WEEKLY BRIEFLY NOTED: For 2024-07-10 We

It is very hard to argue either that r* has risen or that r* does not matter for stabilization policy; François Chollet has an adult version of my baby-comprehension take on MAMLMs; very briefly...

It is very hard to argue either that r* has risen or that r* does not matter for stabilization policy; François Chollet has an adult version of my baby-comprehension take on MAMLMs; very briefly noted; my New York Times Musk piece comes out from behind the paywall; before 1870 the Malthusian Devil cometh, but maybe not for 500 years; & Weekly Briefly Noted for 2024-07-05 Fr…

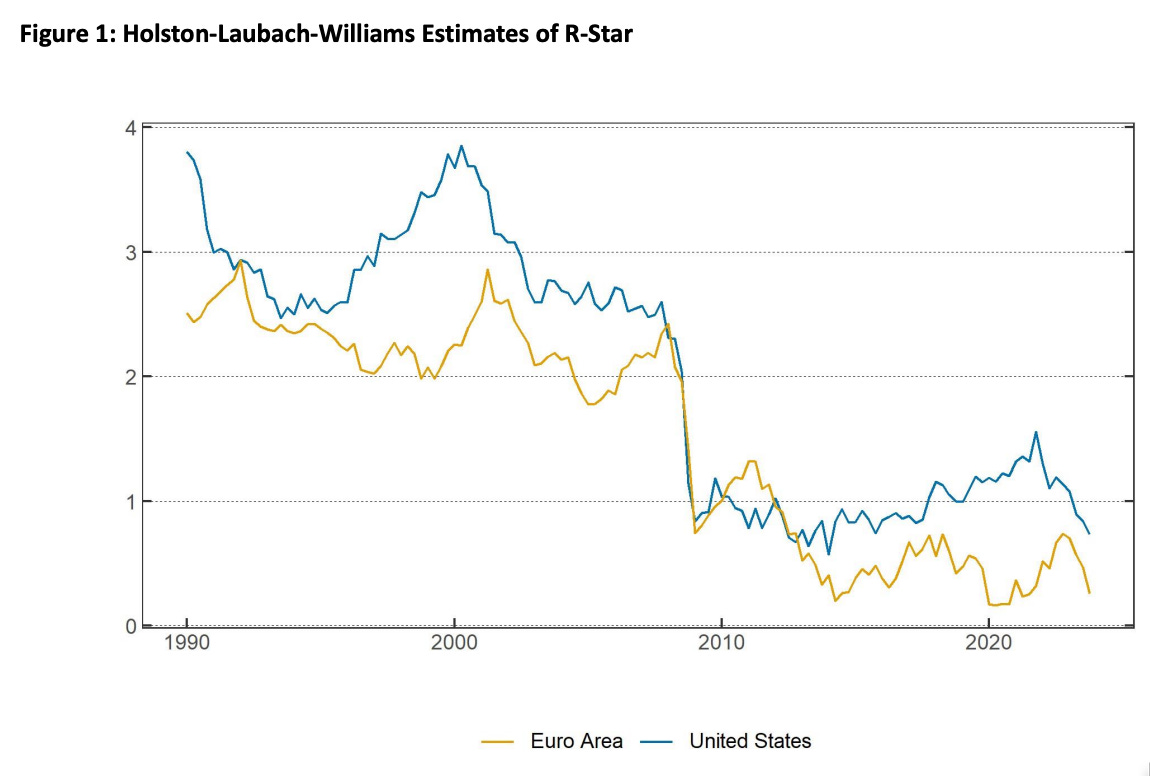

ONE IMAGE: R*:

John Williams: R-star—A Global Perspective: ‘[There is] recent commentary suggesting that r-star has risen due to persistent changes in the balance between the supply and demand for savings…. Market-based measures of five-year, five-year-forward real rates for the euro area and the United States have risen well above the HLW estimates…. Although the value of r-star is always highly uncertain, the case for a sizable increase in r-star has yet to meet two important tests. First… plausible factors pushing up r-star on a sustained basis are likely to be global… tension between the evidence from Europe that r-star is still very low and arguments in the United States that r-star is now closer to levels seen 20 years ago. Second, any increase in r-star must overcome the forces that have been pushing r-star down for decades… pre-pandemic trends in global demographics and productivity growth…. HLW estimates of euro area and U.S. trend potential GDP growth in 2023 are nearly unchanged from their respective 2019 values…. As… Knut Wicksell and others have stressed, r-star is either explicitly or implicitly at the core of any macroeconomic model or framework one can imagine. Pretending it doesn’t exist or wishing it away does not change that…. Second… the high degree of uncertainty about r-star means that one should not overly rely on estimates of r-star in determining the appropriate setting of monetary policy at a given point in time… <https://www.bis.org/review/r240703f.htm> <https://www.newyorkfed.org/research/policy/rstar> <https://www.newyorkfed.org/medialibrary/media/newsevents/speeches/2024/jcwilliams-ecbforum-070324-slides.pdf#page=3> <https://www.newyorkfed.org/newsevents/speeches/2024/wil240703>

ONE AUDIO: François Chollet on Deep Learning & the Meaning of Intelligence on Sean Carroll’s Mindscape:

François Chollet’s interpretation of what GPTLLM's are doing, appears to be very close to mine a neural network, and its weights are a very flexible function for mapping inputs to outputs, with very heavy magic going on in the construction of the vector space representation of input pages and the associated similarity groupings that are than used to interpolate the output. Such a thing is not “thinking”. But, then, our brains are neural network-like. What are our brains doing, then, that is “thinking”? Unless you want to claim that there is additional heavy magic involved in the Darwinian-algorithm design of our own neural networks—and, if so, what is it?—we have here a very bad sufficient-quantity-becomes-qualitatively-different emergence problem, don’t we? Highly recommended:

Sean Carroll: François Chollet on Deep Learning & the Meaning of Intelligence: ‘Francois Chollet: “AI systems are far from intelligent. Instead, they're highly advanced pattern-matching engines, capable of astonishing feats within their training domains but lacking the ability to reason or truly understand…. LLMs are vastly superhuman… memorization machines… very, very low intelligence, very, very low generalization power, but extremely high memorization…. It can only give you things that are simple interpolations of programs, code snippets that are seen before… <https://www.preposterousuniverse.com/podcast/2024/06/24/280-francois-chollet-on-deep-learning-and-the-meaning-of-intelligence/>

Carroll, Sean. 2024. “François Chollet on Deep Learning and the Meaning of Intelligence”. Mindscape Podcast. June 24. <https://www.preposterousuniverse.com/podcast/2024/06/24/280-francois-chollet-on-deep-learning-and-the-meaning-of-intelligence/>.

Very Briefly Noted:

Mesoeconomics: The problem is that the discipline of steering complex systems is no yet anywhere. Networks matter. But robust and generalizable analytical tools and insights into them are still very rare: Gillian Tett: Forget macro and micro, it’s mesoeconomics that matters: ‘Understanding networks properly will help us to better grasp how the economy actually works…. Supply chain shocks have recently wrongfooted inflation forecasts…. Industrial policy is back in vogue…. Digital innovation. Big Data is enabling economists to track business networks with once-unimaginable levels of detail…. Economists used to act like medieval doctors, making diagnoses by looking at body parts and deducing how these interact, they now aim to be more like physicians with microscopic cameras who watch how blood circulates in order to assess a patient’s health. Networks matter… <https://www.ft.com/content/79cf81af-5073-4c73-938b-93e8ac08c74d>

