My weekly read-around...

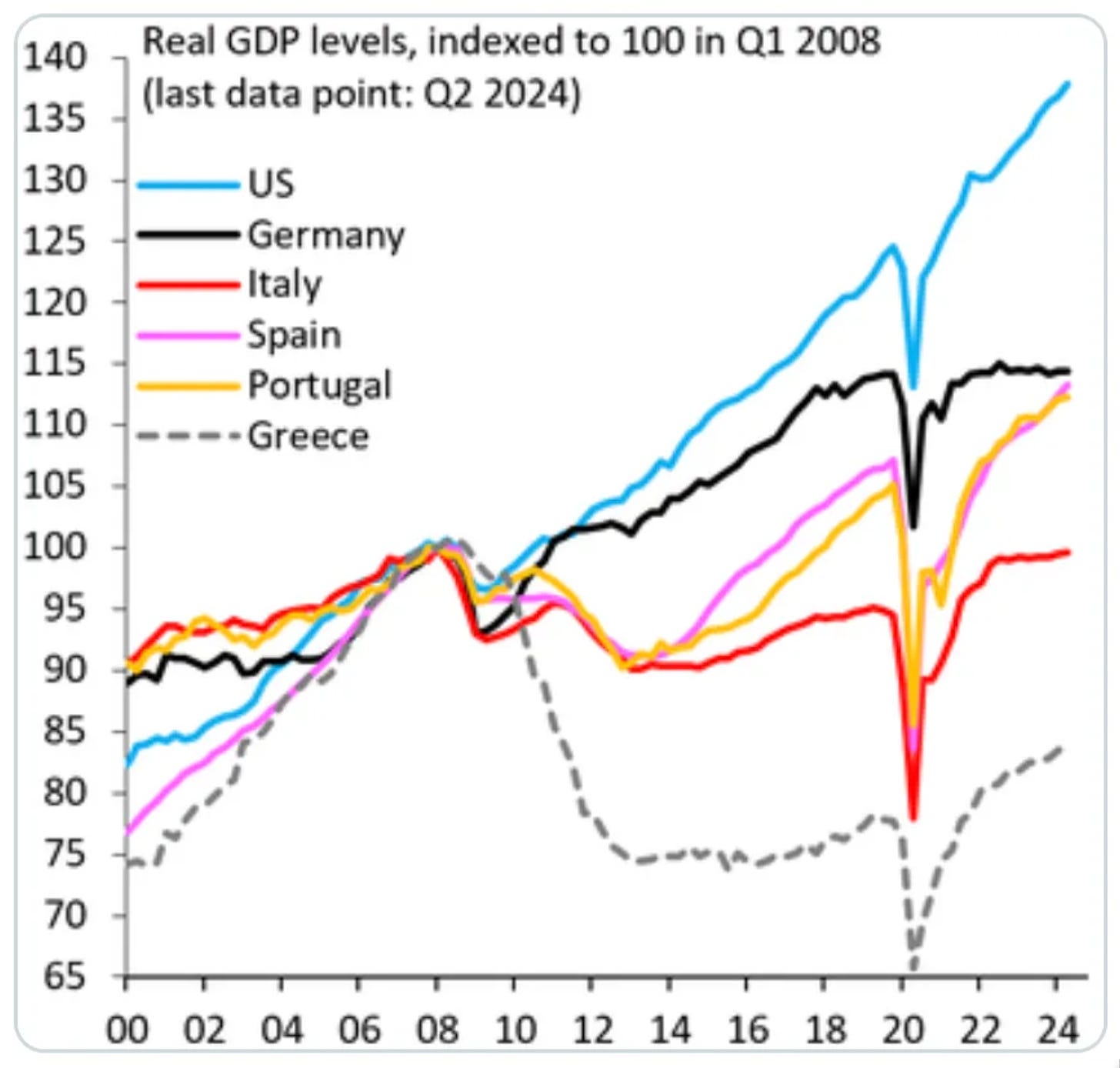

ONE IMAGE: Since the Start of the Great Recession:

It really is the Long Depression in much of Europe, at least until 2020. Population drives some of this, but not all:

