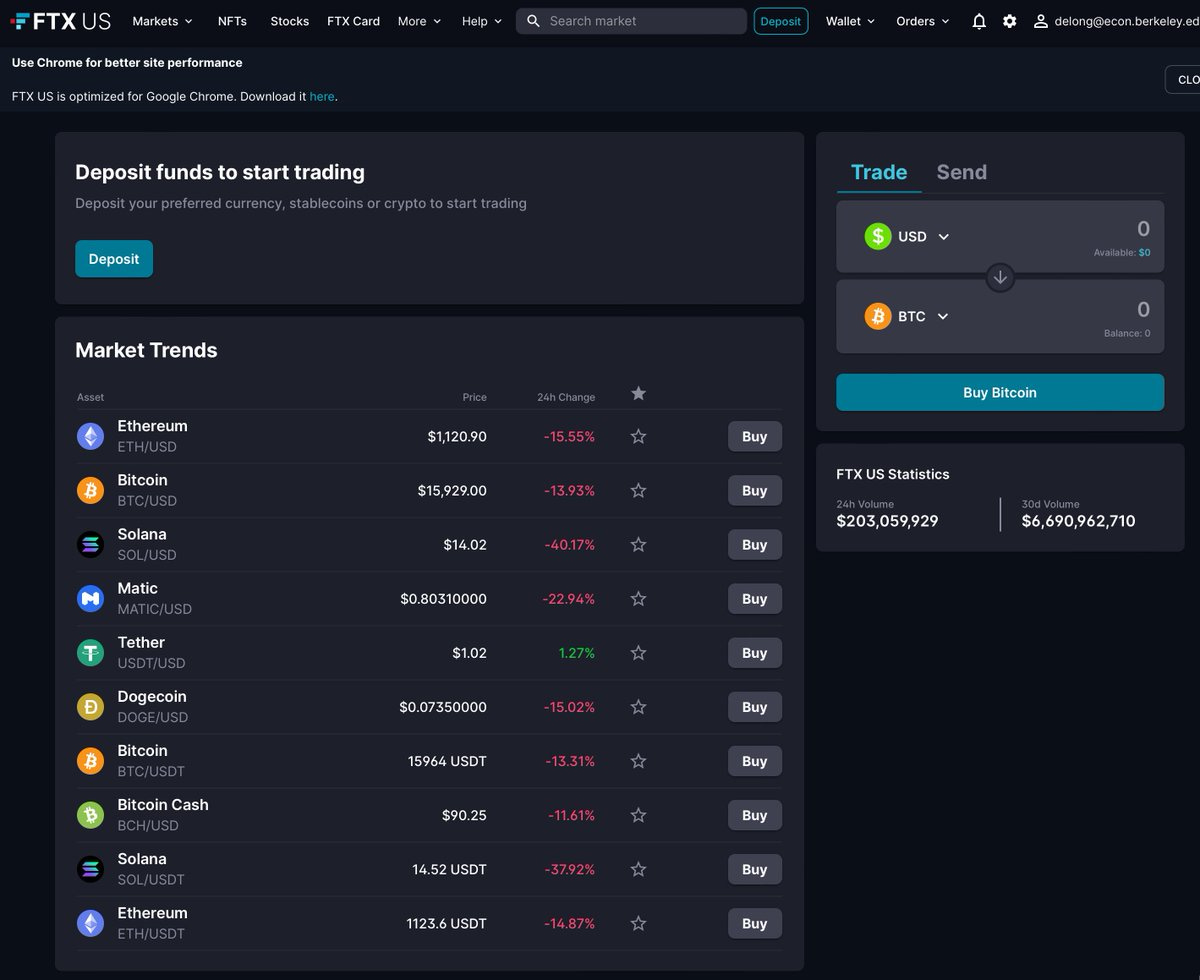

One Image: Crypto:

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Branko Milanovic: Western money and Eastern promises: ‘It is a grand bazaar. Gorbachev begins by asking DM 20 billion in order to remove Soviet troops from Eastern Germany. Kohl comes with only DM 5 billion. He asks Americans to help: they refuse. Kohl then scrambles to find a total of DM 8 billion, the offer that Gorbachev rejects as a “dead end”. Kohl moves to DM 12 billion. Still no good. In desperation, Kohl offers an additional DM 3 billion of interest-free loans. Deal…

