Time to Revisit: How Does This Assessment Look Fourteen Months Later?

I need to update my assessment I made 14 months ago about "Team Transitory" vis-à-vis "Team Persistent" on US early-2020s inflation. I need to update it because I am supposed to be giving the Tobin...

I need to update my assessment I made 14 months ago about "Team Transitory" vis-à-vis "Team Persistent" on US early-2020s inflation. I need to update it because I am supposed to be giving the Tobin-Godley Lecture on 2025-02-22 (Sa) at the Eastern Economic Association in New York…

So what does it look like today as if the proper assessment is of "Team Transitory" vis-à-vis "Team Persistent" on US early-2020s inflation?…

On one level, I think that this from Team Persistent’s Larry Summers is correct: Odds are that Team Persistent was largely wrong because Team Transitory’s policy advice was not taken.

Larry:

Larry Summers: We haven’t nailed the landing yet: ‘Look at underlying inflation rates… some… are still running well above 2 per cent. If inflation is currently at 2 per cent, it’s not clear that it won’t go back up again. And it isn’t clear that the landing has been soft… declining flows of credit, inverted yield curves, aspects of consumer behaviour… credit strains… raise the possibility that the landing won’t be soft…. The landing may be hard, and we may overfly. That said… hav[ing] inflation above 4 per cent and unemployment below 4 per cent, and you extricate from that situation without a recession… has never happened before in the United States…. And it certainly looks in play as a possibility…. Primary credit should be given to the Fed for having acted relatively rapidly to correct its earlier errors…. The Fed in 2022 raised rates very sharply in a way that did not take place during the Vietnam period. So I think that, ironically, if team transitory proves to be vindicated, it will only be because their policy advice was not taken. It will be because the Fed moved strongly enough that [inflation] expectations never became unanchored… <https://www.ft.com/content/59fff67e-b136-4435-89e1-2400b90f4b83>

But Team Persistent’s policy advice was right not because an inertial inflationary spiral was taking hold—not because the inflation process was indeed persistent—but, rather, because the underlying strength of Biden-Era forces pushing up investment in America was much more powerful than either side thought likely.

And here is my whole thing from fourteen months ago:

I Was on "Team Transitory". My historical perspective has, I think, made me much smarter than the majority of my peers in analyzing inflation so far this decade. I was not hypnotized into ignoring the reality outside my window by being unable to think of analogies and models other than “we are repeating the inflation of the 1970s”.

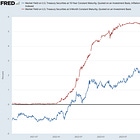

However, writing as a card-carrying member of Team Transitory, I must admit that I was substantially alarmed when the Federal Reserve kept raising rates in and after August 2022, after short rates broke above 2.5%/year nominal.

It seemed to me that it was running unwarranted and unnecessary risks of pushing the economy into recession, and possibly back into a depressed low-activity secular-stagnation zero interest-rate trap that it would be impossible to get out of in a timely fashion. Shifting from an inflation-indexed real ten-year rate of -1.0%/year to one of 0.5%/year seemed to me to be substantial monetary contraction. In view of the fiscal contraction already then in play, the prudent move seemed to me to pause, wait, and see what effect the Fed’s policy moves from January through July 2022 would have, and let the “long and variable lags” work out.

Thus a define point to Larry Summers, when he says: “ironically, if team transitory proves to be vindicated, it will only be because their policy advice was not taken…” The underlying expansionary momentum of nominal aggregate demand turned out to be much stronger than I would have imagined, and had the Federal Reserve paused Federal Funds-rate increases starting in August 2022, it would almost surely have seen significantly worse inflation news after that, had to restart the increases in or before the summer of 2023, and we would not now be quibbling about how this-or-that suggests that we are not certainly on a “soft landing” glide path:

Larry Summers: We haven’t nailed the landing yet <https://www.ft.com/content/59fff67e-b136-4435-89e1-2400b90f4b83>: ‘Look at underlying inflation rates… some… are still running well above 2 per cent. If inflation is currently at 2 per cent, it’s not clear that it won’t go back up again. And it isn’t clear that the landing has been soft… declining flows of credit, inverted yield curves, aspects of consumer behaviour… credit strains… raise the possibility that the landing won’t be soft…. The landing may be hard, and we may overfly. That said… hav[ing] inflation above 4 per cent and unemployment below 4 per cent, and you extricate from that situation without a recession… has never happened before in the United States…. And it certainly looks in play as a possibility…. Primary credit should be given to the Fed for having acted relatively rapidly to correct its earlier errors…. The Fed in 2022 raised rates very sharply in a way that did not take place during the Vietnam period. So I think that, ironically, if team transitory proves to be vindicated, it will only be because their policy advice was not taken. It will be because the Fed moved strongly enough that [inflation] expectations never became unanchored…

