Key Insights:

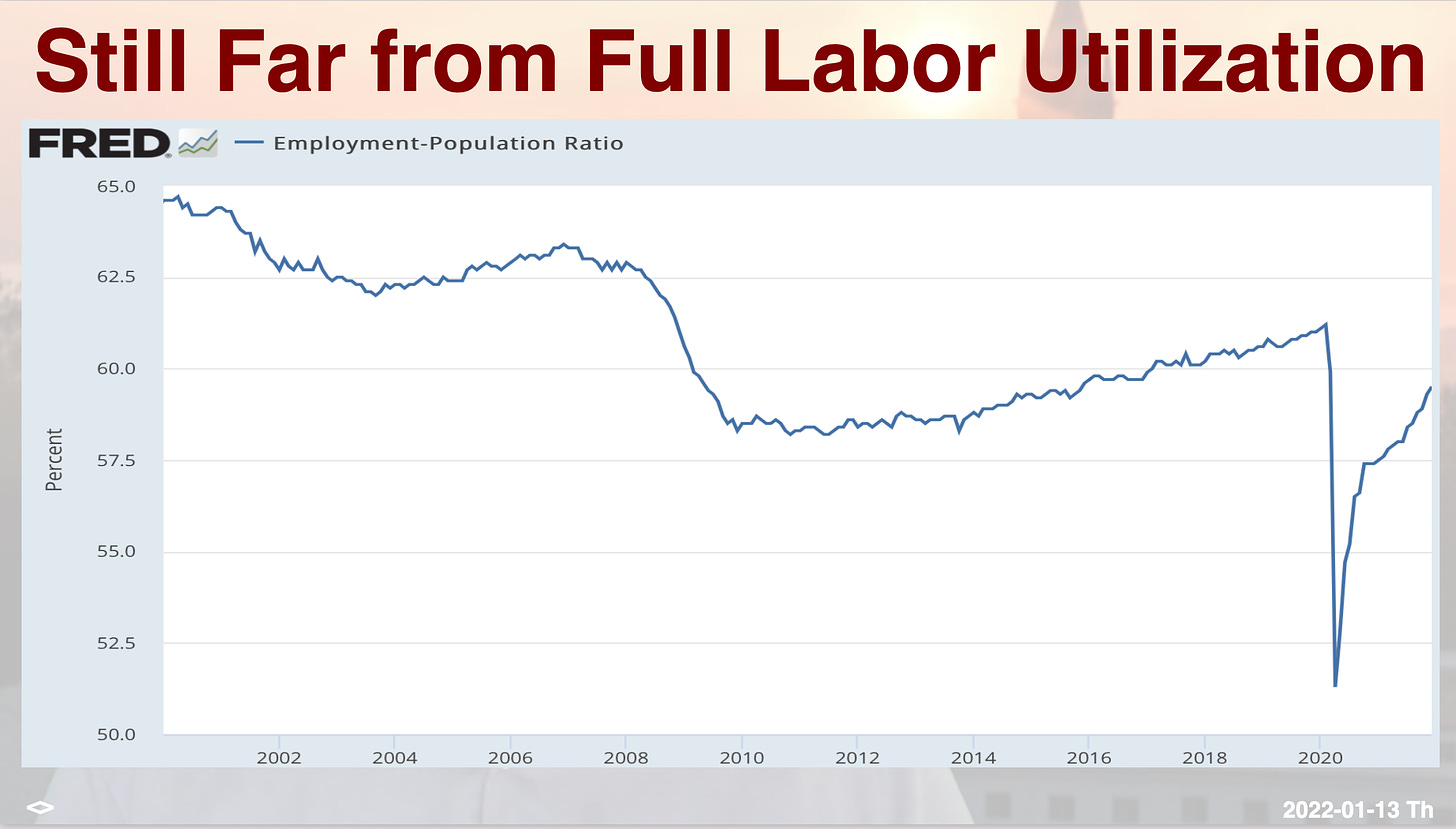

Macro Policy Guiding Principle: prioritize full employment—make Say’s Law true in practice even though it is false in theory…

