My weekly read-around...

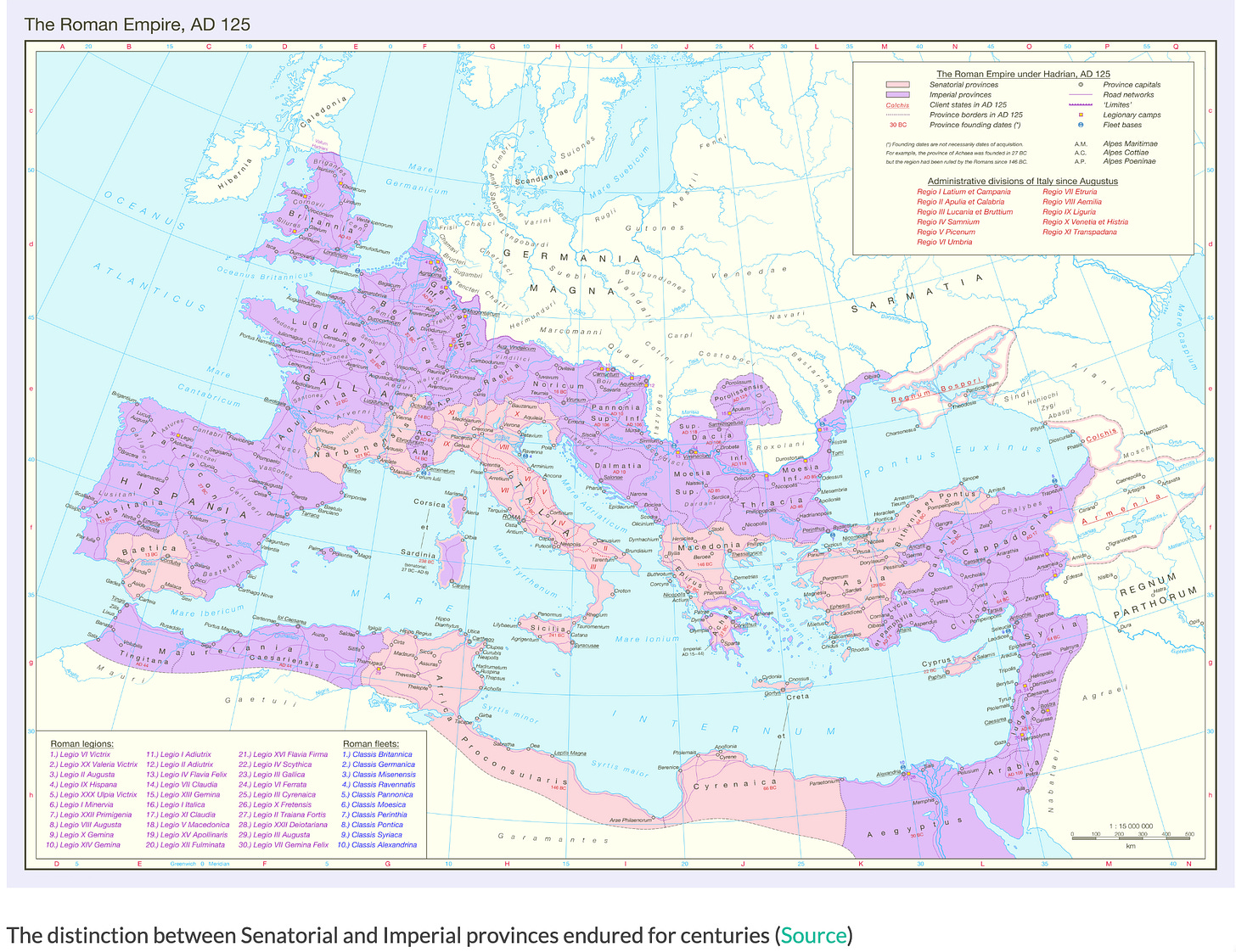

ONE IMAGE: The Arcana Imperii of the Roman Empire…

…was the perpetual assignment by the Senate to the Princeps of all of the regions where legions were stationed to him as his provinciae in which he was to exercise his maius imperium (in fact delegated to his legati Augusti pro prætore), and the confinement of normal Roman politics of city offices and provincial governorships to the regions without legions.