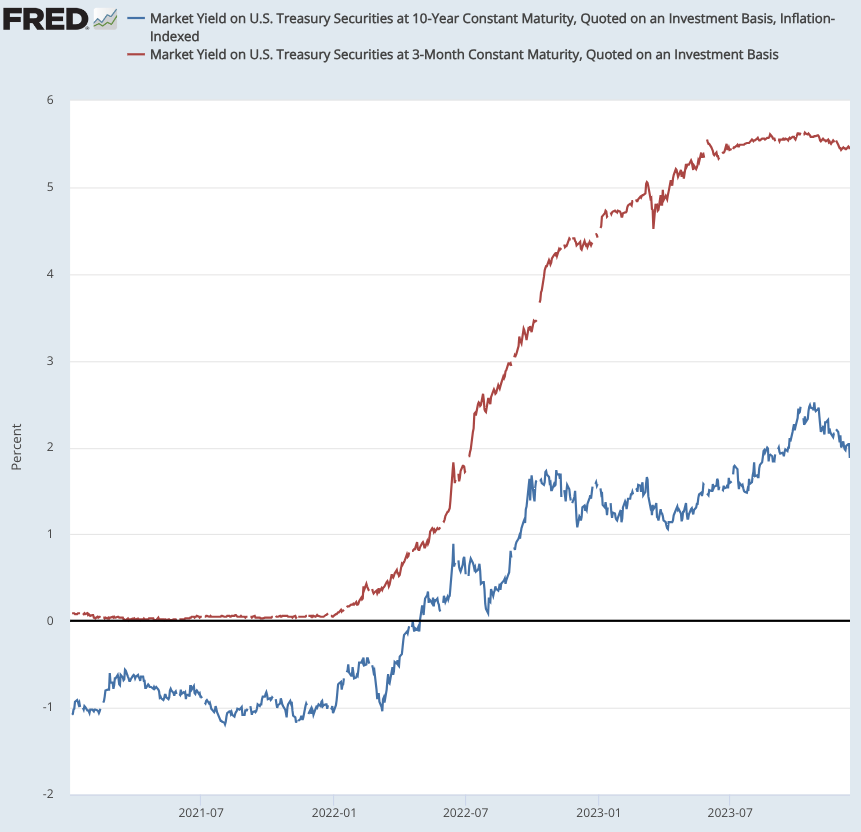

And, while Larry is right in a technical sense when he says: “inflation above 4 per cent and unemployment below 4 per cent, and you extricate from that situation without a recession… has never happened before in the United States…” the recessions that followed the late-1940s and early-1950s recessions were very brief. Plus inflation normalized without any restrictive monetary policy at all. (Indeed, monetary policy could not have been restrictive: the Federal Reserve was then committed to pegging the value of government bonds at a high level.)

In addition, I think Larry is wrong in denouncing the Federal Reserve for “earlier errors” in not raising interest rates before January of 2022. It seems to me optimal policy—both ex ante and ex post—for the Federal Reserve to have moved late to raise interest rates until it was nearly certain that the risks of a return to a secular stagnation régime were minimal. And that near certainty did not come until the end of 2021. Moreover, it seems to me optimal policy—both ex ante and ex post—for the Federal Reserve if it is indeed then going to move late to raise interest rates for it then to move fast. The fear of moving fast is that when you move fast you break china. But this time the only shards of porcelain on the floor are from three big but not too-big-to-fail banks, with minimal impact on the economy’s ability to mobilize and productively deploy resources.

We have had four episodes of post-WWII inflation, counting the late 1960s-early 1970s Vietnam War-triggered and the mid- and late-1970s OPEC-triggered as separate episodes alongside the late-1940s and early-1950s. Each episode has its unique characteristics shaped by geopolitical events, fiscal policies, and the global economic environment:

The late 1940s saw inflation driven by the post-war structural wheeling of the economy away from its wartime configuration driven by pent-up consumer demand.

The 1950s were characterized by the Korean War's impact on prices as the economy again underwent structural wheeling, this time into its Cold War configuration.

The late 1960s and early 1970s were marked by the Vietnam War and Great Society programs, leading to significant government spending expansions in the context of accommodative monetary policy.

Finally, OPEC in the 1970s drove supply shocks that drastically pushed up prices in the context of inflation expectations having already been unmoored by the Vietnam episode.

The focus of the policy discussion on inflation over the past three years has been almost exclusively on these latest two episodes. That has struck me as very odd. It seemed to me that the two earlier episodes had much more to teach us, and that the latter two had very important elements—accommodative monetary policy, unmoored inflation expectations, and truly mammoth and persistent adverse supply shocks—that were simply not being repeated here and now in the early 2020s.