Somewhat paradoxically, we have not advanced very far in our study of network capabilities and bottlenecks. In terms of analytical tools, linear programming is still the most useful thing I see around me. And in terms of disciplines, the only thing that can think coherently about these issues is not sociology or economics or even management, but the thinking being that is an economy made up of profit seekers—for price is a signal of scarcity and value. Of course, then you have to incentivize the actors to create value rather than scarcity.: Bill Janeway: The Rise of Mesoeconomics: PROJECT SYNDICATE: ‘Digitalization… has opened… new possibilities for the study of the economic networks, regions, and sectors…. George A. Lincoln…. “Although it is comparatively easy to speak of converting requirements… into… end items and… end items into needed raw materials, machine tools, manpower, and facilities and of converting these factors into money, the actual detailed action of conversion… is a difficult process requiring judgment and a great deal of toil and time. The capabilities side of the equation is even more difficult…. A miscalculation which is small, measured in dollars or tonnage, a shortage of copper, for example, may create a major disruption.”… Seven decades later, this… thinking has become newly relevant… [as] the necessary framework for operationalizing the “modern industrial and innovation strategy”… <https://www.project-syndicate.org/onpoint/mesoeconomics-study-of-networks-supply-chains-key-to-successful-industrial-policies-by-william-h-janeway-2024-05>

Central Country: I really feel the lack of the Portland-Richmond and San Rafael-Tijuana bullet trains: Benjamin Schneider: Mass Transit That Can Move a Megalopolis: ‘Growing cities around the world are creating “rapid regional rail” systems that allow residents to commute across metro areas at high speeds. Will the US get on board?… When completed, the emerging regional rail system in China’s Pearl River Delta will be among the most advanced in the world. The system will not only elide the difference between metros and commuter rail, it’s quick enough to nip at the threshold of high-speed rail, as well. Trains connecting Guangzhou, Dongguan, Foshan and Shenzhen will be able to reach speeds of up to 200 kmh, or nearly 125 mph. “That’s something that has not been previously seen in urban analysis—the prospect of 70 million person megaregions that are able to operate as a single economic unit,” Gupta said… <https://www.bloomberg.com/news/features/2024-07-02/london-paris-seoul-show-commuting-power-of-fast-regional-rail>

Economics: There is only a very narrow set of tariffs that are even potentially useful for successful industrial policy: Dan Drezner: The Populist Attempt to Rewrite Stylized Facts: ‘Economic populists are trying to discredit accepted stylized facts in economics while introducing newer and dumber stylized facts…. To my dying day I will not understand why those who were worried about excessive trade with China opposed U.S. entry into the Trans-Pacific Partnership…. For now, the likes of Vance and Harris have succeeded in convincing Beltway folks that globalization produced the China shock which in turn immiserated the United States and that globalization reduces economic resiliency. But neither supposition is correct. The China shock was undeniably real, but the rest is a crock. As I noted in Reason last year: “The costs of the China shock had less to do with… federal, state, and local authorities failing to respond to it… variations in community response.”… As for the relationship between globalization and resiliency, the recent pandemic suggests that they are positively and not negatively correlated… <http/s://danieldrezner.substack.com/p/the-populist-attempt-to-rewrite-stylized>

Neofascism: India, South Africa, Britain, and now France have seen four narrow yet significant defeats for the various global flavors of neofascism. But things right now do look bleak in the United States: Johan Fourie: Populism is everywhere: ‘Except in Africa…. Populism has moved from… narrowly defined (if unsuccessful)… economic policies to… an ideology… that splits society into… the ‘virtuous people’ and the ‘corrupt elite’…. [No longer in] association with redistributive policies, it is now characterised by…[1] arguing that ordinary people are morally superior and, thus, rightfully should hold power… [2] leaving no room for diversity or minority rights… [& 3] ignor[ing] traditional checks and balances, which they claim are tools of the corrupt elites…. This stance… clashes with the principles of liberal democracy… [and] goes hand-in-hand with authoritarian practices, blending anti-elite sentiments with harsh security measures and anti-immigrant nationalism… <http/s://www.ourlongwalk.com/p/populism-is-everywhere>

Drezner: The China Shock was mainly about transportation and communications technology, not policy. The main contribution of policy was dollar overvaluation caused by fiscal deficits.

https://thomaslhutcheson.substack.com/p/dollars-and-deficits

https://thomaslhutcheson.substack.com/p/policy-tariffs-and-trade-3-china

Central Country: My guess is that with today's regulatory framework the Eastern terminus of the Transcontinental Railroad would be Oakland.

I was just looking at the BART and see that it hardly goes south of SF at all! ???