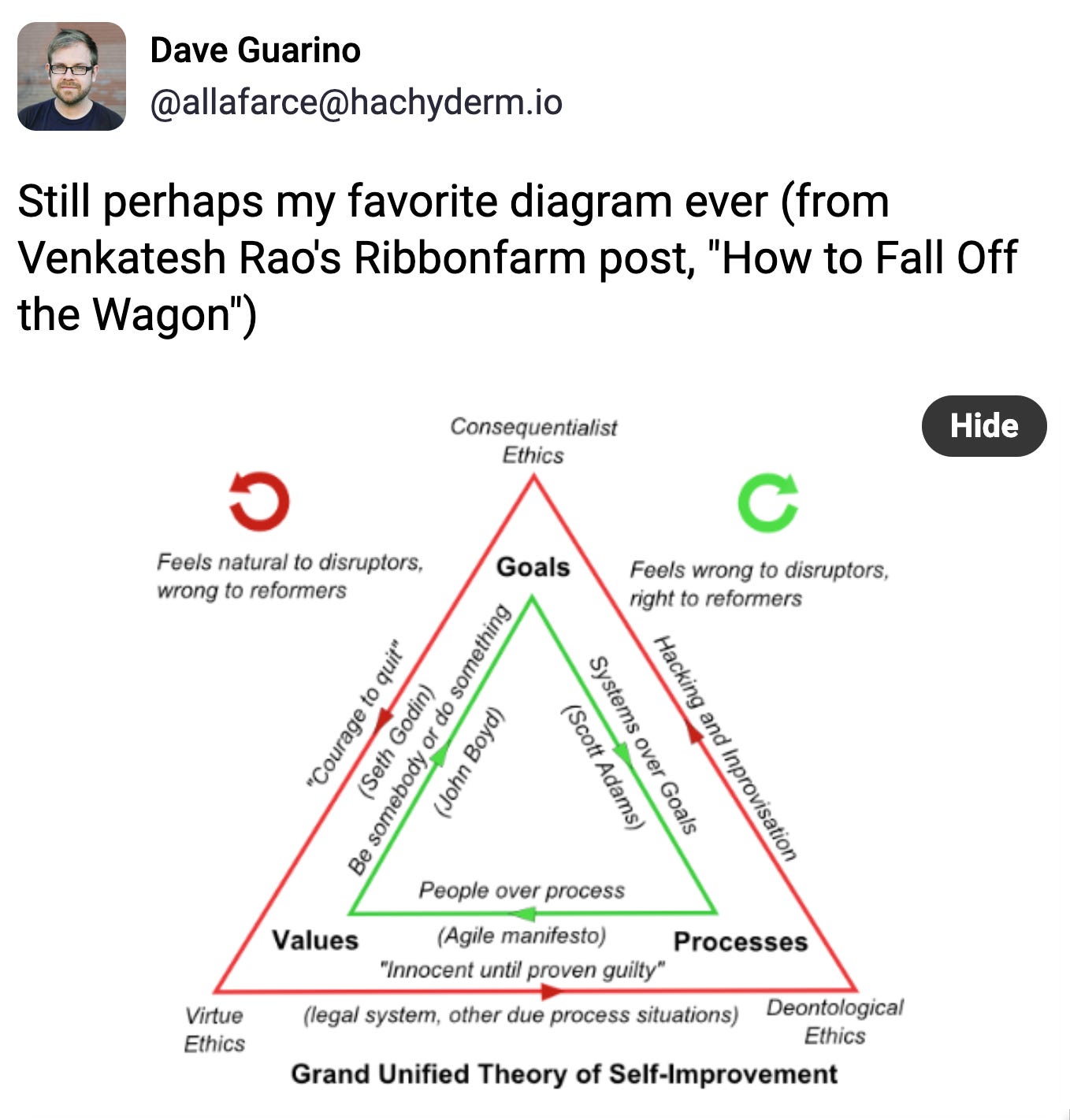

ANOTHER IMAGE: The Eternal Square Dance of Ethics & Focus:

Very nicely put indeed. And so disruptors always attempt to travel counterclockwise, trying to fix the flaws of reliance on values by processes, and then the failures of processes by focusing on goals, and then the manipulation of goals by appealing to processes. Meanwhile, reformers try to fix process problems by shifting to a focus on values, fix problems with values by shifting to a focus on rubber-meeting-the-road goals, and fix goal failures by shifting to a focus on processes.

ONE VIDEO: Cornelius Brothers & Sister Rose:

Apropos of Claudia Goldin’s new paper “Babies” <https://www.nber.org/papers/w33311>, on how countries where the total fertility rate is now approaching 1—a population decline of 50% every generation—are countries where rapid economic growth a generation ago opened up opportunities to women, but where previous stagnation had cemented High Patriarchy’s cultural ability to resist the coming of modernity. Hence now it is hard to convince young women to reproduce given the cultural baggage of the ascribed role of “motherhood” they then undertake.

The solution, of course, is to change the hearts and minds of young men.

High Patriarchy teaches young men that their role is to provide resources and “protection” in return for cosseting and deference—and that a lot of the ability to provide resources and “protection” comes from first acquiring status in the male community, in substantial part by joining in the policing of uppity women. But women with economic options have less need are much less willing to be “protected” than their great-grandmothers, have other ways of getting resources, and the idea that motherhood comes not just with children but a husband that must be hand-fed makes it less appetizing. It would be more appetizing if the potential husband would be focused on making you laugh and on being an extra helpful pair of hands to assist you in your constant multitasking, rather than off spending his energy playing some male-community pecking-order game.