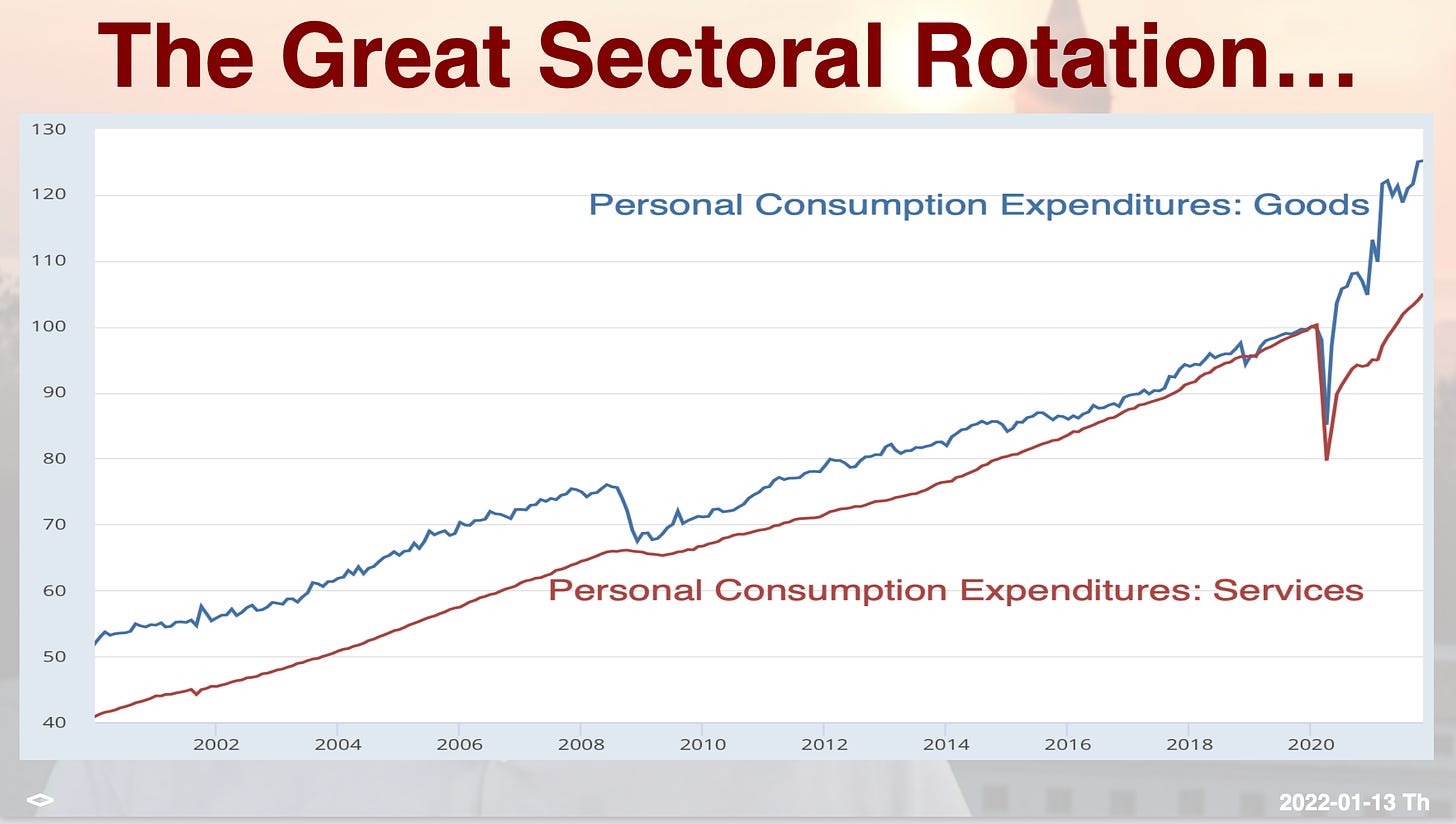

Macro Policy Guiding Principle: move the economy as fast as possible to what its long-term optimal structural configuration should be

Macro Policy Guiding Principle: Guiding principles (1) and (2) overrides desirability of immediate price stability…