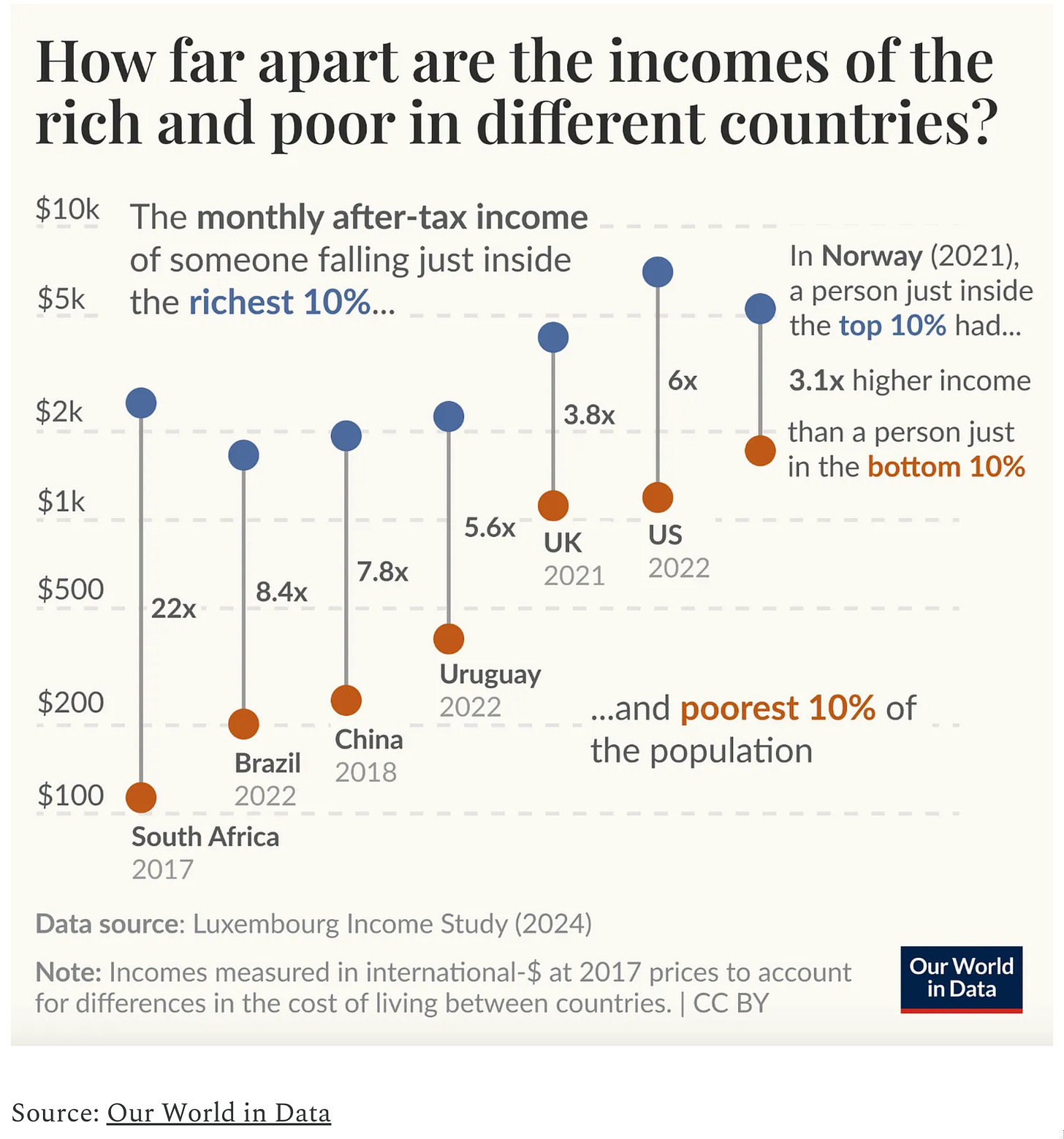

ANOTHER IMAGE: Britain Punches Very Close to America’s Weight with Respect to the Real Income of the Poor:

Of course, the Tory government dismantling that Nick Clegg chose to inflict on the UK has been trying hard to eliminate that accomplishment:

ONE AUDIO: Orley Ashenfelter & Sam Bowles:

Samuel Bowles on his career-long struggle to transform economics into a discipline with a human face:

How witnessing stark inequality in India as a boy compelled him to examine questions of social justice. “[It]... bothered me about how we could all be so similar across the world and yet there are [the] differences in income between countries like India at the time and [the] U.S….”

Collaborating with economist Herb Gentis on how schools in the United States socialize students to conform to the existing social and economic structures “primarily by the ways [they] organize the experiences of kids…”

Research at the Santa Fe Institute into the origins of inequality… [with] the advent of farming...

<https://overcast.fm/+AA-EwMlhW4E>

Note: I would not say that there has been little movement in inequality since the coming of the ox and the plow. There has been an enormous reduction in the share of surplus appropriated by the élite, at least on a national scale. There has been an enormous reduction in the brutality with which the élite extracts the surplus it grabs. And over and above those factors, in a utility-metric rather than an exchange-value metric inequality has definitely fallen since the days of Gilgamesh, Caligula, and Henry VIII.