So, if you don’t like a TFR = 1 in your society, listen to the wise Eddie Cornelius: “Whoa, strange as it seems/You know you can't treat a woman mean/So my friend, there you have it/I said it's the easy, simple way/If you fail to do this, don't blame her if she looks my way/'Cause I'm gonna treat her like a lady…”

Very Briefly Noted:

Post-Neoliberalism: The fight over what post-neoliberalism will be continues. Noah Smith has an excellent rant against the thinking of the smart and well-intentioned but often wrong David Dayen and Marshall Steinbaum. It is, as I said, a rant. But in my view it is constructive and productive ranting:

Noah Smith: “Biden's tarnished industrial legacy”: ‘He began our Great Rebuilding, but his approach had fundamental flaws…. “More than a half-dozen senior administration officials… Jonathan Fine… Antony Blinken… Kurt Campbell… Rahm Emanuel… Janet L. Yellen… Jared Bernstein and top Commerce officials… argued against or expressed reservations about the [US Steel] position Biden ultimately took.”… Biden scuttled the Nippon Steel deal… [because] United Steelworkers president David McCall… [was] against the deal[,] even though the merger would probably have… created more good union jobs…. Just as progressive leaders confuse advocacy groups <washingtonpost.com/busi… with the “communities” of people they claim to represent, Biden seems to have confused union leaders with union workers…. Progressives refuse to engage with or appeal to the American public… and instead insist on engaging only through opportunistic middlemen….

It also represents a fundamental ideological orientation.,,, David Dayen: “There’s something uniquely un-American about [supply-side progressivism]. ‘A liberalism that builds boils down to the idea that people can’t be trusted’, said [Marshall] Steinbaum. ‘Elites must make the sound enlightened decisions because they don’t trust democracy or politics’. Supply-side progressives like [Matt] Yglesias and [Ezra] Klein are skilled at detecting the structural problems in American government. They’re less concerned with the problem of power as an impediment to progress. And they’re certainly not interested in equalizing that power”…. A rhetorical sleight of hand [here]… [not] power to get things done… [instead Dayen] means activists’ and unions’ power to extract money and other concessions from progressives by blocking them from getting things done. The power Dayen envisions is not power over nature or the state or America in general, but power within the Democratic party….

It was this same vision of “power” that led the Biden administration to hobble many of its own efforts with “community benefit” programs and other contracting requirements… which Dayen explicitly endorses…. Mandating that the Department of Transportation hold a block party in order to build an EV charger is, frankly, silly. Once again, it’s emblematic of how out-of-touch the people who make these policies are — they have so little first-hand knowledge of underprivileged communities that they struggle to imagine how or where they might express their opinions about development.

But it’s also indicative of a focus on veto power within the Democratic party and veto power over the state, instead of on building state power itself…. This approach,,, utterly neglects the question of how to make sure that power within the Democratic party matters at all…. The activists and union leaders and anti-neoliberal think tankers… won their battle to squeeze power out of the Biden administration, only to lose the wider war. As a result, Biden’s legacy as America’s Great Rebuilder will be severely tarnished. <noahpinion.blog/p/biden…>

As I have said before, it is rich for David Dayen and Marshall Steinbaum to say that Matthew Yglesias and Ezra Klein are doubleplusungood for not instinctively trusting “democracy” and “politics”. The United States is a country where a majority of those who could be bothered to bestir themselves and vote voted for Donald Trump in 2024 and for George W. Bush in 2004 and for Ronald Reagan in 1980. If you trust “democracy” and “politics”, full stop, then you are right now out there cheerleading for Donald Trump on the principle that vox populi, vox dei. And if you try to excuse yourselves by saying that we distrust élites and they must submit to a democracy that has all the power, but only to the “democracy” of how the people ought to have voted—well, then, you are on the road to the very same hell that Rosa Luxemburg vainly pleaded to Vladimir Lenin to turn aside from. <https://substack.com/@delongonsubstack/note/c-84742936>

CryptoGrifts: I never understood what the hell the reason was why anybody should not take a look at MicroStrategy and run very far away from it very fast. I would not, however, say that the people running MicroStrategy are “desperate”—they, rather, see that the NAV the market is offering them is crazy, and want to exploit the incoming shareholders willing to buy at such valuations as much as possible as fast as possible by taking in their money as fast as they can, because they won’t stay crazy forever:

Craig Cobin: “If bitcoin is the future, what explains MicroStrategy’s need for speed?”: ‘Accelerating purchases, insider sales, and a rapidly evaporating premium…. The company has amassed over two per cent of all bitcoin in existence, funded through a combination of shares and convertible bonds… turned a humdrum business software firm into something akin to a bitcoin ETF… trading at a frothy premium to its net asset value…. Yet… while bitcoin has maintained its stratospheric altitude at around $100,000 per coin, MicroStrategy’s stock has drifted lower, shedding 40 per cent since peaking intraday on November 21 at $550…. Its premium to net asset value has meanwhile decreased from a high of 3.8 times to 1.9 times…. The company’s frenetic execution of its $21bn “at-the-money” equity offering…. According to JPMorgan analysts, MicroStrategy accounted for an astonishing 28 per cent of capital inflows into the cryptocurrency market in 2024…. Last Friday the company announced plans to raise up to $2bn in perpetual preferred stock this quarter to buy more bitcoin… just over a week after MicroStrategy said it was seeking shareholder approval to increase its share count by over 3000 per cent from 330mn to 10.33bn….. The company’s leadership recognises that the current NAV premium — the financial equivalent of finding money growing on trees — might not be permanent. There’s a hint of urgency (or desperation) in the air, an extreme haste to lock in this discrepancy between MicroStrategy’s stock and the bitcoin price before it is arbitraged away… <ft.com/content/e25e9938…>

<https://substack.com/@delongonsubstack/note/c-84706422>

Macroeconomics: I am keeping track of analyses of the macroeconomy that recognize that macroeconomic policy needs to promote not just price stability and full employment but also grease the movement of real relative prices to their proper von Hayek resource allocation signalling values. There are damned few of them. Here is one:

Marcus Nunes: “Inflation & the Macroeconomy”: ‘One effect of the big microeconomic shocks was to significantly disrupt relative prices…. Should the Fed have acted to constrain NGDP [after the plague]? I believe that if the Fed had acted that way, instead of relative prices being “adjusted” by inflation, they would have “adjusted” through a, maybe strong, recession. Inflation would have risen by much less and fallen more swiftly, but unemployment would have lingered much higher. In any case real output would be “stuck” at a significantly lower path!… Sometimes… relative price disruptions can be so large that trying to keep NGDP at the stable path that prevailed before the shock can have significant long term negative consequences. Therefore, there may be situations, hopefully rare, when a higher stable path is desirable…. As to… “why is inflation stuck at 2.5%”, I feel confortable to argue that results from putting a large weight on Owners Equivalent Rent (OER)… an imputed price… no one pays… [that]d suffers from lagged calculations. The Harmonized Index of Consumer Prices (HCPI) differs from the CPI only by not considering OER… [and] has remained very close to the 2% target… <marcusnunes.substack.co…>

<https://substack.com/@delongonsubstack/note/c-84703557>

Neofascism: The Hoover Institution has long had a very serious intellectual quality control problem—prioritizing ideological rigidity over empirical engagement, coupled with an extreme unwillingness to police itself at any level. We look forward to a new round of claims that Trump’s next tax cuts will pay for themselves. And we loom back on the sorry tale of Hoover and the California fast-food minimum wage:

Jessica Burbank: “The [Hoover Institution] Minimum Wage Claims You Keep Hearing Are Totally Fake. We Can Prove It”: ‘In September 2023, California passed a law to bring fast food workers’ minimum wage up from $16 to $20 an hour. A flurry of reports predictably followed…. Hoover… a think tank with $879.8 million in total assets, continued to dig in against AB 1228, publishing multiple articles over the past year attempting to pin “lost jobs” on rising wages. At the heart of the research are three major claims made by Lee Ohanian…. 1. Government jobs account for 96.5% of job growth in California over 2.5 years, 2. California lost 410,000 jobs from February 2020-February 2024, and 3. California lost 10,000 jobs in the fast food sector since the minimum wage law was signed in September 2023…. All three claims are false, and the Hoover Institution has now had to retract six articles based on faulty research by Ohanian. The claims were first debunked by Invictus <bsky.app/profile/tbpinv…, an anonymous poster… <dropsitenews.com/p/7151…>

<https://substack.com/@delongonsubstack/note/c-84702119>

War & Rumors of War: Is Russia out of AFVs? If so, does Putin know Russia is out of AFVs? The best time to have ended Putin’s attack on Ukraine was three years ago. The second-best time is now. But how? What deal could Putin be pushed to accept that he would then keep?:

Trent Telenko: ‘We see this lack of Russian tanks and AFV's on the Ukrainian battlefield and in the empty Russian depots, but still the Western Media goes "Russia Strong" for the eyeballs and clicks…. Lost Weapons: ‘Russian telegram paging basically saying what all the vehicle depot trackers are saying. Russian armored assaults no longer sustainable. No more tank company assaults and battalions now only have a few armored vehicles. While commanders act like it’s still 2022… <x.com/TrentTelenko/stat…>

<https://substack.com/@delongonsubstack/note/c-84700272>

Live from the Chaos-Monkey Cage: WTF!?!?!? II: Donald Trump thinks that North Sea oil rigs are being taxed to fund loss-making windmills:

Donald Trump: ‘The U.K. is making a very big mistake. Open up the North Sea. Get rid of Windmills!…

