WEEKLY BRIEFLY NOTED: For 2024-06-15 Sa

Trying to peer into the MAMLM LLM black box; social control of women by state; corporate America & its workers; very briefly noted; Shadow Fed conference comments on Orphanides & on Levy & Plosser...

Trying to peer into the MAMLM LLM black box; social control of women by state; corporate America & its workers; very briefly noted; Shadow Fed conference comments on Orphanides & on Levy & Plosser; do financial system-aware Republicans have any ovaries at all?; six office-hour questions; the supercore PCE soft landing was a year ago; could Marx be right for our day?; Elon Musk should not be a meme-stock booster; Donald Trump: sundowning in America; the world teaches us about monetary economics; 70,000 years of economic growth, & BRIEFLY NOTED: For 2024-06-07 Fr…

ONE VIDEO: Seeing into the MAMLM LLM Black Box:

Josh Batson, Kevin Roose, & Casey Newton

<https://www.anthropic.com/news/mapping-mind-language-model>

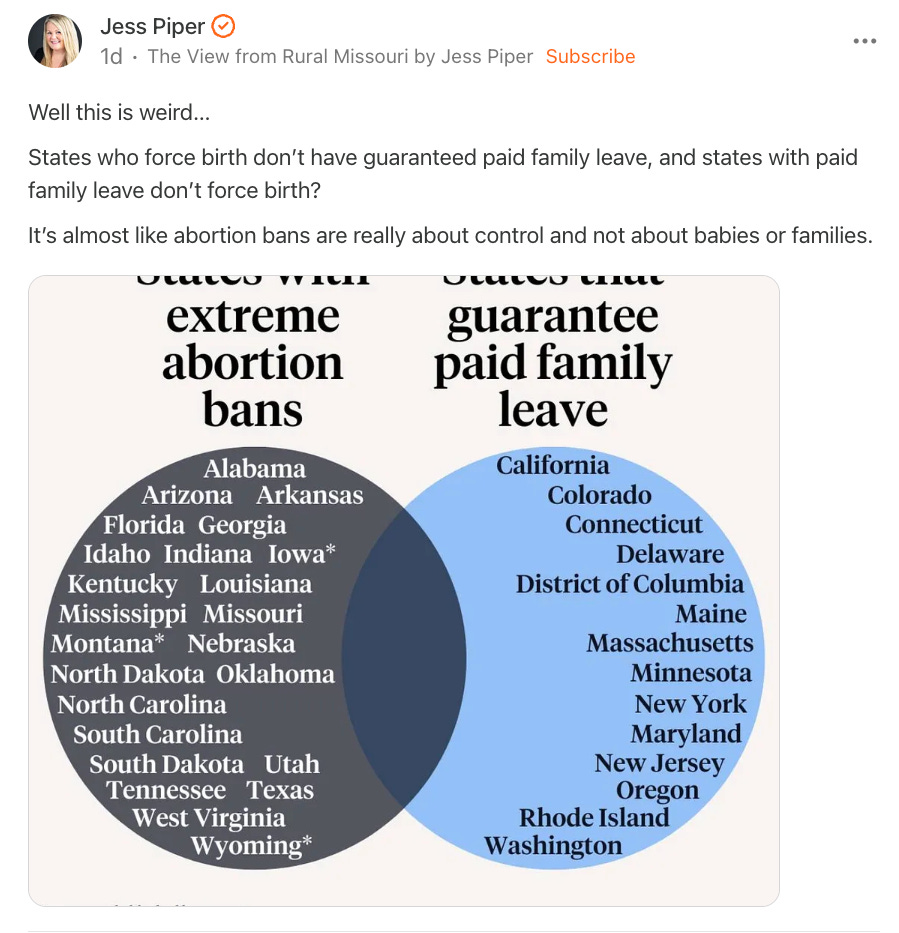

ONE IMAGE: Social Control of Women:

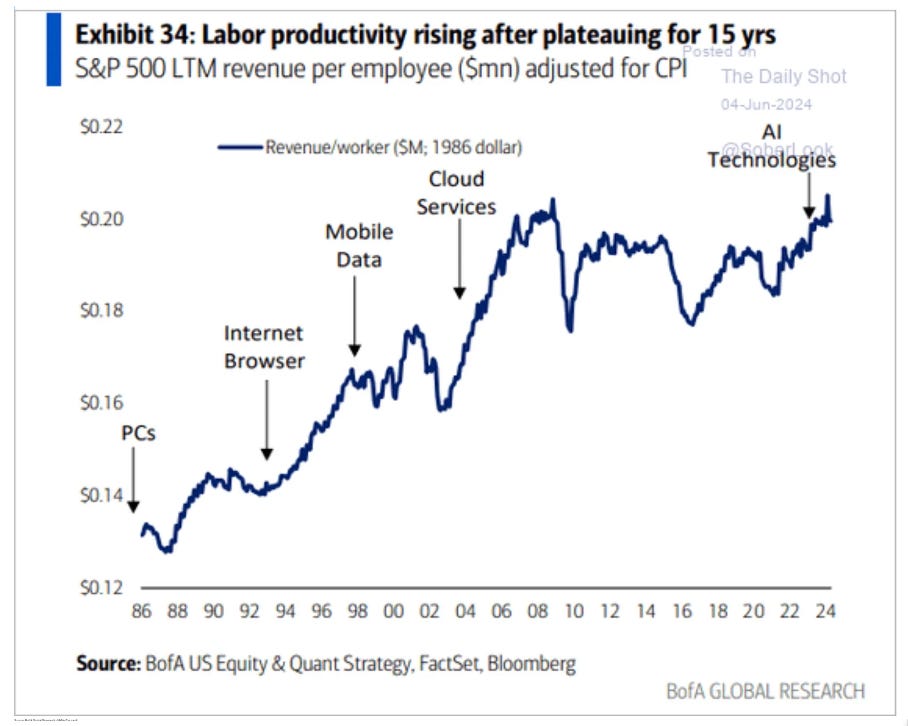

ONE IMAGE: Corporate America & Its Workers:

An interesting number, even if not economy-wide labor productivity. Shows, among other things, how devastating the Obama-era failure to prioritize full employment was:

Very Briefly Noted:

Economics: I discussed two papers at their spring meeting at Chapman University. An organization that is, from my perspective, one of John Stuart Mill’s useful intellectual adversaries: often wrong, but always thought-provoking, and definitely useful as an alternative perspective: Shadow FOMC: ‘An independent organization… evaluat[ing] the policy choices and actions of the Federal Reserve’s Open Market Committee (FOMC)…. The Committee’s deliberations are intended to improve policy discussions among policy makers, journalists and the general public with the hope that wiser policy decisions will result. Since 1973, the SOMC has met on a regular basis to discuss economic policy… <https://events.chapman.edu/92517> <https://chapman.zoom.us/j/95425059821> <https://manhattan.institute/project/somc>

One of the great classics: Bound, John, David A. Jaeger, & Regina M. Baker. 1995. "Problems with Instrumental Variables Estimation When the Correlation Between the Instruments and the Endogenous Explanatory Variable Is Weak." Journal of the American Statistical Association 90 (430): 443-450… <https://doi.org/10.1080/01621459.1995.10476536>

Possible reasons why I have been seriously overscared of a crash and a recession for the past two and a half years: Torsten Sløk: ‘Before the pandemic, the share of outstanding mortgages with interest rates below 4% was 38%. Today it is 63%…. Housing is adjusting very slowly to Fed hikes. Millions… still benefit from… locked-in low mortgage rates…. The transmission mechanism of monetary policy is much slower than normal…. A key reason why the economy is still so strong is the significant tailwind to growth coming from CHIPS… I[RA]… and… Infrastructure…. Monetary policy is using high interest rates trying to slow the economy down. Fiscal policy is utilizing open-ended policies to boost growth and employment. In short, the positive effects of fiscal policy are dominating the negative effects of Fed hikes... <https://www.apolloacademy.com/positive-effects-of-fiscal-policy-dominating-negative-effects-of-fed-hikes/>

But signs of weakening private investment are becoming more evident: Christ Anstey: Investment Plans Show Pain of Fed Rates Reset: ‘The impact is visible in investment spending, which is among the most interest-rate sensitive of economic activities: Capital investments in manufacturing will rise by only 3.9% this year, down from a January estimate of 6.7%, S&P Global Market Intelligence projects. The Institute for Supply Management’s latest economic forecast showed company leaders expect only a 1% increase in capital outlays this year, down from an estimate of almost 12% last December. The Association For Manufacturing Technology last month reported that average monthly orders from contract machine shops are 11.3% lower in 2024 than in 2023, reflecting a shift by customers “away from longer-term procurement cycles.” The backdrop for those changes in plans and projections: a sharp shift in expectations for interest rates in 2024… <https://www.bloomberg.com/news/newsletters/2024-06-11/fed-rate-cuts-latest-investment-plans-show-pain-of-fed-reset?cmpid=BBD061124_NEF>

