My weekly read-around...

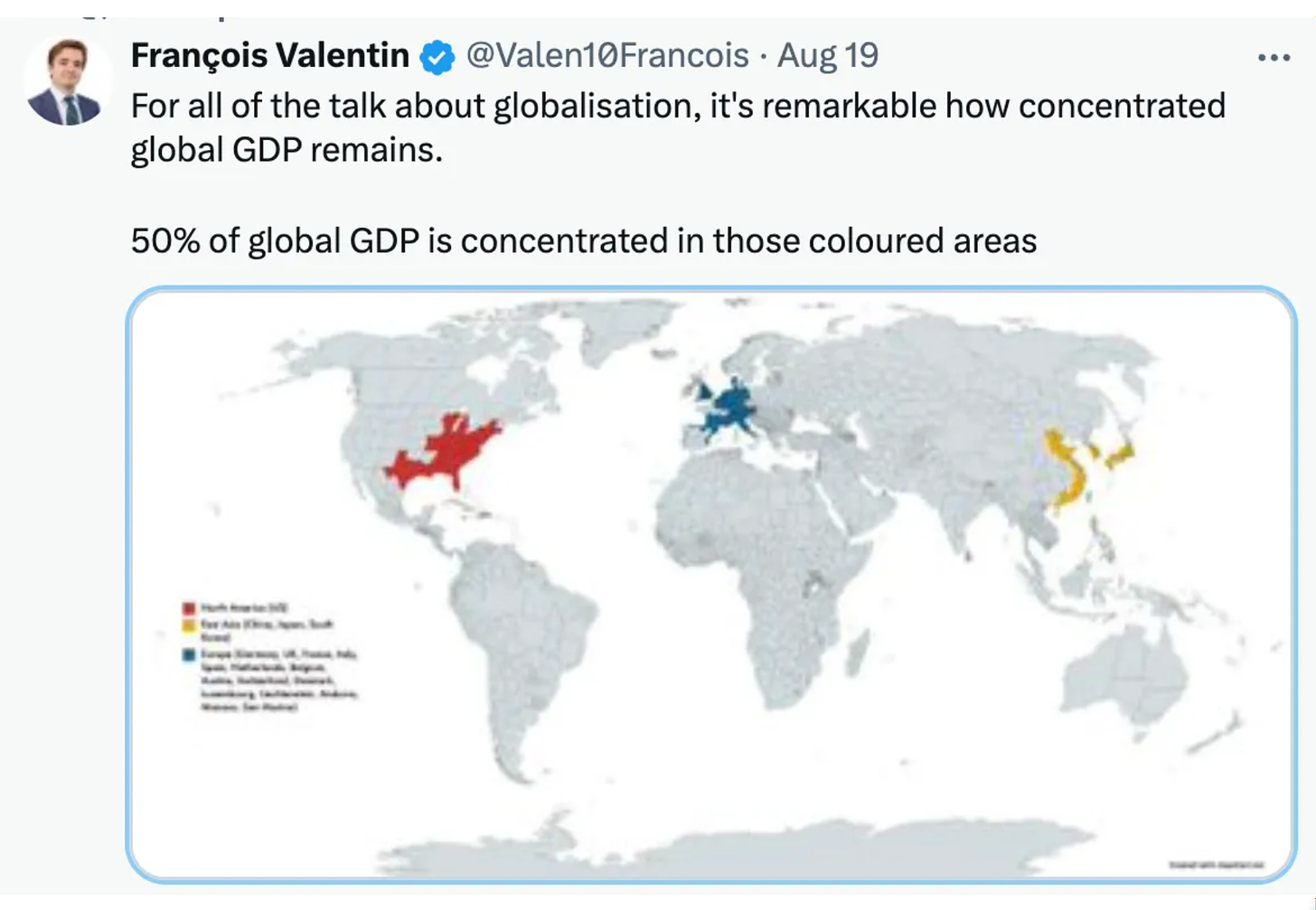

ONE IMAGE: Half of World GDP in Three Connected Regions with Less than One-Tenth of World Population

This map really should have swapped out Alabama, Mississippi, and a small piece of coastal China for more of western Europe and Australia’s Boomerang Coast in order to get the minimal population-share. Area is, I think, marginally less interesting than people. But both are fascinating, and very important:

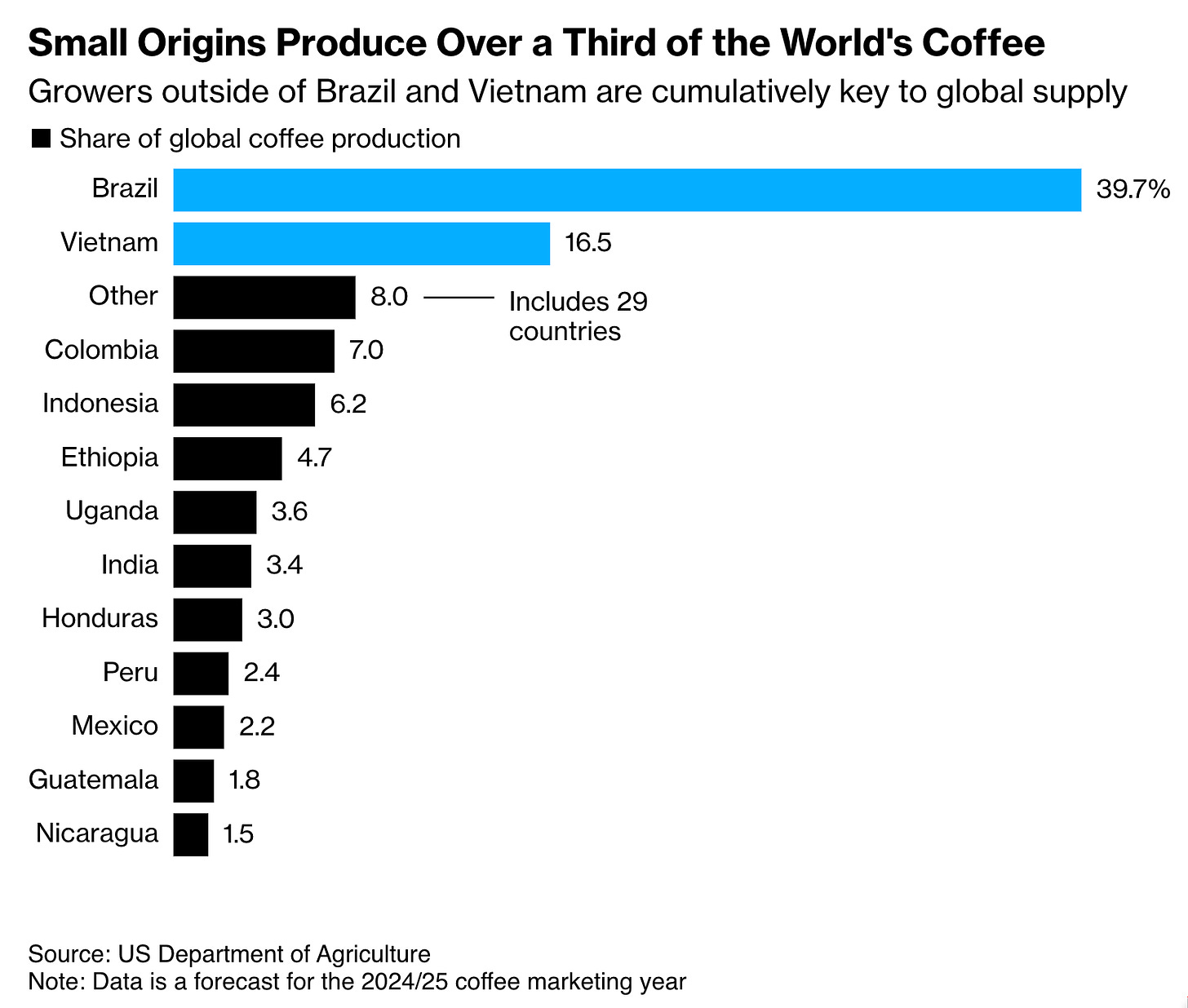

ANOTHER IMAGE: How Did Vietnam Get so Big in World Coffee Production so Fast?:

ONE AUDIO:

Odd Lots: Tracy Alloway, Joe Weisenthal, & Matt King: Hidden Forces Driving the [Early August] Market Selloff <https://overcast.fm/+AAQN1rZrz-Y>

A very puzzling shock with virtually no even short-term impact on pretty much anything—thus a substantial mystery…

MOAR AUDIOS: Evolution of Brains! & Bodies!:

Dwarkesh Podcast: Dwarkesh Patel & David Reich—How One Small Tribe Conquered the World 70,000 Years Ago <https://overcast.fm/+AAb53M05jOg>

On Humans: Ilari Mäkelä & Suzana Herculano-Houzel—Is the Human Brain Special? <https://overcast.fm/+AA8kS-J0QEo>

SubStack NOTES:

Very Briefly Noted:

Economics: I see John Auther this morning writing on how bond market interest-rate expectations “impl[y] bad things about the economy:

John Auther: Points of Return: ‘The JOLTS survey…. Joe Lavorgna of SMBC Nikko cautioned: “The labor market was in balance two months ago. However, the downtrend in job openings is concerning and hints at the possibility that the hiring and separation rates will deteriorate… support a 50-basis-point September rate cut…. Bets on the Fed to cut rates aggressively grew in confidence. The projected fed funds rate for its January meeting is now back to its lowest since February…. The market now expects the Fed to cut at every meeting between now and the end of next year. Once the fed funds are down at about 3%, it’s expected to leave it there for a while. That implies bad things about the economy… <https://public.hey.com/p/5U9oT7YXDfGoP7ibFwdZzsEW>

But I say: not so fast. The marginal bond trader these days is not the best forecast of what is going to happen in the economy. And the view that r* really is 3%—and that the Fed is going to get back there in the next fifteen months—is an optimistic one. “Bad things for the economy” is a Fed funds rate in fifteen months that is not 3%, but rather zero.Bill Dudley: High Tariffs, Weak Dollar? A Recipe for Disaster: ‘Donald Trump’s plan to boost US manufacturing is fundamentally flawed…. Ghe policies of higher tariffs and a weaker dollar are fundamentally at odds…. Trump’s proposed tax cuts… [mean only] a US recession… [could then] push down investment relative to savings. Trump’s policies could conceivably achieve this inadvertently…. The potential damage doesn’t end there. Higher tariffs would also stoke inflation…. Foreign governments would probably retaliate, making US exports even less competitive…. Economic friction would increase…. Productivity would suffer as output shifted from areas where the US had a comparative advantage…. Trump’s promises may sound good to voters hoping that higher tariffs would foster a renaissance in US manufacturing. If only it were so easy… <https://www.bloomberg.com/opinion/articles/2024-09-05/high-tariffs-weak-dollar-a-recipe-for-disaster?cmpid=socialflow-twitter-business>

Santiago Alvarez, Alberto Cavallo, Alexander MacKay, & Paolo Mengano: Markups and Cost Pass-through Along the Supply Chain: ‘We study markups and pricing strategies along the supply chain. Our unique dataset combines detailed price and cost information from a large global manufacturer with matched retail prices collected online for the period July 2018 through June 2023. We show that total markups—reflecting the difference between retail prices and production costs—are stable over time, despite the inflationary period at the end of the sample. Along the supply chain, manufacturer and retail markups are negatively correlated. For the most part, we find similar patterns across countries, though there is substantial heterogeneity in the split of markups between the manufacturer and retailers. Our analysis also reveals divergent pricing behaviors in response to cost shocks. The manufacturer adjusts prices more quickly than retailers and appears to more fully incorporate idiosyncratic cost shocks to specific products. Both types of firms respond more quickly to expected costs than to unexpected costs… <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4935032>

Morwenna Coniam: Office Values: ‘Office values in US central business districts have plunged 52% from their highs, with San Francisco, Manhattan and the core areas of Washington and Boston posting some of the biggest price declines among global metropolises since the pandemic. But outer neighborhoods are holding up better or even thriving. Nationally, the drop in values from the peak is 18% in US markets classified as suburban, or areas that are outside the traditional core. And in high-demand neighborhoods such as Century City, investor dollars continue to flow. You can read more about the divergence in today’s Big Take… <https://www.bloomberg.com/news/newsletters/2024-08-27/five-things-you-need-to-know-to-start-your-day-americas?cmpid=BBD082724_MKT>

Economic Development: Atif Mian: The structural roots of development: ‘Pakistan is not a typical developing country. It differs systematically from countries at similar levels of income per capita. Pakistan invests a third less than the average country at its income per capita. Pakistan’s child mortality rate is way higher, and literacy rate significantly lower. Its female labor force participation rate is less than half that of developing countries at similar income level…. The core reason for Pakistan’s divergence from rest of the world is that its leaders have not focused on the structural conditions necessary for growth. The focus instead has been on foreign borrowing, or some other half-baked idea driven by a broken nervous system. Unless there is structural change in the decision making process that focuses on the fundamentals, growth is unlikely to happen… <https://www.atifmian.com/p/the-structural-roots-of-development>