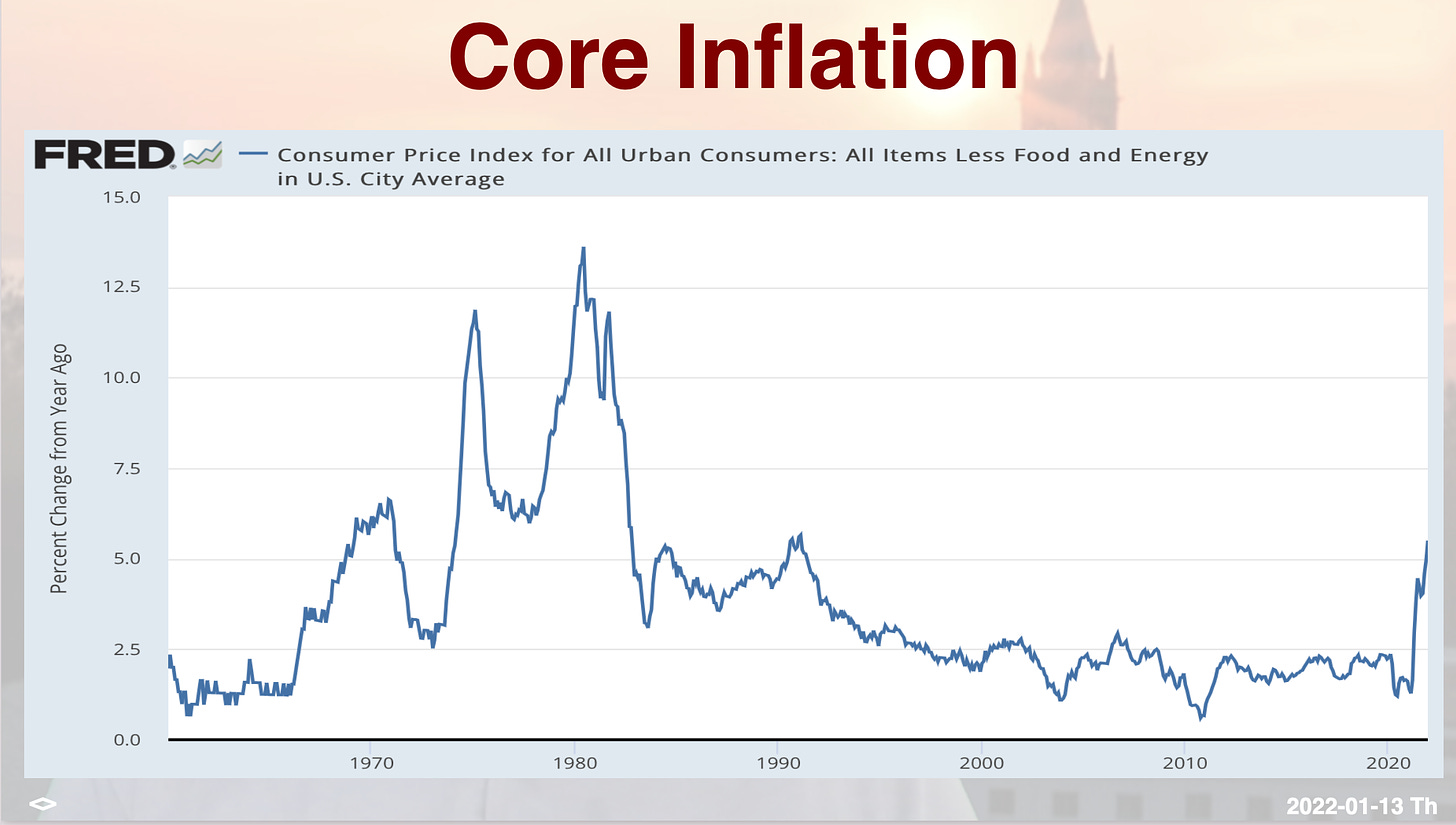

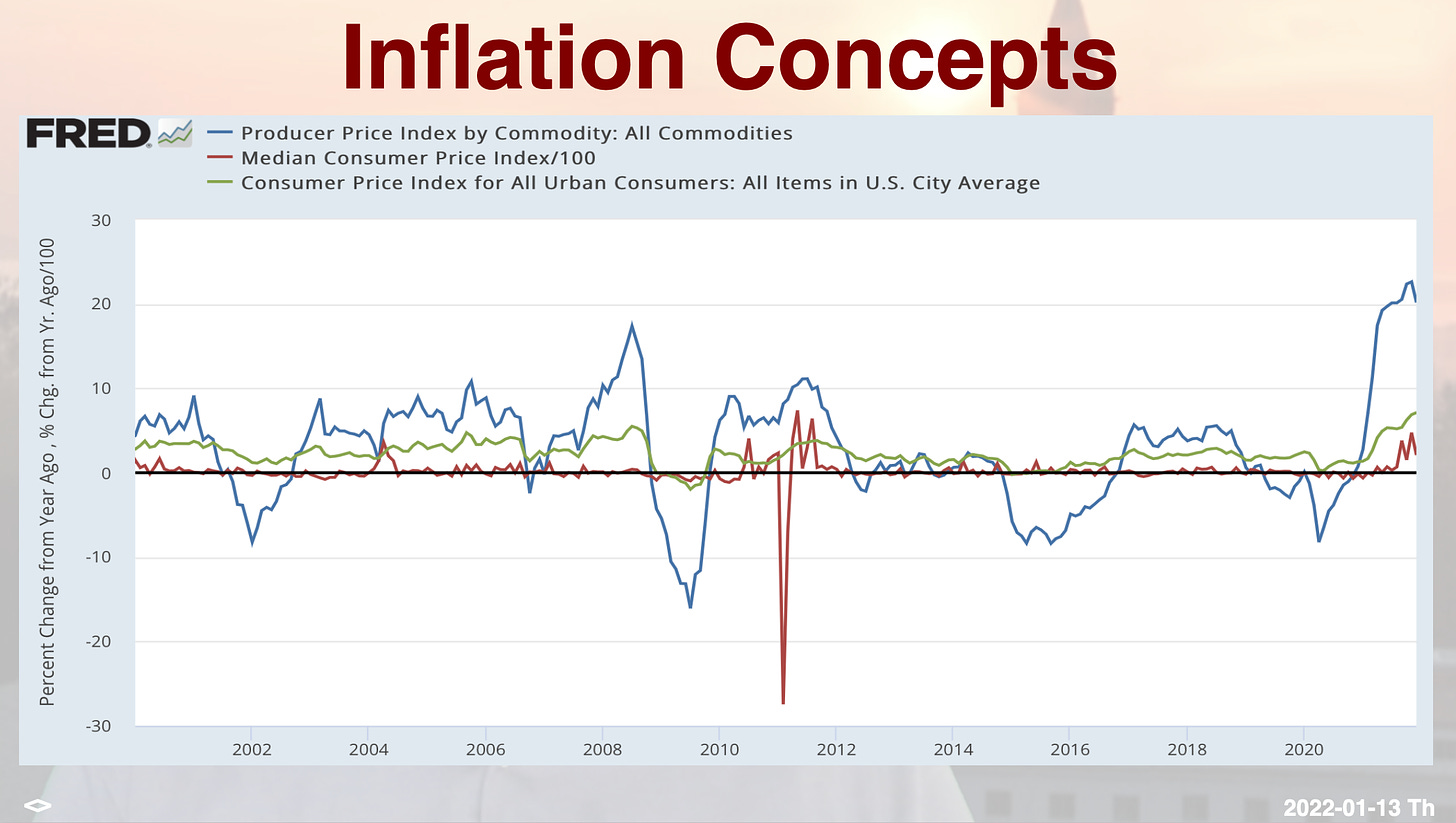

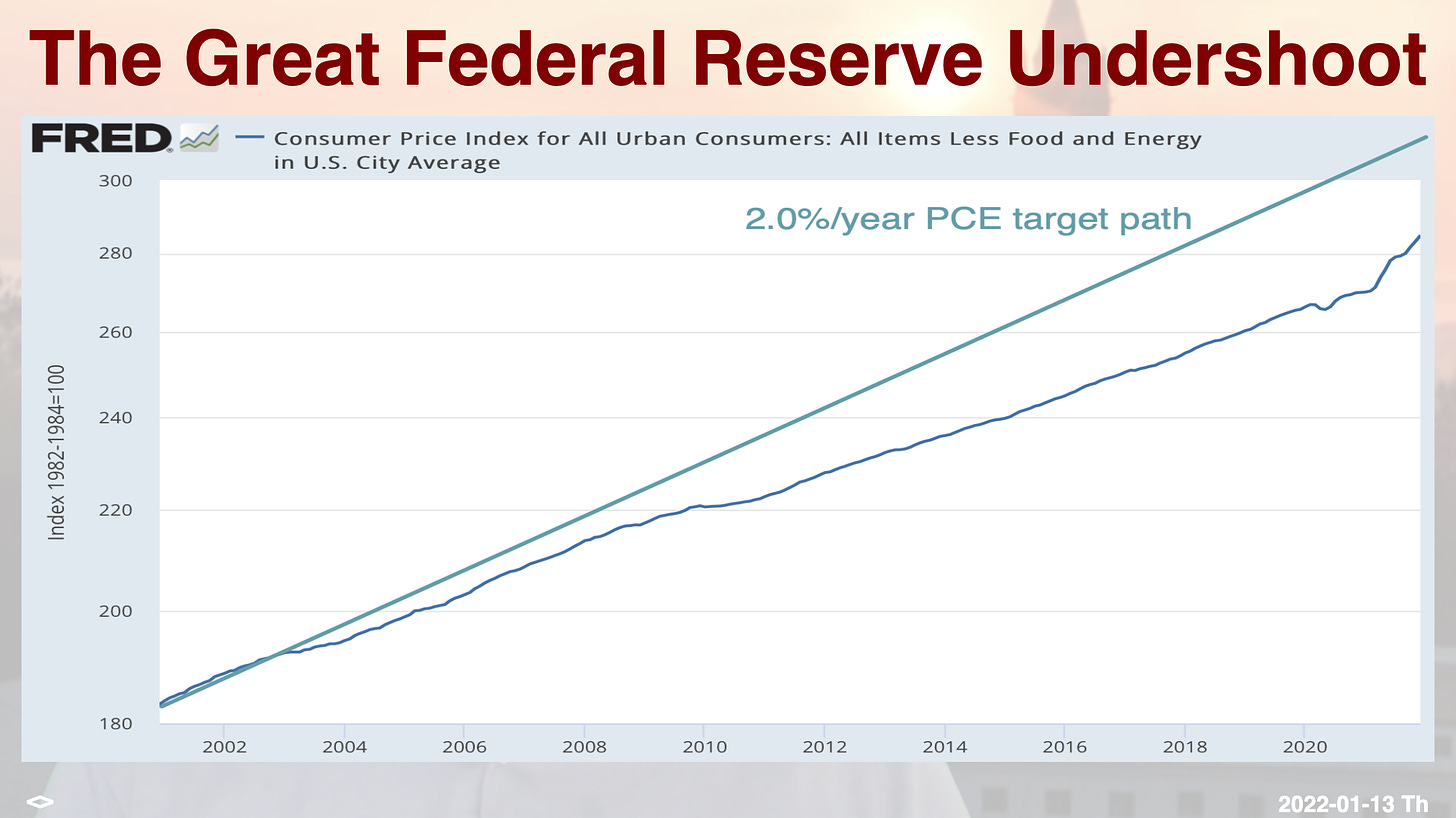

We still have lots of room to run before we can say that the post-Volcker Fed has failed to meet its inflation target in an average-outcomes sense…

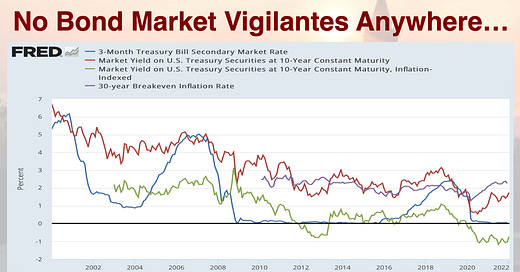

Time to panic about inflation will be when the bond market gets worried about it—but right now the bond market is very much “Fed has got this”…

Yet the political economy of the thing is overwhelmingly relevant: inflation that gets Biden booted from office would be very bad…

Even prolonged inflation may help—in that there is a lot of structural reform we need to do, and this may help us get it done…

Hexapodia!

John Maynard Keynes (1919): The Economic Consequences of the Peace <https://archive.org/details/in.ernet.dli.2015.14117/page/n228/mode/1up?view=theater&q=lenin>:

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers,", who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