Windfall tax… windmills. As Jeff Tiedrich says: “Buckle up: it’s going to be a bumpy four years…”

<https://substack.com/@delongonsubstack/note/c-84575125>

Live from the Chaos-Monkey Cage: WTF!?!?!?:

Donald Trump: ‘The Democrats are all ‘giddy’ about our magnificent American Flag potentially being at ‘half mast’ during my Inauguration. They think it’s so great, and are so happy about it because, in actuality, they don’t love our Country, they only think about themselves. Look at what they’ve done to our once GREAT America over the past four years - It’s a total mess! In any event, because of the death of President Jimmy Carter, the Flag may, for the first time ever during an Inauguration of a future President, be at half mast. Nobody wants to see this, and no American can be happy about it. Let’s see how it plays out. MAKE AMERICA GREAT AGAIN!… <jefftiedrich.com/p/cogn…>

So the hope is to cut short the standard mourning period for President Carter? Is the hope to have a big fight about it, have January 6ers raise flags to full mast, and hope that they get videos of them beating some people responsible for flags up during the process? <https://substack.com/@delongonsubstack/note/c-84574351>

Journamalism: Paul Krugman complains about Jonathan Weisman:

Paul Krugman: “Bothsidesing, With a Republican Slant: Here We Go Again": ‘Election results don’t change the facts…. I found a lot to agree with in Jonathan Weisman’s big oiece <nytimes.com/2025/01/04/… on how Democrats lost the working class, although he barely mentions the extent to which Republicans have followed anti-worker policies, including attempts to privatize Social Security and kill the Affordable Care Act…. Biden, however, was the most pro-worker president we’ve had in generations, only to find his political prospects dimmed by inflation. So whose fault was that?

Well, if you ask me, readers deserve more than this: “Democrats said the president was the political victim of a global trend emerging from the pandemic. Republicans pointed to his policies, and one piece of legislation in particular, the $1.9 trillion American Rescue Plan, saying it poured gasoline on the smoldering embers of post-pandemic inflation…”bOK, Democrats say one thing, Republicans say another. Views differ on shape of planet. But what are the facts? Shouldn’t readers at least be told that cumulative inflation since the start of the pandemic has been pretty much the same in all advanced countries, which sure seems to support the Democratic narrative that Biden’s policies weren’t responsible?…

You can still find ways to blame the A.R.P… claim that Europe was more vulnerable to the Putin shock… so we should have had less inflation, and the fact that we didn’t can be attributed to excess stimulus. But that… doesn’t work numerically…. The raw fact is that America didn’t have higher inflation than other advanced economies — yet Weisman not only doesn’t tell readers that, he slants the narrative by giving the last word to a Republican asserting that it was all Biden’s fault… <paulkrugman.substack.co…>

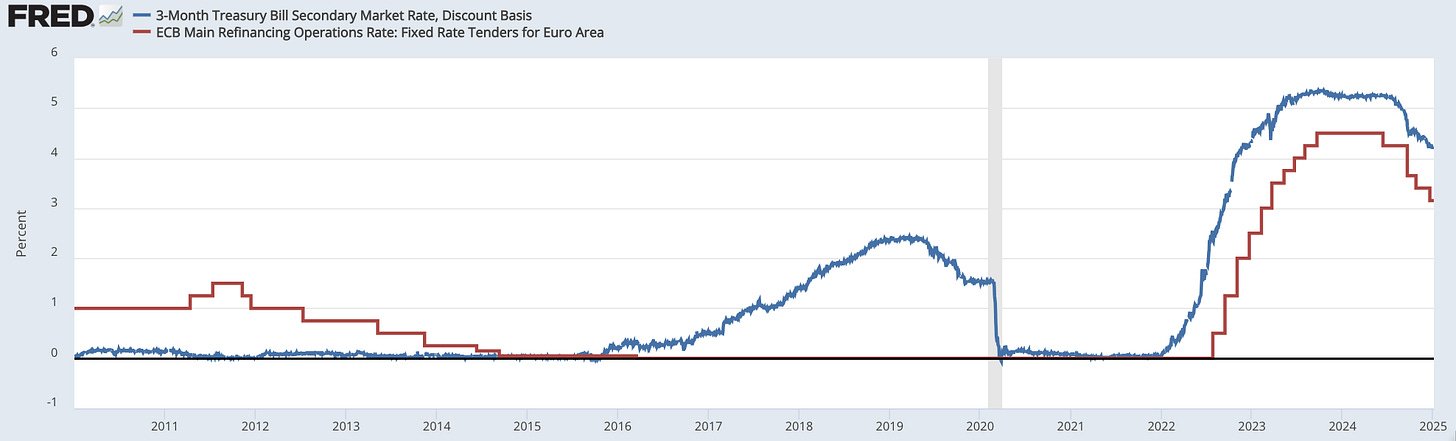

My view is that Congress and the President make fiscal policy, and the Federal Reserve makes monetary policy, but the Federal Reserve works inside the fiscal-policy decision loop and thus can—if it wishes—alter monetary policy to neutralize the expected effects of fiscal policy on aggregate demand. Thus it makes sense to say that the President and Congress choose the budget deficit and then the Federal Reserve chooses from the menu of aggregate demand level-interest rate level pairs that choice of budget deficit offers it. Thus the Federal Reserve is rightly given responsibility for choosing among feasible combinations of unemployment and inflation. And it never made sense to blame the ARP for inflation—it was the Federal Reserve’s decision to risk inflation in order to decrease the risks of a return to secular stagnation.