SpaceX is now a great success as a (1) technology-forcer and (2) stakeholder network and (5) a meme company. But its value as a source of long-run profits for fundamental investors and as a ball in the speculative financial casino roulette wheel still hangs in the balance: Ryan Cooper: ‘Wild to me that SpaceX accounted for *80 percent* of all payload launched into space last year—not just US cargo, but for the entire planet…. Hard to believe that this drug addled shithead who owns 5 companies, spends half his waking life posting Nazi propaganda on Vichy Twitter, and the other half (allegedly) harassing his employees, could be responsible for this. but I guess anything is possible… <https://arstechnica.com/space/2023/11/2023-has-been-another-year-with-a-record-number-of-orbital-launches/>

Private-equity valuation games for beginners: Matt Levine: ‘To be fair, it’s not like the secondary-market buyers are just making up valuations. They are relying on official outside valuations, rather than their own subjective views: “When the Hamilton Lane fund buys a stake in a private-equity fund, it relies on the valuation provided by the other fund’s manager, known as the general partner. ‘We do not adjust the GP’s valuation’, said Erik Hirsch, co-chief executive officer of Hamilton Lane. ‘We would have no basis to adjust that’.” No basis? Not any basis at all? Weil can think of one: “Did the Hamilton Lane fund’s ability to buy a stake for so little raise any question about the higher valuation? ‘Absolutely not’, Hirsch said.” Obviously market prices have nothing to do with value… <https://www.bloomberg.com/opinion/articles/2024-06-10/private-equity-is-on-sale>

On the other hand, GM’s commitment to invest what is necessary to not die in the next generation is in grave doubt. “We don’t have anything good to do in the way of investment with our free cash flow” is really not a good look at all: Mike Forsythe: ‘Alternate headline: “Shielded from Chinese competition by high tariffs, GM blows money that could have gone to investment in EVs on financial gamesmanship”: Bloomberg: ‘General Motors authorizes a new $6 billion share buyback plan and raises its dividend <https://trib.al/TxGhoVo>… <https://x.com/PekingMike/status/1800499570599993605>

Journamalism: Can anyone tell me the game that the WSJ editorial page and corporate management are playing? “We gave favorable coverage to a guy holding one of our journalists hostage in the hope of keeping him sweet somehow” is one hell of a look: Josh Marshall: ‘A million times this: Chris Labarthe: “I mean, how can we even consider these WSJ pieces without the context of Trump's announcement that he's partnered with Putin in holding a WSJ reporter hostage, and won't release him if Biden wins…<https://twitter.com/joshtpm/status/1798367142964072506?cxt=HBwW9MDcwe3YivUxAAAA&cn=ZmxleGlibGVfcmVjcw%3D%3D>

Donald Trump’s major cognitive decline is not something the media spends a lot of time covering, is it?: Griffin: ‘You have to look at the glaring warning signs around Donald Trump. Listening to him now doesn't sound like him in 2016. I'm seeing a decline in him and others who know him have said that too. He confuses Nancy Pelosi with Nikki Haley, he confuses the president of Turkey with the president of Hungary, and he constantly confuses Joe Biden and Barack Obama. He's not sharp… <https://www.threads.net/@bidenharrishq/post/C8DZDrsxPf5>

MAMLMs: I confess I : Moskov: ‘Where is the revenue from AI in the market?… Meta is using AI for Reels ranking…. Amazon uses it for review aggregation…. Github Copilot and call center products…. The significant time lag between buying GPUs (benefitting NVDA) and buying inference…. Models leveraging H100s are [not] even trained yet, much less available to customers, even though NVDA already has their revenue from them. There will always be a good year or more lag in this way…. A lot of the companies buying large volumes of chips are frankly making bad financial decisions…. LLMs are basically loss leaders for the future…. Nobody should have expected a productivity revolution from people talking to chatbots. It takes time for vendors to integrate AI well, so that users can be successful and get value… <https://www.threads.net/@moskov/post/C74pchDSoFe>

MAMLMs

The wrong qestion is being asked. It is not revenue generation, but cost (labor) reduction that is relevant. Didn't Brad and Noah do a hexapodia post on this based on Noah's book review? Meanwhile Trump has apparently had an AI (ChatGPT?) rewrite a speech to make it "beautiful". Asked what did he say to the speechwriter? "You're fired". In Trump's case, he no doubt needed someone to do all the initial speech writing and then use the AI to do the rewrite. Maybe he can hire a beautiful woman to do the AI speech writing work for 15 mintes a day.

Labor productivity.

It wold be more instructive to add plots for unemplyment rates and median income to the chart. Adding pointers to technology introduction is just pandering to the "information technology improves productivity" explanation/meme rather than possibly more important factors. After all, revenue per employee can rise simply by firing employees and having the remaining ones work harder and longer hours.