Nate Silver: Candidate Quality Mattered: ‘As it often does: I wrote about my three key questions heading into Election Day… polling error… turnout… the third question, about whether candidate quality would matter, is the easiest to answer: It’s a resounding yes…. Look at the large difference between Senate and gubernatorial results in states with both types of races…

Peter Leyden: The Great Progression, 2025-2050: ‘The next 25 years will see the introduction and scaling up of… energy… biotech… infotech…. Authoritarian closed societies always lose to open democracies in the long run…

Michelle Goldberg: Here’s Hoping Elon Musk Destroys Twitter: ‘Twitter as like staying too late at a bad party full of people who hate you. I now think this was too generous to Twitter. I mean, even the worst parties end. Twitter is more like an existentialist parable of a party, with disembodied souls trying and failing to be properly seen, forever. It’s not surprising that the platform’s most prolific users often refer to it as “this hellsite”…

¶s:

The Economist: The spectacular fall of FTX and Sam Bankman-Fried: ‘The apparent size of the hole in ftx’s balance-sheet indicates problems ran far deeper than a rival starting rumours. The details of what went wrong in the beanbag-strewn offices of ftx and Alameda are not yet clear. An exchange, which sits between buyer and seller and takes a spread, should not be an easy business to bankrupt. It is not typically exposed to runs, since it merely holds assets on behalf of investors…. The crypto winter had previously claimed only the types of victims that would be expected, including a poorly designed stablecoin, a hedge fund and several platforms that made risky loans. That it has come for ftx, a well-regarded business, and Mr Bankman-Fried is an enormous blow. It has left other institutions scrambling to reassure customers. Coinbase, a large exchange, has sent out reassuring missives to the press. Its share price has nevertheless shed a fifth of its value in recent days, and is close to all-time lows…

Charles Dickens: Little Dorrit: ‘Mr Merdle was immensely rich; a man of prodigious enterprise; a Midas without the ears, who turned all he touched to gold. He was in everything good, from banking to building. He was in Parliament, of course. He was in the City, necessarily. He was Chairman of this, Trustee of that, President of the other. The weightiest of men had said to projectors, “Now, what name have you got? Have you got Merdle?” And, the reply being in the negative, had said, “Then I won’t look at you.”… But, at about the time of High ‘Change, Pressure began to wane, and appalling whispers to circulate, east, west, north, and south. At first they were faint, and went no further than a doubt whether Mr Merdle’s wealth would be found to be as vast as had been supposed; whether there might not be a temporary difficulty in ‘realising’ it; whether there might not even be a temporary suspension (say a month or so), on the part of the wonderful Bank. As the whispers became louder, which they did from that time every minute, they became more threatening…

Duncan Weldon: Learning the wrong lessons: ‘The BOE was already raising interest rates to bring inflation back to target. Given that looser fiscal policy would add to demand and hence spending the Bank would have to raise interest rates at a faster pace and to a higher terminal value to offset the government’s actions. Looser fiscal policy meant tighter monetary policy and therefore, gilts fell in value. But that was not all that was going on. There was also the LDI debacle. Which, in the words of the BOE, risked a ‘fire sale dynamic’ in the gilt market…. Fiscal rules are a useful thing. But they need to take account of the economic cycle and focus on the medium term. Rules that require adding to a downturn are bad rules. Promising to do incredible things is not the route to credibility. The biggest package of tax cuts in 50 years – funded by borrowing – was an irrational fiscal policy…. A sharp tightening of fiscal policy now even as consumer demand dries up is equally inappropriate…

"Authoritarian closed societies always lose to open democracies in the long run"

Fortunately I'd finished my coffee before reading this, no liquid damage.

All systems collapse in the long run but I don't think we're playing rock-paper-scissors, as the remark would suggest. Not intended as a factual statement I suppose.

" The biggest package of tax cuts in 50 years – funded by borrowing – was an irrational fiscal policy…"

Isn't ANY size tax cut funded by borrowing bad? Isn't this the conventional wisdom (outside of "media macro"/NYT pundit types) since Reagan/GWB and Trump/Ryan did it?