Jason Furman on how to properly worry about the U.S. national debt; Paul Krugman on the end of the claim that jobless Americans are “zero marginal product workers”; very briefly noted; Jan Hatzius of Goldman Sachs says: soft landing achieved; PerplexityAI is a lying liar, in many senses; services-led economic development appears a forlorn hope; be sure to count all of the costs of geoengineering when you think about it!; right-wing global-warming denier hyena-hack Holman Jenkins is truly deranged in his takes on Elon Musk; Paul Krugman says: soft landing achieved; & Lucidity on "AI" investments considered harmful; the great Agrarian-Age vine-&-figtree shortage; reviewing Blinder's "Monetary & Fiscal History"; Joe Wiesenthal praises my "Slouching Towards Utopia"; Isaac Asimov on dominionist ethnonationalism; & weekly briefly noted for 2024-06-15 Sa...

ONE VIDEO: Jason Furman (2021): When, If Ever, Should We Worry About the Debt?

IMAGES: Employment:

The “America’s jobless are zero-marginal-product workers” scare of twelve years ago was one of the crudest, cruelist, and most ridiculous doctrine ever advanced by economists of note and reputation:

Very Briefly Noted:

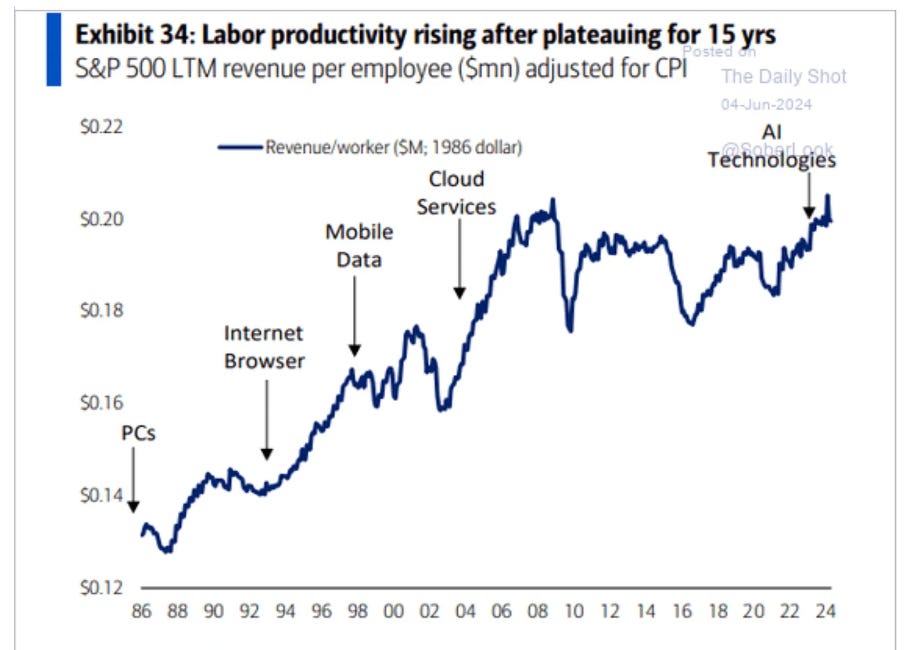

Economics: So far, "AI" is huge profits for NVIDIA, as only Google and Apple have escaped the trap of paying NVIDI, exactly as much as it wants because they do not dare delay things for six months needed to build an alternative, cheaper, hardware-software stack—and quite possibly fail to do so. So far, "AI" is software companies finding that they have to provide services expenses in training and then in data center and electricity inference costs simply to protect their existing oligopoly, profit centers, without gaining significant additional revenue in return. And, so far, "AI “is a bunch of startups with no business models saved to pull the plug into years when Open AI, Microsoft, or Google Sherlock, you—unless you can get acquired by one of them as part of the Sherlock process first. IMHO, Google is highly likely to make money off of this because it does not have to pay the NVIDIA tax. IMHO, Apple is highly likely to make money off of this because it will sell devices for which it does not pay the NVIDIA tax, plus users pay the electricity costs. And Microsoft and OpenAI may make serious money. That is what the finances look like to me right now. But what does all this mean for technology and humanity’s collective wealth? I do not even have a guess yet: Brody Ford: AI Isn’t Making Much Money for Software Companies — Yet: ‘Application makers are laser-focused on building AI tools…. [But] is… anyone is willing to pay for them…. A year and a half into AI mania, there isn’t much [software] revenue to show for this work…. In many cases, software companies can’t even decide on how to charge for them. Some are using AI as a pitch for higher-priced subscription tiers, others are selling “generative credits,” and a few others — like Zoom Video Communications Inc. — are just bundling AI features for free…. Meanwhile, makers of AI-oriented hardware like Dell Technologies Inc. have seen massive rallies. On Tuesday, Nvidia Corp. passed Microsoft Corp. and Apple Inc. to become the world’s most-valuable company. That’s because most AI spending at this point is going toward hardware or cloud infrastructure, which is used to train and deploy models... <https://www.bloomberg.com/news/newsletters/2024-06-19/salesforce-workday-struggle-to-make-money-from-boom-in-ai-demand?cmpid=BBD061924_TECH>