And I still think that, technocratically, that was the right decision for the Feb to have made. But I find myself in a very small minority here.

As for the “US inflation ought to have been lower than Europe’s, and the ARP kept that from being so”, note that the Fed raised interest rates faster and higher than the ECB even though the Putin Ukraine invasion shock was arguably less—the ARP did not at all constrain the Fed in its inflation-fighting stance.

And as for Weisman: Back when I interacted with him, other reporters at other newspapers on his beat would tell me “he was a journalism major; he doesn’t understand the issues, and has no idea which of his sources are credible; but he’s smart: he will learn”.

But my assessment was that he learned something different. What he learned was that he needed to make sure that he learned as little as possible about the actual substance, because if he did learn about the substance he would have to ask hard questions and so piss off his sources and it would be more difficult to write his stories. Hence what he learned—and this is still true—that his job was to please his sources rather than inform his readers. When you read a Weisman article, think always “this is what his sources want me to believe” rather than “this is how it is”. If you read him with that frame, his work can be useful. But not if you take Weisman as working for you and to inform you.

<https://substack.com/@delongonsubstack/note/c-84550731>

Done!

Paul: 'One more thought: perhaps have them read something on the systematic importance of economic history for economists. Something that may not appreciate take for granted if they have only been taking standard econ courses. I have in mind something like Solow's “Economics and Economic History”... <braddelong.substack.com…>

MAMLMs: This strikes me as very smart. I would, however, point out that in the end Netscape failed to become one of the Oligopolistic platforms and turn Windows into a "poorly debugged collection of device drivers". It failed because Microsoft was willing to spend whatever it took to keep that from happening. Similarly, Amazon, Microsoft, Facebook, Google, and company are willing to spend whatever it takes to keep from having to pay any OpenAI tax in the long run, and Apple is doing all that it can do to keep from having to pay any OpenAI tax even in the short run. My view is that they are more likely than not to succeed. And that long-term investors in OpenAI are lighting their money on fire. (Short-term investors are probably correct in their expectation that at some point there will be enough of a hype cycle that they can exit their positions at a profit. And OpenAI is doing very good—but expensive—work forcing technology forward, probably for humanity's long-run good, possibly for its evil):

Kaleberg: '[For] Netscape... scaling was about building up the network infrastructure, a well understood problem, and getting more parties to get online as users, presenters of information and online merchants. There were a rather obvious use cases. LLMs don't have a broad use case, and existing LLMs do a crappy job.... Amazon['s]... AI summary of reviews.... [But] it pays to read carefully to get a sense of who is writing and on what they based their opinion. It also pays to watch for non-obvious details about the product. LLMs trash all of that. They can't handle unreliable narrators or factor in point-of-view. Scaling LLMs is patently ludicrous. It's like Moore's Law in reverse.... You can't make a dog the size of a horse by feeding it ten times as much dog food. For some common sense on the subject, check out Rodney Brooks... <braddelong.substack.com…>

MAMLMs: Feeding the internet to a GPT LLM produced an extremely persuasive and linguistically fluent internet s***poster. And there, I think, the simple “scaling law” story ends. Now do not get me wrong—that is an amazing accomplishment. But it is not the road to A(G)I, true AI, or SuperIntelligence. And the usefulness of a tireless immediately responsive internet s***poster is limited.

There now appear to be two possible roads:

Back up, and train a GPT LLM as a summarization engine on an authoritative set of information both through pre-training and RAG, and so produce true natural-language interfaces to structured and unstructured knowledge databases. That would be wonderful. But it is best provided not by building a bigger, more expensive model but rather by slimming down to keep linguistic fluency while reducing costs. Moreover, that would be profitable to provide: it would essentially be performing the service of creating a bespoke intellectual Jeeves for each use case. Doing that would produce profitable businesses. But it would not validate $3 trillion corporate market cap expectations.