In the latter stages of the war all the belligerent governments practised, from necessity or incompetence, what a Bolshevist might have done from design. Even now, when the war is over, most of them continue out of weakness the same malpractices. But further, the Governments of Europe, being many of them at this moment reckless in their methods as well as weak, seek to direct on to a class known as "profiteers" the popular indignation against the more obvious consequences of their vicious methods. These "profiteers" are, broadly speaking, the entrepreneur class of capitalists, that is to say, the active and constructive element in the whole capitalist society, who in a period of rapidly rising prices cannot help but get rich quick whether they wish it or desire it or not. If prices are continually rising, every trader who has purchased for stock or owns property and plant inevitably makes profits.

By directing hatred against this class, therefore, the European Governments are carrying a step further the fatal process which the subtle mind of Lenin had consciously conceived. The profiteers are a consequence and not a cause of rising prices. By combining a popular hatred of the class of entrepreneurs with the blow already given to social security by the violent and arbitrary disturbance of contract and of the established equilibrium of wealth which is the inevitable result of inflation, these Governments are fast rendering impossible a continuance of the social and economic order of the nineteenth century. But they have no plan for replacing it…

References:

William J. Baumol (1999): Retrospectives: Say’s Law <https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.13.1.195>

John Maynard Keynes (1919): The Economic Consequences of the Peace <https://archive.org/details/in.ernet.dli.2015.14117/page/n228/mode/1up?view=theater&q=lenin>

Paul Krugman (1998): It’s Baaack!: Japan's Slump & the Return of the LiquidityTrap <https://www.brookings.edu/wp-content/uploads/1998/06/1998b_bpea_krugman_dominquez_rogoff.pdf>

Paul Krugman (2018): It’s Baaack, Twenty Years Later <https://www.gc.cuny.edu/CUNY_GC/media/LISCenter/pkrugman/Its-baaack.pdf>

+, of course:

Vernor Vinge: A Fire Upon the Deep <https://books.google.com/books?id=fCCWWgZ7d6UC>

Share this post