There is now next to no price discovery in either commercial real estate or private equity. And that raises a profound fear that right now the economy is much more fragile than we know, in ways that we cannot really know: Torsten Sløk: The Pain in Real Estate Continues: ‘It is remarkable how vacancy rates for commercial real estate are moving sideways or higher in a strong economy, see the first chart below. You would have expected that the ongoing strong growth in employment and GDP would push vacancy rates lower. If the Fed succeeds with slowing the economy down, then all these lines will move higher, and potentially very quickly. Combined with the steep maturity wall for CRE, see the second chart, the bottom line is that the pain in office, apartments, and industrial real estate continues… <https://www.apolloacademy.com/the-pain-in-real-estate-continues/>

I do wish that Dan had gone further, and had calculated an index of getting the right nail installed in the right place, and—of course—that he had gone back much, much further: Daniel Sichel (2022): The Price of Nails since 1695: A Window into Economic Change: ‘The share of nails in GDP dropped back from 0.4 percent of GDP in 1810—comparable to today’s share of household purchases of personal computers—to a de minimis share more recently; accordingly, nails played a bigger role in American life in that earlier period. Finally, real nail prices have increased since the mid 20th century, reflecting in part an upturn in materials prices and a shift toward specialty nails in the wake of import competition, though the introduction of nail guns partly offset these increases for the price of installed nails.… Sichel, Daniel E. 2022. "The Price of Nails since 1695: A Window into Economic Change." Journal of Economic Perspectives 36 (1): 125-150. <https://www.aeaweb.org/articles?id=10.1257/jep.36.1.125>

American Political Economy: The Obama-era decisions coming from the top down and finding great support among the technocracy that “we have to build our policies to please David Brooks”, “we have to talk aggressively away from the rapid restoration of full employment and make a Grand Bargain that will cut back the social-insurance state”, and “the bankers have us by the plums, and so we need to do more to make them happy” were indeed, from one perspective, decisions of “legislative strategy, not… ideological fundamentals”. But it was only the ideological fundamentals that could ever make anyone think this was good legislative strategy: Matt Yglesias; How I went from left to center-left: ‘The influential Roosevelt Institute put out a 2021 report concluding that neoliberal economics and Obama-style racial liberalism had fundamentally failed and needed to be replaced with a “new paradigm.” I just do not think that this is correct. Obama and his team were flawed human beings who made mistakes…. I was often frustrated with their extreme reluctance to admit to any errors of judgment. But I do not think there has actually been any huge conceptual leap…. Could a different approach to legislative strategy have finagled more money out of congress?… I think… probably yes. But that’s an argument about legislative strategy, not about ideological fundamentals. So that’s been one of the biggest shifts for me: a leftward slippage of the political spectrum that I think was largely unwarranted. But there are also a few issues where I’ve grown genuinely more conservative.… <https://www.slowboring.com/p/how-i-went-from-left-to-center-left>

Crypto & Other Grifts: Those pushing for unregulated crypto this are not concerned with any "right to gamble freely", let along with any remaining dregs of some long-dead libertarian Web3 vision. They are concerned with the ability to run profitable pump and the dump machines by making as many material misrepresentations as they can about what is really going on: Joe Weisenthal: Crypto narratives come and go: ‘Talking about use case is almost kind of a joke at this point…. Five or six years ago, you heard a lot about how crypto could be this new tool for modes of social coordination…. This was fanciful vaporware, [but] it was at least kind of interesting fanciful vaporware… an ideological project…. Now all… is financialization and memecoins…. Now… the rhetoric of freedom is… about maintaining the right to gamble, unfettered, on instruments that often look a lot like stocks, without all of the disclosure and other regulations that apply to listed companies… <https://www.bloomberg.com/news/newsletters/2024-06-20/five-things-you-need-to-know-to-start-your-day-americas?cmpid=BBD062024_MKT>

Lying by saying that you are doing things that you are not, and lying by saying that you are not doing things that they are. “Vaporeware” as a weapon to be deployed against competitors and users has long been a thing. But in the aftermath of Web2 and crypto it has taken on a much nastier edge: Dhruv Mehrotra & Tim Marchman: Perplexity Is a Bullshit Machine: ‘That secret IP address—44.221.181.252—has hit properties at Condé Nast… at least 822 times in the past three months…. Immediately after a WIRED reporter prompted the Perplexity chatbot to summarize the website's content, the server logged that the IP address visited the site…. [And] Perplexity is summarizing not actual news articles but reconstructions of what they say based on URLs and traces of them left in search engines… [while] purporting to be based on direct access to the relevant text. The magic trick that’s made Perplexity worth 10 figures… [is] that it’s both doing what it says it isn’t and not doing what it says it is… <https://www.wired.com/story/perplexity-is-a-bullshit-machine/>