Keep building bigger and more expensive models, but then thwack them to behave by confining them to domains—Tim Lee says coding, and mathing—where you can automate the generation of near-infinite amounts of questions with correct answers for reinforcement learning. That would be a tremendous boon for programmers and mathematical modelers. But expensive:

Timothy B. Lee: It's the end of pretraining as we know it: ‘Frontier labs have been releasing smaller models with surprisingly strong performance, but not bigger models that are dramatically better than the previous state of the art…. Small models have been exceeding expectations… [while] all three frontier labs have been disappointed in the results of recent large training runs…. When I started this newsletter in March 2023… it was widely assumed that OpenAI would continue pursuing the scaling strategy that had led to GPT-4…. What a difference a year makes…. Sutzkever… at… NeurIPS machine learning <youtube.com/watch?v=WQQ…>…[:] “Data is the fossil fuel of AI. It was created somehow and now we use it, and we’ve achieved Peak Data, and there will be no more…”. Sutzkever said people are now “trying to figure out what to do after pretraining,” and he mentioned three specific possibilities: agents, synthetic data, and inference compute…. Post-training has increasingly focused on improving model capabilities in specific areas like coding and mathematical reasoning. Because answers in these domains can be checked automatically, labs have been able to use existing LLMs to create synthetic training data. Labs can then use a training technique called reinforcement learning to improve a model’s performance in these domains… <understandingai.org/p/i…>

Is MAMLM financial winter coming—not for the technologists and the engineers and those of us who will greatly enjoy building out the usefulness of the capabilities we already have, but for the financiers who want to raise nine-figure money to train next-generation and beyond models?

<https://substack.com/@delongonsubstack/note/c-83797321>

International & Development Economics: Hard to believe that this—truly excellent—book is now almost ten years old:

Richard Baldwin (2016): The Great Convergence: Information Technology & the New Globalization: ‘Human Capital Is Key This checklist… suggests that… people and skills are perhaps the most important when thinking about a new paradigm for competitiveness policy). Most workers are not internationally mobile for personal reasons, so domestic investment in human capital tends to stay domestic…. Skilled service workers are often subject to agglomeration economies…. A skills-cluster is more than the sum of its parts, which in turn means that the cluster can pay over-the-odds wages. Human capital has the extra attraction… [that] skills that produce excellence are often transferable across sectors and stages…. [Plus] skill-intensive services are inputs into many different stages and products, so demand for such tasks is more stable… <archive.org/details/gre…>

The insights come SOOOO fast & furious:

The “dual geographic unbundling” framework with the unbundling of non-luxury production from the place of consumption as a result of the coming of the fully-globalized economy around 1870 and the unbundling of manufacturing from the place of design and engineering around 1990.

The resulting profound shift from the mass-production to the globalized value-chain mode of production.

The extremely spotty “quilted” nature of the post-1990 Great Convergence as only a few regions with good-enough rule of law, excellent transport and communication links (including airports at which planes with lie-flat first-class seats land plus Ritz-Carlton hotels), and the key human capital resources are able to take full advantage of the Second Great Unbundling.

Thus only the I6—China, Korea, India, Indonesia, Thailand, & Poland—are able to transform their economic rôle in the global economy, and only in addition Brazil, Australia, Mexico, Turkey have been able to significantly boost their share of global GDP.

The (relative! relative only!!) marginalization of blue-collar workers in rich countries as their location is no longer a key source of value-creation.

The limits of the Great Convergence as frequent high-touch face-to-face communication and the need for physical presence continue in importance.

These are all true gold.

Looking less good nearly a decade later is Baldwin’s argument that comparative advantage is now shaped by the ability of firms, rather than nations, to capture and control knowledge-intensive stages of production, and his claim that high-value activities like design, branding, and post-manufacturing services and to a lesser degree resource supply now necessarily dominate over traditional fabrication. Knowledge leaks out via the processes of fabrication, even if not through the processes of assembly. Fabrication requires the supervision of engineers, if only to maintain and tune the foreign-produced machines. And learning-by-doing by engineers and skilled craftsmen has an economic quality of its own. Thus when Baldwin suggests rethinking industrial policy to focus on service industries and skill clusters as the new industrial base for modern economies, my response is that he needs to spend more time in the Pearl River Delta and in Greater Shanghai.

Baldwin, Richard. 2016. The Great Convergence: Information Technology & the New Globalization. Cambridge, MA: Belknap Press of Harvard University Press. <archive.org/details/gre…>.

<https://substack.com/@delongonsubstack/note/c-83790529>

Meanwhile, Here in the Chaos-Monkey Cage: Elon Musk comes out 100% in support of illegal immigrants who have managed to sneak across the border and who have then worked like hell to contribute to this country. They forever have his respect, he says. And Donald Trump agrees, and retweets the sentiment:

Elon Musk: ‘Anyone—of any race, creed, or nationality—who came to America and worked like hell to contribute to this country will forever have my respect. America is the land of freedom and opportunity. Fight with all your being to keep it that way! <eschatonblog.com/2024/1…>

I understand why former illegal immigrant Elon Musk would take this position. And it is certainly true that if you are opposed to picky bureaucratic government regulations, migration and work-permission restrictions are one of your targets. But is it really on-brand for Trump to do so? <https://substack.com/@delongonsubstack/note/c-83737255>

With Trump, there is always considerable question of who is "everybody" here, what are lies of a demented neofascist, and what is planned. Who is inside and who is outside, and who knows and who half-knows, and who is in on the con, who thinks they are in on the con but is actually not in the con—is being conned by being made to think they are in on the con when they are not—and who does not know that there is a con. It is not easy to untangle. And the principals can shift the narrative in a blink of an eye, as reversals are part of the game. After spending twenty years making it impossible for anyone else to go to China, Nixon went to China and was then acclaimed as a Great Statesman, after all... -B.