Alan Blinder once opined to me that the structure of the macroeconomy changes so fast and business cycles come sufficiently rarely that forward-looking business-cycle analysis is always fundamentally a one data-point regression, based on the last cycle. This seemed to me to be obviously true, inasmuch as as the immediate past economic structure and how the macroeconomy reacted to the last shock is the only even semi-reliable piece of information about structure. But there are also shocks. And the shock that caused the last business cycle may well be very different from the shocks currently on the menu. Thus I think that there is value in looking further back than the last cycle for analogous shocks.

The big analytical point I take away from this episode of trying to understand the inflation process in real time is that it is time for us to take seriously the study of the links from changing macro structure to changing business-cycle outcomes. The transition from a manufacturing-based to a service-oriented and now to an information-driven economy has profound implications for how business cycles manifest and are managed. Traditional tools of monetary and fiscal policy may well have different effects in an attention-information economy than they had in a global value-chain or a mass-production economy. Understanding these links is crucial for developing more effective policy interventions that are attuned to the current economic realities.

Forty years ago, as a young whippersnapper, I was sure that by now we would have these links from changing macro structure to changing business-cycle outcomes nailed.

But we are, basically, still nowheresville in terms of comprehending the intricate and changing dynamics of modern business cycles.

What do we know about how the business-cycle changes as we have moved from a commercial-society economy to a steampower-society economy, and then, successively, to applied-science, mass-production, global value-chain, and now attention-information economic structure?:

Commercial-society economy business cycles were primarily driven by agricultural outputs, seasonal variations, the limitations of physical trade—and the interactions of these with finance. Economic downturns often resulted from poor harvests. Booms were associated with bountiful yields and thriving trade. Financial crises were very real, but did not lead to idle capacity and persistent mass unemployment—rather, whatever goods were owned by the bankrupt were auctioned off on the steps of the Rialto Bridge, insolvent debtors were sent to be galley slaves, and the system picked itself up rapidly.

Steampower-society economy business cycles saw a shift towards industrial output as the primary driver. The regularity of factory production, the rise of urban centers, and the development of railroads and steamships transformed the nature of economic fluctuations, with industrial production and capital investment becoming key factors—and the industrial depression with increased mass urban poverty and idleness as the principal features.

Applied-science economy business cycles were characterized by significant technological advancements and the rise of large corporations. This era saw a more significant role for government in managing economic cycles, with strong Progressive-Era pushes for regulatory frameworks and the emergence of welfare systems to deal with the obvious inadequacies of capitalism.

Mass-production economy business cycles were dominated by the manufacturing sector, with consumer goods production and automobile industries playing significant roles—plus the importance of growing consumer credit.

Global value-chain economy business cycles reflected the interconnectedness of the global economy. Economic fluctuations were no longer confined to national borders, as supply chain disruptions, trade policies, and foreign exchange rates became increasingly influential.

Attention-information economy business cycles are currently being shaped by… what?

Understanding the evolution of business cycles across these different economic structures would seem to be crucial for effective economic policy-making.

But we do not.

References:

DeLong, J. Bradford. 2023. "I Was on Team Transitory: My Historical Perspective." Grasping Reality. December 15. <https://braddelong.substack.com/p/i-was-on-team-transitory-my-historical>.

Summers, Lawrence. 2023. "We Haven't Nailed the Landing Yet." Financial Times. December 14. <https://www.ft.com/content/59fff67e-b136-4435-89e1-2400b90f4b83>.

What most people do not realize or acknowledge is that they got the labor market wrong. The labor force increase did a lot of the inflation-reducing work for the Fed. And the labor demand was so strong that employers absorbed nearly all of the increase in the labor force. That left us with low unemployment and moderating wage pressures. Waiting for you to enlighten us on why this is novel to the current period. Just to throw spaghetti on the wall, could it perhaps be a function of readily available information about job vacancies, easier job searches due to access to that information, and quicker matching of workers to jobs (because interview and employment can essentially occur remotely online). This time we sure did employ a massive number of people in a short duration, despite high retirement rates during Covid.

If economists cannot forecast the economy any more than historians can predict future events, why is so much attention given to forecasting rather than just explaining economic history? Historians don't try to predict the future but can offer possibilities based on what seems to rhyme with the past. The public-facing attention of economists is predicting the future based on the economic present and events taken. The result seems to be many failed predictions, even if the models have some value. Maybe it is a mathiness approach that provides a false sense of accuracy, that with hindsight proves wrong. Are economists less like sorcerers and more like sorcerers' apprentices?