Economic History: Lukas Rosenberger, W. Walker Hanlon, & Carl Hallmann: Innovation Networks in the Industrial Revolution: ‘How did Britain sustain faster rates of economic growth than comparable European countries, such as France, during the Industrial Revolution? We argue that Britain possessed an important but underappreciated innovation advantage: British inventors worked in technologies that were more central within the innovation network. We offer a new approach for measuring the innovation network using patent data from Britain and France in the late-18th and early-19th century. We show that the network influenced innovation outcomes and demonstrate that British inventors worked in more central technologies within the innovation network than French inventors. Drawing on recently developed theoretical tools, and using a novel estimation strategy, we quantify the implications for technology growth rates in Britain compared to France. Our results indicate that the shape of the innovation network, and the location of British inventors within it, explains an important share of the more rapid technological change and industrial growth in Britain during the Industrial Revolution... <https://www.cesifo.org/en/publications/2024/working-paper/innovation-networks-industrial-revolution>

Journamalism: Paul Campos: : ‘The New York Times decided to give Rich Lowry column space to discuss how Donald Trump should make “character” the central issue of the 2024 presidential campaign. That sounds like the premise for an Onion article, but behold…. “Is he or she qualified, trustworthy and strong, and does he or she care about average Americans?”… Trump is dead last among presidents in caring about average Americans, because he’s dead last among presidents in caring for other human beings…. He is a narcissistic sociopath…. Lowry’s column is the most extreme form of gaslighting, and the NYT’s willingness to print it illustrates the extent to which the people who run the paper are either actively hoping that Trump wins, or failing utterly to meet their responsibilities to the historical moment, or some horrifying combination of this grim comment on their own characters… <https://www.lawyersgunsmoneyblog.com/2024/08/that-joke-isnt-funny-anymore>

Journamalism to the Max: The "New York Times's" former Ombudsman calls out the newspaper for its extremely ugly... mendacity? incompetence? cynicism? malevolence? in putting two big thumbs on the scale to normalize the deplorable ugly "the cruelty is the point" ravings of Donald Trump, and thus do what it can to boost Trump's chances in November. My view as to the most probable cause: the WORD has come down from the Sulzburgers that they really like their tax cut, and the reporters and other staff are falling in line:

Margaret Sullivan: An ugly case of 'false balance' in the New York Times: ‘Jill Abramson, the former top editor of the New York Times… nam[ing] the best reporters…. Jane Mayer… [and] James Risen…. I heard from Risen a few days ago…. He wrote to express his outrage at his former employer for a recent story. I pay particular attention to him as a former Timesman himself and a journalist of integrity. “At first, I thought this was a parody,” Risen told me.… “Harris and Trump Have Housing Ideas. Economists Have Doubts,” is the headline of the story he was angered by…. The story takes seriously Trump’s plan for the mass deportation of immigrants as part of his supposed “affordable housing” agenda. Here’s some both-sidesing for you, as the paper of record describes Harris’s tax cuts to spur construction and grants to first-time home buyers, and Trump’s deportation scheme. “Their two visions of how to solve America’s affordable housing shortage have little in common …But they do share one quality: Both have drawn skepticism from outside economists.” The story notes that experts are particularly skeptical about Trump’s idea, but the story’s framing and its headline certainly equate the two… <https://braddelong.substack.com/cp/148389045>John Quiggin: ‘I don't get claims about Harris being policy-light. She's carrying on the policies of the former Biden-Harris ticket, including $5 trillion in new tax revenue, restructuring of the Supreme Court, industrial policies that break with decades of neoliberal orthodoxy and national protection of abortion rights. But it seems as if only policies announced after July 2024 are considered to belong to Harris… <https://substack.com/@jquiggin/note/c-66959063>

Neofascism: J.J. McCulloch: ‘It’s kinda weird how all the most popular MAGA-era political superstars are people who have only the thinnest of ties to the Republican Party. In some ways it really was a hostile takeover that revealed the fundamental weakness of the party as an institution. It’s not clear at all to me that this has anything to do with policy. People liked Trump as a person. All available polling suggests Republican voters consider Trump vastly more honest, incorruptible, religious, etc than other Republicans. There's no metric for holding Trump accountable…. Whatever Trump does is axiomatically declared good, which reflects that it's all just personal loyalty. It's not like Trump could cross some policy line that would make MAGA criticize him. His loyalty was developed because he was a very popular TV star that people loved. I think being politically incorrect was part of why he took off in Republican circles, but more and more I think his celebrity appeal is massively underrated… <https://x.com/JJ_McCullough/status/1827377502383182212>

How is it that Texas, with a greater area, few people, and much samller GDP is included, and not California? Is it because someone wanted to make contiguous regions rather than show where the actual economic powers are?