<https://substack.com/@delongonsubstack/note/c-83642476?>

Touché... I should have drawn a distinction between wars of conquest and then exploitation, which do not work after 1776, and an alternative: wars of “demographic replacement” (waged usually, but not always, by agricultural industrial against hunter-gatherer and herdsman populations) which— distressingly frequently—do still “pay“ after 1776…

<https://substack.com/@delongonsubstack/note/c-83440366>

SubStack Posts:

The country that, as an American, I so often find falling into the Uncanny Valley...

A reminder of just how unable Donald Trump is to have a chain of thought, or to connect to reality these days. Donald Trump has a very unconventional take on Pacific Coast-region water resources here in America. & one where none of his “allies” have lifted a finger to disabuse him. He has creatures seeking to make a buck or two off of him, but no friends:

We economists know preferences, market structures, supply, demand, equilibrium, and surplus. Half at least of economic history is using what we economists know to understand history in the very important ways that non-economic historians most lamentably do not. But that half is not terribly useful to economics graduate students very few of whom are going to become economic historians. We should teach them the other half of economic history. But what is that other half, and how is it best taught? I get to try to teach incoming economics graduate students how to gain a much deeper and richer understanding of preferences, market structures, supply, demand, equilibrium, and surplus by looking behind them at the processes of historical development—how these things came to be, and how they might well have been otherwise (and become otherwise in some future. But what is the best way to do this? Especially since I find myself psychologically incapable of cutting my topic and reading list below eighteen!…

Attempting to tap risk-lovers and those needing savings vehicles for nine figures. I think somebody should do this, and that that somebody should not be an organization laser-focused on preserving its own particular & peculiar tech-platform money-gusher; but it is not clear how to convince those seeking savings vehicles promising expected returns with calculable risks that they should contribute; rather, the pitch has to be to those who are risk-lovers comfortable with Knightian uncertainty. Why? because OpenAI’s quest for AGI has turned into as much a financial marathon as a technological race. The stakes? Transforming our world is the agenda. But what about the sub-agenda of making & keeping promises to those seeking a comfortable and not too uncertain return on their investment? What strategy can they devise, up against rivals like DeepMind and Apple all eager to collect the AI platform tax for themselves, and facing other platforms from Facebook to Oracle all desperate to avoid having to pay any substantial permanent AI platform tax?…

The "New York Times" demonstrates once again that money spent on it is wasted. It is going to be a long, sad, and damaging four years, isn't it? Incompetent “sanewashing” journalistic narratives portraying the incoming Trump II administration as even semi-normal hide the ball from their audiences. Trump’s “populism” is a calculated performance overlaying a chaotic mess, with, right now, the chaos-monkey chaos starting with a first-round fight between Original Trumpists and Trump-Aligned TechBros about whether the hierarchies it will try to reinforce will be those of ethnicity or of wealth…

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

> Keep building bigger and more expensive models, but then thwack them to behave by confining them to domains—Tim Lee says coding, and mathing—where you can automate the generation of near-infinite amounts of questions with correct answers for reinforcement learning. That would be a tremendous boon for programmers and mathematical modelers. But expensive:

I don't understand this claim. I.e. what DeepMind did for math Olympiads [ https://deepmind.google/discover/blog/ai-solves-imo-problems-at-silver-medal-level/ ] used the purely linguistic skills of a LLM to formalize problems and then applied (comparatively very lean, pun not intended) specialized engines to work on them.

To my eyes that shows that coding and maths are areas where we can/should/will get advantages from AI by using LLMs to bridge between informal language and specialized tooling (which I think we can do with much smaller specialized models than what we already have) and then leveraging existing hardware and software tools to build non-LLM models for those domains; basically LLMs as parsers and things like AlphaZero-for-maths/-quantum chemistry/-etc as domain-specific compilers.

I'm not saying the intellectual Jeeves isn't a good idea or business model, but that's like using electrical power *only* to use a conveyor belt to move pieces from manual workstation to manual workstation.

Baldwin. Good no doubt but omits

a) skilled labor is also immobile internationally becasue of immigration restrictions. 85,000 H1B visas is ridiculous!

b) the budget deficit as US anti-industrial policy

c) US trade negotiators prioritizing getting US owners paid for IP (Gordons fault?) over accepting more more US manufactured exports. (and I do mean "manufactured." I have seen USDA FAS people in embassies working on us exports of honey and chicken entrails. :))