MAMLMs: I think that this is both right and wrong. There is deep and heavy magic in the construction of the embeddings vectors and the similarity metric that relates them. We do not understand this deep and heavy magic, however. And that makes it useful only as a… pastiche machine for stochastic parrots, but given our affordance to interact via natural language, stochastic parrotage can be very valuable indeed: Gary Marcus: Partial Regurgitation & how LLMs really work: ‘What the LLM does is more akin to what some high school students do when they plagiarize: change a few words here or there, while still sticking close to the original. LLMs are great at that. By clustering piles of similar things together in a giant n-dimensional space, they pretty much automatically become synonym and pastische machines, regurgitating a lot of words with slight paraphrases while adding conceptually little, and understanding even less…. The unknowing repetition of a joke from reddit — by a machine that doesn’t get the joke — refracted through a synonym and paraphrasing wizard that is grammatically adept but conceptually brain-dead. Partial regurgitation, no matter how fluent, does not, and will not ever, constitute genuine comprehension. Getting to real AI will require a different approach… <https://garymarcus.substack.com/p/partial-regurgitation-and-how-llms>

Central Country: I need to reread Yasheng Huang’s The Rise & Fall of the EAST: How Exams, Autocracy, Stability, and Technology Brought China Success, and Why They Might Lead to Its Decline this summer: Debin Ma: China’s Long March Back to Stagnation: PROJECT SYNDICATE: ‘History, for the current regime, is not about understanding the past; rather, it has become a tool to legitimize the past decade’s ideological turn…. Four decades of reform and opening-up coincided with dazzling double-digit economic growth, leaving many to believe – with a sigh of relief or even amnesia – that the Mao era was firmly in the past. But the events of the past decade show that not everyone shared that belief…. Huang presents his own position unequivocally, proclaiming the market to be the ultimate driving force of China’s economic growth miracle. In his “shorter” history, he – like other staunch supporters of the market view – gives credit to the ideological and intellectual dynamism of the 1980s as the origin of China’s transformation… <https://www.project-syndicate.org/onpoint/china-historical-roots-of-economic-miracle-and-return-to-statism-by-debin-ma-2024-01>

San Francisco: Most fun dining experience of the post-plague world: Lauren Saria (2023): Michelin-Starred Mister Jiu’s Returns Refreshed and Ready to Make More Memories in Chinatown: ‘Chef Brandon Jew says switching to a tasting menu makes the restaurant more focused—and more sustainable…. There’s now a larger Cantonese-style wok better suited for cooking the fried rice on the a la carte bar menu and there’s also a proper, old-school steam table for the cheong fun… <https://sf.eater.com/2023/3/27/23658324/mister-jius-reopen-new-tasting-menu-chinatown-restaurant>

Public Reason: There is absolutely nothing wrong with sharecropping as risk-spreading and capital-mobilizing in its place; it is only when it becomes part of a force-and-fraud domination-and-exploitation scheme that it deserves its negative connotative valence: Venkatesh Rao: ‘The SubStack team is sincere... the tensions of being a VC-funded platform while being writer-friendly and growing total readership…. The “sovereign creator” archetype described by Hamish is a bit of dangerous mythologizing…. But… calling it “sharecropping”… as critics like to is equally inaccurate…. The team is actually managing well…. 1. Network effects are real…. 2. SubStack now curates discovery… fine and reasonable but vulnerable to dangerous temptations…. 3. Subscriber list data and (in a janky way), Stripe billing relationships… “owned” by writers…. Best of a bad set of options…. 4. Relationship tools… are all great, but this is where… alignment is weakest. 5. Copyright is fraught…. 6. Product growth vectors in short-form video and swipe-based low-friction graph curation…. Revenue being linked to longform core adequately balances those pressures for now…. 7. Finally, perhaps my biggest concern is the gradual dominance of in-app reading and features over both email and web. The closed UX is eating the open protocol…. Overall, substack is about as good as Web 2.5 can get. But it’s ultimately in “don’t be evil” zone rather than “can’t be evil” zone… <https://substack.com/@ribbonfarmstudio/note/c-57119199>

Strictly speaking, one should NEVER worry about "debt." Worry about the suboptimal spending and taxing policies that produced it. If [which I do not believe for a minute] the spending taxing policies were optimal, the debt is nothing to worry about.

https://thomaslhutcheson.substack.com/p/debtpocalypse

"Tasting menus" are exactly why I hate Michelin-starred restaurants. If I have to jump through hoops just to score a reservation and pay a fortune for the privilege then by the time I get there I want the experience to be about me, not the fucking chef. I'll order what I feel like eating à la carte, thank you very much, not what the chef feels like feeding me off a glorified prix fixe.