Very Briefly Noted:

Economics: To first-order, surprisingly large numbers of firms have substantial market power, hence minimum wage laws greatly diminish Harberger triangles, leading to more employment, higher wages, and economic rents reduced by significantly less than worker welfare is boosted. It also leads to higher investment and thus, presumably, productivity as well. Yet dead-enders will dead-end:

Invictus: New CA QSR Min Wage Study. A Victory Lap.: ‘The brouhaha… when CA Gov Gavin Newsom signed into law (taking effect April 1, 2024) a new $20 minimum wage for so-called “limited service” (a/k/a fast food or QSR) restaurant workers…. Some shoddy reporting at the Wall St. Journal [by Heather Haddon]… unquestioningly reprint[ing] industry press releases… [by a] reporter… unfamiliar with… seasonal… data…. The mistake then spread to… [Lee Ohanian at the] Hoover Institution, then a CA group called CABIA, the NY Post and, of course, Fox News…. The entire episode is reminiscent of what happened in Seattle a decade ago, which this site painstakingly debunked in great detail…. Now comes the first… study about the hike…. [Michael Reich & Denis Sosinsky: Sectoral Wage-Setting in California:] ‘The sectoral wage standard raised the average pay of non-managerial fast food workers by nearly 18%… [without] affect[ing] employment adversely. It did increase fast food prices… by about… 15 cents for a $4 item. Consumers, therefore, absorbed about 62% of the cost increases…. Restaurant profit margins likely fell… <https://ritholtz.com/2024/10/update-new-ca-qsr-min-wage-study-a-victory-lap/>The very sharp Martin Wolf notes the incompetent and unprofessional publication by the Atlantic Monthly of Oren Cass’s bid for a job in the Trump administration by telling lies about the extent to which the tariff policies proposed by Trump have any valid industrial-policy rationale. They do not. Martin does not note that the Atlantic then piles Pelion upon Ossa by rejecting valid rebuttals for no valid reason:

Martin Wolf: Trump’s trade policies would hurt the world: ‘His new suggestions would have a far bigger impact than the relatively modest ‘starter protectionism’ of his first term…. Donald Trump believes that tariffs have magical properties. He even claimed in his speech at the Economic Club of New York last month that “I stopped wars with the threat of tariffs”. He added: “I stopped wars with two countries that mattered a lot.” So great is his faith in tariffs that he has proposed raising them to 60 per cent on imports from China and up to 20 per cent on imports from the rest of the world. He has even suggested a 100 per cent tariff on imports from countries threatening to move away from the dollar as their global currency of choice…. As Kimberly Clausing and Maurice Obstfeld write in a blistering paper for the Peterson Institute for International Economics, it is not enough to argue that some benefits might follow. To justify Trump’s proposals one has to assess the costs of the proposed measures, the scale of the purported benefits and, above all, whether these measures would be the best way to achieve the desired objectives. Alas, the costs are huge, the benefits doubtful and the measures inferior to alternative options…<https://www.ft.com/content/92a2e8b9-198e-4e92-8a57-5043bfd1eedf>The critics of the American economy today—some say we still have moderate ongoing inflation, but they are wrong; others say that we had the past burst of inflation and darkly hint it stores up trouble for the future, but they are (a) wrong, (b) without any explanation of how that wave of transitory inflation that washed over the whole world could have been avoided here in the United States without making our exports massively uncompetitive, and ignoring the facts that the good things (i), (iii), and (iv) in the US economy today required that we let that burst of inflation do its von Hayekian price-adjustment work:

Noah Smith: Let us pause to appreciate the remarkable U.S. economy: ‘It really doesn't get much better than this, folks…. There are four things you want from a macroeconomy… (i) high employment rates… (ii) low and stable inflation rates… (iii) fast wage growth… and… (iv) fast productivity growth, because ultimately that’s what creates durable gains in living standards. Right now, the U.S. economy is giving us all of those things… <https://www.noahpinion.blog/p/let-us-pause-to-appreciate-the-remarkable>The question is: is TSMC simply talking its book now when it disseminates what it says is very good news about yields at its Arizona plants? And how might we be able to tell?:

Rana Faroohar: The perils of America’s chips strategy: ‘In early September, Taiwan Semiconductor Manufacturing Company, which plans to start mass producing chips in Arizona by 2025, achieved production yields similar to what it can do in established plants back home. That’s a big deal. Yield rate is not only a key factor in profitability, it also leads to more productivity. This is the great lesson from Taiwan’s chip success: making things matters. By producing more and more of something in the physical world, you move up the innovation food chain. That is something that has always been obvious to engineers, if not also to economists. Despite all the criticism around delays in semiconductor production (as if it’s possible to rebuild a multitrillion industry in a few months), a lot of progress has been made, not just in yields but also in areas like workforce training… <https://www.ft.com/content/52cfb4b6-d562-4caa-a7da-35a717ac4072>Central Country: The unwillingness of the rest of the world to allow China another major export surge, the small weight in the economy of truly “new productive forces”, and the strong ideological aversion of the rulers of the party-state to China’s becoming a prosperous consumer society seem to me overwhelmingly likely to trap China in its own version of the middle-income trap, starting now:

Logan Wright: China's Economy Has Peaked. Can Beijing Redefine its Goals?: ‘The decline in China’s economic growth is structural…. Beijing has some capacity to improve the country’s long-term economic trajectory through policy changes, [but] political and financial constraints prevent Beijing from pursuing these necessary reforms…. Advanced manufacturing-led growth and consumption-led growth face meaningful constraints and are unlikely to generate the same pace of economic growth as China has seen…. Electric vehicles, solar cells, and lithium-ion batteries… are [not] likely to offset the impact of the declining property or infrastructure construction…. Moreover, if manufacturing is the most important driver of growth relative to domestic consumption, this intrinsically implies external demand from the rest of the world will be stronger than domestic demand… <https://www.prcleader.org/post/china-s-economy-has-peaked-can-beijing-redefine-its-goals>Cognition: Giving your underlings time for the bets they place to fully play out is one of the hardest things to do as a boss, and one of the most important. I am reminded of a passage from Lois McMaster Bujold’s science-fiction novel Brothers in Arms: “Back in the foyer Ivan said, ‘Now what?’ ‘I think’, said Captain Galeni, ‘it is time to return to the embassy. And send a full report to HQ.’ The urge to confess, eh? ‘No, no, never send interim reports’, said Miles. ‘Only final ones. Interim reports tend to elicit orders. Which you must then either obey, or spend valuable time and energy evading, which you could be using to solve the problem’. ‘An interesting command philosophy; I must keep it in mind. Do you share it, Commander Quinn?’ ‘Oh, yes’…”:

Dan Davies: songs my portfolio manager taught me (part 4): ‘Tell me your reporting frequency, I’ll tell you your investment horizon…. During one such conversation, a particularly hard-charging German guy said that he “didn’t care about” something I was telling him, because “I am a long term investor”. I demurred, saying something like “don’t you have to close your book every single day?” and he kind of blew up. I had touched a nerve, because this guy was indeed allowed to hold overnight positions and was very proud of the fact, and was quite pissed off that I’d mistaken him for one of the ordinary traders. So anyway, he subjected me to a quite extended rant, of which one particular passage sticks in my mind (and has presumably been rewritten over the years by the polishing effect of memory). “I can hold a stock for five years if I want!”, he told me. “As long as the daily P&L is OK, I can hold it for as long as I like”… <https://backofmind.substack.com/p/songs-my-portfolio-manager-taught-bec>War: The news from the Middle East has not been good since at least the assassination of Yitzhak Rabin:

Dan Drezner: The Middle East Earthquakes: ‘The hard-working staff here at Drezner’s World would strongly prefer not writing about the international relations of the Middle East…. The October 7th assault and the war in Gaza are just littered with violations of the laws of war… if Netanyahu said the sky was blue I would go outside for independent confirmation; Arab allies of the United States behave just as badly as Israel; The Middle East is always the region that brings out the hypocrisy in U.S. foreign policy; Despite a region seeped with realpolitik U.S. foreign policy, U.S. enemies have gotten stronger and not weaker in the 21st century…. In an equation in which the constants are Prime Minister Netanyahu and the Ayatollah Ali Khamenei, strategic stability is not going to happen anytime soon… <https://danieldrezner.substack.com/p/big-developments-in-the-middle-east>Neofascism & Global Warming: The costs of David Boren’s blocking Al Gore’s BTU tax back in 1993 continue to mount:

David Rothkopf: ‘As Hurricane Milton bears down on Florida, no campaign ad could be more relevant, more powerful or more damning regarding Trump. Harris-Walz: Well done, yet again, Olivia Troye! <https://x.com/djrothkopf/status/1843644385206120645>: Kamala Harris: “ake it from those who know him best: If Donald Trump is reelected, he will fill the White House with loyalists—and there will be no one to stop his worst instincts. Watch our new ad: <https://x.com/KamalaHarris/status/1843623002207871307>

SubStack NOTES:

SubStack Posts:

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

A miniature story about tariffs: A friend was offered the full price of a new helicopter for his low time old one. Seems Taiwan has a 100% duty on new helicopters and a much lower one on used.

High tariffs would develop a new industry of tariff avoidance. My friend is one of the smartest businessmen I know. He had a dirt moving company that did a lot of dirt moving during the housing boom. The company employed 500 workers. He sold the company just before the Great Housing Crash happened.

" surprisingly large numbers of firms have substantial market power,"

Not so surprising if you've been observing the corruption of the judicial system over the last 40 years and influential economists' theoretical contributions to the idea that this is actually a good thing.